Updated July 5, 2023

What is Investment Banking?

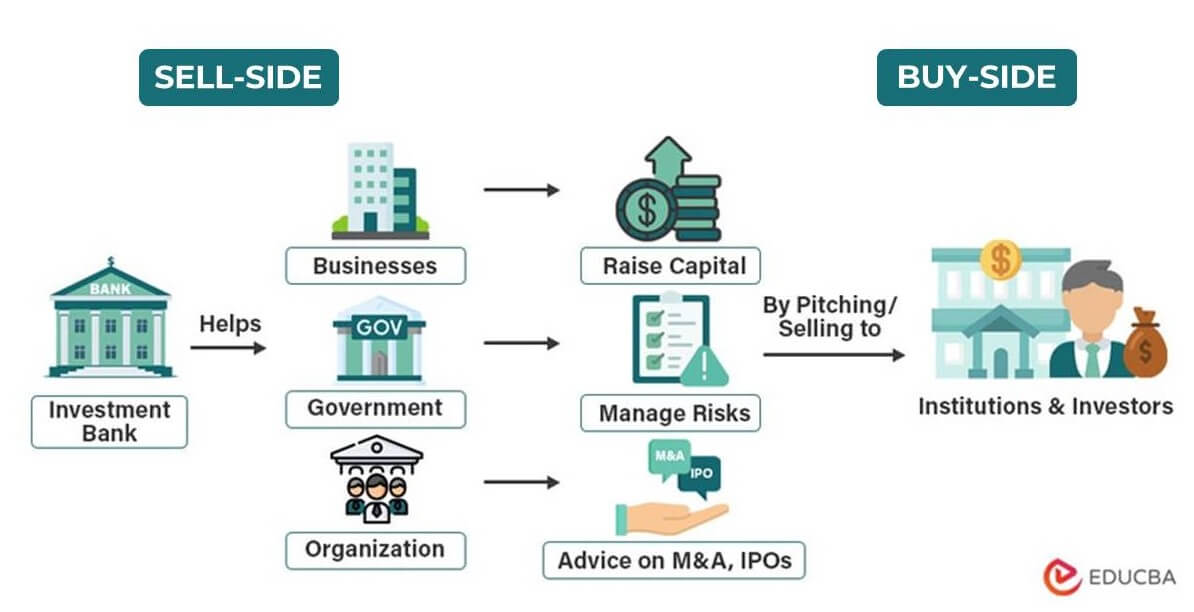

Investment banking is a financial service where smart, experienced individuals help businesses & governments with complex transactions like raising capital by selling stocks/bonds, buying or merging with other companies, and managing risks.

Investment banks also engage in proprietary trading, which involves using their own capital to buy/sell financial instruments to generate profits.

Most importantly, investment banks help companies by connecting them with the capital markets. They simplify the issuance and selling of securities to investors, bridging the gap between financial institutions and firms.

History

Investment banking has a rich history that spans centuries. Here are some of the critical events that shaped this industry:

1792: The New York Stock Exchange (NYSE) was established, providing a marketplace for trading securities.

The late 1800s: Notable firms like J.P. Morgan and Goldman Sachs emerged, offering financial services to clients. It was the foundation for investment banking to operate as a separate industry.

The 1930s: The US government passed the Glass-Steagall Act to prevent a recurrence of the Great Depression by separating investment and commercial banking activities.

1970: Investment banking saw the advent of new financial instruments, such as junk bonds and mortgage-backed securities.

The 1980s: Financial industry deregulation led to a surge in mergers and acquisitions activity and an increase in innovative financial products.

The 1990s: Investment banks played a significant role in the dot-com boom and bust, while the emergence of the global financial union reshaped the industry.

The 2000s: The financial crisis of 2008 increased regulation, including the Dodd-Frank Act, to prevent future crises. The crisis also led to the bankruptcy or acquisition of several major investment banks.

Functions of Investment Banking

Investment banks typically provide their clients with a range of financial services. These services can include:

Underwriting and Issuing Securities

Investment banks help companies raise capital by issuing and selling securities such as stocks, bonds, and other financial instruments.

For example, Wall Street Investment Bank may assist a technology firm, Tech Innovations Inc., to issue an initial public offering (IPO) to raise funds for business expansion.

