Table of Contents

What is Change in Net Working Capital Formula?

The change in net working capital formula calculates how much the net working capital for a company has increased or decreased in the current period compared to the previous period or over a period of time.

To calculate the Net working capital, subtract the total current liabilities (accounts payable, salaries, dividend payable, income taxes, etc.) from the total current assets (cash & cash equivalents, inventory, accounts receivable, etc.).

Formula

Where,

Net Working Capital = Current Assets – Current Liabilities

Therefore,

Net Working Capital for Current Period = Current Assets (Current Period) – Current Liabilities (Current Period)

Net Working Capital for Previous Period = Current Assets (Previous Period) – Current Liabilities (Previous Period)

Interpretation

Here is how you can interpret what a positive and a negative change in the net working capital indicates.

| Change in Net Working Capital | Interpretation |

| Positive Change | The company’s current assets have increased more than current liabilities. It means improved liquidity and capacity to cover obligations. |

| Negative Change | Current liabilities have grown faster than current assets. It means potential issues in meeting financial commitments. |

However, both increases and decreases can have positive and negative impacts, depending on the company and its industry. So, it’s essential to interpret the changes as per the industry standards, company strategy, and overall financial health. At the end of the article, you will find a detailed explanation of what the change can mean in different industries.

Simple Explanation

Let’s say you have a business that makes t-shirts. In your factory, you have invested money in things like fabric, finished t-shirts, and cash in the bank. These are your current assets. On the other hand, you have expenses, like paying your workers and bills for your machinery. These are your current liabilities.

The change in net working capital formula helps you figure out how your current assets and liabilities change over a year. If your assets grow more than what you need, you’ll have extra money, which is a good thing. However, if your expenses increase more than your assets, you may have problems managing your costs.

So, just like your clothing business, the change in net working capital formula helps businesses see if they have enough value to run the business.

How to Calculate Change in Net Working Capital?

Step 1: Calculate Net Working Capital for the current period

Let’s say, in the current period, a company has: Current Assets: $500,00, Current Liabilities: $200,00

NWC (current period) = $500,00 – $200,00 = $300,00

Step 2: Calculate Net Working Capital for the previous period

Let’s say, in the previous period, your company had: Current Assets: $500,00, Current Liabilities: $250,00

NWC (previous period) = $500,00 – $250,00 = $250,00

Step 3: Calculate the Change in Net Working Capital: Net Working Capital (current period) – Net Working Capital (previous period)

Change in NWC = $300,00 – $250,00 = $50,00

Examples (With Excel Template)

Example #1

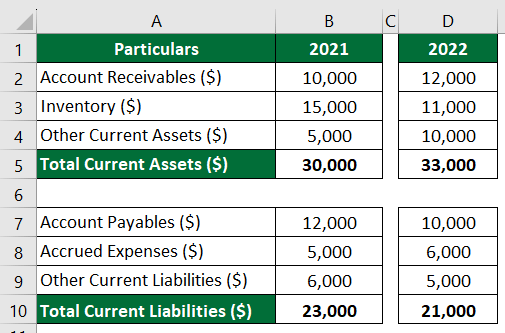

Let’s consider the below data from the balance sheet of Stellar Craft Corporation, which manufactures tiles. We have gathered information on current assets and liabilities for 2021 and 2022. Here, we need to calculate the change in net working capital.

Solution:

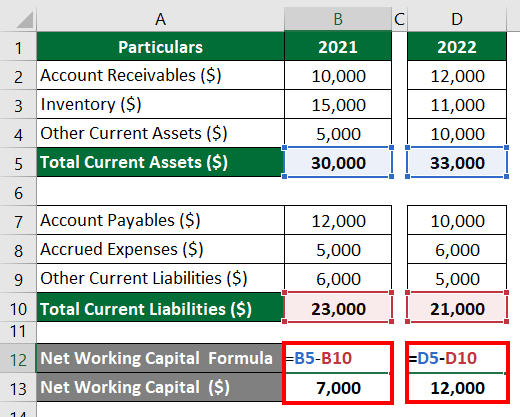

Before calculating the change, we have to determine the net working capital.

