Updated November 23, 2023

Payback Period Formula

The payback period formula can be termed as the tool required for capital budgeting feet can estimate the length of tenure required to reach the capital investment amount from the profitability of the business over the period of time.

The total capital investment required for the business is divided by the projected annual cash flow to calculate this period, usually expressed in years.

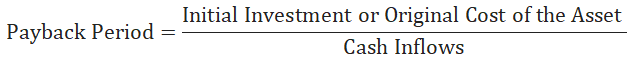

Here’s the Payback Period Formula –

OR

Where,

- P = Payback period.

- PYFR = Number of Years immediately preceding year of Final Recovery BA = Balance Amount to be recovered

- CIYFR = Cash inflow — Year of the Final Recovery

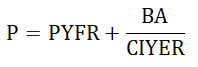

Example of Payback Period Formula

Let’s take an example to find out the Payback Period for a company: –

A particular Project costs USD 1 million, and the project’s profitability would be USD 2.5 Lakhs per year. Calculate the Payback Period in years.

Using the Payback Period Formula, We get-

- Payback Period = Initial Investment or Original Cost of the Asset / Cash Inflows.

- Payback Period = 1 million /2.5 lakh

- Payback Period = 4 years

Explanation

The payback period is a measure organizations use to determine the time needed to recover the initial investment in a business project. It is a crucial factor in decision-making, as a shorter payback period signifies a faster return to profitability. However, one limitation of the payback period is its disregard for the time value of money, which refers to the declining worth of money over time. The concept of the time value of money highlights that the present value of money is higher than its future value. When evaluating the payback period or determining the breakeven point in a business venture, it is crucial to consider the opportunity cost and the influence of the time value of money.

Significance and Use of Payback Period Formula

One of the major characteristics of the payback period is that it ignores the value of money over time. The payback period formula calculates the years it will take to recover the invested funds from the particular business.

For example, a project costs USD 1 million, and the project’s profitability would be USD 2.5 Lakhs per year. Calculate the payback period in years and interpret it.

So the payback period will be = 1 million / 2.5 lakh or 4 years.

While calculating the payback period, we ignore the basic valuation of 2.5 lakh dollars over time. In other words, we fix the profitability of each year, but we place the valuation of that particular amount over the period of time. As a result, the payback period fails to capture the diminishing value of currency over increasing time.

Types of Payback Period

When calculating break-even in business, businesses use several types of payback periods. The net present value of the NPV method is one of the common processes of calculating the payback period, which calculates the future earnings at the present value. The discounted payback period is commonly utilized in capital budgeting procedures to assess the profitability of a project. A discounted payback period’s net present value aspect does not exist in a payback period in which the gross inflow of future cash flow is not discounted.

Another frequently used method is IRR, or internal rate of return, which emphasizes the rate of return from a particular project each year. The rate of return may not be the same over all the years. Last, a payback rule called the payback period calculates the time required to recover the investment cost.

Features of Payback Period Formula

- The payback period is a basic understanding of the return and time period required to break even. The payback period formula is very basic and easy to understand for most business organizations.

- Within several methods of capital budgeting payback period method is the simplest form of calculating the viability of a particular project, reducing cost, labor, and time.

- The payback period reduces the obsolescence of a particular machine because it prefers a shorter tenure compared to a larger time frame.

- Companies with lower cash balances in the balance sheet, hired date, and very weak liquidity would benefit from this method.

- The payback period, however, emphasizes on speedy recovery of investment in capital assets.

Demerits of Payback Period Formula

- A small deviation in labor cost or cost of maintenance can change the earnings and the payback period.

- This method ignores Solvency II, the liquidity of the business.

- This method only concentrates on the company’s earnings and ignores capital wastage and other factors like inflation, depreciation, etc.

- The time value of money is not at all considered in this method.

- Several other methods must be implemented during capital budgeting decisions to address the overlooked amount of capital investment in the payback period.

- This method cannot determine erratic earnings, and perhaps this is the main shortcoming of this method. As we all know, the business environment cannot be the same for each and every year.

Suitability of Payback Period Formula

- The payback period is only suitable for units that don’t have huge amounts in hand.

- The payback period is most suitable in dynamic markets and under certain investment scenarios.

- Most business people prefer a shorter payback period to reduce the risk factor as the business world changes each and every day and the rate of change accelerates.

- Companies suffering from a huge debt crisis and seeking profitability from pilot projects commonly refer to the payback period.

Payback Period Calculator

You can use the following Payback Period Calculator

| Initial Investment OR Original Cost of the Asset | |

| Cash Inflows | |

| Payback Period Formula | |

| Payback Period Formula | = |

|

|

Payback Period Formula in Excel (With Excel Template)

Here, we will do the same example of the Payback Period formula in Excel. It is very easy and simple. You need to provide the two inputs i.e, Initial Investment and Cash Inflows

You can easily calculate the Payback Period using Formula in the template provided.

Conclusion

The payback period is an essential assessment during the calculation of return from a particular project. It is advisable not to use the tool as the only option for decision-making. During similar kinds of investments, however, a paired comparison is useful. In the case of detailed analysis like net present value or internal rate of return, the payback period can act as a tool to support those particular formulas.

Recommended Articles

This has been a guide to a Payback Period formula. Here, we discuss its uses along with practical examples. We also provide a Payback Period Calculator with a downloadable Excel template. You may also look at the following articles to learn more –