Updated August 1, 2023

Return on Invested Capital Formula (Table of Contents)

- Return on Invested Capital Formula

- Examples of Return on Invested Capital Formula (With Excel Template)

- Return on Invested Capital Formula Calculator

Return on Invested Capital Formula

Return on Invested Capital is a profitability ratio that determines how well a company is using its capital to generate returns. The return on Invested Capital formula can be calculated by dividing NOPAT by the total invested capital in the company.

Return on Invested Capital Formula

Where:

- NOPAT – It can be described as the operating profit of the company minus the income taxes.

NOPAT = EBIT (1-t), where EBIT is Earnings before Interest and Taxes

- Invested Capital – It can be described as the total amount of capital invested in the company by both shareholders and lenders.

Examples of Return on Invested Capital Formula (With Excel Template)

Let’s take an example to understand the calculation of the Return on Invested Capital formula in a better manner.

Example #1

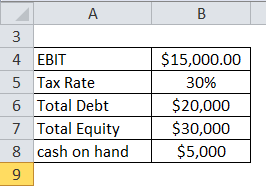

Let’s take the example of company X, whose EBIT is $15000, and the tax rate is at 30%. Similarly, the total debt is $20000, the total equity is $30000, and the cash on hand is $5000.

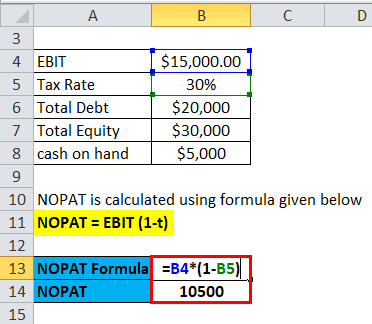

The formula to calculate NOPAT is as below:

NOPAT = EBIT (1-t)

- NOPAT= $15000 (1-0.3)

- NOPAT= $15000 * 0.7

- NOPAT = $10500

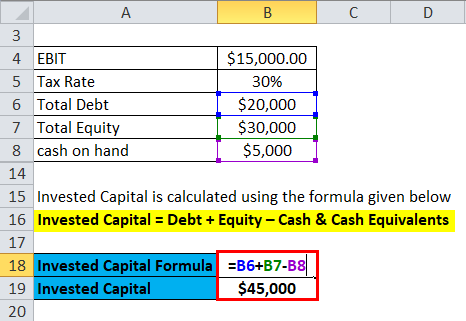

The formula to calculate Invested Capital is as below:

Invested Capital = Debt + Equity – Cash & Cash Equivalents

- Invested Capital = $20000 + $30000 – $5000

- Invested Capital = $45000

The formula to calculate ROIC is as below:

Return on Invested Capital = NOPAT / Invested Capital

- ROIC = $10500 / $45000

- ROIC = $0.23

Example #2

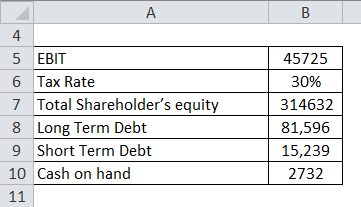

Let’s take an example of a company Reliance whose EBIT is Rs 45725 Cr and whose tax rate is at 30%. Total Shareholder’s equity is Rs 3,14,632 Cr, long-term debt is Rs 81,596 Cr, and short-term debt is Rs 15 239 Cr. Cash on hand is Rs 2732 Cr.

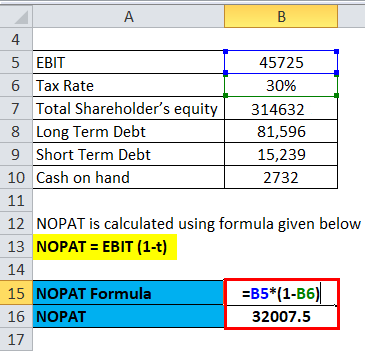

NOPAT = EBIT (1-t)

- NOPAT = 45725 * (1-0.3)

- NOPAT = 45725 * 0.7

- NOPAT = Rs 32007.5 Cr

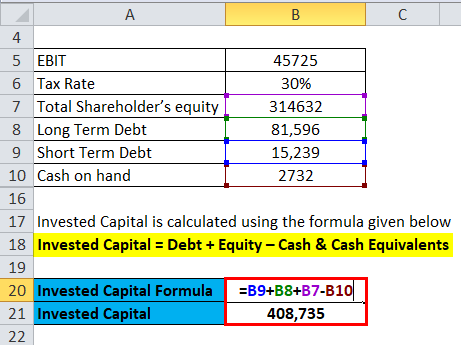

Invested Capital = Debt + Equity – Cash & Cash Equivalents

- Invested Capital = 81596+ 15239 + 314632– 2731

- Invested Capital = Rs 408735 Cr

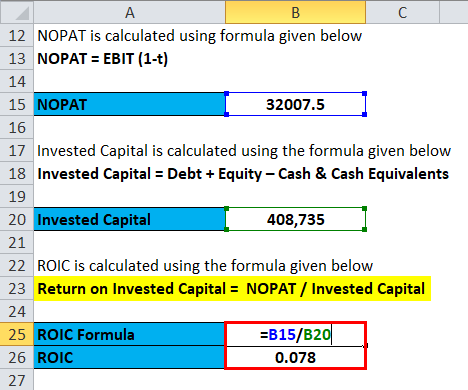

Return on Invested Capital = NOPAT / Invested Capital

- ROIC = Rs 32007.5 / Rs 408735 Cr

- ROIC = 0.078

Example #3

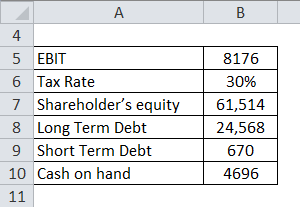

Let’s take an example of the company Tata Steel whose EBIT is Rs 8176 Cr, and the tax rate is at 30%. Total Shareholder’s equity is Rs 61,514 Cr, long-term debt is Rs 24 568 Cr, and short-term debt is Rs 670 Cr. Cash on hand is Rs 4696 Cr.