The formula to calculate net working capital is as follows,

Net Working Capital = Current Assets – Current Liabilities

For 2021,

Net Working Capital = 30,000 – 23,000

Net Working capital = $ 7,000

For 2022,

Net Working Capital = 33,000 – 21,000

Net Working Capital = $12,000

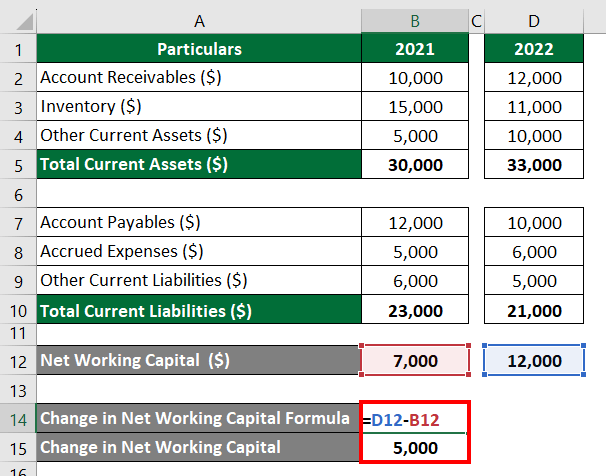

Now, let’s calculate the change in net working capital using the below formula,

Working Capital for Previous Period (2021)

= 12,000 – 7,000 = $5,000

Interpretation of the Result

We can see that the company’s net working capital increased by $5000 during this period. As it is a positive change, it indicates that the company’s current assets have increased more than its current liabilities over the specified period. It means that the company has enough working capital to easily pay its short-term debt and cover any additional financial obligations.

Example #2: Amazon Inc.

Let’s consider the total current assets and liabilities of AMAZON.COM, INC for 2021 and 2022. Here, we will calculate the change in net working capital.

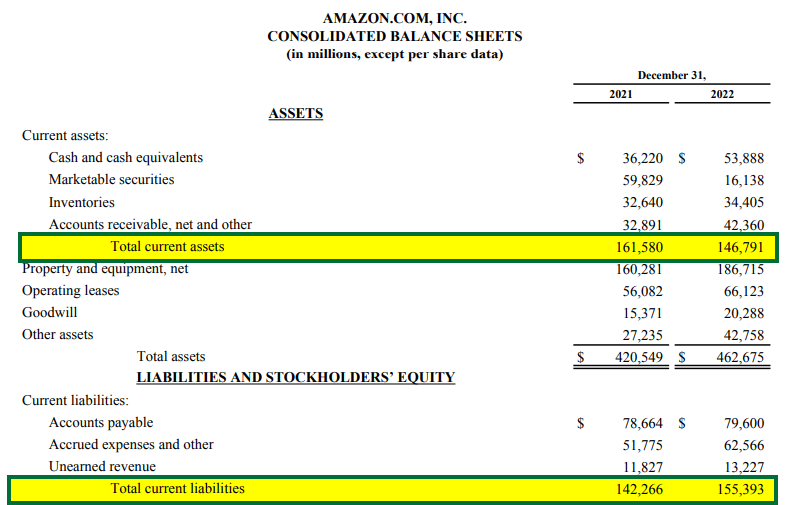

Below is the snapshot of Amazon’s annual report for the years 2021 and 2022:

Solution:

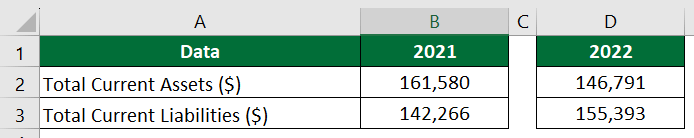

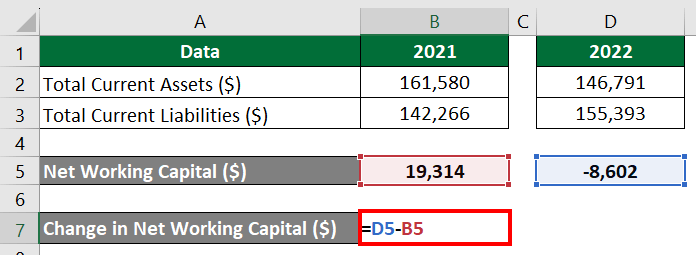

Step 1: Enter the data in Excel, as shown below.

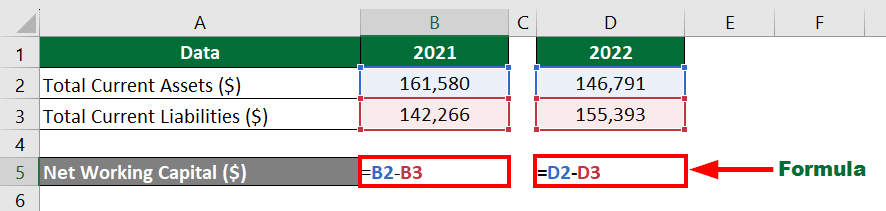

Step 2: To calculate the net working capital, enter the below formula in respective cells.

