What is Equity Research?

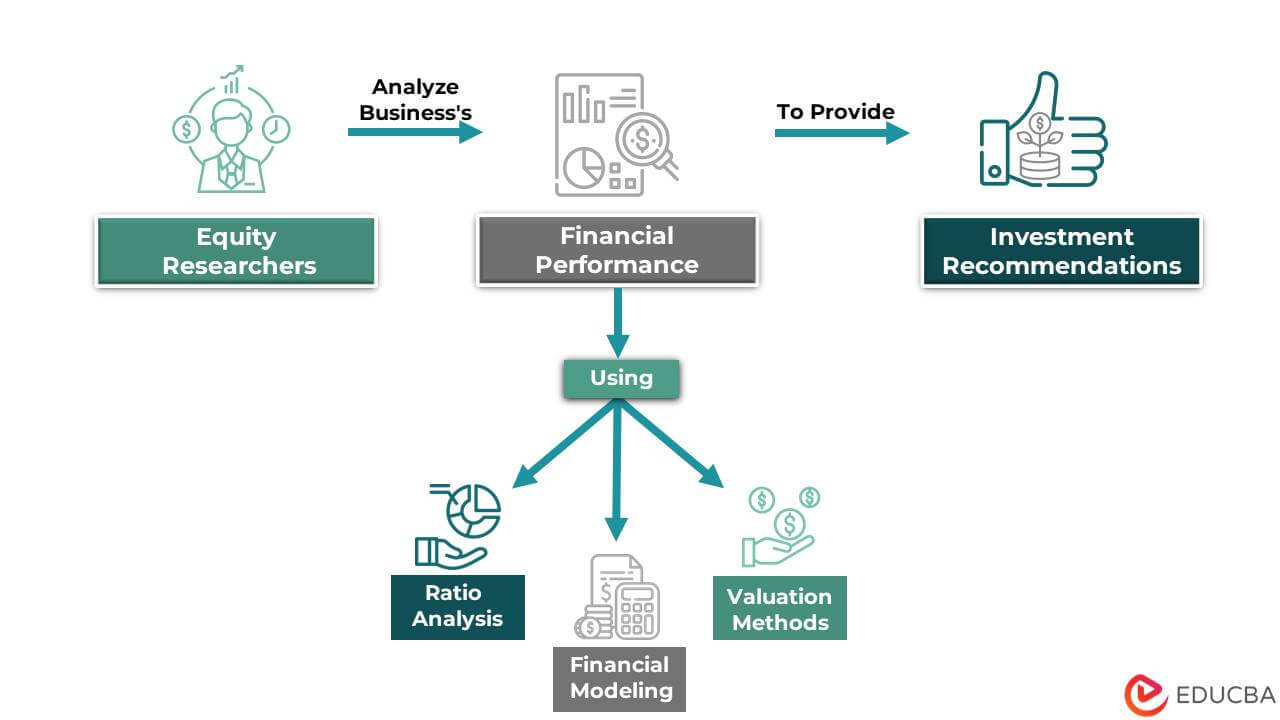

Equity research is the process of analyzing a company’s financial performance using techniques like ratio analysis, financial modeling, and valuation methods. Equity research analysts provide buy, hold, or sell recommendations to investors and traders according to these analysis reports.

Typically, brokerage firms, investment banks, and independent research firms research equity and distribute the reports to institutional and retail investors. The insights that the research analysts provide play a crucial role in shaping investment decisions and guiding trading strategies.

Who Conducts Equity Research?

Equity Research analysts, usually working at investment banks, brokerage firms, asset management firms, and independent research firms conduct research in equity. These analysts use their expertise to analyze financial data, economic trends, and market conditions and provide investors with accurate insights.

Institutional investors like mutual funds or hedge funds may also have in-house teams comprising experienced analysts specializing in a particular sector or industry. These analysts use various research tools and techniques, like ratio analysis, financial modeling, etc., to analyze potential investments.

