Updated August 9, 2023

Who is a Financial Modeling Consultant?

A Financial Modeling Consultant designs, develops, and analyzes financial models to help companies make financial decisions. They can be individual experts and entities such as consulting firms or companies offering financial modeling services.

Their main goal is to create accurate models to help the company decide about investments, budgets, and strategies. They are like financial architects who use numbers to help companies see their financial future more clearly and make better choices.

Roles & Responsibilities

Their major roles and responsibilities are as follows:

- Building Financial Models: Creating accurate financial models to help companies analyze their businesses and make strategic decisions.

- Analyzing Data: Collect and analyze financial data to identify potential trends and opportunities.

- Assessing Deals: Analyze financial data and risks to evaluate potential mergers, acquisitions, or investments.

- Supporting Decisions: Provide financial advice to lead important decisions and strategies for the company’s progress.

- Managing Risks: Identify, monitor, and advise solutions to decrease potential financial risks.

- Budgeting and Planning: Coordinate with groups to create budgets and track financial progress compared to the initial plans.

- Building Relationships: Develop strong connections with clients and cooperate effectively within teams.

- Training and Mentoring: Offer guidance and support by sharing knowledge about financial modeling techniques and skills.

Investment Banks

- IPO financial modeling

- Valuation analysis

- M&A modeling

- Project finance modeling

- Deal analysis

Private Equity and Venture Capital Firms

- Investment evaluation

- Private equity modeling

- LBO modeling

- Due diligence

Startups

- Financial modeling

- Fundraising projections

- Growth strategy planning

Non-Profit Organization

- Developing accurate budgets

- Assessing financial viability

- Risk Assessment

Individuals

- Personalized investment guidance

- Retirement planning

- Debt repayment strategy

- Tax optimization

Career Options & Salary

Financial Modeling Consultant’s salary varies depending on the location, expertise, and position in the firm. If they decide to explore different careers, there are many opportunities across diverse industries and sectors.

Here are several potential career options, along with the description and salary per Payscale and Glassdoor.

| Career Option | Salary Range (Annual) | Description |

| Investment Banking Analyst | $55,000 – $97,000 | They study data and advise on mergers, acquisitions, and investments. |

| Corporate Finance Manager | $128,000 – $322,000 | They analyze a company’s financial performance and help them with strategic planning and decision-making. |

| Portfolio Manager | $59,000 – $154,000 | Managing investment portfolios and strategically guiding financial decisions to achieve specific goals. |

| Equity Research Analyst | $53,000 – $143,000 | They analyze companies and stocks to help investors in smart buying and selling choices. |

| Risk Analyst | $50,000 – $97,000 | They identify potential risks for a company and suggest ways to minimize them. |

| Private Equity Analyst | $53,000 – $97,000 | They assess and manage investments in private companies to help them grow and make profits. |

Qualifications

Educational Background

- A bachelor’s degree in Finance, Economics, Accounting, Business, or Math is generally needed.

- Higher degrees, like a Master’s in Business Administration (MBA) or a Master’s in Finance, is preferred.

Certifications

- Although not necessary, certifications like CFA, Certified Public Accountant (CPA), or Financial Risk Manager (FRM) can make you more trusted and skilled.

5. Industry Knowledge

Knowing about the industry in which the business operates is key. This helps the consultant create financial models that fit that business and industry.

6. Risk Assessment

A good consultant should be able to tell what might go wrong, including possible risks in financial models. They should plan for various scenarios, and the scenario might affect outcomes.

7. Problem-Solving

The consultant should be able to recognize financial difficulties, create innovative solutions, and suggest decisions based on analysis.

8. Software Proficiency

Knowledge of basic and advanced Excel functions, macros, and VBA programming is essential. It’s also good if the consultant knows about other industry-specific software that can help them make models.

List of Financial Modeling Consulting Firms

The Financial Modeling Consulting Firms offer expert analysis and strategic insights to guide businesses in optimizing their financial decisions. The table lists the names of the top five firms in a random order.

| Name | Client Base | Annual Revenue (in Billions – 2022) |

| McKinsey & Company |

|

$12.5 |

| Bain & Company |

|

$6 |

| Deloitte |

|

$60 |

| Boston Consulting Group |

|

$11.7 |

| KPMG |

|

$35 |

Q2. Can you work as a financial modeling consultant as a freelancer/remote job?

Answer: Yes, You have the option to work as a freelance consultant or work remotely. Most companies and people hire freelancers for small projects or longer assignments. If you know what you are doing and have the right skills, you can find clients online, work together remotely, and provide financial modeling consulting services, no matter where you are.

