Updated November 17, 2023

Difference Between Contribution Margin vs Gross Margin

The gross margin determines the costs associated with the only product manufacturer. It is an important tool to detect the raw material costs for a company compared to the competitors. Whereas contribution margin relates to the analysis of the product part by part, such as all the variable costs part by part within an individual product. The term contribution margin refers to calculating the profit at different production stages that involve only variable costs like packaging, marketing, and distribution.

Let us study much more about Contribution Margin vs Gross Margin in detail:

Costs and expenses are associated with a Business. The costs can be further classified as variable costs and Fixed costs. Compulsory costs, which cannot be reduced and do not depend upon the quantity of the product, are known as Fixed costs. For example, expenses like Rent, Building, depreciation, Salaries, etc., which are associated with a factory, are fixed, no matter how much production a particular company is doing. On the other hand, certain costs depend on the number of units the company produces and can be nil in case of zero units produced.

Gross Margin

The Gross Margin is calculated as follows:

Gross Profit / Sales *100

In other words, Gross profit is a percentage term for Sales. It is required to detect the material cost required to manufacture a product. Manufacturing expenses include direct costs like Raw material costing, cost of packaging, and wages. Thus, Sales minus the Direct Raw material costs are calculated. The profit that we get is the Gross profit.

Contribution Margin

We calculate the contribution margin after deducting the variable expenses required for the product and variable period expenses. We obtain the profit after meeting these variable expenses and determine the percentage of the contribution profit in terms of sales.

Contribution margin = Sales – (variable costs and variable expenses) / total sales*100

Example with an illustration:

The income statement of NOCIL Ltd. for the year ended 31/03/18 (INR in Cr):

| Total Revenue | 982.19 |

| Cost of Materials Consumed | 444.19 |

| Purchase of stock in trade | 2.94 |

| Change in Inventories of FG, WIP, and Stock | -6.51 |

| Employee Benefit Expenses | 71.19 |

| Depreciation & Amortization | 24.03 |

| Other Expenses | 190.43 |

| Profit before TAX (PBT) | 254.7 |

| Tax Expenses | 84.77 |

| Net Profit | 169.93 |

Additional information:

- ‘Cost of materials’ includes 60% of fixed expenses and 40% of the variable part.

- Within ‘Other expenses’, 25% is included as marketing and packaging expenses, which are variable.

From the above financial data, we can derive the Contribution and Gross margin as follows.

Gross margin = (Total Revenue – Cost of goods sold)/total sales * 100

= (982.19-444.19 /982.19)*100 = (538/982.19) = 54.78% and

Contribution margin = (Total Revenue – Total Variable costs)/total sales * 100

**As we know, 25% of COGS and 40% of ‘Other costs’ are variable.

Thus Contribution Margin = 982.19 – (25% of 444.19) + (40*190.43) / 982.19 *100

= 982.19- (111.05 + 76.17) /982.19 *100 =982.19- 187.22 /982.19 *100

= 80.94%

Thus, from the above, the gross and contribution margins are derived as 54.78% and 80.94%, respectively.

The Importance of Contribution Margin vs Gross Margin is as Follows

- One major importance of the Contribution margin vs the Gross margin is to detect the variable costs and the percentage of fixed costs included within the margin. In case of any shutdown of production plants, these powerful tools could help detect future strategies’ management.

- If there has been a loss of market share of a particular product, the higher the fixed costs, the higher the expenses, resulting in lower profitability and margins.

- These are the strongest tools necessary for companies whose strategy is to play in the volume growth of the products. Volume growth means adding in the number of products. The more the number of products sold, the more profit. And at one point, the break-even point arrived, and there was margin expansion. The break-even point is determined by the fixed cost associated with the Cost of Goods sold and within the ‘Other Expenses’. Again, Depreciation and Employee expenses are also a part of fixed costs.

- Variable costs are present within the COGS, as well as with the packaging costs, marketing, and distribution costs. Remembering that variable costs affect the contribution margin at different production phases is significant. Thus, it helps the management with cost optimization, cost efficiency, and reduction of costs to enhance profitability.

- One company may have several products, and the margins related to each product are different. Thus, to enhance profitability and margins, the company has to push those ‘high margin’ products, adding added margin to the Net Profit margin. Thus, the contribution margin becomes helpful in getting an accurate view and the importance of each product.

