Updated July 26, 2023

Net Present Value Formula (Table of Contents)

What is the Net Present Value Formula?

Net Present Value is the present value of all cash inflows and outflows of a project over a period of time.

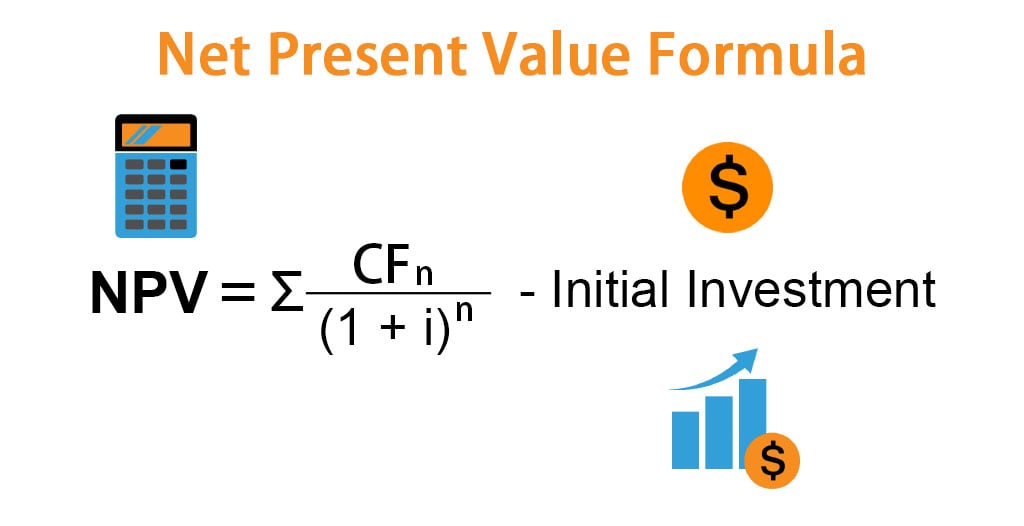

Formula For the Net Present Value is given below:

Where,

- n = Period which takes values from 0 to the nth period till the cash flows ending period

- CFn = Cash flow in the nth period

- i = Discounting rate

Examples of Net Present Value Formula (With Excel Template)

Let’s take an example to understand the calculation of Net Present Value in a better manner.

Net Present Value Formula – Example #1

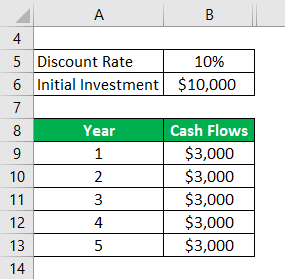

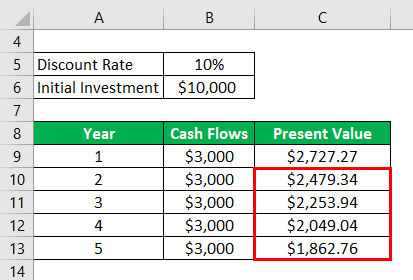

Assuming the initial cash flow for a project is $10,000 invested for a project and subsequent cash flows for each year for 5 years is $3,000. The discount rate is assumed to be 10%. Calculate Net Present Value.

Solution:

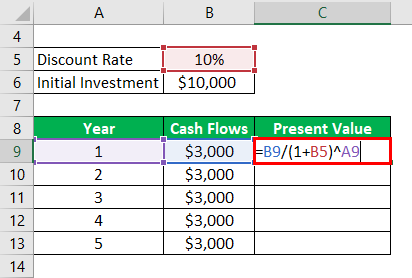

First, we have to calculate the Present Value

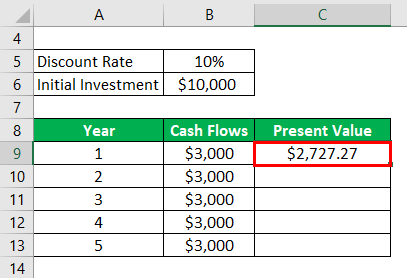

The output will be:

Similarly, we have to calculate it for other values.