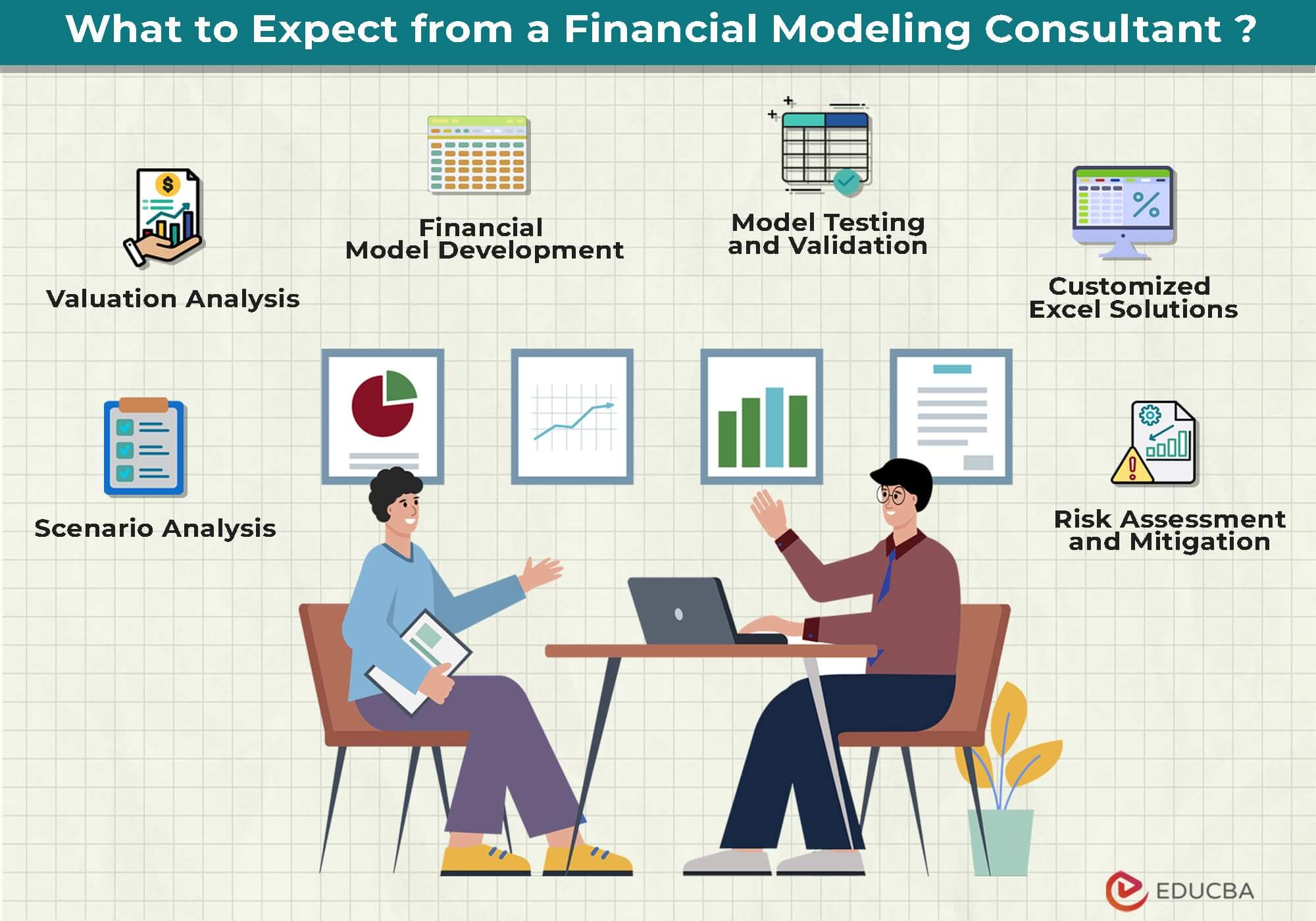

Q3. What are the common financial modeling consulting services?

Answer: Among the most common services are:

- Creating financial models.

- Giving financial guidance and assisting with budgets.

- Performing data analysis to help identify investment opportunities.

- Evaluating mergers and other commercial transactions.

Recommended Articles

This article is a guide to financial modeling consultants. From information about the roles and responsibilities to the salary and other career options, you also learn about the top firms in the industry. You can visit a few similar articles recommended below,