Updated October 23, 2023

Introduction to the Stock Market in India

India may look like a small dot on the globe, but if someone does a detailed stock market analysis, they may find the same opportunities they can expect from any other promising market. India’s rising markets are opening the path to a promising future of stock market growth in India. The percentage of Indians who have investments in the domestic stock market is currently quite low. Still, more money will join the frame with the anticipated GDP development and stable financial market.

Stock Exchange Market in India

In the Indian Stock Market, the majority of the trading takes place on its two stock exchanges market in India, which are:

- The Bombay Stock Exchange (BSE)

- The National Stock Exchange (NSE)

1. The Bombay Stock Exchange (BSE)

Bombay Stock Exchange (BSE) is the world’s 11th largest stock exchange market by market capitalization as of 31 December 2012. It is located on Dalal Street, Mumbai, Maharashtra, India. It was established in 1875. The Bombay Stock Exchange (BSE) is India’s oldest Stock Exchange and one of Asia’s oldest stock exchanges.

BSE traces its history to 1855 when four Gujarati and one Parsi stockbroker would gather under banyan trees in front of Mumbai’s Town Hall. As the number of stock market brokers kept increasing, these meetings’ locations were changed many times. In 1874, the group moved to Dalal Street, and in 1875, it became an official organization known as ‘The Native Share & Stock Brokers Association.

BSE provides a market for trading in,

- Equity

- Debt instruments

- Derivatives

- Mutual funds

It also has a platform for stock market trading in equities of small and medium enterprises (SMEs)

- More than 5,000 companies are listed on BSE, making it the world’s No. 1 exchange for listed members. (Source: http://www.bseindia.com).

- The companies listed on BSE Ltd command a total market capitalization of USD 1.32 Trillion as of January 2013.

- It is also one of the world’s leading exchanges (3rd largest in December 2012) for Index options trading (Source: World Federation of Exchanges).

- BSE’s popular equity index – the S&P BSE SENSEX – is India’s most widely tracked stock market benchmark index.

- It is traded internationally on the EUREX and leading exchanges of the BRCS nations (Brazil, Russia, China, and South Africa).

Functional Timing of the BSE

The hours of operation are, in terms of the local timing, which is GMT+5.30. It is functional on all days of the week except Saturdays, Sundays, and holidays declared by the Exchange in advance.

| Session | Timing |

|---|---|

| Pre-open Trading Session | 09:00 – 09:15 |

| Trading Session | 09:15 – 17:00 |

| Position Transfer Session | 17:05 – 17:15 |

| Closing Session | 17:05 – 17:15 |

| Option Exercise Session | 17:07 |

2. The National Stock Exchange (NSE)

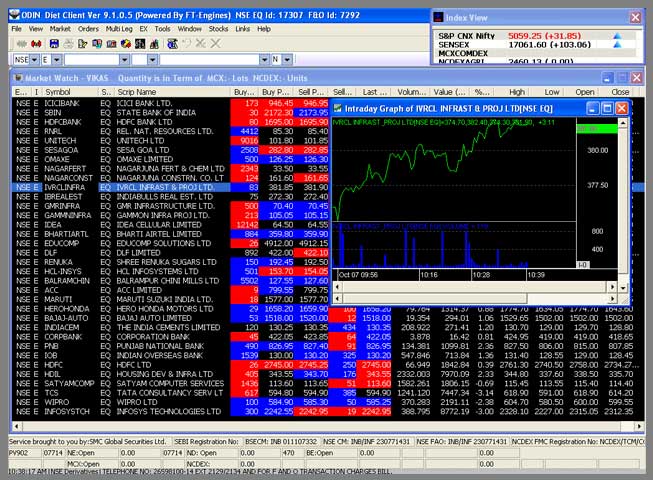

The National Stock Exchange of India Ltd. (NSE) was established in the mid-1990s as a demutualized electronic exchange. It is located in the financial capital of India, Mumbai. NSE has a market capitalization of more than US$989 billion and 1,635 companies listed as of July 2013. NSE’s flagship index, the S&P CNX Nifty, is used extensively by investors in India and worldwide to gain exposure to the Indian equities market.

A group of leading Indian financial institutions started it at the request of the Government of India to bring transparency to the Indian market, and it has a diversified shareholding consisting of domestic and global investors. They incorporated the exchange in 1992 as a tax-paying company and recognized it as a stock exchange in 1993.

As per Wikipedia, NSE offers trading in the following segments:

Equities

- Indices

- Mutual Funds

- ExchangeTraded Funds

- Initial Public Offerings

- Security Lending and Borrowing Scheme

Derivatives

- Equity Derivatives (including Global Indices like S&P 500, Dow Jones, and FTSE )

- Currency Derivatives

- Interest Rate Futures

Debt

- Corporate Bonds

Trading Session of Stock Market in India

Trading on the equities segment occurs on all days of the week (except Saturdays, Sundays, and holidays declared by the Exchange in advance). The stock market timings of the equities segment are as follows:

1. Pre-open Session

Order entry & modification Open: 09:00 hrs

Order entry & modification Close: 09:08 hrs

*with random closure at the last minute. Pre-open order matching starts immediately after the close of pre-open order entry.