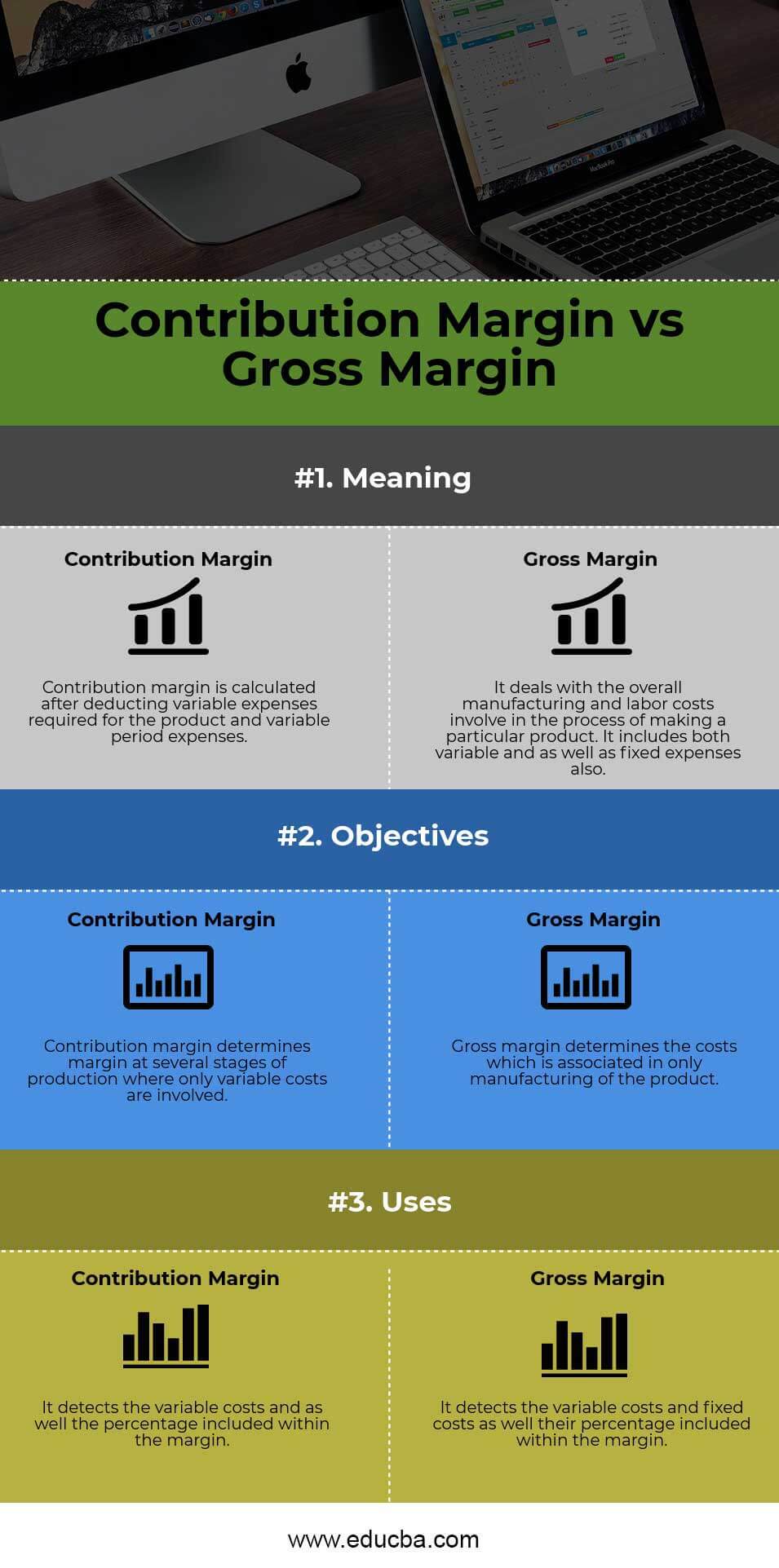

Contribution Margin vs Gross Margin (Infographics)

Below is the top 3 difference between Contribution Margin vs Gross Margin:

Key Differences Contribution Margin vs Gross Margin

Both Contribution Margin vs Gross Margin are popular choices in the market; let us discuss some of the major differences between Contribution Margin vs Gross Margin:

- On the other hand, gross margin deals with the overall manufacturing and labor costs involved in making a particular product. It includes both variable and as well as fixed expenses also. The contribution margin deals with the variable costs only.

- Outsourcing or information technology companies take the entire employee costs within COGS as they consider employee expenses part of their cost of goods sold. In the case of other manufacturing companies, do not include employee expenses within Gross Margin, as they fall under Operating expenses. Costs like manufacturing, packaging costs, logistics costs, freight, commissions, wages, etc., fall into the Contribution margin category.

- In the case of Contribution margin and Gross margin, the types of expenses taken are mostly variable expenses in the case of gross margin and a Mixture of variable and fixed in the case of contribution costs.

Contribution Margin vs Gross Margin Comparison Table

Let’s have a look at the Comparison between Contribution Margin vs Gross Margin:

| Basis of comparison |

Contribution margin |

Gross Margin |

| Meaning | The contribution margin is calculated after deducting variable expenses required for the product and variable period expenses. | It deals with the manufacturing and labor costs of making a particular product. It includes both variable and as well as fixed expenses also. |

| Objectives | The contribution margin determines the margin at several stages of production where only variable costs are involved. | Gross margin determines the costs associated with the only manufacturer of the product. |

| Uses | It detects the variable costs and the percentage included within the margin. | It detects the variable and fixed costs and their percentage included within the margin. |

Conclusion

The Contribution Margin and Gross Margin help determine the company’s profitability and cost-effectiveness. The management takes this margin seriously to combat the business cycle so that the margins remain impacted and profitable. However, in economic turmoil, management would emphasize retaining the top line and pushing high-margin products to keep the bottom line intact. In a severe recession, the management might work on volume growth, and the margin has to be maintained through different cost-cutting techniques.

Recommended Articles

This has guided the top difference between the Contribution Margin and Gross Margin. Here, we discuss the Contribution Margin vs Gross Margin key differences with infographics and a comparison table. You may also have a look at the following articles to learn more-