Updated November 23, 2023

Quick Ratio Formula (Table of Contents)

Quick Ratio Formula

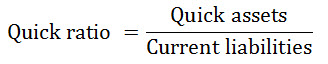

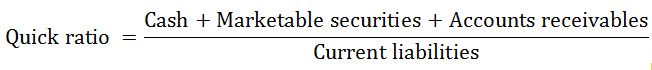

The quick ratio is a popular metric used to calculate the short-term liquidity position of a company. The formula for the Quick ratio is:

In the above Quick ratio formula,

Quick assets refer to assets that can be converted into Cash within 90 days.

Quick assets = Cash or cash equivalents, Marketable securities & Accounts receivables

Now that we know what quick assets are, let us break down the formula as follows:

Let us now calculate the Quick ratio with a simple example.

Examples of Quick Ratio Formula

Example #1

Consider a company XYZ has the following Current Assets and current liabilities.

- Cash: $10000

- Inventory: $5000

- Stock investments: $2000

- Inventory: $4000

- Prepaid taxes: $800

- Accounts receivables: $6000

- Current liabilities: $15000

Therefore,

The quick ratio pertaining to company XYZ can be calculated as follows:

- Quick ratio = Cash+ Stock investments + Accounts receivables/ Current liabilities

- Quick ratio = $10000+$2000+$6000/ $15000

- Quick ratio = $18000/$15000

- Quick ratio = $1.2

The quick ratio of company XYZ is 1.2, which means company XYZ has $1.2 of quick assets to pay off $1 of its current liabilities.

Sometimes companies don’t provide a detailed balance sheet; however, the quick ratio can still be calculated as shown in the below example:

Example #2

Suppose the balance sheet of company XYZ looks like the one shown below.

- Total current assets = $22800

- Inventory = $4000

- Prepared taxes = $800

- Current liabilities = $15000

Since company XYZ did not give the breakdown of the quick assets, the quick ratio can be calculated with the below method:

- Quick ratio = Total current assets – Inventory – Prepared taxes/ Current liabilities

- Quick ratio = $22800 – $4000 – $800/ $15000

- Quick ratio = $18000/$15000

- Quick ratio = $1.2

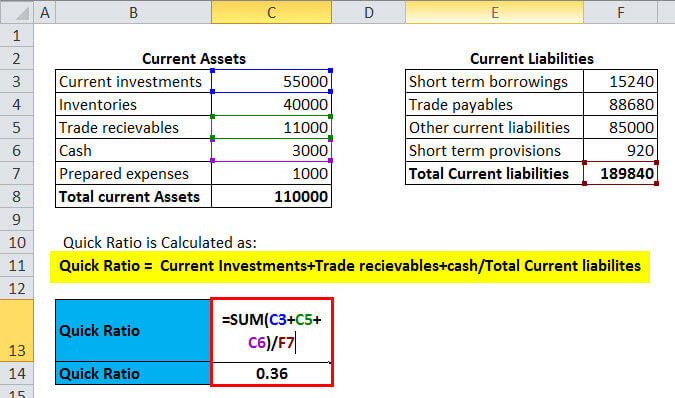

Example #3

Now that we have a basic understanding of the calculation of quick ratio, let us now go ahead and calculate the quick ratio of Reliance Industries:

The Current Assets and current liabilities of Reliance Industries for FY 2017 – 18 are;

- Current Investments = 53,277.00

- Inventories = 39,568.00

- Trade Receivables = 10,460.00

- Cash And Cash Equivalents = 2,731.00

- Short-Term Loans And Advances = 3,533.00

- Other Current Assets = 14,343.00

- Current Liabilities = 190647

Therefore,

- Quick ratio = Current Investments+Trade Receivables+Cash And Cash Equivalents+Short Term Loans And Advances+Other Current Assets/Current Liabilities

- Quick ratio = 53277 + 10460 + 2731 + 3533 + 14343/ 190647

- Quick ratio = 84344/190647

- Quick ratio = 0.44

From the above calculation, it is clear that the short-term liquidity position of Reliance Industries is not good. Reliance Industries has 0.44 INR in quick assets for every 1 INR of current liabilities.

