What is Financial Modeling For Startups?

Financial modeling for startups is the creation of models that forecast the company’s performance, like cash flow, growth, profitability, etc., to help with better decision-making.

These models also help companies design effective business plans and gain investors. Startups need enough money to stay afloat in the present and future. Hence, planning how money travels in a startup environment is essential. Thus, predicting future revenue based on current market conditions and factors can be helpful.

Predictive modeling first collects data about current trends, market conditions, and other relevant data that can affect outcomes. They also input the data into one or more models to predict future results. These models include revenue, consolidated model, etc.

Key Takeaways

- Financial modeling for startups is a simulation of the company’s finances. It includes the estimation of revenues and expenses, cash flow, and profitability.

- Startups use financial modeling to assess the viability of their business plans, forecast expected cash flow, and estimate the amount of financing required.

- Startups should do financial modeling because it helps them to understand their cash flow, revenue, and expenses. The process of financial modeling can help them make top future decisions.

- We can use various models to build financial models for startups. DCF, three statement models, and revenue models are some of them.

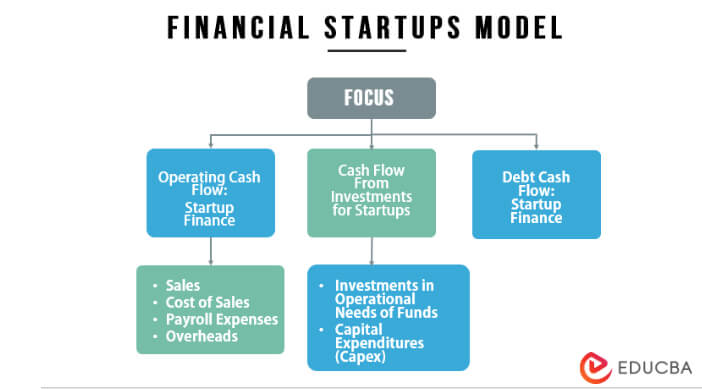

Financial Modeling – Approaches

a) Bottom-Up:

- Here, the analysis begins with the basics and specifics of the business.

- The analyst first evaluates the low-level data of the business.

- The analysis starts from production cost, supply rates, sales volume, etc., and moves upwards to revenue buildup.

b) Top-Down:

- It evaluates the model starting from outside factors.

- They analyze the market overview and move down to the company’s particulars, like average product pricing.

- Analysts also make assumptions using the total available market, serviceable available market, and serviceable obtainable market.

Financial Modeling for Startups – Assumptions

1. Revenue:

- It is a crucial assumption for startup financial models.

- As startups don’t have much financial data, analysts assess the markets of similar industries.

- The assumptions are based on another company’s data matching the startup’s size or scope.

2. Growth Rates:

- Similarly to revenue, even growth rates for various financial metrics are computed using similar industry companies.

- Analysts also formulate precise growth rates by analyzing the product market, their development over time, and other similar product-based companies.

3. Costs:

- After revenue and growth rates, another essential model data is the costs of the products and services.

- This factor includes production, operational, and administrative costs as well.

- One can gauge the average rates for products and services by valuing other companies’ costs.

How to Create Financial Modeling for Startups?

a) Set a Goal:

Before creating a financial model for the startup, businesses need to decide on a goal. Setting a specific objective can help narrow down the extensive process

b) Determine the KPIs:

After setting a goal, companies can choose their key permanence indicators. Thus, these KPIs will help them build the model efficiently.

c) Choose a Financial Model:

There are various financial models available that aid specific objectives. Therefore, choosing the correct model per the company’s requirements is necessary.

d) Make Assumptions:

Making accurate assumptions is an essential step in creating a financial model. However, as the startups do not have historical data, they can use data from similar industry companies.

e) Feed the Data:

Start feeding the data into the table. Add data from the income statement, the cash flow, and the balance sheet.

f) Perform Calculations:

After successfully adding data, analysts perform meticulous calculations, from analyzing to computing critical financial measures. Therefore, they use data linking to link all tables dynamically.

g) Summarize:

Finally, create a report for the financial model. This financial summary includes the company’s present and future monetary values. This report can usually help gain investments as well as make business plans.

