Updated November 17, 2023

Overhead Ratio Formula

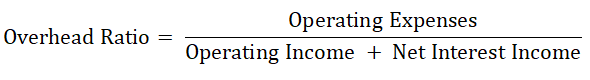

The overhead Ratio is the ratio of the operating expenses and the summation of operating income and taxable net interest income. It can also be defined as comparing any firm’s operating expenses to total income not attributable to its goods and services.

Here’s the overhead ratio formula –

Example of Overhead Ratio Formula

Let’s take an example to find out the overhead ratio for a company:

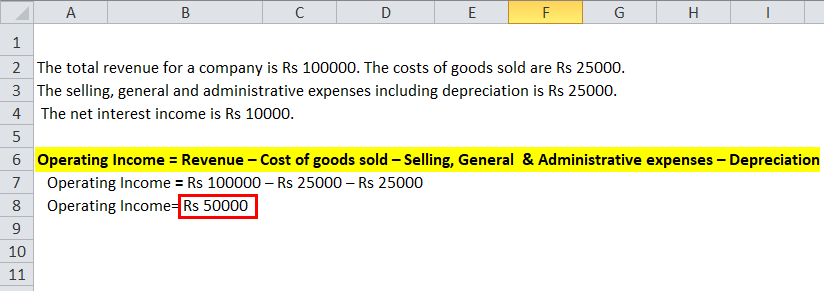

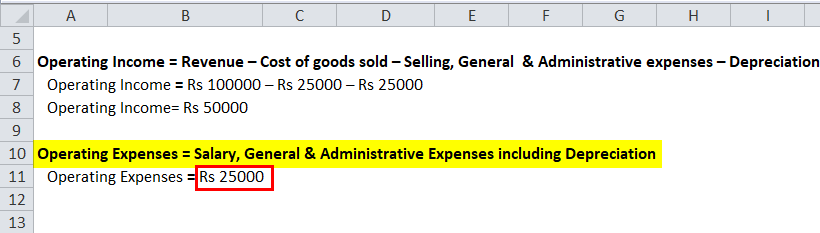

The total revenue for a company is Rs 100000. The cost of goods sold is Rs 25000. The selling, general, and administrative expenses, including depreciation, are Rs 25000. The net interest income is Rs 10000.

Then, the overhead ratio can be calculated below: –

- Operating Income = Rs 100000 – Rs 25000 – Rs 25000

- Operating Income= Rs 50000

- Operating Expenses = Rs 25000

- Net Interest Income = Rs 10000

Hence, the Overhead Ratio using the formula can be calculated as: –

- Overhead Ratio = 25000 / (50000 + 10000)

- Overhead Ratio = 25000 / 60000

- Overhead Ratio = 41.67%

Explanation of Overhead Ratio Formula

The overhead ratio is a financial ratio that lets the firm know its expenses as a percentage of its income. The firm incurs operating expenses daily, encompassing sub-items like rent, utilities, maintenance, salaries, wages, and depreciation on plant and machinery. Net Interest Income represents the variance between interest earned and interest paid on debt during a given financial period. Operating income is the firm’s income from manufacturing goods and services after deducting all the expenses.

The common overhead items are costs not directly related to manufacturing goods and services, which are direct labor, direct raw materials, and expenses billed directly to the customer. The items considered as overhead costs are selling, general and administrative expenses such as rent, utilities, salaries and wages, maintenance expenses, etc. These sub-items on the income statement represent the difference between gross and operating profit. Overhead costs can be fixed, semi-variable, or variable, but these are indirect costs.

Significance and Use of Formula

Any firm would strive to lower this ratio without affecting its product quality or competitiveness in the industry. A firm can cut its expenses to affect the overhead ratio positively, but it can affect the quality of the goods and services it provides.

One can look at gross profit margin and operating margin to understand how overhead costs affect the income statement of an economy. Gross profit margin includes the costs associated directly with manufacturing a good or the service provided by the company. In contrast, the operating margin includes direct and indirect costs of producing that good or service.

The overhead ratio alone does not indicate anything about the firm’s operations. It should be comparable to competitors and near to the industry standard. For example: – for the above firm, the overhead ratio is 0.41. If the industry standard is 0.3, it indicates that the firm’s overhead costs are more than the industry standards, and the indirect costs are bloated compared to direct costs; hence, the firm needs to reduce these overhead costs to maximize profit.

However, it does not mean that firms should reduce their overhead costs to a minimum. Reducing it will affect the company’s performance in terms of quality and affect the company negatively. The firm should try to balance the ratio in terms of industry standards, and it should not affect the company’s efficiency.

Overhead Ratio Calculator

You can use the following Overhead Ratio Calculator

| Operating Expenses | |

| Operating Income | |

| Net Interest Income | |

| Overhead Ratio Formula | |

| Overhead Ratio Formula | = |

| |||||

| = |

|

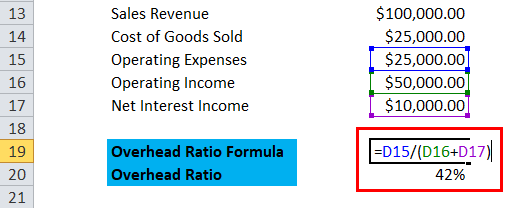

Overhead Ratio Formula in Excel (With Excel Template)

Here, we will do the same example of the Overhead Ratio formula in Excel. It is very easy and simple. You must provide the three inputs of Operating Expenses, Operating Income, and Taxable Net Interest Income.

You can easily calculate the Overhead ratio using the Formula in the template provided.

First, we need to calculate the Operating Income

Then we need to find out Operating Expenses.

Now, we can calculate the Overhead Ratio using Formula

Recommended Articles

This has been a guide to an Overhead Ratio formula. Here, we discuss its uses along with practical examples. We also provide an overhead ratio calculator with a downloadable Excel template. You may also look at the following articles to learn more –