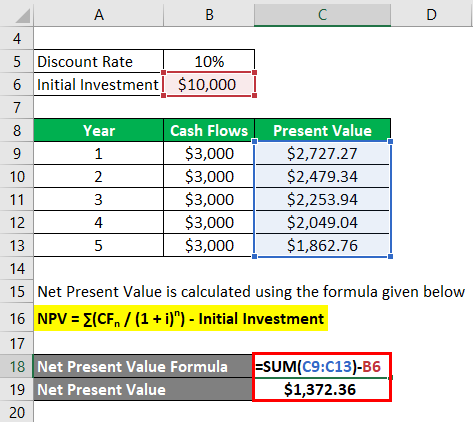

Net Present Value is calculated using the formula given below

NPV = ∑(CFn / (1 + i)n) – Initial Investment

- NPV = ($2,727.27 + $2,479.34 + $2,253.94 + $2,049.04 + $1,862.76) – $10,000

- NPV = $1,372.36

Net Present Value Formula – Example #2

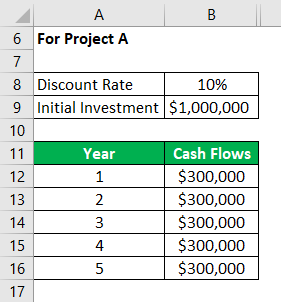

General Electric has the opportunity to invest in 2 projects. Project A requires an investment of $1 mn which will give a return of $300000 each year for 5 years. Project B requires an investment of $750000 which will give a return of $100000, $150000, $200000, $250000 and $ 250000 for the next 5 years. Then Calculate the Net Present Value which can be used to decide which opportunity is better and should be invested in.

Note: Net Present Value is used by companies in capital budgeting decisions to decide which investment they would rather do. Based on the results of the Net Present Value, a company may decide on investing in one project and rejecting another.

For Project A

Solution:

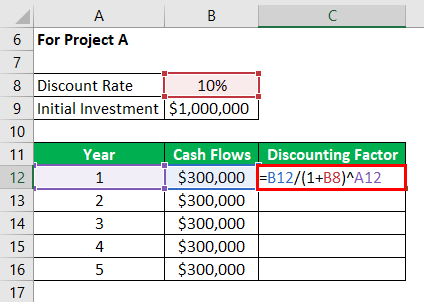

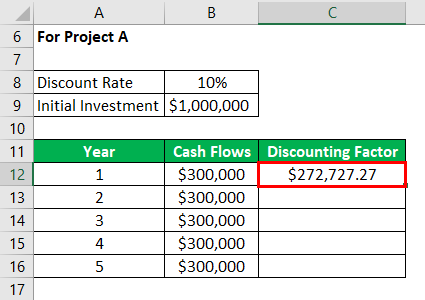

First, we have to calculate the Discounting Factor

The output will be:

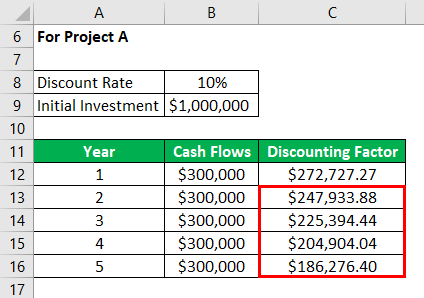

Similarly, we have to calculate it for other values.

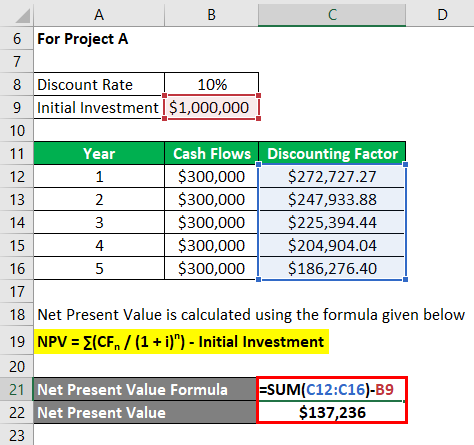

Net Present Value is calculated using the formula given below

NPV = ∑(CFn / (1 + i)n) – Initial Investment

- NPV = ($272,727.27 + $247,933.88 + $225,394.44 + $204,904.04 + $186,276.40) – $1,000,000

- NPV = $137,236

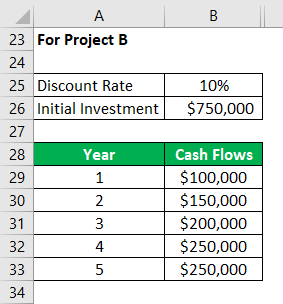

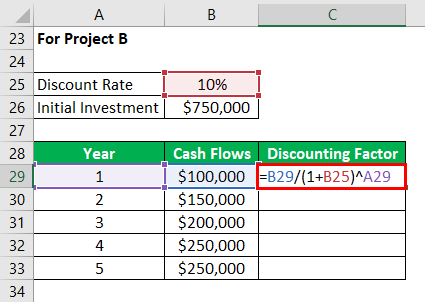

For Project B

Solution:

First, we have to calculate the Discounting Factor.