It also helps to compare the previous years’ quick ratio to understand the trend. So let us now calculate the quick ratio of Reliance Industries for FY 2016 – 17.

- Current Investments = 51,906

- Inventories = 34,018.00

- Trade Receivables = 5,472.00

- Cash And Cash Equivalents = 1,754.00

- Short-Term Loans And Advances = 4,900.00

- Other Current Assets = 8,231.00

- Current Liabilities = 152826

Therefore,

- Quick ratio = Current Investments+Trade Receivables+Cash And Cash Equivalents+Short Term Loans And Advances+Other Current Assets/Current Liabilities

- Quick ratio = 51906+5472+1754+4900+8231/152826

- Quick ratio = 72263/152826

- Quick ratio =0.47

The comparative study of a quick ratio for FY 16 & 17 suggests that the quick ratio of Reliance Industries declined from 0.47 to 0.44. This indicates that the short-term liquidity position of Reliance Industries is bad, and hence it cannot pay off its current liabilities with the quick assets. It also makes sense to look at the contribution weightage of each asset in the overall quick assets.

If you notice the quick assets of Reliance Industries, the short-term investments have more weightage, with 53277 contributions to the overall quick assets of 84344. This means that strategically, Reliance Industries has made good short-term investments that can be converted into Cash to pay off its current liabilities. However, the quick assets are insufficient to meet its short-term liquidity requirements.

Explanation

- The quick ratio also called the acid test ratio, is based on the historical practice of using acid to test metals for gold. The metal would undergo the acid test to prove pure gold; otherwise, it is just a metal. Similarly, investors test the companies to determine their short-term liquidity position by calculating the quick ratio.

- The quick ratio is similar to the current ratio in calculating current assets; however, while calculating the quick ratio, we eliminate Inventory & prepared expenses. The reason is the assumption that Inventory may not be realized into Cash within 90 days. The Inventory includes Raw materials and works in progress; therefore, liquidating the Inventory promptly becomes difficult.

- A quick ratio of 1 or more is considered to be good. It means that the short-term liquidity position of the company is good. A quick ratio of 1 indicates that for every $1 of current liabilities, the company has $1 In quick assets to pay off. Similarly, a quick ratio of 2 indicates the company has $2 in current assets for every $1 it owes.

- The assets considered under the quick ratio are Cash & cash equivalents, Marketable securities/Investments, and Accounts Receivables.

Use of Quick Ratio

- The quick ratio is mainly used by investors/creditors to determine the short-term liquidity position of the company they are investing in/lending.

- It also helps the company’s management decide the optimum level of current assets that must be maintained to meet the short-term liquidity requirements.

- The quick ratio also helps enhance the company’s credit score for taking credit in the market.

Significance and Use of Quick Ratio Formula

While the quick ratio is a quick & easy method of determining the company’s liquidity position, diligence must be done in interpreting the numbers. To get the complete picture, it is always better to break down the analysis and see the reason for the high quick ratio.

For example, if the quick ratio increase is impacted by the spike in Accounts receivables and the payment from the creditors is delayed, the company may not be able to meet its immediate and short-term debt obligations.

Now that we understand the complete know-how of the quick ratio, please go ahead and try calculating the quick ratio on your own in the Excel template made for you to practice. Please also analyze and see the reason for the increase/decrease in the quick ratio.

Quick Ratio Formula Calculator

You can use the following Quick Ratio Formula Calculator

| Quick Assets | |

| Current Liabilities | |

| Quick Ratio Formula= | |

| Quick Ratio Formula= | = |

|

|

Quick Ratio Formula in Excel (With Excel Template)

Here, we will do the same example of the Quick Ratio Formula in Excel. It is straightforward. You need to provide the two inputs, i.e., Current Assets and Current liabilities

You can easily calculate the Quick Ratio Formula in the template provided.

Recommended Articles

This has been a guide to the Quick Ratio Formula. Here, we discuss its uses along with practical examples. We also provide a Quick Ratio calculator and a downloadable Excel template.