Updated August 1, 2023

Profitability Index Formula (Table of Contents)

- Profitability Index Formula

- Examples of Profitability Index Formula (With Excel Template)

- Profitability Index Formula Calculator

Profitability Index Formula

The Profitability Index is a measure firms use to determine the relationship between the costs and benefits of doing a proposed project.

Here’s the Profitability Index formula –

Examples of Profitability Index Formula (With Excel Template)

Let’s take an example to understand the calculation of the Profitability Index formula in a better manner.

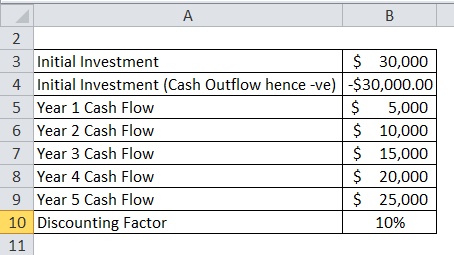

Example #1

Let’s take the example of Project A, whose cash flows are depicted below: –

Formula to calculate Profitability Index is:

Profitability Index = PV of Future Cash Flows / Initial Investment

Profitability Index = (Net Present Value + Initial Investment) / Initial Investment

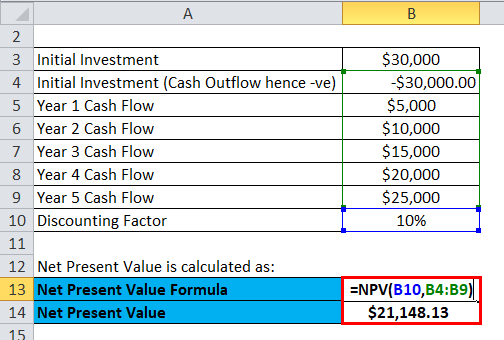

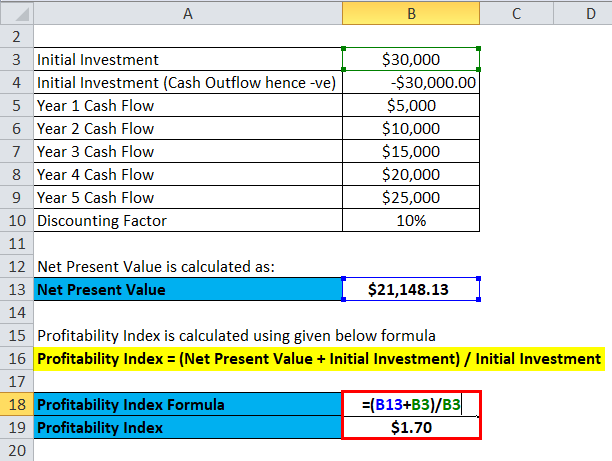

First, we calculate Net Present Value

Then, we calculate Profitability Index

Profitability Index = ($21148.13 + $30000) / $30000

Profitability Index = $1.70

Example #2

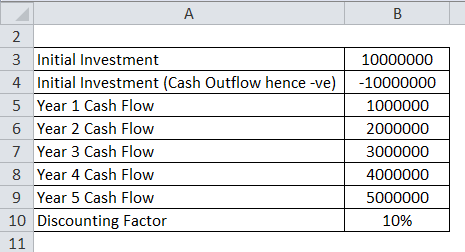

Let’s take an example of Reliance which as a Project X whose cash flows are depicted below: –

Formula to calculate Profitability Index is:

Profitability Index = PV of Future Cash Flows / Initial Investment

Profitability Index = (Net Present Value + Initial Investment) / Initial Investment