Mergers and Acquisitions

Investment banks advise clients on mergers and acquisitions, such as valuing companies, negotiating terms, and providing financing for transactions.

For instance, Global Investment Bank may provide advisory services to BioMed Pharma, a pharmaceutical firm, in acquiring a smaller rival company to expand its market share.

Financial Advisory Services

Investment banks provide financial advice and analysis, including market research, strategic planning, and risk management.

For example, New York Investment Bank may offer strategic planning and risk management services to help a retail company, Fashionista Corp., expand its product lines and enter new markets.

Asset Management

Investment banks manage assets for clients, like managing investment portfolios, providing research and financial market analysis, and making investment decisions on behalf of clients.

For instance, Chicago Investment Bank may manage investment portfolios for a high-net-worth individual named John Smith. It provides him with research and analysis on financial markets and makes investment decisions per his preferences and risk appetite.

Trading and Other Investment Activities

Investment banks engage in trading and other investment activities using their capital, which can generate profits.

For example, Miami Investment Bank may engage in proprietary trading activities, such as buying and selling securities for its account, to generate profits.

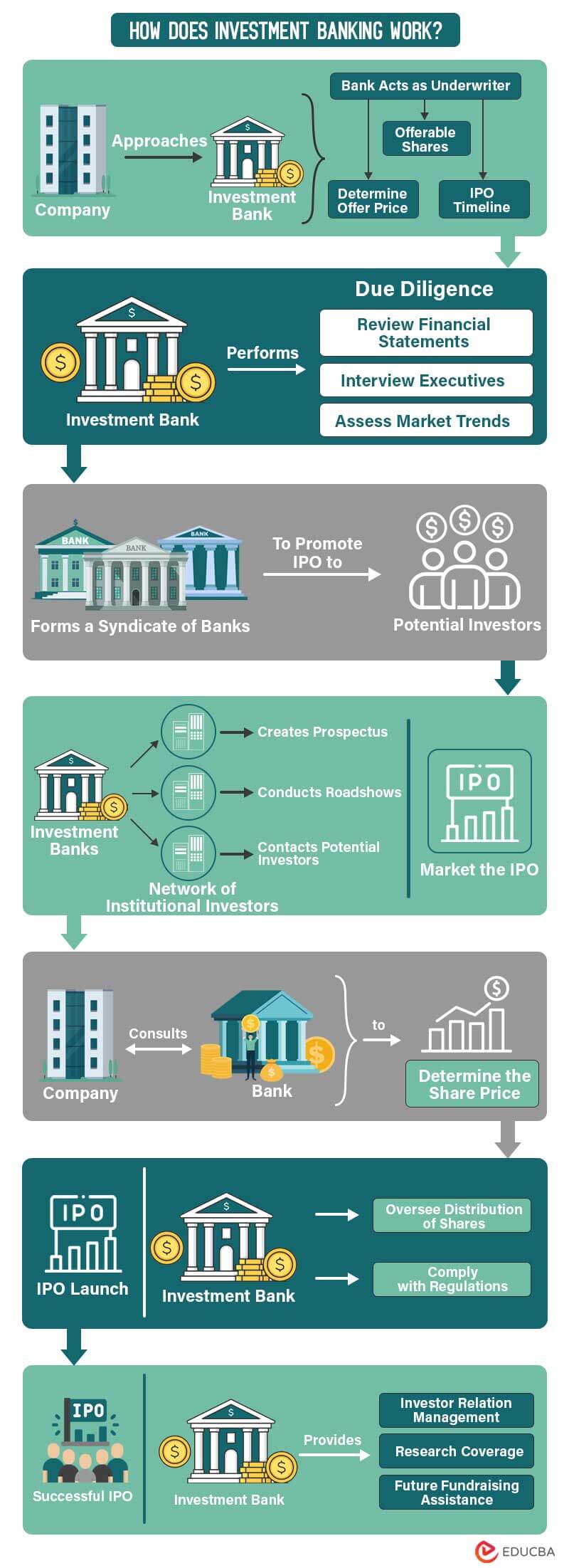

How Does it Work?

Investment banks help companies achieve their strategic objectives by accessing capital markets. Here’s how investment banks guide a company through an initial public offering (IPO):

Step 1: The Company Approaches an Investment Bank

A company seeking to go public approaches an investment bank to act as an underwriter for the IPO. The investment bank works with the company to determine the offer price, total shares, and IPO timeline.