Equity Research Process: Steps Involved

It is the process that equity analysts follow for their research:

Step #1: Conducting Industry and Company Analysis

Analysts start by analyzing the industry in which a company operates. They evaluate trends, competitive landscape, regulatory environment, and other factors that impact a firm’s financial performance.

They also evaluate the company’s management, business model, products/services, and more. Moreover, they conduct a detailed analysis of the financial statements: Income statement, balance sheet, and cash flow statement.

Step #2: Creating Financial Models

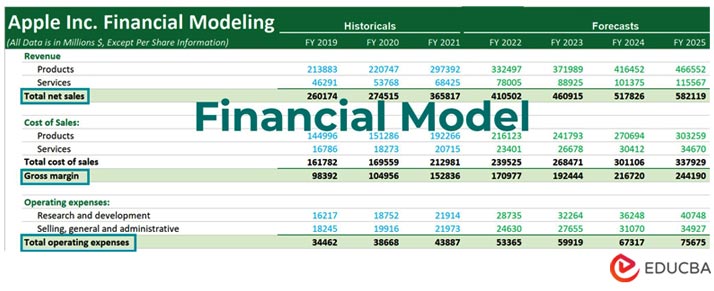

Analysts use financial modeling techniques to project a company’s future financial performance. They make assumptions about factors such as revenue growth, profit margin, and capital expenditure and use these assumptions to create financial models.

The financial model depicts how the company’s financial performance is likely to evolve over time.

(Image Source: eduCBA’s Financial Modeling Course)

Step #3: Valuing the Company

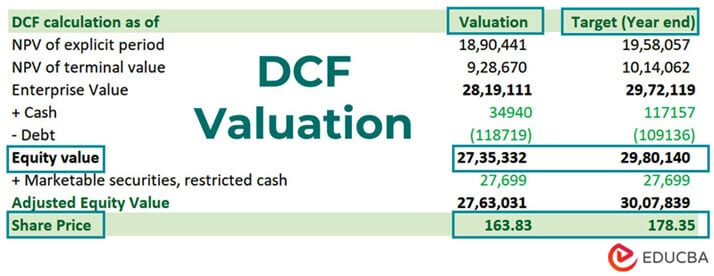

Analysts use various valuation methods to determine the intrinsic value of a company’s stock. It involves using discounted cash flow analysis, price-to-earnings ratios, or other valuation metrics.

The goal is to determine whether a company’s stock is over or undervalued based on its financial performance and growth prospects.

Step #4: Providing Recommendations

Depending on their analysis, analysts provide buy, hold, or sell recommendations on a company’s stock. They also provide a target price for the stock, which represents the price at which they believe the stock is fairly valued.

Step #5: Distributing Research Reports

Institutional and retail investors, as well as other investment professionals, typically receive the final research reports. The reports provide detailed information about the company’s financial performance, as well as its growth prospects and potential risks.

Investors use these reports to make informed investment decisions and regulate their trading strategies.

Step #6: Supporting Investment Banking Activities

Investment bankers use this research to support their clients’ capital-raising plans, mergers and acquisitions, and other strategic initiatives. They use it to identify potential acquisition targets, evaluate the financial position of companies in a particular industry, etc. The research reports help them develop other investment ideas to help clients achieve their financial objectives.

Example: Analyzing Tesla Inc.

An analyst is analyzing Tesla Inc., a company that designs and manufactures electric vehicles. Here is the process the analyst follows,

Step #1: The analyst begins by analyzing the electric vehicle industry, observing trends such as the increasing popularity of electric vehicles and the potential impact of government regulations on the industry.

Step #2: Next, the analyst analyzes Tesla’s financial statements to understand its revenue and profit trends, as well as its cash flow and balance sheet position. The analyst also evaluates Tesla’s competitive position in the electric vehicle market, reviewing factors such as market share and product innovation.

Step #3: As per the analysis, the analyst creates a financial model to project Tesla’s future financial performance. They also use various valuation methods to determine the Tesla stock’s intrinsic value.

Step #4: Finally, the analyst provides a target price of the share along with a recommendation on whether to buy, hold, or sell the Tesla stock.

Step #5: The final research report holds all the information and is then distributed to hedge funds, asset avengers, and institutional & retail investors.

