Updated November 18, 2023

Operating Profit Margin Formula

Operating Profit margin is a ratio that measures profitability and efficiency for controlling the cost and expenses related to business operations. It provides an overview to customers of how much profit the company can make after paying all the variable costs.

In this article, we will learn about Operating Profit Marginal Formula.

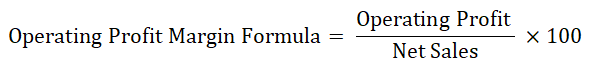

The formula for calculating the Operating Profit Margin is as follows:

Examples of Operating Profit Margin Formula

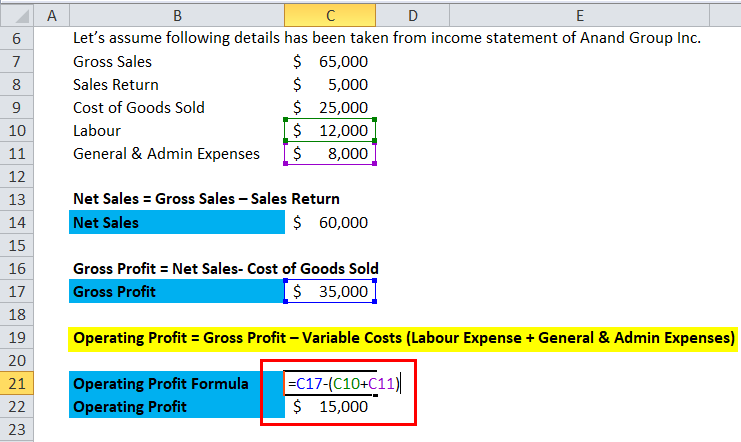

Let’s assume the following details have been taken from the income statement of Anand Group Inc.

- Gross Sales – $65,000

- Sales Return- $5,000

- Cost of Goods Sold- $25,000

- Labour $12,000

General & Admin Expenses-$8000

To calculate the Operating Profit Margin of Anand Group Inc., we need two things:

- Net Sales and

- Operating Profit

Net Sales can be calculated by deducting Sales return from the Gross Sales, i.e.,

- Net Sales = Gross Sales – Sales Return

- Net Sales = $65,000 – $5,000

- Net Sales = $60,000

Operating profit can be calculated by deducting all the variable expenses from Gross Profit.

Where,

- Gross Profit = Net Sales- Cost of Goods Sold

- Gross Profit = $60,000 – $25,000

- Gross Profit = $35,000

And

- Operating Profit = Gross Profit – Variable Costs (Labour Expense + General & Admin Expenses)

- Operating Profit = $35,000 – ($12,000 + $8000)

- Operating Profit =$35,000 – $20,000

- Operating Profit = $15,000

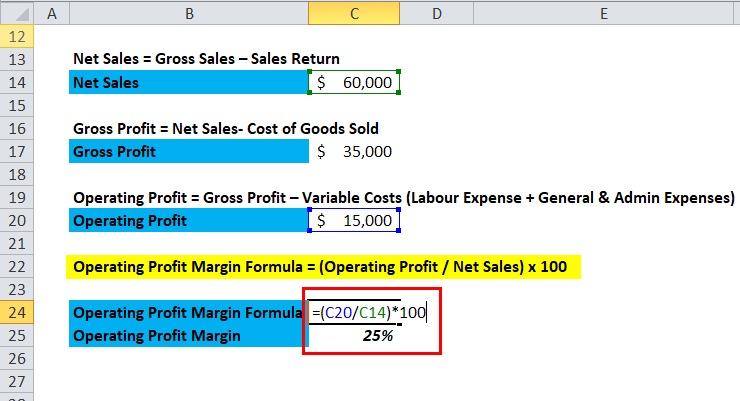

We can calculate the Operating Profit Margin using the two inputs as follows.

- Operating Profit Margin Formula = (Operating Profit / Net Sales) x 100

- Operating Profit Margin = ($15,000 / $60,000) x 100

- Operating Profit Margin = 25%

Explanation of Formula

We need Operating Profit and net Sales to calculate the Operating Profit Margin.

