Updated October 27, 2023

Definition of Business Valuation

Business valuation is a set of procedures and complete processes to determine a business’s worth. Although it may sound easy, adequately valuing your business requires preparation and thought.

Business Valuation Certification

Business valuation certification of the process to value a company is carried out only when selling or buying the business. A certification is a versatile tool that significantly impacts managers’ actions. A business valuation certification can demonstrate the business’s direction when used as a business performance indicator. It identifies which strategy is working best from the business perspective. Companies that have several subsidiaries have to decide how to distribute their resources. Valuation is a significant part of the filtration process. Business valuation certification units showing the most significant growth value and making a more considerable contribution to the total value should ideally receive a more substantial slice of the resources pie.

Business valuation certification is also a critical management motivation tool. Balance sheets and profit and loss statements can often forge an incorrect picture of the true worth of a business. Much accounting jugglery is involved in preparing financial statements. They include many components that have little or no realizable worth. Managers who rely on these numbers may be unaware of leading the company to trouble. Valuation, here, is a “checking mechanism” used in addition to the conventional formats. It’s also a valuable yardstick for assessing the industry’s life cycle position. If the value of the business drops over time, the management can check whether more resources are required to maintain the market position. It may reveal that demand in that particular industry is wavering.

Exiting at the right time ensures a reasonable price and avoids significant losses, while a steady increase in value indicates growth and market opportunities. Business valuation is a universal performance indicator for companies of all sizes.

Business valuation is a corporate-wide analysis that gives a general picture of a company’s market and industry position. The versatility of business evaluation means it can complement the existing management tools and serve as a filtering process for project appraisal exercises.

However, the method used in business valuation is critical. The analysis has to be transparent and, at the same time, consider external influences. The processes should be understood by all parties involved.