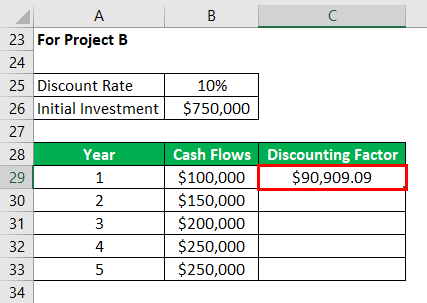

The output will be:

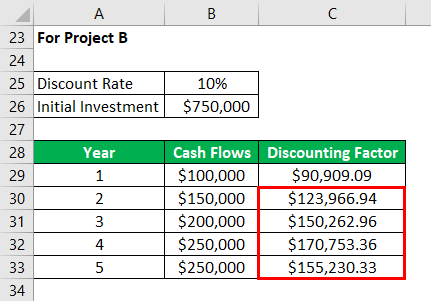

Similarly, we have to calculate it for other values.

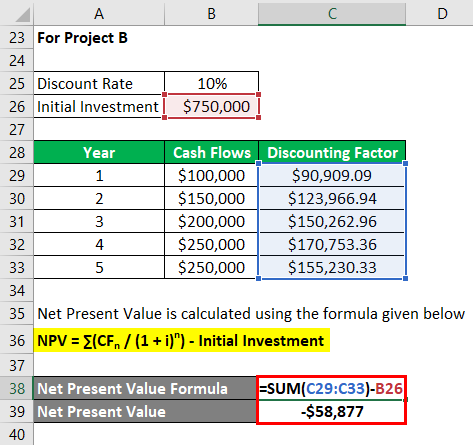

Net Present Value is calculated using the formula given below

NPV = ∑(CFn / (1 + i)n) – Initial Investment

- NPV = ($90,909.09 + $123,966.94 + $150,262.96 + $170,753.36 + $155,230.33) – $750,000

- NPV = -$58,877

Hence General Electric should go for Project A.

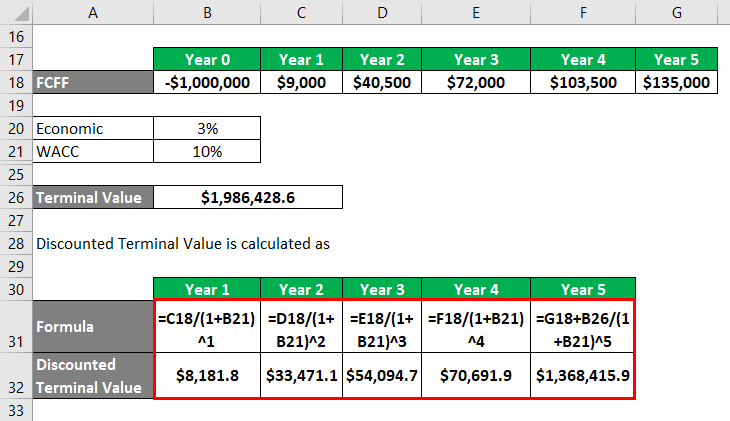

Net Present Value Formula – Example #3

Net Present Value formula is often used as a mechanism in estimating the enterprise value of a company. The projected sales revenues and other line items for a company can be used to estimate the Free Cash Flows of a company and utilizing the Weighted Average Cost of Capital (WACC) to discount those Free Cash Flows to arrive at a value for the company.

For example: –

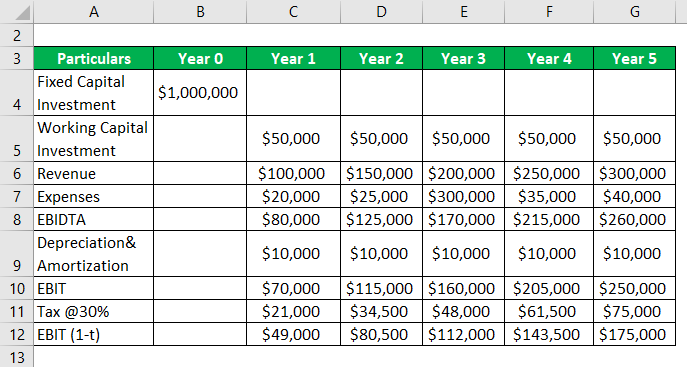

For Apple Inc. following are the estimated profit and loss line items for the next 5 years. Calculate Net Present Value.