Step 2: The Investment Bank Conducts Due Diligence

The bank performs due diligence on the company to ensure its financials are accurate and it is a suitable candidate for an IPO. The process involves reviewing financial statements, interviewing executives, and assessing market trends.

Step 3: Investment Bank Forms a Syndicate

The bank forms a syndicate of other banks to share the underwriting risk and assist with the offering.

Step 4: Investment Bank Markets the IPO

The bank uses its institutional investors’ network to market the IPO and generate demand for the offering. It involves creating a prospectus and conducting roadshows to promote the IPO to potential investors.

Step 5: IPO Pricing

In consultation with the company, the investment bank determines the price to offer the shares to the public. The bank aims to price the shares high enough to generate significant proceeds for the company but not so high that the offering fails.

Step 6: IPO Launch

On the day of the IPO, the investment bank oversees the distribution of shares to investors. It also ensures that the offering complies with regulatory requirements.

Step 7: Post-IPO Support

After the IPO, the investment bank may support the company by helping to manage its relationship with investors, providing research coverage, and assisting with future fundraising activities.

Examples

Here are some real-life examples of investment banking activities:

Goldman Sachs advised on the acquisition of Red Hat by IBM

In 2018, IBM announced its acquisition of Red Hat, a leading provider of open-source software solutions, for $34 billion. Goldman Sachs advised Red Hat on the deal, helping to negotiate the terms and providing financing for the transaction.

JPMorgan Chase managed the IPO of Uber.

In 2019, ride-hailing giant Uber went public in one of the largest IPOs in history. JPMorgan Chase served as one of the lead underwriters and helped manage the sale of Uber’s shares.

Morgan Stanley and the acquisition of E-Trade

In 2020, investment bank Morgan Stanley announced its acquisition of a leading online brokerage firm, E-Trade. Morgan Stanley structured the transaction to create a top, globally wealthy workplace.

Investment Banking Role and Skills

An investment banker is a financial professional who helps companies and governments raise money. They typically work for large investment banks and provide clients with various financial services.

As investment bankers, their day-to-day responsibilities may include:

#1 Conducting financial analysis and valuations

Skills Required: Strong analytical and quantitative skills, proficiency in Excel, financial modeling, and forecasting skills.

Examples of Tasks: Analyze financial statements and data, assess a company’s or asset’s value, and perform due diligence on potential investments.

#2 Identifying potential clients and developing financial models

Skills Required: Business insight, market knowledge, excel, and sales skills.

Examples of Tasks: Develop and maintain client relationships, identify potential investment opportunities, and build financial models to evaluate investment potential.

#3 Preparing pitch books and presentations

Skills Required: Strong writing and presentation skills, attention to detail, and creativity.

Examples of Tasks: Create pitch books and presentations to market investment opportunities and communicate complex financial data to clients clearly and concisely.

#4 Negotiating deal terms and managing client relationships

Skills Required: Strong interpersonal skills, ability to build rapport and establish trust, and knowledge of financial regulations.

Examples of Tasks: Negotiate the terms of financial transactions, develop and maintain positive client relationships, and ensure compliance with applicable laws & regulations.

#5 Collaborating with other professionals such as lawyers, accountants, and regulatory agencies

Skills Required: Teamwork skills, ability to work with professionals from diverse backgrounds, knowledge of legal and regulatory frameworks.

Examples of Tasks: Work with legal and accounting professionals to ensure compliance with regulations and laws and liaise with regulatory agencies on behalf of clients.

#6 Working on M&A, IPOs, debt, and equity offerings

Skills Required: Knowledge of investment banking processes and procedures, ability to multitask and manage deadlines, and strong project management skills.

Examples of Tasks: Manage the transaction process from start to finish, coordinate with clients and other professionals involved in the deal, and ensure successful transaction completion.

#7 Staying up-to-date with financial markets and industry trends

Skills Required: Strong interest in financial markets and trends, ability to analyze and interpret market data, willingness to learn and adapt.

Examples of Tasks: Monitor financial markets and industry trends, stay informed of new financial products/services, and analyze data to identify potential investment opportunities.

