Updated November 20, 2023

Net Working Capital Formula

The Networking capital formula helps evaluate the company’s short-term liquidity position.

The formula for Net working capital is:

Example of Net Working Capital Formula

Let us understand Net working capital with the help of the following practical examples:

Net Working Capital Formula – Example #1

Consider a company called XYZ Ltd that operates in a Retail segment and has the following current assets and current liabilities:

- Cash: 10000

- Accounts receivable: 6000

- Inventory: 20000

- Accounts payable: 3000

- Outstanding salaries: 5000

The following steps need to be followed to calculate Net working capital:

Step 1: Identify the current assets and current liabilities.

Current assets are any assets that can be converted into cash, typically in a year, whereas current liabilities are any liabilities required to be paid in a year.

Current assets in the above example are calculated as follows:

- Current assets = 10000 +6000 + 20000

- Current assets = 36000

Current liabilities in the above example are calculated as follows:

- Current Liabilities = 3000 + 5000

- Current liabilities = 8000

Step 2: Net working capital calculation:

Net Working Capital is Calculated using Formula

- Net Working Capital = 36000 – 8000

- Net Working Capital = 28000

Since XYZ ltd current assets exceeded the current liabilities, the working capital of XYZ Ltd is positive. This indicates that XYZ Ltd can pay all its current liabilities using only current assets. In other words, the company is highly liquid and financially sound in the short term. They can use the extra liquidity to grow their business and expand further.

If XYZ Limited’s liabilities had exceeded the assets, the working capital would be negative, indicating that the short-term liquidity is not good and the current liabilities cannot be paid off with the current assets.

Net Working Capital Formula – Example #2

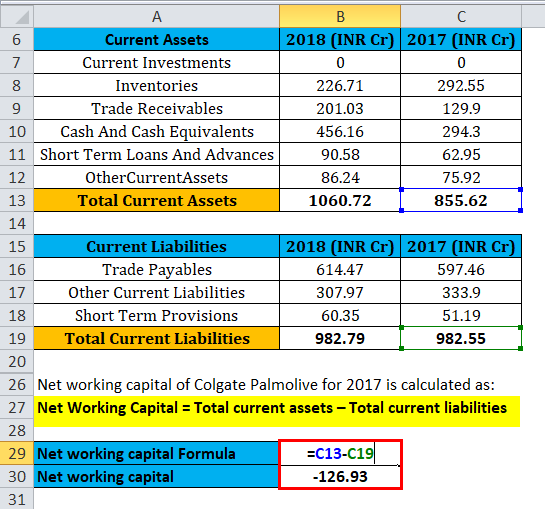

Now that we have the flair of NWC let us go ahead and do a practical Net working capital calculation of Colgate Palmolive – India.

The following figures have been extracted from the financials of Colgate Palmolive – India

|

Current Assets |

2018 (INR Cr) |

2017 (INR Cr) |

|

Current Investments |

0 |

0 |

|

Inventories |

226.71 |

292.55 |

|

Trade Receivables |

201.03 |

129.9 |

|

Cash And Cash Equivalents |

456.16 |

294.3 |

|

Short-Term Loans And Advances |

90.58 |

62.95 |

|

Other Current Assets |

86.24 |

75.92 |

|

Total Current Assets |

1060.72 | 855.62 |

|

Current Liabilities |

2018 (INR Cr) |

2017 (INR Cr) |

|

Trade Payables |

614.47 |

597.46 |

|

Other Current Liabilities |

307.97 |

333.9 |

|

Short Term Provisions |

60.35 |

51.19 |

|

Total Current Liabilities |

982.79 |

982.55 |

Let us now calculate the Net working capital of Colgate Palmolive – India, based on the above figures.

- Net working capital = 1060.72– 982.79

- Net working capital = 77.93 Cr

Based on the above calculation, the Net working capital of Colgate Palmolive – India is positive, indicating the company’s short-term liquidity position.

If you compare the liquidity position of Colgate from the previous year, it has improved significantly.

Net Working Capital 2017 = Total Current Assets – Total Current Liabilities

- Net Working Capital 2017= 855.62 – 982.55

- Net Working Capital 2017 = -126.93 Cr

The Net working capital of Colgate Palmolive – India had increased from -126.93 Cr in 2017 to 77.93 Cr in 2018. This means the company’s liquidity position is better in 2018 than 2017.

Explanation

Net working capital is an important measure that helps investors determine the company’s liquidity position. It indicates if the company has enough short-term convertible assets to meet its short-term debt obligations.

The Net Working Capital formula can be broken down into two components:

- The first component of the Net Working Capital formula is Current assets. Current assets are referred to the assets that can be converted into cash within a year’s time period. Current assets include Cash, Sundry debtors, Inventory, Accounts receivables, etc.

- The second component of the Net Working Capital formula is Current liabilities. Current liabilities are the debt obligations that need to be paid in a year’s time. Current liabilities include accounts payable, Sundry creditors, Outstanding salaries, etc.

It also makes sense to compare the NWC with the previous year’s figures to determine the trend. It indicates whether the company consistently maintains its positive/negative liquidity position. The more positive the trend is, the more liquidated the company is.

While negative working capital is a bad sign, it must be noted that negative working capital does not mean that the company will die. It just indicates that the short-term liquidity position of the company is bad. A company can still meet its short-term debt obligations, regardless of the number of current assets it has, if the company has easy access to short-term debt, such as a line of credit. If the company enjoys a considerable market reputation, it can easily access credit to meet its short-term debt obligations.

Significance and Use of Net Working Capital Formula

- The Net working capital calculation is mostly done in the investment analysis. Before investing in a company or a lender lending to the company, an investor usually tries to determine the company’s liquidity position by calculating the Net working capital.

- If the Net working capital is positive, the company has enough current assets to pay off its debt. It gives the investor assurance that the company is stable.

- If the Net working capital is negative, the company does not have enough current assets to pay off its short-term debt. Although it’s a poor sign, the investor need not base his decision on a single metric. The investor will dig in using metrics like Profit margins and asset turnover to determine the company’s financial health.

To sum it up, Net working capital is a useful metric that gives out the company’s financial health with a single calculation. However, it is also recommended to consider the other metrics and not base the decision on a single metric. Now that you have understood the concept and gone through the various calculations, it is recommended that you try your hand at Net working capital calculation by doing it practically. A template has been worked out for you; please try to understand and attempt the calculation on your own.

Net Working Capital Calculator

You can use the following Net Working Capital Calculator

| Total Current Assets | |

| Total Current Liabilities | |

| Net Working Capital Formula | |

| Net Working Capital Formula = | Total Current Assets – Total Current Liabilities |

| = | 0 – 0 |

| = | 0 |

Net Working Capital Formula in Excel (With Excel Template)

Here, we will do the same example of the Net Working Capital formula in Excel. It is very easy and simple. You need to provide the two inputs i.e. Total current assets and total current liabilities

You can easily calculate the Net Working Capital using Formula in the template provided.

First, we calculate the Net Working Capital of Colgate Palmolive for 2018

then, First, we calculate the Net Working Capital of Colgate Palmolive for 2017

Recommended Articles

This has been a guide to a Net Working Capital formula. Here, we discuss its uses along with practical examples. We also provide a Net Working Capital Calculator with a downloadable Excel template. You may also look at the following articles to learn more –