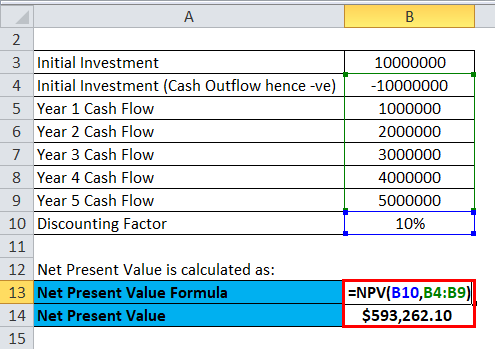

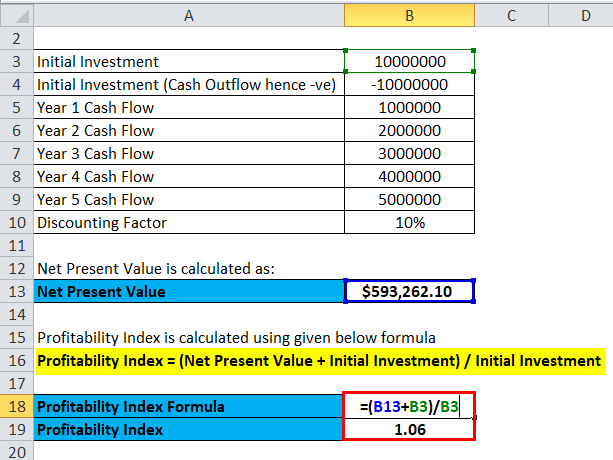

First, we calculate Net Present Value

Then, we calculate Profitability Index

Profitability Index = (593262.10 + 10000000) / 10000000

Profitability Index = 1.06

Example #3

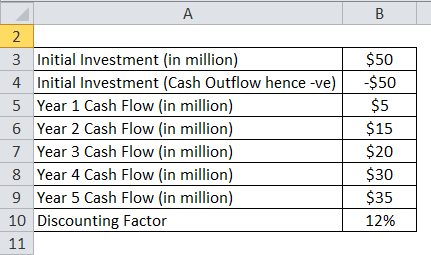

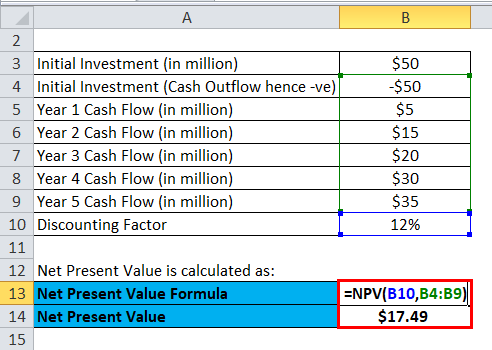

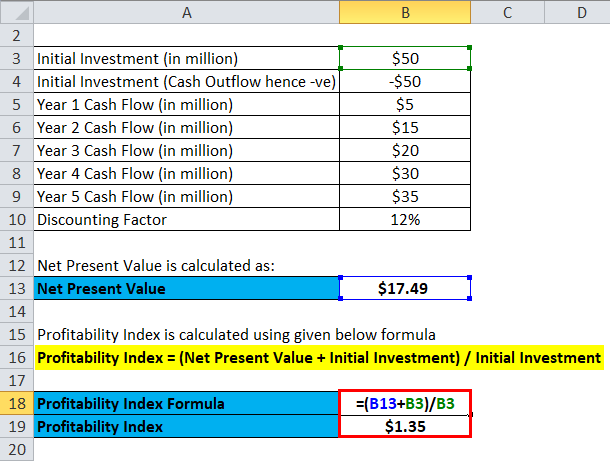

Let’s take the example of Company Apple, which has a Project Z whose cash flows are depicted below: –

The formula for calculating Profitability Index is:

Profitability Index = PV of Future Cash Flows / Initial Investment

Profitability Index = (Net Present Value + Initial Investment) / Initial Investment

First, we calculate Net Present Value

Then, we calculate Profitability Index

Profitability Index = ($17.49 + $50 million) / $50 million

Profitability Index = $1.35

Explanation of Profitability Index Formula

Firms use the profitability index to determine the relationship between costs and benefits for a proposed project. They utilize this measure to rank projects based on the value created per investment unit.

- Present Value of Future Cash Flows – The concept of the time value of money is used to determine the present value of future cash inflows for the project. When discounting, we consider that $1 received in the future is not equal to $1 today, and therefore, we must use a proper discounting factor to determine the value of future $1 today.

- Initial Investment – It is the initial capital outlay for the project. This is the beginning outlay, and we do not consider other outlays at different project points as an initial investment.

Relevance and Uses of Profitability Index Formula

As stated, Profitability Index = PV of future cash flows / Initial Investment.

This can be further broken down into: –

So based on the above formula: –

- If the profitability index is > 1, then the company should proceed with the project as it generates value for the company.

- If the profitability index is < 1, then the company should not proceed with the project as it destroys value for the company.

- If the profitability index is = 1, then the company should be indifferent to proceeding with the project since it does not create additional value for the company or destroys value.

This measure can be used to determine which project should be done. If there are multiple projects, the project with the highest profitability index should be chosen. This is called a benefit-cost ratio when limited capital and projects are mutually exclusive. This differs from accepting the project with the highest Net Present Value. The basis of comparing projects with only the Net Present Value does not take into account what is the initial investment. Profitability Index compares the Net Present Value reached with the initial investment and shows the most accurate representation of the usage of company assets.

There are certain advantages and disadvantages of using the Profitability Index to decide which project to proceed.

Advantages: –

- The PI index can indicate whether the project can create or destroy value for the company.

- The PI index considers the time value of money and the risk of cash inflows in the future and discounts it with a cost of capital.

- When there is a need for capital rationing, the PI index is useful for ranking projects.

Disadvantages: –

- The PI index requires the cost of capital, which is generally difficult to estimate.

- There is ambiguity in results for mutually exclusive projects if initial investments are different.

Profitability Index Formula Calculator

You can use the following Profitability Index Calculator.

| PV of Future Cash Flows | |

| Initial Investment | |

| Profitability Index | |

| Profitability Index | = |

|

|

Conclusion

Firms use the Profitability Index to determine the relationship between costs and benefits for a proposed project. If a company has limited capital and faces multiple mutually exclusive projects, it must choose the project with the highest profitability index. This is because projects with a profitability index greater than one generate value for the company. In contrast, those with a profitability index of less than one indicate that the project destroys value for the company.

Recommended Articles

This has been a guide to the Profitability Index formula. Here we discuss How to Calculate the Profitability Index along with practical examples. We also provide Profitability Index Calculator with a downloadable Excel template. You may also look at the following articles to learn more –