#8 Maintaining a high level of accuracy and attention to detail

Skills Required: Strong attention to detail, ability to maintain accuracy under pressure, proficiency in financial analysis.

Examples of Tasks: Ensure financial analysis and valuation accuracy, prepare and review financial documents, and perform quality control checks.

#9 Having excellent interpersonal skills

Skills Required: Strong communication skills, ability to build client relationships, and effective listening skills.

Examples of Tasks: Communicate effectively with clients and other professionals, build positive relationships based on trust and mutual respect, listen actively, and respond appropriately.

#10 Being able to work well under pressure and tight deadlines

Skills Required: Strong time management skills, ability to prioritize tasks, and capacity to work efficiently under pressure.

Examples of Tasks: Manage multiple tasks and deadlines, prioritize tasks effectively, and remain focused and efficient under pressure.

Types

The four types of investment banks are:

Regional Boutique:

These banks are smaller and deal with a maximum of a dozen customers. They also specialize in only a single region or location. Thus, their customers are mainly small and local organizations. Moreover, they focus on a specific service field, such as M&A or IPOs.

Elite Boutique:

Elite boutique banks provide considerably high-value deals than regional boutique banks. They have multiple offices in the country but do not have a global presence like Bulge bracket banks. Their services are restricted to a sole sector like regional boutiques.

Middle Market:

The middle market banks are similar to the elite boutique in case of global presence and reach. However, their deals range between $50 million to $500 million. Furthermore, the middle market offers various services like deal structuring, asset management, raising equity, debt, capital, etc.

Bulge Bracket:

They are multinational banking firms that deal with large clients and deals. They also have an outstanding global presence, a recognizable name, and offices across the globe. There are no limitations on the range of services the bulge bracket banks offer.

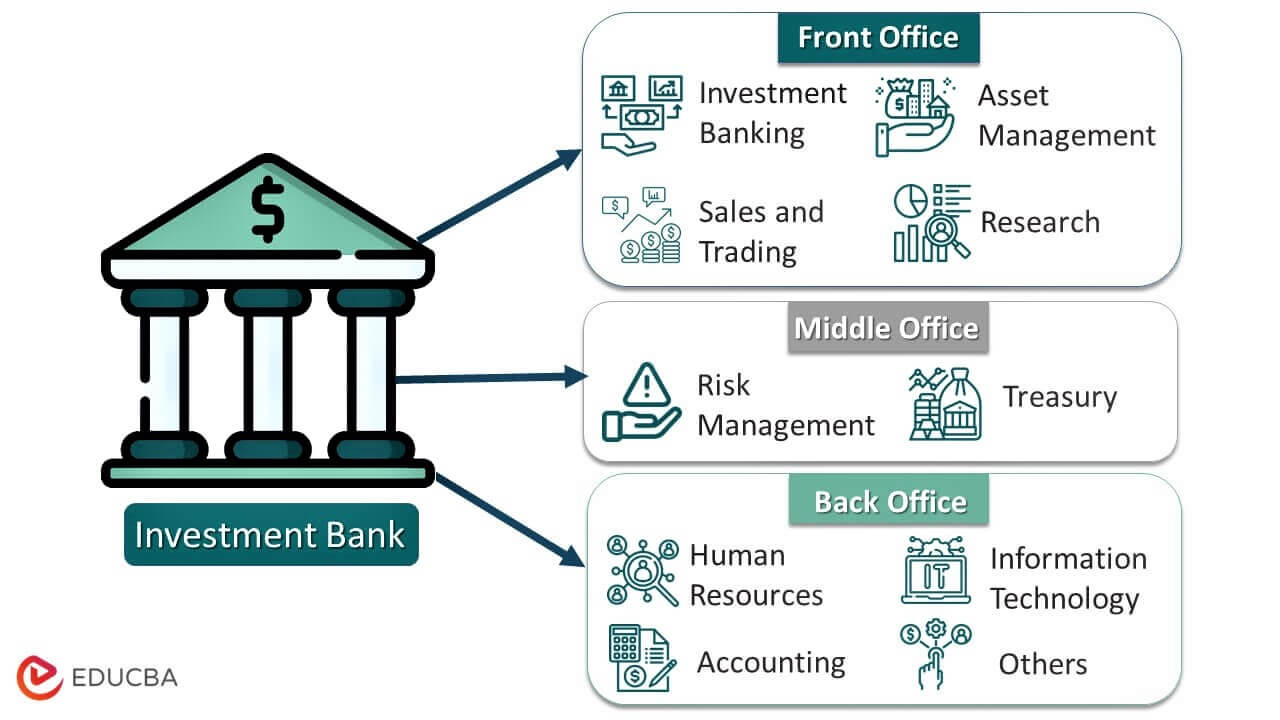

Structure

Investment banks typically include three departments – the front, middle, and back offices.

