Updated October 27, 2023

Introduction to Range Trading

Range trading is not reserved for the Wild West of the markets, but it is certainly beneficial when a market lacks direction. The most important key to range trading is to find support and resistance to define the range. As with any trading strategy, this technique also requires strategic risk management in the event of a breakout. The range trading strategy actively associates with Forex trading as one of the most effective strategies when there is no market trend or direction. You, too, can carve your path to prosperity using a range trading strategy. Let’s learn more about this innovative range trading strategy.

Range Trading Strategies

Range trading is an active investment approach to purchase and sell over a brief period.

Let’s look at a few strategies.

1. Find Your Range

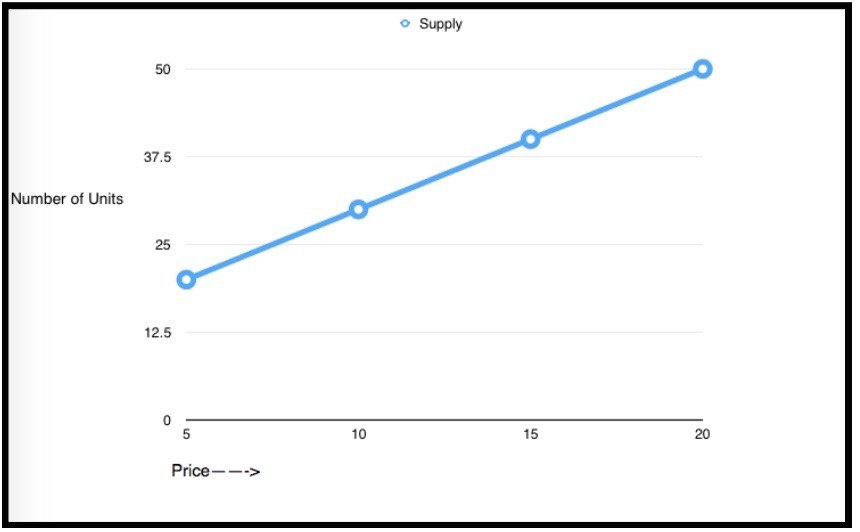

The first step of the range trading strategy is to find the range. Forces of supply and demand can impact prices in the forex market, and this is where support and resistance enter the equation. Helping traders locate levels in which supply and demand in a given currency pair may transform once lines have been crossed. Supply is the amount available at a specific price, while demand is the amount required or wanted at a particular price. The prices of a product or instrument can have a massive impact on the amount demanded by the marketplace or the supply one can get. When the price increases, the seller’s willingness to offload the product will also rise, illustrated by the supply curve showing how additional units become available as prices increase.

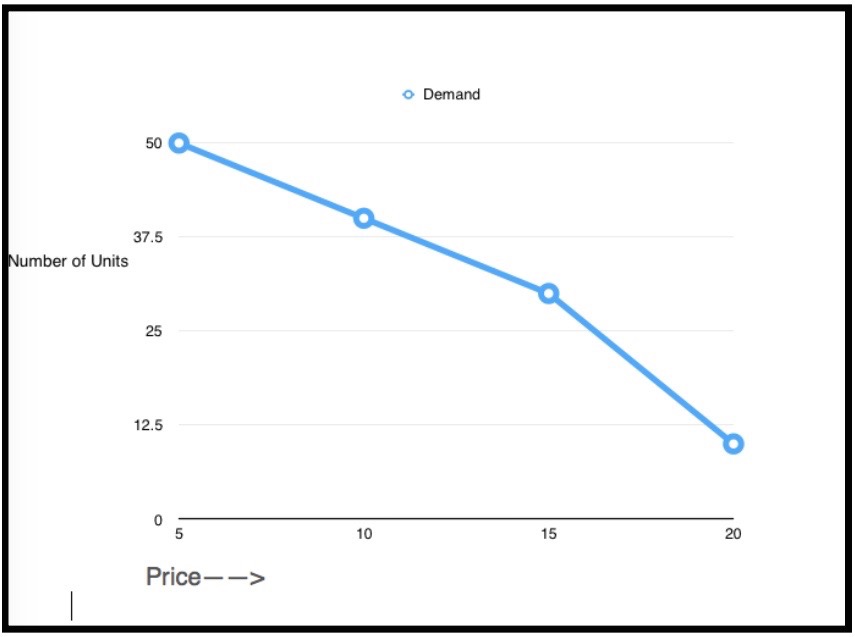

On the other side of the divide, buyers will demand more at lower prices, and as price rises, demand falls, as can be seen in the demand curve below:

Supply and demand play out through support and resistance. Support is when demand begins to outstrip supply, causing prices to shoot higher. Resistance is the opposite. Breakouts hold that predicting the stimuli driving price change may be challenging to forecast.

