Updated October 30, 2023

Difference Between Gross Income vs Net Income

In Gross Income vs Net Income, Gross Income is a comapny’s total earnings before subtracting expenses like taxes, insurance, etc. In contrast, Net income is the company’s total profit after removing all the costs and taxes from the gross income.

For example, let us suppose a business XYZ Ltd. has sales of $1,000,000, a cost of goods sold of $600,000, and selling expenses of $ 250,000. Then, for company XYZ Ltd., the gross income is $400,000, and its net income is $150,000. When considering a wage earner, the gross income represents the total salary paid to the individual by the employer before any deductions are made, while the net income represents the earnings left after making all adjustments and appropriations from the gross pay, such as payroll taxes and retirement plan contributions.

For example, Ramesh earns $1,000, and his wages have $300 in deductions taken for retirement contributions. Then, his gross income is $1,000, and his net income is $ 700.

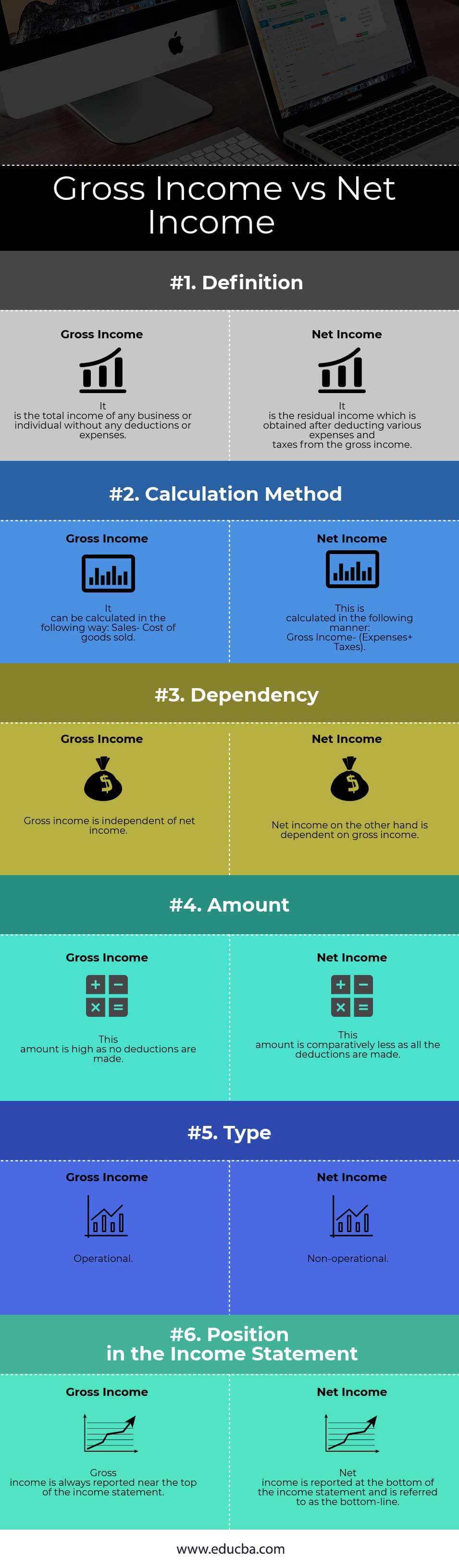

Head To Head Comparison Between Gross Income vs Net Income (Infographics)

Below is the top 6 difference between Gross Income and Net Income:

Key Differences Between Gross Income vs Net Income

Let us discuss some of the major Differences Between Gross Income vs Net Income:

- The total amount of income without deducting any expenses is known as gross income. The residual amount after deducting taxes and other expenses is net income.

- The gross income is always higher than the net income since no deductions are made.

- We can get a net income after adjusting and appropriations from Gross Income. Deduct all the expenses to arrive at net income.

- The most important difference between Gross Income and Net Income is that net income always depends on gross income.

- Deduct the operational expenses of a business from the gross income while deducting all non-operational expenses from the net income.

- The income statement always records gross income at the top, but it always mentions net income at the bottom.

- Gross income represents the amount without adjustments and appropriations, while net income represents the amount left after reducing all expenses, interest, taxes, losses, and dividends.

Comparison Table of Gross Income vs Net Income

Below are the 6 topmost comparisons between both:

| Basis of comparison |

Gross Income |

Net Income |

| Definition | It is the total income of any business or individual without any deductions or expenses. | Obtain the residual income after deducting various expenses and taxes from the gross income. |

| Calculation Method | Calculate it in the following way: Subtract the cost of goods sold from sales. | This is calculated in the following manner: Gross Income- (Expenses+ Taxes). |

| Dependency | Gross income is independent of net income. | Net income, on the other hand, is dependent on gross income. |

| Amount | The amount is high because no deductions have been made. | This amount is comparatively less because all the deductions have been made. |

| Type | Operational | Non-operational |

| Position in the Income Statement | Report gross income near the top of the income statement. | Report net income at the bottom of the income statement and call it the bottom line. |

Gross Income vs Net Income in Running Business

The financial statement records gross income at the top and net income at the bottom. The financial statement not only helps to understand a company’s position but also helps the investors and lenders understand the company’s exact viability in the financial market, so Gross Income and Net Income are very important.

For a smaller business, these two figures help to understand the financial picture in the long run and identify areas and ways to control expenses so that the business can thrive and grow. These figures also help to know the lucrative business areas so that improvements can be made.

Conclusion

Keeping track of the gross and net income is the key to a successful business. It helps to know when to increase the rates, whether specific expenses are mandatory, and the target clients and projects on whom the business must focus on progress in the long run. Both gross and net income are intertwined because gross income is necessary to derive net income. Gross and net income are important components of a financial statement and financial analysis. These two components help a business analyze how effectively and efficiently the company allocates its resources.

Recommended Articles

This is a guide to Gross Income vs Net Income. Here, we discuss the Gross Income vs Net Income differences with infographics and a comparison table. You may also have a look at the following articles to learn more –