- Front Office: The front office managers and advisors develop client relationships by helping them exchange assets, buy/sell securities, and execute trades. It is the revenue-generating division, where the activities include advisory services, underwriting, trading, research service, and more. It primarily consists of product & industry groups in the banking division. Moreover, it also comprises sales, trading, asset managers, and research groups in the other divisions.

- Middle Office: People in this division are responsible for monitoring and handling the treasury. The middle office is also responsible for operating risk management-related services.

- Back Office: Back office staff deals with customer services, human resources, office management, staff payroll, accounting, and others. It also handles the financial reports to ensure the client’s transactions are accounted for correctly.

Investment Banking Career & Hierarchy

The investment banking career path typically involves the following steps:

- Analyst: The entry-level position is typically that of an analyst. Analysts are responsible for gathering and analyzing financial data, preparing financial models and presentations, and supporting senior bankers on transactions.

- Associate: Individuals may get the associate role after a few years as an analyst. Associates have more responsibility than analysts and manage projects, lead client meetings, and work with analysts to prepare financial models and presentations. Associates typically have an MBA or other advanced degree.

- Vice President: After several years as an associate, the company may prompt the individual to become vice president. Vice presidents manage client relationships, lead transactions, and supervise analysts and associates.

- Director/Managing Director: The next step in the investment banking career path is typically that of a director or managing director. These positions involve more strategic responsibilities, such as business development, leading teams, and managing relationships with senior clients.

- Partner: Some investment banks have a partnership structure where senior executives can become partners. Partners have a stake in the business and are responsible for the firm’s overall success.

Investment Banking Jobs

Investment banking offers a range of jobs depending on the bank’s size and focus. Some of the most common types of employment include:

|

Job Role |

Description | Investment Banks Hiring in the US |

Investment Banks Hiring in Asia |

| Analyst | Conducts financial analysis, creates financial models, and prepares presentations for senior bankers. | Morgan Stanley, Bank of America Merrill Lynch, Citigroup, J.P. Morgan, Goldman Sachs | Mitsubishi UFJ Financial Group, HSBC, SMBC Nikko Securities, Mizuho Securities |

| Associate | Worked with senior bankers on transactions, managed client relationships, and lead teams of analysts. | Jefferies, Barclays, UBS, Credit Suisse, Evercore | HSBC, Mitsubishi UFJ Financial Group, Daiwa Securities, Nomura Securities |

| Vice President | Manage client relationships, lead transactions, and supervise analysts and associates. | Bank of America Deutsche Bank, Morgan Stanley, Goldman Sachs | Mitsubishi UFJ Financial Group, HSBC, Nomura Securities, Mizuho Securities |

| Director/ Managing Director | Have strategic responsibilities such as business development, leading teams, and managing relationships with senior clients. | Blackstone Advisory Partners, Perella Weinberg Partners | SMBC Nikko Securities, Mitsubishi UFJ Financial Group, Daiwa Securities |

| Sales and Trading | Manage and execute trades for clients. | Goldman Sachs, J.P. Morgan, Citigroup, Morgan Stanley | Mitsubishi UFJ Financial Group, SMBC Nikko Securities, Daiwa Securities, Nomura Securities |

| Risk Management | Identify and manage risks in the bank’s portfolio. | Morgan Stanley, Citigroup, Goldman Sachs, Wells Fargo | Standard Chartered Bank, Sumitomo Mitsui Banking Corporation |

| Compliance | Ensure that the bank is complying with relevant laws and regulations. | Bank of America Merrill Lynch, Goldman Sachs, J.P. Morgan | Mitsubishi UFJ Financial Group, HSBC, Standard Chartered Bank |

| Operations | Support the bank’s day-to-day operations, including settlement, clearing, and reconciliation of trades. | Deutsche Bank, Citigroup, J.P. Morgan, Morgan Stanley | Mitsubishi UFJ Financial Group, Nomura Securities, Sumitomo Mitsui Banking Corporation |

| Private Equity | Invest in and acquire companies to improve their operations and sell at a profit. |

