Updated November 7, 2023

Difference Between Growth Stock vs Value Stock

Growth stocks will have substantial growth potential shortly. Investors usually hold this perception because these companies have consistently exhibited better-than-average earnings growth records when compared to the broad market or respective industry. They consider these stocks as high-quality stocks or successful companies with distinguishing prospects. In contrast, investors perceive value stocks as currently undervalued compared to their intrinsic value or fundamental worth. Although the respective companies are fundamentally sound, for some temporary reason, most market participants consider them less favorable investments.

Let us study much more about Growth stocks and value stocks in detail.

- Most growth companies pay little or no dividends since plowing back the profits for further business expansion is considered a more feasible and lucrative opportunity. Distinguishing prospects could be innovative products/services, a continuous stream of creative ideas that keep transforming quickly, good business models, or good management. Most of the growth companies are new companies that are capitalizing on their innovative ideas. While growth stocks offer high returns on capital, chances of price declines are also high, especially in the case of small unstable companies.

- Some examples of reasons could be legal problems, negative publicity or disappointing earnings in the short-term, or other more specific issues not connected with the company’s operations. Investors aim to bank on these stocks by buying at low bargain prices and selling when the market realizes the full potential of the respective companies.

- The intrinsic value of a stock is a subjective concept and can vary based on the varying assumptions made by the investor. The value group usually consists of comparatively larger and well-established companies with financially strong fundamentals and hence are less risky than the growth stocks. However, within the value group, inventories of new companies could also be there whose potential has yet to be fully recognized by broader market participants.

- Risk-averse investors may also go for income stocks that are fairly stable and offer competitive dividends, like the common stock of utility companies or preferred stock promising fixed dividends.

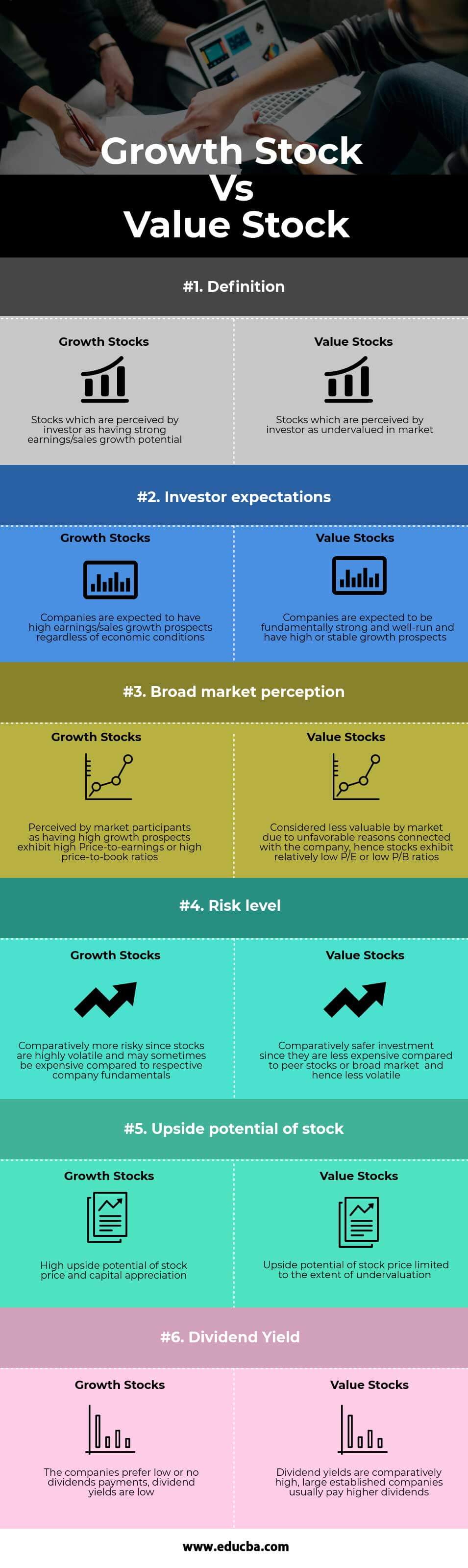

Head To Head Comparison Between Growth Stock and Value Stock (Infographics)