Equity Research Report

Equity research reports provide investors with a comprehensive analysis of a company, including its financial performance, market position, growth prospects, management team, and industry trends. The reports may also include a recommendation on how to trade the stock, as well as a target price according to the analyst’s analysis.

The format is as follows:

[Report Title]

[Date]

[Table of Contents]

1. Executive Summary

- A brief overview of the company

- Key highlights and conclusions

- Investment recommendation

2. Company Overview

- Business description and history

- Key products/services and markets

- Competitors and market position

- The management team and ownership structure

3. Financial Analysis

- Historical financial performance

- Financial ratios analysis

- Forecasted financial performance

4. Industry Analysis

- Market size and growth potential

- Competitive landscape and market trends

- Regulatory and economic factors

5. Investment Risks

- Key risks to the investment

- Mitigating factors and risk management

6. Valuation

- Valuation methodology

- Comparable companies analysis

- Discounted cash flow analysis

- Target price and investment recommendation

7. Conclusion

- Key takeaways and recommendations

- Final investment recommendation

[Appendix]

- Additional supporting data and research

Example: Tesla Inc.

Equity Research Jobs: Hierarchy & Responsibilities

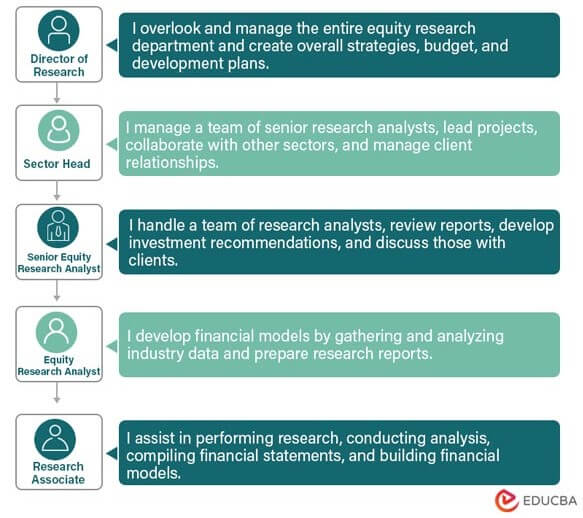

Hierarchy:

The hierarchy varies depending on each specific firm. However, here is a standard hierarchy structure from lowest to highest:

Responsibilities:

Research Associate:

- Compiling data on public companies, including financial statements and key performance indicators

- Assisting with the development of financial models and analyzing industry trends

- Performing company and industry research to support investment recommendations.

Equity Research Analyst:

- Conducting company and industry conferences and meetings to gather information and insights

- Analyzing and interpreting financial and industry data to make investment recommendations

- Developing and maintaining financial models and valuation methodologies

- Preparing reports and presentations to communicate research findings to internal teams and external clients.

Senior Equity Research Analyst:

- Managing a team of research analysts and overseeing their work on research reports and investment recommendations

- Interacting with institutional clients to discuss investment recommendations and market insights

- Participating in industry events and conferences to stay up-to-date on industry trends and developments

- Developing new investment themes and strategies to meet client needs.

Sector Head:

- Overseeing a team of senior research analysts covering a specific sector or group of sectors

- Leading the development of investment strategies for the sector(s) and managing the team’s research process

- Collaborating with other sector heads to ensure consistent investment themes and strategies across the firm

- Interacting with clients and other stakeholders to communicate the firm’s research and investment recommendations.

Director of Research:

- Setting the overall strategy and direction for the research department

- Ensuring that the research department meets the needs of the firm’s clients and internal teams

- Managing the department’s budget and staffing resources

- Participating in the development of new financial products and investment strategies.