Financial Modeling For Startups Template

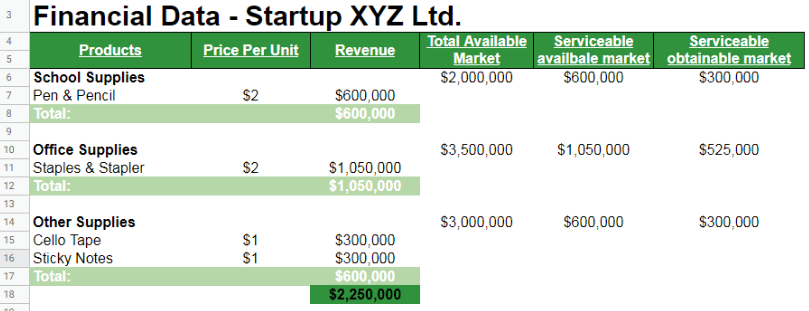

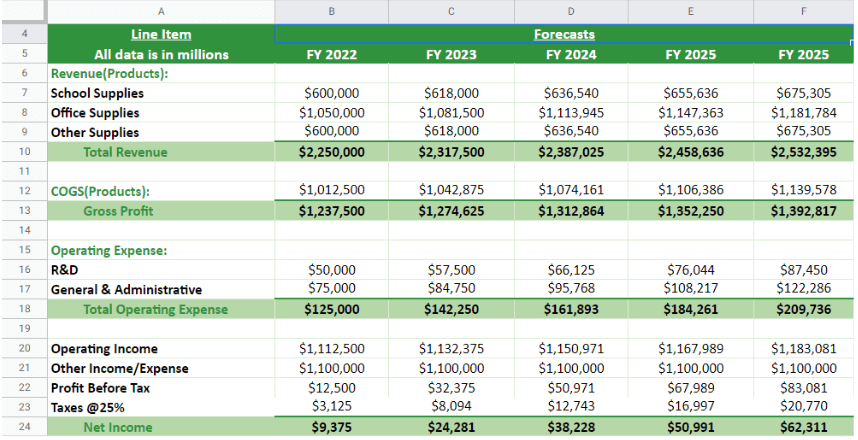

XYZ Ltd. is a startup stationery company that wants to analyze its financials for the next five years. The revenue for the company is based on the total available market, serviceable available market, and serviceable obtainable market.

The company’s given data is,

The growth rate assumptions are as follows,

Revenue Growth rate = 3%;

COGS as Percentage of Revenue = 45%;

R&D (Operating Expenses) Growth rate = 15%;

General & Administrative (Operating Expenses) Growth rate = 13%

Based on the above assumptions and growth rates, the completed financial model for the Startup will estimate the revenue, gross profit, total operating expenses, and net income for the next five years, as seen in the image below.

Financial Modeling For Startups – Models

Financial modeling for startups uses Excel to project a company’s financial performance. There are numerous financial models startups can use. These are a few important ones.

1. 3-Statement Financial Model

The 3-statement financial model includes the three primary financial statements. This model comprises the income statement, balance sheet, and cash flows.

It is a dynamically interconnected model, so it is crucial to understand how to connect the three financial statements. Hence, learning about the basics of financial modeling is necessary. Generally, we can use Excel functions to link the statements. This model can forecast the company’s overall financial position.

2. Discounted Cash Flow (DCF)

The DCF model can determine the value of a business. This model uses the three financial statements to predict the company’s current value based on its future cash flow. It also uses various approaches like WACC calculations, Sensitivity analysis, etc. It can also be beneficial for equity researchers as well as investors.

3. IPO Models

Businesses use this model to value their businesses before going public. When a company decides to sell its stocks in the share market, it launches an IPO. Thus, this model helps them understand what to expect.

As the model analyzes the business, it helps forecast an expected price value for the company’s shares. The model also includes the discount IPO value to ensure they make sales.

4. Budget Model

It is a crucial model in financial planning and analysis. FP&A professionals use it to create a budget for the upcoming year or years. It can also be a helpful model for expanding businesses. It also focuses on the company’s income statement and historical data and bases the predictions on numerous assumptions.

Venture Capital Financial Modeling

- Financial models like DCF and three statement model require historical data to value the company, which can be unfavorable for startups.

- The venture capital model is also the most suitable method to forecast startup performance.

- It mainly helps create reports to attract investors and raise capital and funds. Therefore, major investors like Sequoia Capital, Y Combinator, and Accel have invested in many startups.

- The model also focuses on investments, from determining the investment needed to valuing the company. This includes pre-seed funding, which provides the initial capital for startups to develop their ideas and prototypes.

- However, this model can only be helpful to companies that show high growth potential.

Importance of Financial Startup Model

- It can help analyze the startup project’s viability. Creating a financial model for a business idea will give you a general idea about your finances. Hence, you can assess your business from required funds to expected revenues.

- These models can also help build business growth strategies. Using thorough and meticulous financial models can aid in the decision-making process. You can also determine whether business expansion is appropriate and timely based on the results of financial models.

- Companies can use these models to gain capital from potential investors. Therefore, if the model predicts growth and profit, more investors will be willing to invest in your idea.

- Most banks request financial records to determine the firm’s capacity to repay loans. Therefore a practical financial model for startups will prove advantageous.

FAQs

Q1. What is the importance of a financial model for startups?

Answer: Financial modeling can help test the viability of new ideas or projects through feasibility proposals. Financial modeling is necessary when creating a business plan or determining a company’s financial structure. However, they only support the managers in making better decisions during the planning process. They also help understand their situation and quantify the risk when making one or more decisions.

Q2. How to learn financial modeling for startups?

Answer: Anyone can learn to create financial models for startups. Start by learning the basics like Excel, financial statements, and their analysis. You can also view instructional videos as well. Practice building models using templates and case studies. Enrolling in Financial Modeling programs can also be very useful. You can also attend a class at the college or university. Hence, if you require specialized knowledge, learn about models specific to your industry.

Q3. What is the SaaS financial model?

Answer: The SaaS financial model summarizes the company’s financial performance. It generally projects the overall summary, which includes various forecasts from the company’s financial metrics. A SaaS marketing budget is strategically allocated across various channels to optimize customer acquisition costs and drive sustainable growth for software-as-a-service companies.

Q4. What software to use for financial modeling?

Answer: There is numerous free and paid financial modeling software available. Among the software programs are Quantrix, Oracle BI, Jirav, and Maplesoft, an advanced financial modeling software.

Recommended Articles

This article explains everything about Financial Modeling for Startups. To learn more about Financial Modeling for Startups, visit the following links,