The first component is operating profit.

Operating Profit calculates the Company’s profit from its core business. It is sometimes called EBIT. Operating profit includes income from the core operations of any business before considering taxes and excluding other income from investments. It helps measure the firm’s efficiency to control costs & helps in running its operations effectively.

The second component is Net Sales.

Net Sales can be calculated by deducting Sales return from the Gross Sales. Gross sales are the total revenue. When we deduct sales returns & sales discounts from Gross sales, we get the Net Sales figure. We can get the above figures from the Income statement of any company.

To calculate the Operating Profit Margin, we must compare the operating profit to the net sales.

Significance and Use of Operating Profit Margin Formula

The operating Profit margin formula measures the Company’s operating efficiency and pricing strategy. It provides an overview to customers of how much profit the company can make after paying all the variable costs. Operating profit margin cannot be used as a stand-alone analysis. We need to compare the ratios from previous years to find the deviations in whether a company’s margin is improving.

The operating profit margin of a company can be used as a base to compare its past performance with its competitors. The companies with higher operating profit margins can offer competitive pricing i.e., they can offer lower prices than their competitors. The operating profit margin shows whether the Sales volume is at the level of the fixed costs of production or not. Companies with a high operating profit margin can pay the interest on debt and their fixed cost easily and even survive economic downturns easily. A high operating profit margin is preferred as it shows a company’s earnings per dollar of sales; the higher the margin, the higher the return.

Operating Profit Margin Calculator

You can use the following Operating Profit Margin

| Operating Profit | |

| Net Sales | |

| Operating Margin Formula = | |

| Operating Margin Formula = | = |

|

||||||||

| = |

|

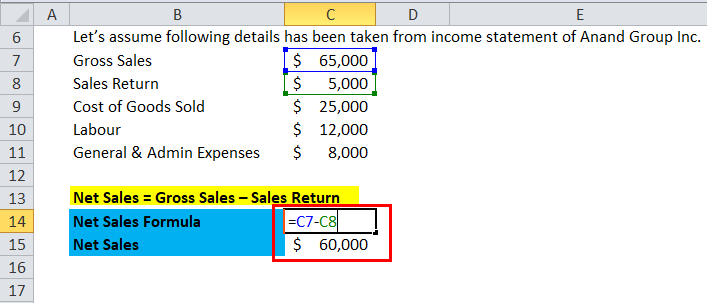

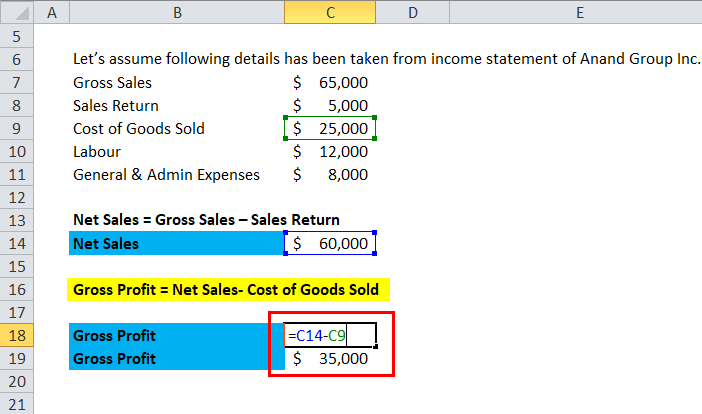

Operating Profit Margin Formula in Excel (With Excel Template)

Here, we will do the same example of the Operating Profit Margin formula in Excel. It is very easy and simple. You need to provide the two inputs of Net Sales and Operating Profit

You can easily calculate the Operating Profit Margin using the Formula in the template provided.

First, we need to calculate the Net Sales.

Then, we need to find out the gross profit. To find the gross profit, we must deduct the cost of goods sold from the net sales.

Then, to find out the operating profit.

Then, we need to calculate the operating profit margin using the formula.

Recommended Articles

This has been a guide to an Operating Profit Margin formula. Here, we discuss its uses along with practical examples. We also provide an Operating Profit Margin Calculator with a downloadable Excel template. You may also look at the following articles to learn more –