Updated November 17, 2023

Preferred Dividend Formula

The formula for calculating the Preferred Dividend is as follows:

Where,

The number of preferred stocks: the number of shares the preference shareholder holds. Fixed dividends at regular intervals are entitled to be received by preference shareholders.

Par value: the face value of a bond or any fixed-income instrument. Par value is also known as Face Value or Nominal Value.

Rate of Dividend: the rate at which the dividend will be paid out; it is calculated at par value.

Examples of Preferred Dividend Formula

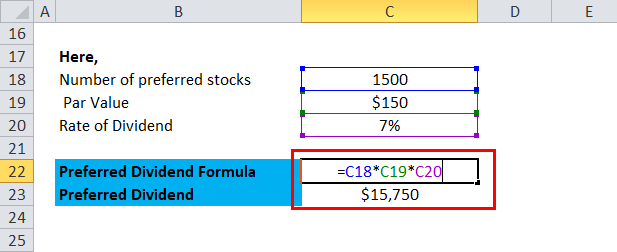

Anand has invested in the preferred stocks of a company. Anand has bought 1500 preferred stocks of that company. As per the company policy, Anand is entitled to a preferred dividend of 7% @ par value of a stock. The par value of each stock is $150. What is the amount of preferred dividend Anand will be getting each year?

In this case, we have the dividend rate, and the par value is given; now, we can calculate a preference dividend using the formula.

- Preferred Dividend = $1500 * 0.07 * 150

- Preferred Dividend = $ 15750

It means that each year, Anand will get $ 15750 preferred dividends.

Explanation of Preferred Dividend Formula

The company pays the preference shareholders an annual amount from its retained earnings for holding the preference shares, known as a preference dividend.

“While the share price can fluctuate, the preferred stock has a structure more akin to…”

Few things that you must know for calculating the preferred dividends.

Firstly, preferred shares have a par value on the dividend pay-out calculated. Next, the Company sets the rate for the preferred dividend at the time of the share issue. Preferred shares can move up and down in price, and the actual dividend yield is based on the current price of any company’s stock.

Let’s assume Anand Group’s stock is available at $50, and the dividend rate is at @8%. Firstly, we have to convert the dividend rate into a decimal. i.e., 8 % as 0.08, which has been arrived at by dividing the percentage by 100 and then multiplying the par value with the dividend rate as a percentage. As per the above-stated example, the preference share yield is $2.5 apiece every year. And if you want to calculate the preferred dividend, multiply the preference share yield with the preference share you own. Assuming you have 500 preferred shares of Anand Group of companies, your preferred annual dividend would be $2.5 multiplied by 500. That brings $1250 as the dividend income for the preference shareholders.

If you want to calculate a company’s total dividend payment to its preferred shareholders, simply multiply the per-share amount and the total number of preferred shares outstanding. However, many companies issue shares in different series of preferred stock with different dividend rates and par values. So, to calculate the total preferred dividend, you’ll need to compute the dividend payment for every series of preferred stocks issued by the company.

Significance and Use of Preferred Dividend Formula

- Preferred dividends are a good option for risk-averse investors looking to invest in less risky assets. It offers a fixed rate of return every year.

- Preference stocks, known as preference shares, receive dividend payments before common shareholders. Companies offer preference shareholders higher dividend rates than equity or common shareholders because they lack ownership control over the company.

- Preferred stock is also labeled as a hybrid security since it possesses characteristics of both common stock and a bond, providing a fixed payout at regular intervals.

- Preferred shares can be converted to a fixed number of common shares. In some cases, preferred shares have a specific time period after which these shares can be converted into common shares. The board of directors can approve the conversion compared to other cases where it is done afterward.

- Even in case of bankruptcy, the preference shareholders are eligible to be paid from the company’s assets first. The pay-out of preference is regular.

- The company puts dividend payments to preferred shareholders into arrears when it does not declare them. This feature of arrears is only applicable to non-cumulative preferred stocks. The company considers it a liability and includes it in the accounts book.

- The company’s legal obligation is to pay out the preferred dividend.

Interpretation of Preferred Dividend Formula

Investors usually purchase preferred stock as a source of regular income through dividends. Preferred stock prices & yields tend to change depending on the prevailing interest rates. If interest rates increase, preferred stock prices can fall, increasing the dividend yields. And vis-à-vis if interest rates fall, the preferred stock price rises, and there is a drop in dividend yield. While evaluating the investment potential of a preferred stock, it is good to compare its dividend yield to the corporate bond’s yield. The company discloses the par value and the dividend rate to the investor during the issue, determining them in the process.

The company cannot announce any dividend if it has carried forward losses or has not offset the previous year’s depreciation against the current year. The company pays the preferred dividend by deducting it from its after-tax profit, and it can only make this payment using company profits after adjusting for depreciation or retained earnings. The company can pay a dividend only in cash. Another medium can be cheques, warrants, or electronic mediums.

Preferred Dividend Calculator

You can use the following Preferred Dividend Calculator

| Number of Preferred Stocks | |

| Par Value | |

| Rate of Dividend | |

| Preferred Dividend Formula = | |

| Preferred Dividend Formula = | Number of Preferred Stocks x Par Value x Rate of Dividend |

| = | 0 x 0 x 0 = 0 |

Preferred Dividend Formula in Excel (With Excel Template)

Here, we will do the same example of the Preferred Dividend formula in Excel. It is very easy and simple. You need to provide the three inputs: Number of preferred stocks, Par Value, and Rate of Dividend. You can easily calculate the Preferred Dividend using the Formula in the template provided.

Here, we calculate the Preferred Dividend using the Formula.

Recommended Articles

This has been a guide to a Preferred Dividend formula. Here, we discuss its uses along with practical examples. We also provide a Preferred Dividend Calculator with a downloadable Excel template. You may also look at the following articles to learn more –