Day-to-Day Activities of an Equity Research Analyst

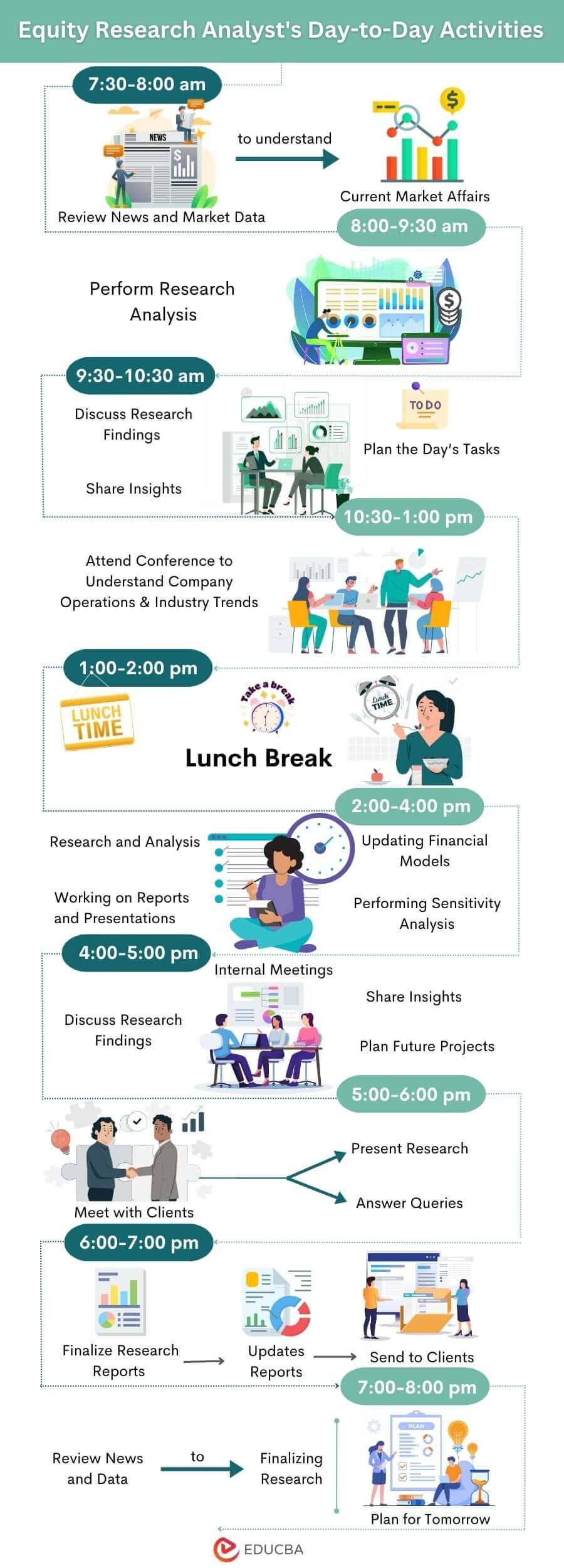

An analyst’s day involves lengthy and demanding work, requiring substantial focus and attention to detail. Here is a typical schedule that analysts follow:

7:30-8:00 am

Review news and market data to understand what’s happening in the markets, industry, and economy.

8:00-9:30 am

Perform research and analysis, including reading financial reports, analyzing data and trends, updating financial models, and performing valuation analysis.

9:30-10:30 am

Collaborate with colleagues to discuss research findings, share insights, and plan the day’s tasks.

10:30-1:00 pm:

Attend conference calls or meetings with company management teams, industry experts, and other stakeholders to gain a better understanding of the company’s operations and industry trends.

1:00-2:00 pm:

Take a lunch break and step outside for fresh air.

2:00-4:00 pm:

Continue working on research and analysis, such as updating financial models, performing sensitivity analysis, and working on reports and presentations.

4:00-5:00 pm:

Attend internal meetings to discuss research findings, share insights, and plan future projects.

5:00-6:00 pm:

Meet with clients to present research findings and answer questions about the company’s financial performance and growth opportunities.

6:00-7:00 pm:

Finalize research reports and presentations, make necessary updates, and send final reports to clients.

7:00-8:00 pm:

Conclude the day by reviewing news and market data, finalizing research notes, and planning for the next day’s tasks.

