Updated November 20, 2023

Net Profit Margin Formula

OR

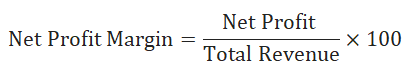

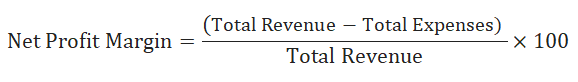

Net profit margin is derived from the Profit and loss Account of a company or a firm, where the overall income and expenditure of the company get recorded under different heads. Net profit margin refers to the percentage of total revenue that remains after all company expenses, which include operating expenses, interest & taxes & preferred stock dividends from its total revenue.

Or,

Profit margin is an accounting calculation that measures the financial health of a business. It is one of the closely analyzed financial formulas. Net Profit margin is a profitability ratio that measures the amount of net income earned with total revenue generated within a specific period of time (Quarterly, half-yearly, or yearly).

Example of Net Profit Margin Formula

Let’s understand the calculation of net profit margin by an example.

We have considered a profit & loss account of XYZ Company for FY2018 to calculate the net profit margins:

|

Profit & Loss Account of ABC Company for the year ended 31st March 2018 |

|

| Particulars | Amount (In INR) |

| Total Revenue | 500 |

| Less: Cost of Goods Sold (COGS) | 400 |

| Gross Profit | 100 |

| Less: Operating Expenses | 50 |

| Operating Profit (EBIT) | 50 |

| Less: Interest Expenses | 10 |

| Profit Before Tax (PBT) | 40 |

| Less: Tax Expenses | 10 |

| Net Profit | 30 |

Based on the above financial figures, we can calculate the net profit margin for FY2018 by using the formula:

Total Revenue = INR 500

Net Profit = INR 30

Calculation of net profit margins by using a formula:

- Net Profit Margin = (Net Profit ⁄ Total revenue) x 100

- Net Profit Margin = (INR 30/INR 500) x 100

- Net Profit Margin= 6.00%

The company earned 6.00% of net profit margins against its total revenues in the financial year 2018.

Explanation

Net profit margin is an important profitability ratio that measures the company’s profit over total sales for a particular period, and it is stated in percentage (%). Net profit margins can be positive in the case of net profit or negative in the case of net losses. A higher net profit margin means that a company is more efficient in converting sales into actual profit and vice-versa.

Calculating the net profit margin needs to have some important details from the company’s income statement (Profit & Loss Account):

- Net Sales or Total Revenue: Net sales are sales revenue that excludes sales returns, excise duty paid and allowances, etc. On the other hand, net sales are the revenue that occurs from the normal course of businesses or sales of goods and services for a particular period of time.

- Total Expenses: A company’s total expenses refer to the expenses incurred in running the business for a particular period. It includes purchases of raw materials, commissions/discounts, fixed expenses (rent, insurance, license fees, utilities, etc.), variable expenses (advertising, delivery charges, electricity, etc.), and tax and interest expenses for the company.

- Net Income:

In many instances, Gross income is the same as total revenue. However, It can differ with certain exclusions, for instance, stock options granted to company executives. For this example, gross income and sales revenue are the same. To arrive at net income for a specific period, like a quarter, a half year, or a year, we subtract from total income/revenue from all business expenses for the same period. These include all operating costs, interest, tax payments, and preferred stock dividends. The remaining profit is called net income for the period.

Significance and Use of Net Profit Margin Formula

- Net Profit margins are used by internal management to set future decision-making about a source of revenue and uses of funds.

- Generally, a reduction in net profit margin would suggest many problems for the companies in expense management or lackluster sales.

- Investors want to know whether the company is making enough money to distribute dividends. One of the indicators they will look at is the company’s profit margin.

- The net profit margins reflect the percentage of the total profit made by a company, which increases the company’s net worth by retaining it in the business.

- This ratio tells about the company’s position in the industry. Always, higher net profit margin businesses continue for a longer period of time and lead the industry.

- It helps the management to declare the dividend, product pricing, market expansion, etc., based on net profit margins.

- Profit margin is very useful when comparing companies in similar industries. A higher profit margin indicates a more profitable company with better control over its costs than its competitors.

- Net profit margins are also useful for lenders or analysts to know a company’s creditworthiness by calculating debt or interest servicing capability.

Net Profit Margin Calculator

You can use the following Net Profit Margin Calculator

| Net Profit | |

| Total Revenue | |

| Net Profit Margin Formula | |

| Net Profit Margin Formula = |

|

||||||||||

|

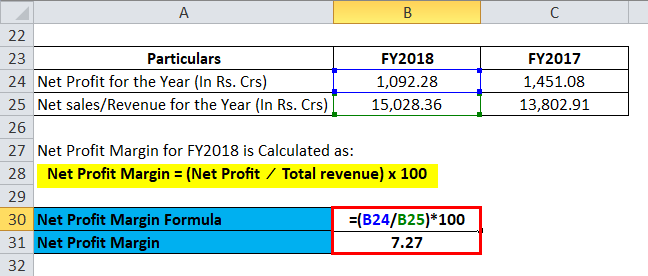

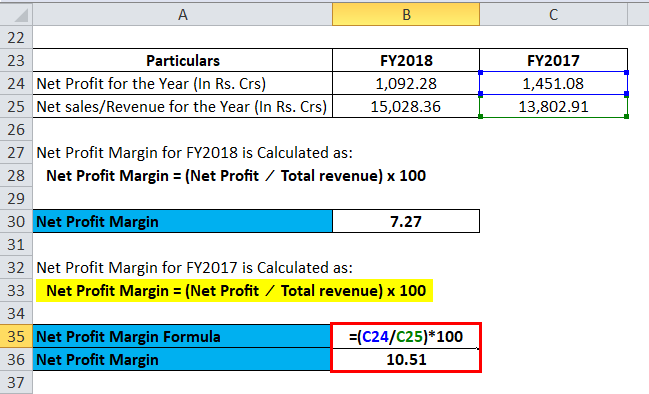

Net Profit Margin Formula in Excel (With Excel Template)

Here, we will do the same example of the Net Profit Margin formula in Excel. It is very easy and simple. You need to provide the two inputs, i.e., Net Profit and Total Revenue

You can easily calculate the Net Profit Margin using the Formula in the template provided

Net Profit Margin for FY2018 is Calculated Using Formula

Net Profit Margin for FY2017 is Calculated Using Formula

Recommended Articles

This has been a guide to a Net Profit Margin formula. Here, we discuss its uses along with practical examples. We also provide Net Profit Margin Calculator with a downloadable Excel template. You may also look at the following articles to learn more –