Updated July 5, 2023

What is Foreign Direct Investment?

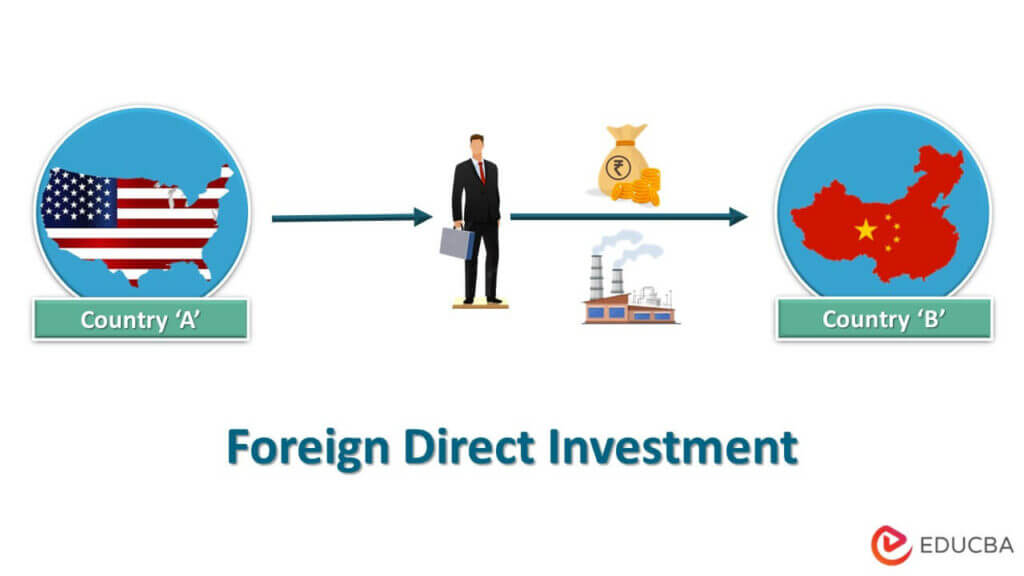

Foreign direct investment is when a firm, individual, or government makes a long-term investment in a foreign country’s business to gain economic benefits.

For example, A coffee-selling company has its roots in the United States of America. The company wants to expand its business by improving the quality of coffee beans. The company owner connected with one of the exporters from Ghana and invested in his business to get good quality coffee beans for his company. This shows how FDI works.

Foreign direct investment (FDI) occurs when an investor from a different nation makes a sizable or long-term investment in a company or business in another nation, which can boost the world’s economy. It is an active type of cross-border investment with around 10% ownership position in the invested company.

Key Highlights

- Foreign direct investments (FDIs) are those investments made by the government or any organization into a foreign concern.

- It can be a great ally for increasing the economic condition of a country.

- In domestic or joint firms, the FDI investors always opt for the controlling positions to actively become part of the management.

- The FDI mainly involves acquiring materials, developing any global presence, or expanding any company’s footprints.

- There are mainly four types of FDI: Horizontal, Vertical, Conglomerates, and platform.

How Does Foreign Direct Investment Work?

For an investor to invest in a foreign business, they do not need to have citizenship of that nation. They can either directly obtain ownership in the target company or may have to acquire government approval in some cases.

Foreign direct investment is a significant contributor to economic expansion. FDI does not limit to capital but can include workforce, technology, tools, and more. It helps bring new technologies, equity, jobs, and enhanced infrastructure into a country.

Examples of Foreign Direct Investment

Example #1

One significant example of FDI is the North Atlantic Free Trade Agreement or NAFTA, which is regarded as the world’s largest free trade agreement. NAFTA FDI grew among countries like Canada, the United States, and Mexico to around $731 billion in 2015.

Example #2

The United States of America stood in the leadership position as the biggest recipient of FDI in 2019. It integrated the status in 2020, counted by the significant direct investments from Germany, Japan, and the Netherlands. Altogether these 3 economies were the sole reason for the increase in FDI (for the last 3 years) in the USA.

Example #3

Most of the FDI for 2020 was fueled by European countries. The United Kingdom and Germany topped the list by accounting for 18% and 15% of the total FDI, respectively. Both inward and outward FDI stocks rose in 2020 in comparison to 2019.

Types of Foreign Direct Investment

#1 Horizontal FDI

- It concentrates on funding a foreign company that is a part of the same sector as one where the FDI investor controls or operates. Here, a corporation invests in a company situated in a different nation and manufactures comparable items.

- For instance, a UK-based wine production company buying a chain of wineries in Germany.

#2 Vertical FDI

- In this FDI, a firm establishes a complementary firm in a different country.

- The investment in the company may or may not belong to the same industry but is still a component of a traditional supply chain.

#3 Conglomerates FDI

- Conglomerate FDI refers to transactions in which investments are made in two wholly different businesses operating in completely distinct industries.

- As investing company lacks any prior experience in a foreign company’s competence, thus, this is often considered a joint venture.

#4 Platform FDI

- A company develops into a foreign nation with platform FDI, but the goods produced are exported to a third nation.

- Platform FDI is generally seen in low-cost economies that come under the free-trade areas.

Importance of Foreign Direct Investment

- It aids in portfolio diversification for investors, encourages reliable long-term loans, introduces cutting-edge technology to developing countries, and gives developing countries financial support.

- It improves infrastructure in underdeveloped countries by bringing in managerial and technological know-how. It also creates more jobs and possibilities.

- It promotes competitive global capital allocation, raises living standards in developing nations, and supports economic recovery or growth.

Advantages & Disadvantages of Foreign Direct Investment

| Advantages |

Disadvantages |

| It promotes the economic growth of a country by boosting the manufacturing and service areas. | Hinders various kinds of domestic investments and even transfers the control of the domestic forms to foreign firms |

| It increases the number of job opportunities available in a country. | Many instances have proved that MNCs work or operate very poorly in foreign countries. |

| It promotes the growth of human resources in a country by enhancing an individual’s skillset. | Influences the exchange rates with an advantage to one country and a disadvantage to another. |

| Most of these FDI goods contribute to the global market, increasing export business. | It can risk political changes and hamper investors’ growth. |

Final Thoughts

Every country around the globe is interested in making FDI in other countries as it seems to be very beneficial. For the investing nation, FDI means lower prices, whilst the nation that welcomes FDI may grow its people, abilities, and technologies. Mergers & acquisitions, logistics, retail services, and manufacturing are a few examples of common.

Frequently Asked Questions (FAQs)

Q.1 What is FDI in simple words?

Answer: FDI is an investment where an investor or a business from another nation takes complete ownership of another country’s business. Such a direct investment helps in boosting a company’s economy.

Q.2 What are the 4 types of FDI?

Answer: Horizontal, vertical, platform, and conglomerate FDI are the 4 different types of FDI. Amongst all the types, horizontal foreign direct investment is the most common FDI across the world, and it refers to the investment of funds in a foreign company with an interest in the same product.

Q.3 What are the factors that affect FDI?

Answer: Various studies have found that foreign direct investment is affected by various factors. Some of them include factor costs, market costs, trade openness, political environment, infrastructure, transport costs, exchange rates, tax rates, property rights, and much more.

Q.4 Why is FDI important for growth?

Answer: Through increasing domestic investment in host economies, FDI can support and supplement capital accumulation. However, FDI’s ability to promote growth can extend beyond the acquisition of purely physical capital.

Recommended Articles

This was a complete guide on the topic of foreign direct investment. It covers its meaning, importance, types, examples, and advantages and disadvantages. You can learn about similar topics from the following articles.