Salary Structure

The salaries of these professionals vary depending on a variety of factors, including the firm, location, level of experience, and other qualifications. Here are approximate salaries for the different levels in the USA, based on data from Glassdoor and Payscale:

| Position | Salary | Bonus |

| Research Associate | $42,000 – $92,000 | $1,000 – $36,000 |

| Equity Research Analyst | $50,000 – $132,000 | $3,000 – $50,000 |

| Senior Equity Research Analyst | $100,000 – $300,000 | $18,000 – $200,000 |

| Director of Research | $200,000 – $600,000 | $150,000 – $300,000 |

Top Equity Research Firms

Here are some of the top firms, their ranking, specialization, and assets under management (AUM). The data for assets under management (AUM) is from 2020 to 2022:

| Firm | Ranking | Specialization | AUM (in billions) |

| JPMorgan Chase & Co. | 1 | Diversified Financial Services | $2,770 |

| Goldman Sachs | 2 | Investment Banking | $2,550 |

| Morgan Stanley | 3 | Investment Banking | $1,305 |

| Bank of America | 4 | Diversified Financial Services | $360 |

| Citigroup | 5 | Diversified Financial Services | $250 |

| Wells Fargo | 6 | Diversified Financial Services | $508.8 |

| UBS | 7 | Investment Banking | $2,600 |

| Barclays | 8 | Investment Banking | $9,800 |

| Credit Suisse | 9 | Investment Banking | $420 |

| Deutsche Bank | 10 | Investment Banking | $991.89 |

| Jefferies | 11 | Investment Banking | $22 |

| Cowen and Company | 12 | Investment Banking | $15.8 |

| Stifel Financial | 13 | Diversified Financial Services | $148.6 |

| Raymond James | 14 | Diversified Financial Services | $174 |

| RBC Capital Markets | 15 | Investment Banking | $742.572 |

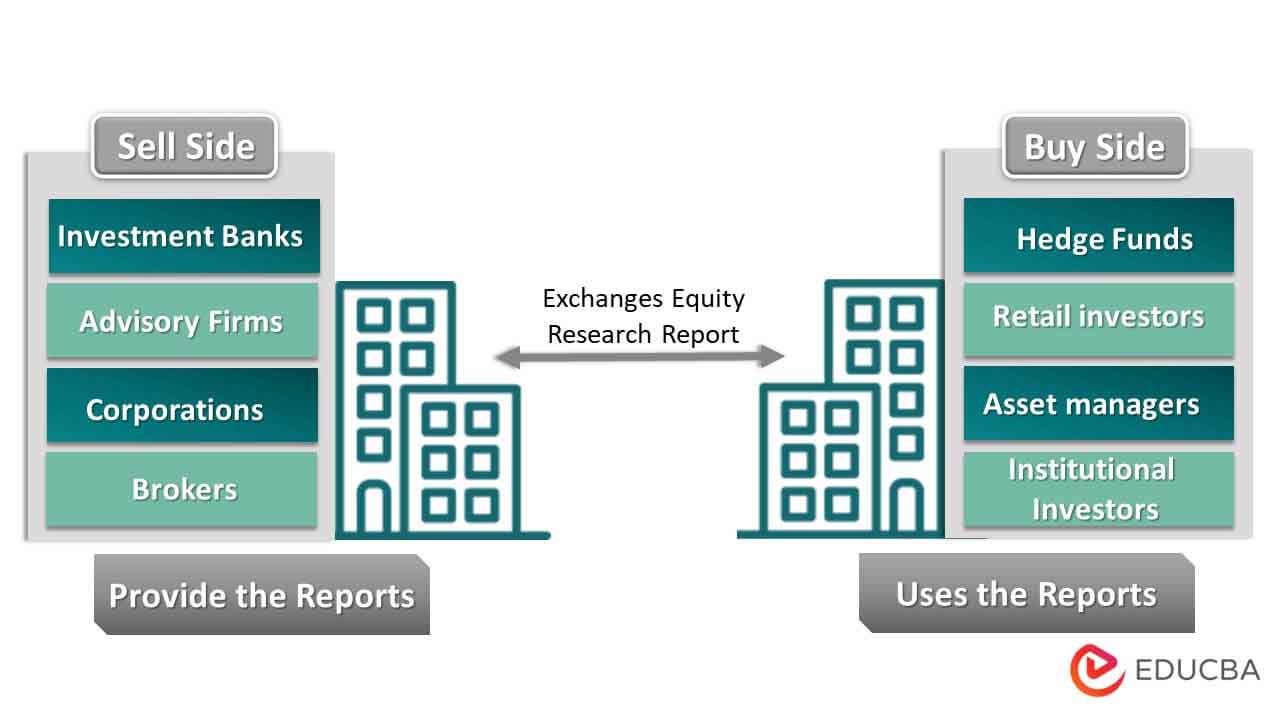

Buy Side and Sell Side of Equity Research

Buy-side refers to firms that manage money on behalf of investors and are looking to buy stocks or other securities that meet their investment criteria. These firms rely on research reports to make informed investment decisions.

Examples of buy-side firms:

- BlackRock: It is one of the largest asset management firms in the world, managing trillions of dollars in assets for clients around the globe.

- Vanguard: It is a leading provider of low-cost index funds and ETFs for individual investors.

Sell Side refers to firms such as investment banks and brokerages that provide research reports to the buy side firms. These sell-side firms typically generate revenue by selling their research to buy-side clients or by executing trades on behalf of those clients.