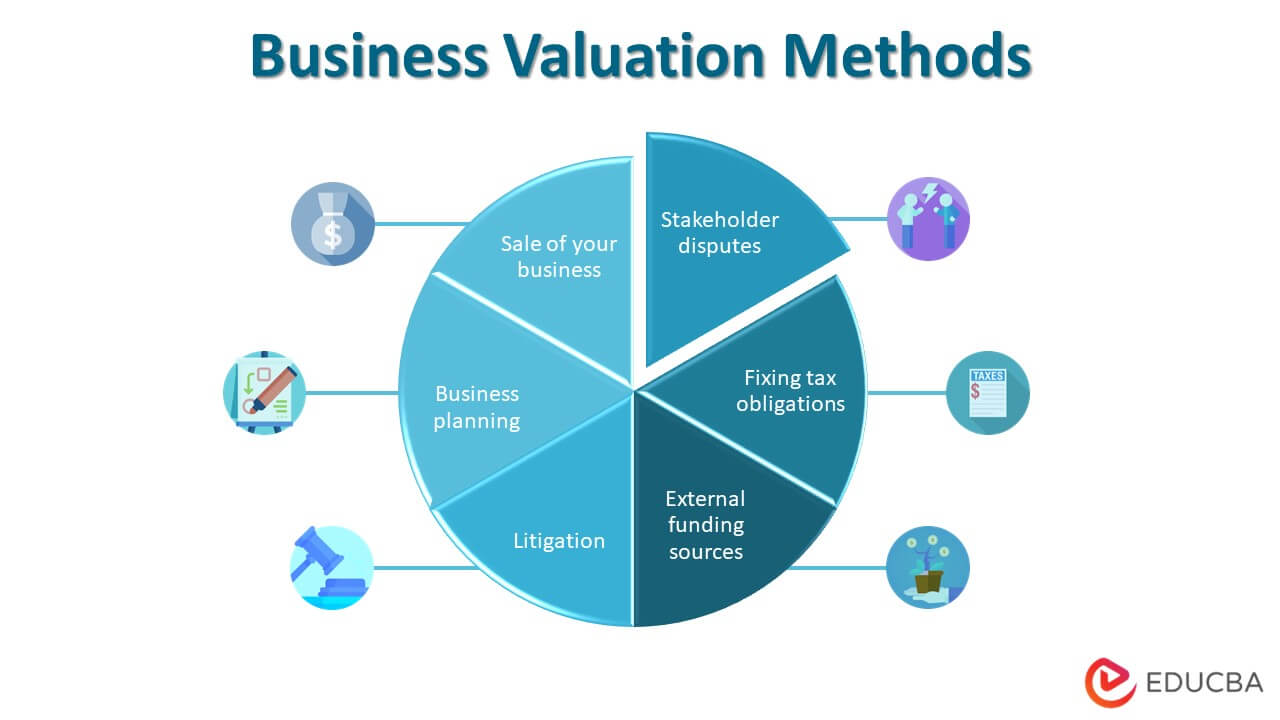

Why Business Valuation?

There are many reasons to carry out a business valuation. Here are some of them.

- Commencing a sale of your business

- Resolving stakeholder disputes

- For future decision-making and business planning

- Fixing tax obligations

- Litigation

- Accessing external funding sources

Business Valuation Calculator

Preparing a business valuation to calculate before starting to sell off the company is a significant step to understanding the actual value of your business. It will reveal accurate numbers and the price you can expect if adequately carried out. It’s often the beginning of all future negotiations. It’s also a reconnaissance for those not in line with the present market situation. In such cases, a candid assessment gives the correct means to make decisions, i.e., go ahead with the sale or improve the business valuation for a calculation in the future.

There could be times when a shareholder may want to leave the business. It could be a cordial parting where the person wants to move on or may stem from years of disagreement. A departure usually entails one party selling his/her stake to the other shareholders. Determining a fair share price for a departing stakeholder could be challenging. An externally prepared business valuation is an appropriate starting point in such cases.

Business Planning

All proprietors must be aware of the market value of their business for forwarding planning. This is particularly important during expansions to know whether it’ll be worthwhile. Understanding the company’s present position will help owners make important decisions about the future of their business.

The Results Depend on Your Assumptions

For one thing, there’s no one way to determine what a business could be worth. That’s because a business valuation could mean different things to different people. While the proprietor of a business may believe that the community it serves has a lot of worth, an investor may think the historical income defines the value of a company. Besides, economic conditions often affect people’s belief in the worth of a business. For instance, more business buyers prefer to enter the market when job opportunities are scarce. It leads to increased competition, resulting in a higher business selling price.

Selling circumstances can also affect the value of a business. There’s a vast difference between a company projected as a part of a well-planned branding mechanism to attract interested buyers and a prompt auction of business assets.

Business Value and Expected Selling Price

In real terms, business value is a company’s expected price while selling. The actual price may vary depending on who fixes the value. The selling price is also dependent on how the sale itself is handled. There’s a difference between a well-executed marketing campaign and a “flash sale.”

Business Valuation Methods

There are three methods of business valuation are given below:

1. Asset Approach

In this Business valuation method, the business is viewed as a set of liabilities and assets, i.e., the building blocks to determine the real business value. Business valuation methods are based on the so-called economic rationale of substitution, which asks: What will be the cost to set up another similar business, like the one being valued, which will create the same economic benefits for its owners?

All operating businesses have their assets and liabilities. Determining their value would be the most natural way to evaluate the company. The difference between the assets and liabilities will be the positive or negative final value.

While it may sound simple enough, the real challenge is to figure out which liabilities and assets to consider for valuation and choose a standard to measure their value. The actual determination of each liability and asset comes next.

Balance sheets, for instance, may not include the more critical assets like indigenously manufactured products and proprietary business methods. If the proprietor didn’t pay for them, they wouldn’t be recorded on the balance sheet.

However, the actual value of these assets is often more significant than all “recorded” assets combined. Imagine a company with no unique products or services but still attracts customers.