- Enter “=B2-B3” in “Cell B5”

- Enter “=D2-D3” in “Cell D5”

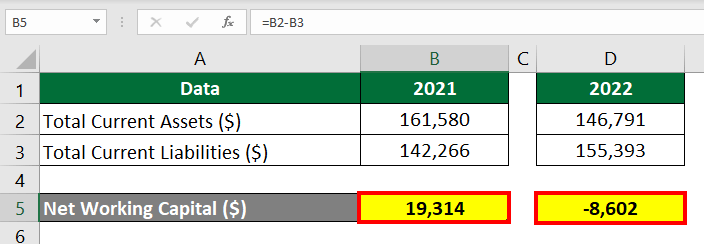

Step 3: Press “Enter”

The net working capital for 2021 is $19,314, and for 2022 is -$8,602.

Now, let’s calculate the change in net working capital,

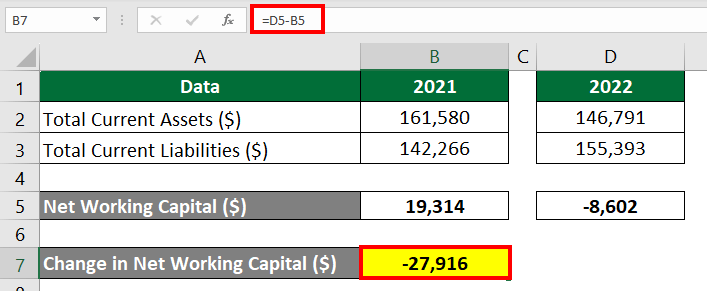

Step 4: Select “Cell B7” and enter the formula,

=D5-B5

Step 5: Press “Enter”.

Interpretation of Result

As we can see, Amazon’s net working capital decreased by $27,916 from 2021 to 2022. It signifies that its current liabilities have increased more than its current assets. However, this doesn’t necessarily mean that Amazon cannot meet its short-term financial obligations.

Generally, companies like Amazon, which have to maintain a large inventory, have negative working capital. It is because they have effective inventory management and can convert it into cash faster, leading to reduced assets.

Change in Net Working Capital in Different Industries

The change in net working capital can vary across different industries due to their unique characteristics and business models. Here’s a simplified explanation for a few industries:

Manufacturing Industry

- An increase in net working capital could be acceptable if it’s in line with planned production, indicating that the company is purchasing raw materials for future production.

- However, excessive increases could mean overstocking and wastage.

- A decrease might be good if it’s due to efficient production and inventory management.

- However, a higher decrease may mean that the firm has inadequate raw materials for future production.

Retail Industry

- An increase might be good as it indicates the company is building up inventory to meet customer demands.

- However, if the increase is too large, it could suggest inefficiencies in managing inventory or difficulty converting it into sales.

- A decrease might indicate efficient inventory turnover and quicker conversion of inventory into sales.

- However, if the decrease is significant, it might mean a shortage of goods available for customers.

Technology Industry

- An increase could be seen as positive if it’s due to growing sales on credit.

- However, the company should manage its accounts receivable well to ensure timely payments; otherwise, it might lead to cash flow issues.

- A decrease might indicate an efficient collection of accounts receivable.

- But a significant decrease might imply that the company isn’t crediting potential customers, limiting sales growth.

Service Industry

- Service-based businesses usually have fewer working capital components. An increase could signal investment in expanding the business or covering short-term expenses.

- However, assessing whether the increase aligns with the business’s growth plans is essential.

- A decrease might indicate efficient expense management or consistent cash inflows from services.

- However, it could also mean that the company is delaying necessary expenditures.

Calculator

You can use the following change in net working capital formula calculator.

| Net Working Capital for Current Period | |

| Net Working Capital for Previous Period | |

| Change in Net Working Capital Formula | |

| Change in Net Working Capital Formula = | Net Working Capital for Current Period – Net Working Capital for Previous Period |

| = | 0 – 0 |

| = | 0 |

Frequently Asked Questions

Q1. What is the difference between a change in net working capital and a change in working capital formula?

Answer: Working capital is a short-term liquidity measurement, while net working capital is a long-term liquidity measurement. While we calculate net working capital using all current assets and liabilities, in the change in working capital formula, we only use the operating assets and liabilities to calculate.

Q2. Why do we use the change in working capital formula?

Answer: The change in working capital formula helps us understand how well a company is doing financially. It lets us check how much money is available for everyday activities and how easily it can handle immediate expenses. This calculation also shows whether the company has enough resources to run its operations smoothly.

Q3. What causes net working capital to increase?

Answer: An increase in current assets or a decrease in current liabilities will cause net working capital to increase. Some key reasons include increased cash equivalent and sales, better inventory management, decreased short-term debt, etc.

Recommended Articles

This article is a complete guide to change in net working capital Formula. Here we discuss how to calculate the change in net working capital along with practical examples. We have also provided a calculator with a downloadable Excel template. You may also look at the following articles to learn more.