Examples of sell-side firms:

- JPMorgan Chase: It is a global investment bank that provides research reports and other services to institutional clients.

- Goldman Sachs: It is a multinational investment bank that provides research on equity, investment banking, and other financial services to institutional clients.

- Morgan Stanley: It is a leading investment bank providing research, wealth management, and other financial services to institutional clients.

How to Get into Equity Research?

Getting into this domain can be a highly competitive and challenging process. However, here are some steps to increase the chances of success:

Step #1: Obtain a relevant educational background: Typically, research professionals have a degree in finance, accounting, economics, or business. Pursuing a Master’s degree, like an MBA in finance, can also be beneficial.

Step #2: Gain experience through internships: Look for internships or entry-level jobs in investment banks, asset management firms, or other financial institutions. It will help you gain the necessary skills and knowledge for a career in equity analytics.

Step #3: Develop your analytical skills: Research on equity requires strong analytical and critical thinking skills. Consider enrolling in courses like financial analysis, financial modeling, and valuation to improve your skill set.

Step #4: Build a network: Attend industry events and reach out to professionals in the field to build connections. Networking can help you learn about job openings and get recommendations.

Step #5: Consider a professional certification: Pursuing a professional certification such as the Chartered Financial Analyst (CFA) designation can demonstrate your expertise and commitment to the field.

Step #6: Apply for jobs in this field: Look for job postings on company websites, job boards, and through your network. Prepare well to showcase your skills and qualifications in your resume and during the interview process.

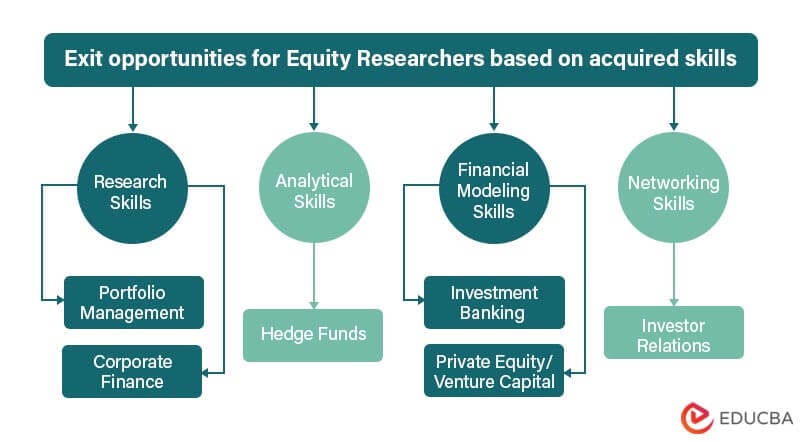

Exit Opportunities

ER professionals often have several exit opportunities available to them. Some common career paths include:

- Portfolio Management: Many analysts transition to portfolio management roles, where they manage a portfolio of investments based on their research insights.