2. Market Approach

As the name implies, the market approach depends on the signs of the actual marketplace to determine the worth of a business valuation. The economic principle of competition is applicable here.

What is the worth of other business valuations that provide the same products and services as mine?

No company can operate in a vacuum. If you have a unique product or service, competitors will offer a similar or broadly similar thing. If you want to buy a company, you have to zero in on the type of business that interests you and then do some market survey regarding the “going rate” for the business type.

On the other hand, if you want to sell your business, check out the market rate on what similar companies are selling for.

It’s intuitive to believe that the “market” would settle to a business-price equilibrium, where the buyers are willing to pay what the sellers are ready to accept. People also refer to this as the fair market value. Here, both parties assume to act fully aware of all relevant facts. Neither side is compelled to close the sale.

The market approach to evaluating a business valuation is one of the best to determine the fair market value, which is a monetary value likely to be exchanged at an arms-length transaction, with the seller and buyer acting in their best interests. The market data is beneficial to support your offer or the asking price. Why should you accept less or offer more if the “going rate” is this much?

3. Income Approach

This approach looks at the key reason to run a business, i.e., generating revenues. If you invest your money, time, and energy into owning the company, what economic benefits will you derive from it? The expected economic use from the purchase or sale is essential. Since the money is yet to come into the bank, there’s some risk of not receiving a part when you expect it. The income valuation method factors in this risk to determine the kind of money the purchase/sale may bring. Since the valuation of the business must be taken at present, the expected risk and income must be translated at the current time. The income approach uses capitalization and discounting as the two methods.

In its simplest form, the capitalization method divides the expected earnings from the business by the capitalization rate. The underlying rationale is that profits define business value, and the capitalization rate is used to relate the two.

For instance, with a capitalization rate of 20%, the business’s value is five times its annual earnings. The capitalization factor is the other way to multiply the income. Either way, one values the business today.

The discounting method works differently. First, you project the income stream of your business for some time in the future, which is usually measured in years. Next, determine the rate of discount that reflects the risk of generating the income on time.

Lastly, figure out the worth of the business at the end of the projection period. People also refer to this as a company’s terminal or residual value. The discounting calculation reveals what the business is worth today.

Business Valuation and Risk

Both income valuation methods do the same; you can expect identical results. There is a correlation between discount and capitalization rates.

CR=DR-K

Here, CR is the capitalization rate, DR is the discount rate, and K represents the average expected growth in income. For instance, if the discount rate is 25% and the projected profits are a steady 5% yearly, the capitalization rate is 25-5=20%. The income input is perhaps the most significant difference between the discounting and capitalization methods. Capitalization considers a single income measure, like the average earnings for the past few years. One discounts income values for every year in the projection period.

The capitalization approach could be a good choice if your company earns steady profits for years. The discounting process will give more accurate results for growing businesses witnessing less predictable profits.

How do Results Differ According to Business Valuation Methods?

Can different business valuation methods reveal different results? Yes, absolutely. Consider two prospective buyers carrying out income projections to assess the risk of owning a business. Every buyer will have a different perspective on the risks involved. Their discount and capitalization rates are likely to differ. Besides, the two buyers will have their plans for the business that will affect the income stream projection.

Even if the two buyers use similar valuation methods, the outcome could be different from the other. Putting it in another way, the investment value standard determines the worth of a business. Depending on their investment objectives and ownership, buyers would measure the value of a business differently. It underscores the importance of considering.

The income valuation approach has the greatest strength of flexibility, allowing one to measure the worth of a business to match its objectives. This versatility makes it a good method for determining a company’s value.

Related Articles

In conclusion, business valuation is an important process for companies that provides a corporate-wide analysis to achieve a general picture of the organization. Businesses can determine their worth and make informed decisions about their future by considering various factors, such as income valuation, selling circumstances, and the buyer’s perspective. Here, we also discuss the three methods of Business Valuation along with the Calculator and certification. You may also look at the following articles-