Updated November 6, 2023

What are Gains?

Any profit realized from an asset or a transaction is considered “gains”.

The profit realized from the sale of a capital asset is referred to as a “capital gain”.

Selling a capital asset after holding it for a year or fewer results in a “short-term gain”.

We can define “long-term gain” as any gain realized from the sale of a capital asset upon holding it for longer than a year.

What are Long-Term vs Short-Term Capital Gains?

In Long-term vs Short-term Capital Gain, long-term capital gains come from selling assets after holding them for a longer time, usually more than 1-3 years, while short-term capital gains come from selling assets within a year for a quick profit.

For example, Mr. Joe purchased 100 stocks of ABC Corporation at $10.00 each. After holding the stocks for 6 months and determining that the markets were favorable, he sold them off at $12.00 each. Thus, he made a short-term capital gain of $2.00 per stock (or $200.00).

Similarly, consider this example: Ms. Jane bought gold in 2012 worth $3,000.00. She held it for 3 years and sold it off in 2015 for $3,800.00 (with market levels higher than in 2012). Since the holding period was more than a year, we shall refer to the profit of $800.00 as a long-term capital gain.

However, before actually calculating the exact amount of gains, some changes need to be deducted from the realized returns, like:

- brokerage fees (if any) incurred as part of the transaction;

- administrative costs of stationery (and/or stamping if legal formalities are involved);

- attorney costs (if any);

- any other expenses directly related to such a transaction.

An exemption exists if a person acquires the asset through inheritance, as a gift, or from a will. The person acquiring it transfers it (and does not sell it). Hence, there is no capital gain. In active voice, the sentence would be: “The receiver calculates the holding period for the asset from the date the original holder purchased it when they wish to sell the asset, thereby determining the type of gain.”

Difference Between Long-Term vs Short-Term Capital Gains

When an investor earns a profit on the sale of assets such as Real estate, stocks, bonds, or Mutual funds, it’s called Capital gains. This is considered Taxable income, and the amount of such tax primarily depends on 2 factors:

- Income of the investor

- The time period for which the asset has been held

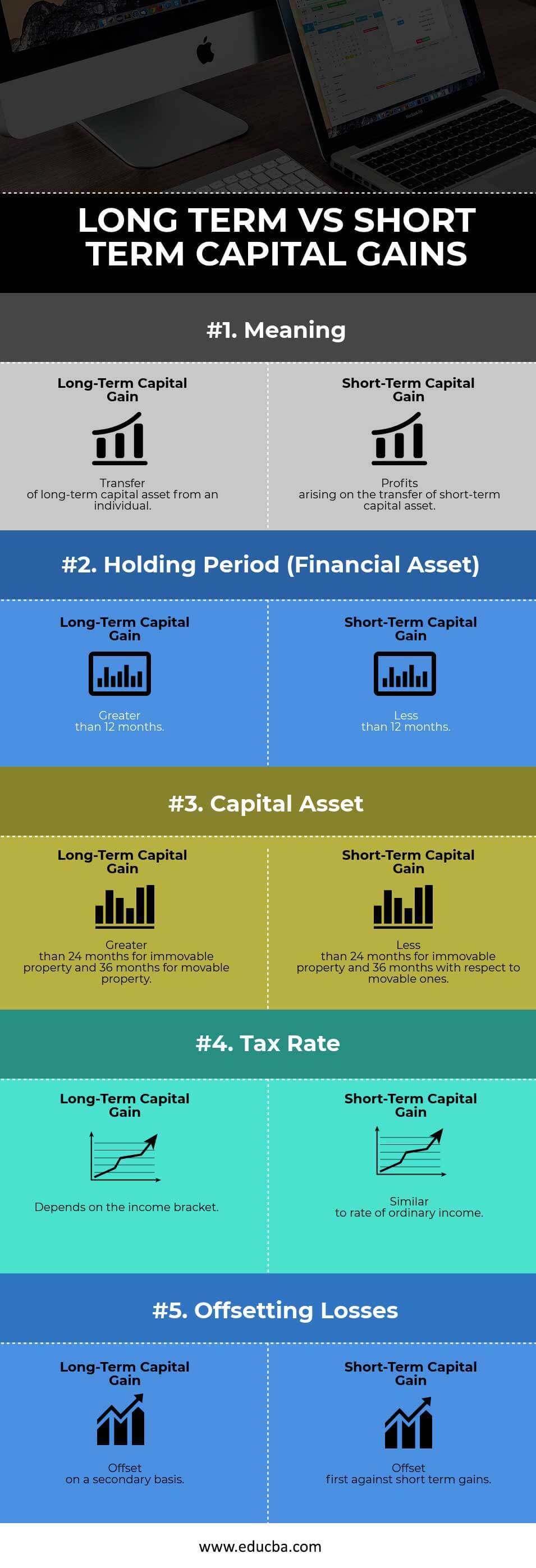

Head To Head Comparison (Infographics)

