Updated November 8, 2023

Difference Between Revenue vs Earnings

A Business unit, such as a Firm, Company, etc., does total Sales throughout the financial year, referred to as Revenue. However, the period can be divided into Quarterly or half-yearly, nine-month, or even monthly to calculate the company’s sales. In contrast, Earnings are the remaining amount of total income after deducting all the expenses (both operating and non-operating) and all taxes in case of Profits. The company’s earnings depend upon various factors such as the Sector in which the company caters, raw materials or cost of goods sold used for the preparation and marketing of the product, etc.

Let us study much more about Revenue and Earnings in detail:

In Financial terms, Total Income or Total operating Revenues are termed the ‘Top-line’, and Earnings, or the net profit, are termed the ‘Bottom-line’ of a Company. The reasons behind terming Revenue as the Top-line and Earnings as the bottom line are as follows- Revenue is the first item when it appears in an income statement, and Earnings or Net profit comes as the last item as all the expenses and incomes appear before Net profit.

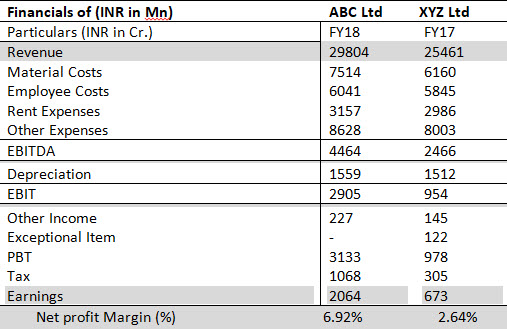

Higher earnings do not necessarily guarantee higher growth when an organization has poor operational efficiency and does not follow cost-reduction techniques. This results in an abnormal increase in operating and non-operating expenses, which decreases earnings and Net profit margin. The net profit margin is the percentage of net earnings over total income. The higher the margin, the better the financial health of the Business. For Example- ABC Ltd. made a Total Revenue of INR 10,00,000 in FY18 with a Net Profit of INR 80,000. In comparison, XYZ Ltd. made total Sales of INR 8,00,000 with a Net profit of INR 80,000. Thus, even though both companies’ earnings are the same, we cannot treat the financial health equally. Because in the first case, ABC Ltd has revenue of INR 10,00,000, which is higher than XYZ Ltd., and the Net Profit margin is 8%(Profitability as a percentage of Revenue).

In the second instance, Even though XYZ Ltd. has a Lesser Income than ABC Ltd, the company could derive equal Earnings with a Net margin of 10% (Profitability as a percentage of Revenue). The modern business world recognizes companies based on the total revenue they generate. It means the particular product of that particular company can derive that total amount of Sales. When similar companies within the same industry deliver different Net profit margins, we can look for the root causes of variations.

One, the income-generating capacity from one product would be lesser than the other, so automatically, the higher income derived by Product One has a higher demand due to higher acceptability and higher customer satisfying ability. Thus, if the two products remain within the same business environment, the costs associated with the products would be more or less the same. But the Product with higher acceptability would result in higher earnings or a higher bottom line than the Second product. Even if the products are more or less the same and have the same acceptability, there can also be variances in the bottom line when the management of one company is less efficient than the other and vice versa.