Solution:

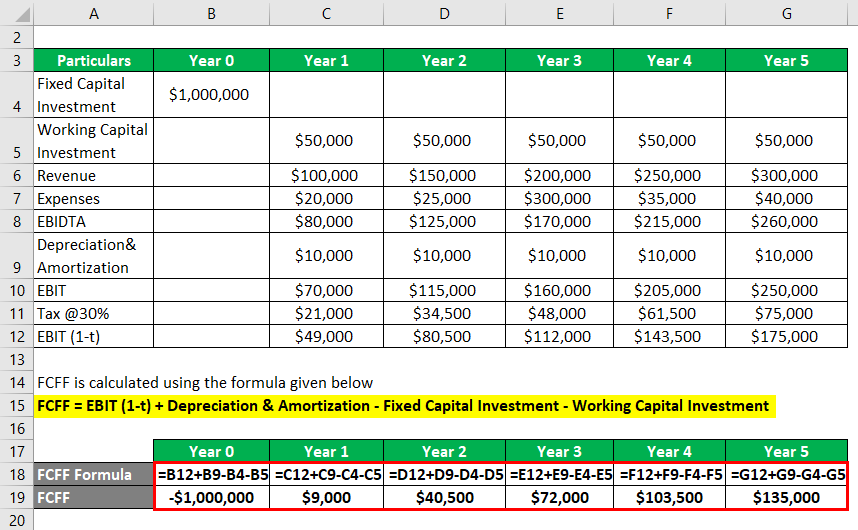

FCFF is calculated using the formula given below

FCFF = EBIT (1-t) + Depreciation & Amortization – Fixed Capital Investment – Working Capital Investment

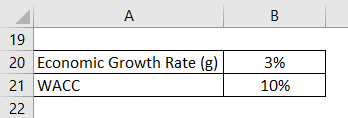

Assuming WACC @ 10%

Assuming g to be the steady-state growth of an economy at 3%.

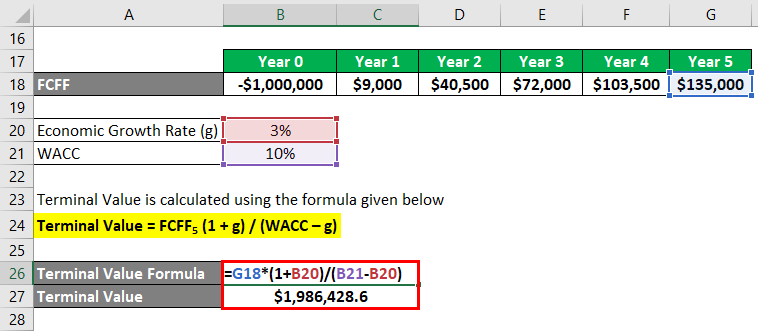

Terminal Value is estimated as the company will be a going concern after Year 5: –

Terminal Value is calculated using the formula given below

Terminal Value = FCFF5 (1 + g) / (WACC – g)

- Terminal Value = $135,000 * (1 + 3%) / (10% – 3%)

- Terminal Value = $1,986,428.6

Net Present Value is calculated using the formula given below

NPV = ∑(CFn / (1 + i)n) – Initial Investment

- NPV = ($8,181.8 + $33,471.1 + $54,094.7 + $70,691.9 + $1,368,415.9) – $1,000,000

- NPV = $534,855

Explanation

Net Present Value can be thought of as a method of calculating Return on Investment on your project. It is used to find out the return of future cash flows that will be accrued by the company on today’s investment. Hence it is essential to discount the cash flows because a dollar earned in the future would not be worth as much today. The time value component is essential because due to various factors such as inflation, interest rates, and opportunity costs, money received sooner is more valuable than money received later.

Similarly, the riskier the investment the more is the discounting factor. Some investments have an inherently higher risk and hence when estimating the Present Value higher discounting factor should be used to value such investments.

Relevance and Uses of Net Present Value Formula

Net Present Value method has multiple users. Net Present Value is used by companies to value their investments and whether a certain project is worth pursuing or not. It is also used by investors to value a company’s total value or equity value and whether they are worth investing in or not.

The key advantage of using NPV is that it gives us a direct measure of the expected increase in the value of any company. There are other methods such as IRR, payback period, etc. to determine whether an investment should be made or not but NPV by far is a better measure of getting the direct benefit of an investment.

It also has its disadvantages such as NPV does not give any consideration to the size of a project. For example, NPV of $100 for an investment of $100 is a worthwhile investment but an NPV of $100 for a $ 1 million investment although positive has to be considered whether it is worth investing in or not.

Conclusion

Net Present Value is the chosen form of valuing any investment opportunity as it provides a direct measure of expected benefit. It accounts for the time value of money which is an important concept and can be used generally to compare similar investments and decide on alternatives. It is not without its drawbacks such as a lot of assumptions that have to be made in arriving at the benefit of investing in the opportunity.

Recommended Articles

This is a guide to Net Present Value Formula. Here we discuss How to Calculate Net Present Value along with practical examples and a downloadable excel template. You may also look at the following articles to learn more –