Below is the top 5 difference between Long Term vs Short Term Capital Gains

Key Difference Between Long-Term vs Short-Term Capital Gains

Both Long-Term vs Short-Term Capital Gains are popular choices in the market; let us discuss some of the major Differences:

- Long-term Capital gains arise from transferring a long-term capital asset from an individual, whereas transferring a short-term capital asset creates a short-term capital gain.

- In the case of a financial asset, the holding period applicable for long-term capital gain is greater than 12 months, and for short-term capital gain, it is less than 12 months.

- Capital assets attract long-term capital gain if the owner holds them for more than 24 months in the case of immovable property and 36 months in the case of movable ones. Conversely, immovable properties incur a short-term capital gain if their holding period is less than 24 months, and movable properties incur a short-term capital gain if their holding period is less than 36 months.

- The income tax bracket one falls into can tax long-term gains at 0%, 15%, or 20%. The government may also need to factor in exceptions when considering the requirements. The same rate of tax applies to both ordinary income and short-term gain.

- If one has any offsetting losses in the same year, it can be offset against capital gains. First, offset all the short-term losses against the short-term gains and offset the long-term losses against long-term gains. If there is still an excess, such as a net long-term gain and a net short-term loss, the extra short-term losses can offset the long-term gains.

- Tax authorities always consider profits as long-term gains regarding inherited assets, particularly real estate.

Respective governments provide special tax provisions for the same. However, if an individual receives property as a gift, they can include the donor’s holding period for themselves. It is important to note that this inclusion does not automatically classify the gain as a long-term gain. - The formulas are:

Let us consider the following examples:

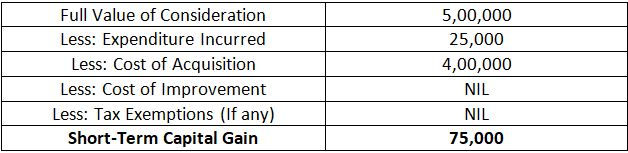

For instance, if Mr. A purchased Gold for INR 4 Lakhs and sold it for INR 5 Lakhs for the year 2017, the STCG would be:

Please note the importance of the following terminologies:

Full Value of Consideration: Amount or consideration received by the seller on transfer/selling the asset

Expenditure Incurred: Expense incurred in transferring the asset like brokerage or fee.

Cost of Acquisition: The amount for which the asset was acquired

Cost of Improvement: Expenses incurred for improvising the asset

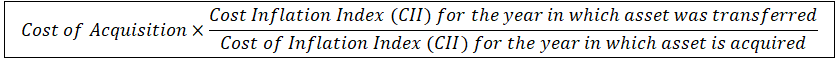

Indexed Cost of Acquisition =

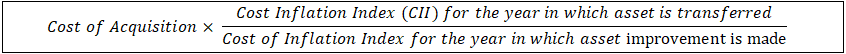

Indexed Cost of Improvement =

The objective of indexation is to factor in the impact of inflation since the period is spread over many years.

The respective Income Tax Act defines various exemptions that taxpayers must consider.

Long-Term vs Short-Term Capital Gains Comparison Table

Below is the 5 topmost comparison between Long-Term vs Short-Term Capital Gains

| Basic Comparison | Long-Term Capital Gain | Short-Term Capital Gain |

| Meaning | Transfer of long-term capital assets from an individual. | Profits arise on the transfer of short-term capital assets. |

| Holding Period (Financial Asset) | Greater than 12 months. | Less than 12 months. |

| Capital Asset | Greater than 24 months for immovable property and 36 months for movable property. | Less than 24 months for immovable properties and 36 months concerning movable ones. |

| Tax rate | Depends on the income bracket. | Similar to a rate of ordinary income. |

| Offsetting losses | Offset on a secondary basis. | Offset first against short-term gains. |

Recommended Articles

Although this has guided the top differences between Long-Term vs Short-Term Capital Gains, here, we also discuss the Long-Term vs Short-Term Capital Gains differences with infographics and a comparison table. You may also have a look at the following articles –