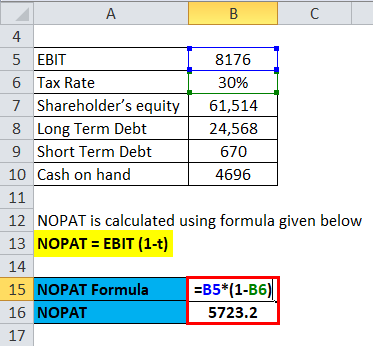

NOPAT = EBIT (1-t)

- NOPAT = 8176 (1-0.3)

- NOPAT = 8176 * 0.7

- NOPAT = Rs 5723.2 Cr

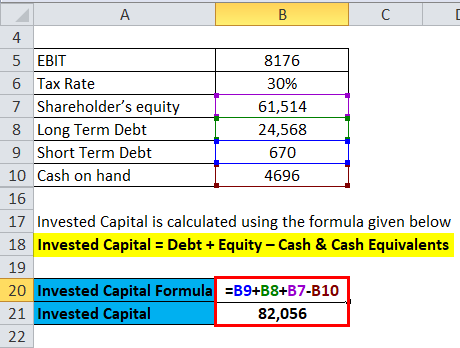

Invested Capital = Debt + Equity – Cash & Cash Equivalents

- Invested Capital = 24568 + 670 + 61514– Rs 4696

- Invested Capital = Rs 82056 Cr

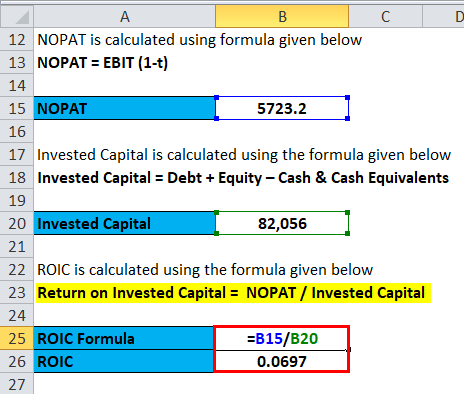

Return on Invested Capital = NOPAT / Invested Capital

- ROIC = 5723.2 / 82056 Cr

- ROIC = 0.0697

Explanation of Return on Invested Capital Formula

Return on Invested Capital is a profitability ratio determining how well a company uses its capital to generate returns. To calculate the Return on Invested Capital (ROIC), divide the company’s NOPAT by the total invested capital. NOPAT represents the operating profit of a company or firm minus the income taxes. Invested Capital refers to the total amount of capital invested by debtholders and shareholders, excluding the Cash and Cash equivalents held by the company.

To prevent uncharacteristic results of ROIC, we should make some adjustments. For example, we should use Earnings from continuing operations while estimating EBIT by removing earnings from discontinued operations and other income. Additionally, we should add any current portion of short-term and long-term debt while calculating Invested Capital and remove net assets of discontinued operations.

Relevance and Uses of Return on Invested Capital Formula

The company can use Return on Invested Capital (ROIC) as a proxy for its growth. Comparing ROIC to the company’s Weighted Average Cost of Capital (WACC) allows for assessing whether the company is creating shareholder value. If the ROIC exceeds the WACC, the company generates excess returns, which can be reinvested in further company development. On the other hand, if the ROIC is not greater than the WACC, it implies that value is not being created for the shareholders and debtholders of the company. The Return on Invested Capital formula holds greater significance for sectors such as petroleum, steel, or manufacturing companies, which tend to make significant investments in capital expenditure compared to other companies.

Using ROIC has a downside as it fails to indicate which segment of the company generates value since it considers the NOPAT as a whole. Sometimes, companies utilize Net Income minus Dividends instead of NOPAT, which leads to even more obscure results as the return can stem from a single occurrence event. Moreover, analysts employ ROIC in conjunction with the P/E ratio to provide context. If a company’s P/E ratio is higher when viewed independently, it suggests that it is overvalued. However, strong support from a high ROIC indicates that the company consistently generates higher rates of return and, consequently, should have a higher P/E.

Return on Invested Capital Formula Calculator

You can use the following Return on Invested Capital Calculator.

| NOPAT | |

| Invested Capital | |

| Return on Invested Capital | |

| Return on Invested Capital | = |

|

|

Conclusion

The Return on Invested Capital (ROIC) is a profitability ratio determining how effectively a company utilizes its capital to generate returns. The formula for calculating ROIC involves dividing the Net Operating Profit After Taxes (NOPAT) by the total invested capital in the company. To calculate NOPAT, certain adjustments must be made, such as excluding earnings from discontinued operations.

In order to determine whether a company is generating excess returns, its ROIC needs to be greater than the Weighted Average Cost of Capital (WACC). This indicates that the company is generating consistent returns above its cost of capital. Moreover, ROIC is often used with the Price-to-Earnings (P/E) ratio to understand better whether a company’s higher P/E ratio is supported by its consistent returns above the WACC.

Recommended Articles

This has been a guide to Return on Invested Capital formula. Here we discuss How to Calculate the Return on Invested Capital along with practical examples. We also provide Return on Invested Capital Calculator with a downloadable Excel template. You may also look at the following articles to learn more –