2. Regular Trading Session

Normal/Retail Debt/Limited Physical Market Open: 09:15 hrs

Normal/Retail Debt/Limited Physical Market Close: 17:00 hrs

Block deal session is held between 09:15 hrs and 09:50 hrs.

3. The Closing Session

The closing session is held between 17.05 hrs and 17.15 hrs. The Exchange may, however, close the market on days other than the above scheduled holidays or may open the market on days originally declared as holidays.

Almost all Indian firms are listed on both exchanges, but NSE has a dominant share in spot trading.

Trading Mechanism of Stock Market in India

In both exchanges, stock market trading occurs through an open electronic limit order book, in which the trading computer matches orders. As this process is entirely computerized, market orders placed by investors are automatically matched with the best limit orders. Sellers and buyers are not directly interacting with each other as they remain anonymous. This order-driven automated system maintains transparency by displaying all buy and sell orders in the trading system. These orders can be placed through brokers.

Settlement Cycle and Trading Hours

The settlement time followed for Equity spot markets is T+2 rolling settlement. For example, if any trade occurs on Monday, it gets settled by Wednesday. All stock exchange trading occurs between 9:55 am and 3:30 pm, Indian Standard Time (+ 5.5 hours GMT), Monday through Friday.

They deliver shares in dematerialized form, and each exchange has its own clearing house, which serves as a central counterparty and assumes all settlement risk.

Market Indexes

The most noticeable market indexes in India are Sensex and Nifty. Sensex, which includes shares of 30 firms listed on the BSE, is the oldest market index for equities, representing about 45% of the index’s free-float market capitalization. Sensex was created in 1986 and provided time series data from April 1979 onward.

S&P CNX Nifty includes 50 shares listed on the NSE, representing about 62% of its free-float market capitalization. S&P CNX Nifty was created in 1996 and provided time series data from July 1990 onward.

Market Regulation

The Securities & Exchange Board of India (SEBI) regulates the Securities market in India. The responsibility for developing and regulating the stock market lies with it. They established it in 1988 and granted it statutory powers in 1992.

How Can One Invest in India?

In India, outside investments were started in the 1990s. These foreign investments are classified into Foreign Direct Investment (FDI) and Foreign Portfolio Investment (FPI).

We refer to the investments in which an investor is involved in the management and operations of the company as FDI, and we treat the investments made in shares as FPI.

If you want to invest in India, you should register either as a foreign institutional investor (FII) or as one of the sub-accounts of a registered FII.

Foreign Institutional investors mainly consist of:

- Mutual Funds

- Endowments,

- Banks

- Asset Management, etc.

Investment Opportunities for Retail Foreign Investors

Foreign entities and individuals can invest in Indian stocks through institutional investors. Investments could be made through some of the offshore instruments, like,

- Depositary Receipts like American Depositary Receipts (ADRs), Global Depositary Receipts (GDRs)

- Exchange Traded Funds (ETFs)

As of now, you must understand that the BSE and the NSE are the major stock exchanges in India. Also, there are some regional stock exchanges in India.

Following is the list of regional stock exchanges

| Ahmedabad Stock Exchange Ltd. |

| Bangalore Stock Exchange Ltd. |

| Bhubaneswar Stock Exchange Ltd |

| Calcutta Stock Exchange Ltd. |

| Cochin Stock Exchange Ltd |

| Delhi Stock Exchange Ltd., |

| Guwahati Stock Exchange Ltd. |

| Inter-Connected Stock Exchange of India Limited |

| Jaipur Stock Exchange Ltd |

| Ludhiana Stock Exchange Ltd. |

| MCX SX Exchange Limited |

| Madhya Pradesh Stock Exchange Ltd |

| Madras Stock Exchange Ltd. |

| Magadh Stock Exchange Ltd. |

| Mangalore Stock Exchange |

| OTC Exchange of India |

| Pune Stock Exchange Ltd |

| The Vadodara Stock Exchange Ltd. |

| U.P. Stock Exchange Limited |

| United Stock Exchange of India Limited |

Conclusion

India’s emerging markets are opening the door towards a bright future of stock market growth in India. Currently, the percentages of investments of Indians in the domestic stock market are very low. Still, with the expected growth in GDP and a steady financial market, more money will come into the picture.

Recommended Articles

This is a guide to Stock Market in India. Here, we discuss the introduction, the stock exchange market, and how to invest in the Indian market. You may also look at the following articles to learn more –