– |

– |

Investment Banking Salary

Salaries in the investment banking industry vary widely depending on factors such as location, experience, and the size and reputation of the bank. Here is an overview of salaries and bonuses for various designations:

|

Job Role |

Salary | Approx. Bonus |

Interesting Facts |

| Analyst | $80,000 – $120,000 | Varies | Entry-level analysts often receive complimentary meals and other perks such as gym memberships or company outings despite working long hours. |

| Associate | $120,000 – $200,000 | $50,000 – $100,000 | Associates can earn a higher bonus than their base salary, making it a lucrative career path. |

| Vice President | $250,000 – $400,000 | $150,000 – $300,000 | The job may require frequent travel, but it can also provide the chance to work on international deals and gain exposure to different cultures. |

| Director/ Managing Director | $500,000 – $1,000,000+ | $500,000 – $1,000,000+ | Directors may benefit financially from the success of the company they work for, as they may have a stake in it. |

| Sales and Trading | $150,000 – $300,000 | Varies | Working in sales and trading can offer the chance to work with cutting-edge technology and stay ahead of market trends. |

| Private Equity | Varies | Varies | Private equity professionals may work closely with company management to implement changes, which can be a challenging yet rewarding experience. |

Top Investment Banking Companies

Many investment banking companies worldwide, ranging from small boutique firms to large multinational banks. Below are examples of the top 10 companies listed by rank, location, assets under management (AUM), and their notable facts. The assets under management (AUM) for the companies are from 2021/2022:

|

Rank |

Name | Headquarters Location | Total Assets Under Management (AUM) |

Notable Facts |

| 1 | JPMorgan Chase | New York, USA | $3.7 trillion | The largest bank in the US by total assets and market capitalization. |

| 2 | Goldman Sachs | New York, USA | $2.4 trillion | One of the oldest and most prestigious investment banks in the world. |

| 3 | Morgan Stanley | New York, USA | $1.3 trillion | Has a strong presence in M&A and IPO markets. |

| 4 | Bank of America Merrill Lynch | Charlotte, USA | $1.5 trillion | A leading global investment bank with an extensive network of clients. |

| 5 | Citigroup | New York, USA | $200 billion | Has a strong presence in emerging markets and banking. |

| 6 | Credit Suisse | Zurich, Switzerland | $540 billion | Has a significant presence in wealth management and private banking. |

| 7 | Deutsche Bank | Frankfurt, Germany | $874 billion | One of the largest banks in Europe with a significant presence in investment banking. |

| 8 | Barclays | London, UK | $66.49 billion | Has a significant presence in global markets and a strong track record in M&A. |

| 9 | UBS | Zurich, Switzerland | $3.2 trillion | It has a significant presence in wealth management and is known for its private banking services. |

| 10 | HSBC | London, UK | $571 billion | Has a strong presence in Asia and a significant global network of clients. |

How to Get into Investment Banking?

Investment banking is highly competitive; not everyone entering the field is successful. However, by following these steps and being persistent, you can increase your chances of landing a job in the investment industry:

1. Get a relevant degree: Investment banks prefer candidates with a degree in business, finance, accounting, economics, or any related field. Moreover, attending a top business school can increase your chances of landing a job.

2. Gain relevant experience: Internships or entry-level positions in finance, accounting, consulting, or related fields can help you gain the required skills and knowledge. Also, consider applying for jobs at investment banks or other financial institutions.

3. Develop technical skills: These banks look for candidates with strong analytical and technical skills, including financial modeling, valuation, and accounting. Thus, take courses or online training programs to develop these skills.

4. Build your network: Networking is crucial in investment banking. Therefore, attend industry events and career fairs, and reach out to alumni and field professionals to expand your network.

Degree in Investment Banking

The primary requirement to work in this field is a bachelor’s degree, although many investment bankers also hold advanced degrees.