- Investment Banking: Some professionals move to investment banking roles, where they may work on mergers and acquisitions, equity offerings, or debt issuances.

- Private Equity or Venture Capital: These analysts may also move to private equity or venture capital roles, where they evaluate potential investments, conduct due diligence, and work on deals.

- Corporate Finance: Analysts may transition to corporate finance roles to help companies with financial planning, analysis, and decision-making.

- Hedge Funds: Some research professionals transition to roles in hedge funds, where they use their analytical skills to make investment decisions and manage portfolios.

- Investor Relations: The analysts may also move to investor relations roles, helping companies communicate with investors, analysts, and other stakeholders.

Role of Equity Research in Investment Banking

ER plays an important role in investment banking, particularly in underwriting new equity issuances. Here are some specific ways in which investment bankers use research in equity:

Initial Public Offerings (IPOs)

Research analysts provide detailed analysis and valuation of companies planning to go public through an initial public offering (IPO). The analysis helps develop an IPO prospectus and appeal to potential investors.

Secondary Offerings

Analysts also provide analysis and valuation of companies planning to issue additional shares in a secondary offering. This analysis efficiently markets the new shares to potential investors.

Mergers and Acquisitions

Analysts provide valuation analysis and due diligence on companies engaging in mergers and acquisitions. This analysis determines the value of the participant companies and advises clients on whether to buy or sell shares.

Trading

Equity analysts provide market analysis and recommendations on individual stocks to support a firm’s trading activities. This information can help traders make informed decisions on trading activities like purchasing or selling stocks.

Equity Research Vs. Investment Banking

| Equity Research | Investment Banking | |

| Focus | Analyzing stocks to provide investment recommendations | Advising on corporate finance transactions, such as mergers and acquisitions, initial public offerings, and debt issuances |

| Primary Responsibilities | Analyzing financial data, conducting research, building financial models, and providing investment recommendations to clients or portfolio managers | Helping companies raise capital, identify and evaluate potential merger and acquisition targets, and provide other strategic financial advice |

| Typical Work Environment | Investment banks, asset management firms, or equity research firms | Investment banks or boutique advisory firms |

| Compensation | Generally lower than investment banking but varies based on seniority and firm | Generally higher than equity research but varies based on seniority and firm |

| Skills Required | Strong analytical and critical thinking skills, financial modeling, forecasting, and excellent communication skills | Strong analytical, quantitative, and financial modeling skills, as well as strong interpersonal and communication skills |

| Hours | Typically work fewer hours than investment bankers, still require long hours and the ability to work under tight deadlines | Typically work long hours and under tight deadlines, especially during deals |

| Career Progression | Often leads to roles in portfolio management, corporate finance, or private equity | It often leads to more senior roles in investment banking or private equity |

Frequently Asked Questions (FAQs)

Is CFA necessary for equity research?

No, pursuing a Chartered Financial Analyst (CFA) degree is not necessary to build a professional career in this field. However, CFA enhances one’s knowledge of financial concepts like equity analysis, asset management, credit research, etc. Therefore, enrolling in a CFA program can be favorable.

Which sector is best for equity research?

Numerous sectors use research in equity for one purpose or another. Nevertheless, the prime sectors to enter for a successful career are banking, healthcare, technology, automation, and automobile. A few other best industries are consumer discretionary and telecommunications.

Is equity research a good career?

A career in Equity Research is challenging, with working hours ranging between 55 to 80 hours per week. It is also a very competitive field, making it mandatory for professionals to acquire a leveled-up skillset. However, the compensation for the job is high, which balances the workload. Thus, it is a good yet demanding career prospect.

Does equity research require knowledge of coding?

It does not require knowledge or proficiency in coding. Expertise in only MS Excel can be a helpful aspect to effectively analyzing equity markets. However, command over a few programming languages can help simplify and quicken the research process.

Recommended Articles

We hope EDUCBA’s article on Equity Research was informative and helpful. You can learn more through EDUCBA’s recommended articles.