The format of the Income Statement showing Total Revenue vs Earnings

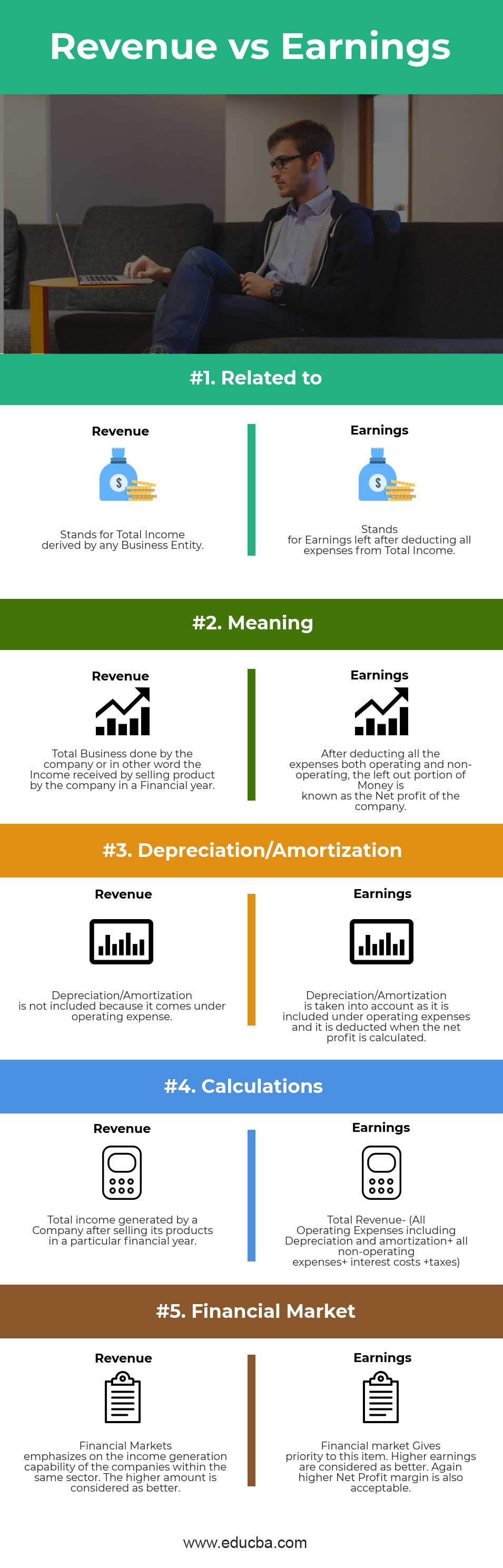

Head To Head Comparison Between Revenue vs Earnings (Infographics)

Below is the top 5 difference between Revenue vs Earnings

Key Differences Between Revenue vs Earnings

Both Revenues vs Earnings are popular choices in the market; let us discuss some of the major differences:

- Revenue comes as the topmost item in the Income Statement Format, whereas Earnings come as the last item in the Income Statement category.

- In the most profitable Business, Net profit is expected to be higher as the product is well accepted by the customers and the Business derives enough profits even after meeting all the expenses.

- Observers have noticed that cost-efficient businesses consistently yield higher returns in terms of net margin.

- Depreciation and taxes are adjusted from Total Income to get the Net Earnings.

- Higher Revenue depends upon the product acceptability and the total demand for the product across the sector. In contrast, higher Net Earnings depend on low costs or increased efficiency in business.

Revenue vs Earnings Comparison Table

Here are some of the comparisons between Revenue vs Earnings –

|

The basis of comparison |

Revenue |

Earnings |

| Related to | Stands for Total Income derived by any Business Entity. | Stands for Earnings left after deducting all expenses from Total Income. |

| Meaning | Total business completed by the company or revenue from product sales throughout a fiscal year. | The company’s net profit is the money left after deducting all operating and non-operating expenses. |

| Depreciation/Amortization | Excluding depreciation and amortization occurs because they fall within operational costs. | We consider depreciation and amortization since we include them in operating expenses and deduct them when calculating net profit. |

| Calculations | Total income generated by a Company after selling its products in a particular financial year. | Total Revenue- (All Operating Expenses including Depreciation and amortization+ all non-operating expenses+ interest costs +taxes) |

| Financial Market | Financial Markets emphasize the income generation capability of the companies within the same sector. The higher amount is considered as better. | The financial market Gives priority to this item. Higher earnings are better. Again higher Net Profit margin is also acceptable. |

Conclusion

However, now you must have a fairer idea of Revenue vs Earnings. In the world of businesses, any company, when it comes up with a new idea or product, aims to increase the volume or number of unit sales to overcome the costs of manufacturing and other product-related expenses like marketing and selling, and Finance costs, etc. Thus, the net profit margin defines the viability of the business; a higher net profit marks higher business efficiency. Stay tuned to our blog for more articles like these.

Recommended Articles

This has been a guide to the top difference between Revenue and Earnings. Here, we also discuss the Revenue vs Earnings key differences with infographics and the comparison table. You may also have a look at the following articles to learn more –