Updated November 17, 2023

Equity Multiplier Formula

Equity Multiplier Formula is a division of the Total Assets and Total shareholder’s Net Equity of a company.

Equity Multiplier can be mathematically expressed as Total Assets / Total Shareholder’s Net Equity.

Equity Multiplier is nothing but a company’s financial leverage. Calculating Equity Multiplier is straightforward, which helps to know the shareholders’ net equity finances and the number of assets of a firm. Suppose the Equity Multiplier ratio is 2, which means investment in total assets is 2 times by total equity of shareholders.

Examples of Equity Multiplier Formula

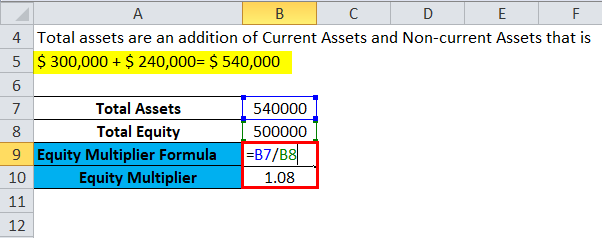

Suppose ABC Company has $ 500,000 of Total Shareholders’ Equity while Current Assets are $ 300,000 and Non-current Assets are $ 240,000.

To this, firstly, we are supposed to find out the total assets

- Total assets are the addition of Current Assets and Non-current Assets, which is

- $ 300,000 + $ 240,000= $ 540,000

- Total shareholders’ equity is already given $500,000.

By using the Equity Multiplier formula, we can easily get

- Equity multiplier = Total Assets / Total Shareholders’ Equity

- Equity Multiplier = $ 540,000 / $ 500,000 = 1.08

From the above example, the Conclusion is Shareholder funds, not the bank or financial institution debt, drive a company’s growth. The less the Equity Multiplier, the less the company uses leverage.

In the below example, we can see that –

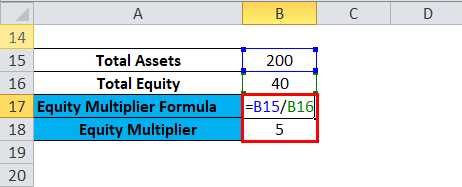

Imagine XYZ Company has Total Assets of $200 Million and Shareholder’s Equity is $ 40 Million while Preferred Share is $ 20 Million.

- Equity multiplier = Total Assets / Total Shareholders’ Fund

- Equity multiplier = 200 / 40

- Equity multiplier = 5

This simply expressed that total assets are 5 times the shareholder’s equity. It shows a company is heavily leveraged, 5 times the equity capital infused by the shareholders.

Explanation of Formula

Two main components need to be discussed in the equity multiplier formula: total assets and common shareholders’ equity-

Total assets mean all current assets (debtors, inventories, prepaid expenses, etc.) and non-current assets (building, machinery, plants, furniture, etc) of the company’s balance sheet. Common Shareholder’s Equity includes common shareholder’s funds only. This is important to note that preference shares would not be part of this because of the nature of the fixed obligation. Shareholders include both preferred shares and common shares. This ratio is useful for all investors as it helps them understand a company’s financial leverage.

The balance statement of the business includes both elements. Only the Equity multiplier ratio cannot be used to analyze the company, as some industries are capital-centric and need more capital than others. An investor must pull out other peer companies in a similar industry, calculate the equity multiplier ratio, and compare it. Suppose the result is similar or close to the industry benchmark of the company you want to invest in. In that case, you should be able to understand that low or high financial leverage ratios are the benchmark of the industry.

Significance and Use of Equity Multiplier Formula

- A higher Equity multiplier ratio indicates the company depends on debt for its financing source. It also indicates that investing in such a company would be risky.

- It helps investors know whether a company invests more in equity or debt.

- The equity multiplier ratio is low when debt financing is not a significant portion of the company’s funding. While the Multiplier ratio is low, the low company does not have much financial leverage to build more in the future, though the future is uncertain. The equity multiplier is vital in balancing the equity ratio and debts.

- The equity multiplier formula most effectively assesses a company’s financial strength. This formula results higher or lower equity multiplier ratio. A higher amount of debt or leverage means the firm may be risky.

- The equity multiplier formula is part of the return on equity DuPont formula for the financial leverage portion of DuPont analysis.

Equity Multiplier Calculator

You can use the following Equity Multiplier Calculator

| Total Assets | |

| Total Share Holder's Fund | |

| Equity Multiplier Formula= | |

| Equity Multiplier Formula= | = |

|

|

Equity Multiplier Formula in Excel (With Excel Template)

Here, we will do the same example of the Equity Multiplier formula in Excel. It is very easy and simple. You need to provide the two inputs: Total Assets and Total Shareholders’ Fund

You can easily calculate the Equity Multiplier formula in the template provided.

To find out the Equity Multiplier, we need to find out two things i.e. Total Assets and Total Shareholders’ Fund.

In the first example, we need to calculate the total assets since the value is not provided.

Total Assets = Current Assets + Non-current Assets

Then, we need to calculate Equity Multiplier.

Here in the Second example, Total Assets are 200, and Total Equity is 40. So here, We directly Calculate the Equity Multiplier using the formula

Recommended Articles

This is a guide to the Equity Multiplier formula. Here, we discuss its uses along with practical examples. We also provide you with an equity multiplier calculator and a downloadable Excel template. You may also look at the following articles to learn more –