Present Value Factor Formula

Present Value Factor Formula:

- r = Rate of Return

- n = Number of Years/Periods

The present Value Factor Formula calculates the present value of all the future values to be received. It works on the concept of time value money. The time value of money is the concept that an amount received today is more valuable than the amount received at a future date.

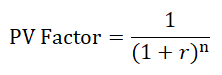

Derivation of Present Value Factor Formula

Where,

- PV = Present Value

- FV = Future Value

- r = Rate of Return

- n = Number of Years/Periods

Example of Present Value Factor Formula

Company Z has sold goods to Company M for Rs. 5000. Company M offered Company Z that either Company M pays Rs. 5000 immediately or pay Rs. 5500 after two years. Discounting rate is 8%.

Now, to understand which of either deal is better i.e. whether Company Z should take Rs. 5000 today or Rs. 5500 after two years, we need to calculate a present value of Rs. 5500 on the current interest rate and then compare it with Rs. 5000, if the present value of Rs. 5500 is higher than Rs. 5000, then Company Z should take money after two years otherwise take Rs. 5000 today.

- PV = FV * [ 1 / (1+r)n ]

- PV = 5500 * [ 1 / (1+8%) 2 ]

- PV = Rs. 4715

As the present value of Rs. 5500 after two years is lower than Rs. 5000, Company Z should take Rs. 5000 today.

Explanation of PV Factor Formula

Present value means today’s cash flow value to be received at a future point in time, and the present value factor formula is a tool/formula to calculate the present value of future cash flow. The concept of present value is useful in making a decision by assessing the present value of future cash flow. Given a situation where you have to decide whether to receive or pay any sum today or in the future, assessing the present value of future cash flows helps make effective decisions by comparing today’s cash flow with the present value of future cash flow.

The present Value of Future Cash Flow is the intrinsic value of the Cash Flow due to be received in the future. It is a representative amount stating that instead of waiting for the Future Cash Flows, if you want the amount today, how much would you receive? The present value of the future cash flows is lower than the future cash flows in an absolute sense as it is based on the concept of the Time Value of Money. As per the concept of the time value of money, money received today would be of higher value than money received in the future as money received today can be reinvested to earn interest. Also, money received today reduces any risk of uncertainty. In short, the longer the time in receiving money lower its current value.

A very important component of the present value factor is the discounting rate. Discounting rate is the rate at which future cash flow value is determined. The discount rate depends on an investment’s risk-free rate and risk premium. Each cash flow stream can be discounted at a different discount rate because of variations in the expected inflation rate and risk premium. Still, for simplicity purposes, we generally prefer to use a single discounting rate. Discounting rate is very similar to interest rate i.e. if you invest in government security, interest rates are low as it is considered risk-free. Similarly, the interest rate of FD is higher than government security because of higher risk than a government security, and similarly in corporate deposits of different companies of different credit ratings.

Hence, the discounting rate of a risky investment will be higher, as it denotes that the investor expects a higher return on the risky investment.

Significance and Use of Present Value Factor Formula

The concept of present value is very useful for making decisions based on capital budgeting techniques or for arriving at a correct valuation of an investment. Hence, it is important for those involved in decision-making based on capital budgeting, calculating valuations of investments, companies, etc.

The present Value Factor Formula also acts as a base for other complex formulas for more complex decision-making like internal rate of return, discounted payback, net present value, etc. It is also helpful in day to day life of a person, for example, to understand the present value of a home loan EMI or the present value of fixed return investment, etc.

Present Value Factor Calculator

You can use the following Present Value Factor Calculator

| r | |

| n | |

| PV Factor Formula | |

| PV Factor Formula | = |

| |||||

| = |

|

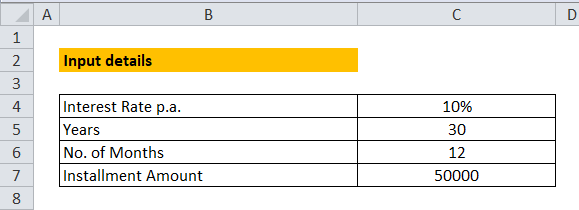

Present Value Factor Formula in Excel (With Excel Template)

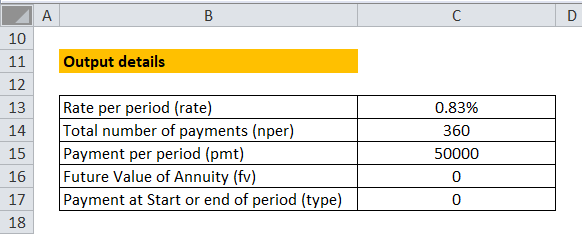

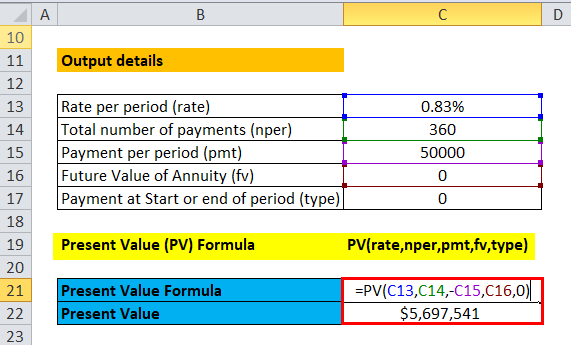

In this example, we have tried to calculate the present value of the Home Loan EMI using the PV factor formula. As illustrated b, we have assumed an annual interest rate of 10% and the monthly EMI Installment for 30 years. The installment amount assumed is Rs. 50,000.

We need to understand the formula’s components to calculate the present value using the PV Factor formula in Excel. The following are the components of the PV formula:

- Rate: Rate is the interest rate or discounted rate used for discounting the future cash flow. As stated before, there can be a different rate for cash flow at different time periods based on inflation and risk premium. Still, for simplicity purposes, we will use a single rate for discounting cash flows at different time intervals.

- Kindly note that the rate used has to be for a period; in our example, we have assumed an interest rate of 10% per annum; however, cash outflow in the form of EMI will happen every month. Hence, we divided 10% by 12 to arrive at a monthly rate i.e. rate per period.

- NPER: NPER is the total number of payments. In our example, we have multiplied 30 years by 12 months each year to arrive at the total number of payments.

- PMT: PMT stands for payment per period. In our example, Rs. 50,000 EMI has to be paid monthly, which is paid per period.

- FV: FV stands for Future Value of Annuity. It means Value to be received at the end of the period. It is optional to provide input for ‘FV’; if left blank, it is considered 0.

- Type: Type helps to determine whether payment will begin at the start or end of the period. If you type ‘0’, payment will be considered at the end of the period, while for ‘1’, it considers payments to be made at the start. It is also optional to provide input for ‘type’; if left blank, it is considered 0.

Now, to calculate and present value in Excel, Use PV Factor Formula, i.e, PV(rate, nper, pmt, fv, type)

Recommended Articles

This has been a guide to a Present Value Factor formula. Here, we discuss its uses along with practical examples. We also provide you with a Present Value Factor Calculator with a downloadable Excel template. You may also look at the following articles to learn more –