Traders must be clear about whether the trading environment will stay the same or change, influencing whether you trade for a range or a breakout.

2. Trading the Range: Status Quo

When trading a range, traders hold that the environment will remain the same, with support or resistance at certain levels. Price actively defines points in the market when demand outstrips supply, creating increased costs or vice versa. If breaks of support or resistance work to make new highs or lows, the trader’s aim ranges from range-bound conditions to sell back at a higher price or buy back at a lower cost, depending upon the nature of the breakout.

Finding the range involves using zones. By connecting short-term highs and lows through horizontal lines, traders actively create zones in the market. An overhead content is a resistance, while support is the area where the price helps up by traders looking to make the big buy.

3. Timing the Entry

Traders can time-range trading entries through numerous methods.

Oscillators: The most popular oscillators include RSI, CCI, and Stochastic. These technical indicators track prices that calculate how far the indicator fluctuates along the centerline. Indicators turn extreme as the price reaches a zone of support or resistance.

4. Managing the Risk

The final part of a successful range trading strategy is risk management. When a level of support or resistance breaks ( as it will), traders have to exit range-based positions by using stop-loss above the earlier high when making a sale within the resistance zone of the range. The process can also be inverted with a stop below the current low while purchasing support.

Sniffing out the profits in range trading is equally simple. In selling a range, orders should be limited to take profit down near support. Profit orders should be placed at earlier identified resistance when purchasing a license.

Tricks of the Trade: Range Trading Strategy

Traders can get the best results using the range trading strategy most suitable for current market conditions. Ranges are a result of the price getting caught between support and resistance. Remember that ranges are difficult to trade, and traders will eschew ranges to trade in trending or breakout situations. Trends can be grabbed onto, and breakouts offer a wonderful chance to break even in the markets, but ranges are another kettle of fish altogether.

Prices have to get caught between support and resistance to catch the range. When this occurs, traders can address the range in 1 of 2 ways and trade for the range to continue, which means the upside is limited or looking for the breakout from the range in the face of a new trend.

Trading Ranges or Looking for Breakouts: The Trade-Off

As traders actively ignore ranges due to their perception of restricted profit potential, they approach the position of resistance when trading through buying support within the range. This is a limited upside type of proposition. Of course, this does not have the lure of a trend or breakout where traders can get on the right side and risk up to 3 to 4 times their capital. In reality, traders are likely to encounter the range as the prevailing market condition almost always.

In the Middle of a Ranging Storm?

Ranges can develop in multiple ways. For example, the short-term range is towards the start of an uptrend as buyers and sellers fight to fend off and gain control over the coming trend. Another situation where the range may result is when a long amount of indecision leads to congested price movements that stay restricted between support and resistance levels. In any context, prices being bound between resistance and support actively lead the markets to experience a range-bound period.

Suppose traders are going to engage in range trading. In that case, they have to be clear that risk management is taking place properly, as a breakout moving in the opposite direction of the trader’s position can lead to massive losses when the breakout turns into a trend pushing traders against the equity line. Therefore, trading ranges are only possible when a breakout against the trader’s position stops.

The goal behind the range trading strategy is simple. It is the same as when you are trading trends – the aim is to buy low and sell high. Another requirement for range trading is that price action must be between resistance and support. The trader may spot a profitable position if they respect support and resistance.

Trading Range – Bound Currencies

This is more common than trading in range-bound securities, but the same principles apply in both cases. The fundamental strategy involves actively identifying and trading at closely established support and resistance zones until the inevitable breakout occurs. An abundance of information on its exchanges makes the US dollar a better choice for Forex traders. When creating a range-bound trading stratagem, actively assessing defined lines of support and resistance is the first step, regardless of the currency pair. Optimal currency pairs are not moving quickly, allowing traders to react to the 2-support or resistance. Traders can enter just long before the support price and place a stop just beyond this. They are entering short before the resistance boundary works oppositely.

Conclusion

Range trading strategy is about placing bets when you know the outcome courtesy of the price action. Finding the support and resistance zones is the key to a successful range trading strategy. Learning how to counter breakouts and catch the trend or buck it when the need arises is essential. This forms the essence of successful range trading.

Related Articles

We hope that this EDUCBA information on “Range Trading” was beneficial to you. You can view EDUCBA’s recommended articles for more information,