#1 Bachelor’s Degree

A bachelor’s degree is usually the minimum requirement for entry-level positions in investment banking. Common fields for investment bankers include finance, economics, accounting, or business administration. However, banks may hire graduates with degrees in other areas, such as engineering, mathematics, or computer science, if they have relevant coursework or experience.

To gain practical experience and industry knowledge, investment banks often offer internships or entry-level programs for recent graduates. These programs may include on-the-job training, mentorship, and networking opportunities.

#2 Advanced Degrees

While a bachelor’s degree is usually sufficient for entry-level positions, advanced degrees such as a Master of Business Administration (MBA) or a Master of Finance (MFin) can provide a competitive advantage for more senior roles.

An MBA or MFin program typically takes one to two years to complete and covers advanced finance, accounting, economics, and management topics. These programs may also offer internships, networking, and leadership development opportunities.

#3 Ph.D. in Finance or Economics

Investment banks may also hire professionals with PhDs in finance or economics for research or analytical roles. A Ph.D. program typically takes several years to complete and requires significant original research and writing.

Investment Banking Vs. Private Equity

|

Particulars |

Investment Banking |

Private Equity |

| Meaning | It is a service-sector business that helps with capital raising, mergers & acquisitions, IPOs, and more. | It facilitates the investment of funds collected from wealthy individuals, pension funds, insurance companies, etc. |

| Business Side | Works for the Sell-side | Works for the Buy-Side |

| Primary Focus | Advisory services | Investing activity |

| Target | It raises capital from the market. | Takes funds from high-net-worth individuals or companies. |

| Type of Analysis | Vague and abstract | Critical and comprehensive |

Frequently Asked Questions (FAQs)

Q1. What are some investment banking courses? Where can we get investment banking certification?

Answer: Beginners can learn investment banking by enrolling in specific online certification programs. Apart from some major universities, various platforms also provide comprehensive online courses that can help understand the fundamentals of the field. Most online platforms also offer the learners verifiable certifications after completing the courses.

Q2. Differentiate commercial banking vs. investment banking.

Answer: Some significant differentiations between investment and commercial banks are:

- Clients: While investment banks deal with Fortune 500 companies, commercial banks serve the national public.

- Deposits & Loans: Commercial banks take deposits and offer loans, while investment banks do not offer lending or depository services.

- Service Type: Investment banks offer specialized services such as underwriting, trading, and asset management. On the other hand, commercial banks focus on traditional banking services like loans and deposit accounts.

- Working Hours & Salary: Investment banking involves longer hours and higher salaries, whereas commercial banking has more regular hours and lower wages.

Q3. What are the usual investment banking hours for analysts?

Answer: Investment banking analysts typically work long hours, averaging around 80-100 weekly. They work on weekdays and weekends, usually starting early in the morning and finishing late at night.

The work schedule can be demanding and may require analysts to work overnight to meet deadlines. However, the exact hours may vary depending on the specific firm and the type of project the analyst is working on.

Q4. What is the qualification of an investment banker?

Answer: There are no set qualifications or experience to become an investment banker. However, most of these positions require a bachelor’s degree in finance, business, economics, or a related field.

Additionally, many employers prefer candidates with prior banking or finance experience. Investment bankers must also have excellent quantitative and analytical skills and superb communication and interpersonal skills to succeed in this line of work.

Q5. What are some best investment banking books for beginners?

Answer: Here are some of the best investment banking books for beginners:

- “Investment Banking: Valuation, Leveraged Buyouts, and Mergers and Acquisitions” by Joshua Pearl and Joshua Rosenbaum.

- “The Business of Investment Banking: A Comprehensive Overview” by K. Thomas Liaw.

- “Investment Banking Explained: An Insider’s Guide to the Industry” by Michel Fleuriet.

- “The Art of M&A: A Merger, Acquisition, and Buyout Guide” by Stanley Foster Reed, Alexandra Lajoux, and H. Peter Nesvold.

- “The Accidental Investment Banker: Inside the Decade That Transformed Wall Street” by Jonathan A. Knee.

It’s important to note that reading these books alone will not make someone an expert in investment banking. However, they can be helpful resources to supplement learning and provide a good foundation for understanding the industry.

Recommended Articles

EDUCBA presents this comprehensive guide to investment banking, exploring all its aspects. You can gain more information by visiting the following articles that EDUCBA recommends.