Below is the top 6 difference between Growth Stock vs Value Stock :

The Key Difference Between Growth Stock vs Value Stock

As you can see, there are many differences:

- The investor perceives growth stocks as associated with high-growth companies with distinguishing prospects expected to help in faster revenue/earnings growth than the market/industry. Value stocks are perceived by an investor as associated with fundamentally sound companies but are currently undervalued in the stock market due to short-term unfavorable reasons

- Growth stocks are usually more expensive with high P/E or P/B ratios, as broad market participants expect these companies to have good growth prospects. In contrast, value stocks are less costly with low P/E or P/B ratios as market participants differ in their view of future growth prospects of the company vis-à-vis the investor.

- Growth investing has higher upside potential because the growth companies continue to surprise the markets with their innovations or business models. Value investing has limited upside potential since the market will eventually recognize the companies’ full potential and price the stocks correctly.

- Growth stocks are more volatile and sometimes expensive compared to company fundamentals, while value stocks are less risky owing to limited downside potential

- Return from growth stocks is contingent on a realization of the investor’s perception of earnings growth prospects. In contrast, returns from value stocks are contingent on the recognition of the investor’s value perception by the market.

Growth Stock vs Value Stock Comparison Table

Below is the top comparison

| The basis of comparison | Growth Stocks | Value Stocks |

| Definition | Stocks that are perceived by an investor as having strong earnings/sales growth potential | Investors perceive stocks as undervalued in the market. |

| Investor expectations |

Investors expect companies to have high earnings/sales growth prospects regardless of economic conditions. |

Companies are expected to be fundamentally strong and well-run and have high or stable growth prospects |

| Broad market perception | Perceived by market participants as having high growth prospects exhibiting high Price-to-earnings or high price-to-book ratios | Considered less valuable by the market due to unfavorable reasons connected with the company, stocks exhibit relatively low P/E or low P/B ratios |

| Risk level | Comparatively riskier since stocks are highly volatile and may sometimes be expensive compared to respective company fundamentals | Comparatively safer investment since they are less expensive compared to peer stocks or broad market and hence less volatile |

| The upside potential of the stock | The high upside potential of stock price and capital appreciation | The upside potential of stock price limited to the extent of undervaluation |

| Dividend Yield | The companies prefer low or no dividend payments, dividend yields are low | Dividend yields are comparatively high, large established companies usually pay higher dividends |

Conclusion

Stocks can provide returns through future growth, current undervaluation in a market, or dividend income. Accordingly, we witness various styles of investing, viz. growth, value, and income investing.

Investors associate growth stocks with companies that have a history of high earnings growth and assume that these companies will generate high growth in the future. This definition mostly fits small companies in their growth phase. Of course, you have more established companies, which may continue to earn high growth due to their innovative capability and strong business models, like Amazon. Growth stocks hardly pay any dividends since they consider it more prudent to reinvest the earnings.

Value investors may look for stocks trading at historically low levels or attractive discounts compared to peers based on P/E or P/B levels etc. In contrast, value stocks are currently undervalued in the market. This mostly fits fundamentally sound companies with a competitive edge difficult to overcome by peers but is now unpopular in the market due to short-term unfavorable events.

Combining growth and value approaches for long-term investment helps to balance risk and return. This blended approach provides the potential for capital appreciation throughout the economic cycle, wherein market and economic situations offer opportunities for both types of investment growth. Now you must have a fairer idea of both Growth Stock and Value Stock. Stay tuned to our blog for more articles like these.

Recommended Articles

This has guided the top differences between Growth Stock vs Value Stock. Here we also discuss the Growth Stock vs Value Stock key differences with infographics and a comparison table. You may also have a look at the following articles –