Updated November 23, 2023

Debt Ratio Formula (Table of Contents)

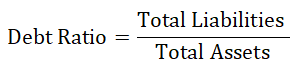

Debt Ratio Formula

The formula for calculating the Debt Ratio is as follows:

Where,

Total liabilities are the total debt and financial obligations payable by the company to organizations or individuals at any defined period. Total liabilities are stated on the balance sheet by the company.

Total Assets are the total amount of assets owned by an entity or an individual. Assets are items of monetary value used over time to produce a benefit for the asset’s holder. If the owners of Assets are a company, these assets are stated in the balance sheet for the accounting records.

Examples of Debt Ratio Formula

Example #1

Let’s assume Company Anand Ltd has stated $15 million of debt and $20 million of assets on its balance sheet; we must calculate the Debt Ratio for Anand Ltd.

We can calculate the Debt Ratio for Anand Ltd by using the Debt Ratio Formula:

- Debt Ratio = Total Liabilities / Total Assets

- Debt Ratio = $15,000,000 / $20,000,000

- Debt Ratio = 0.75 or 75%

This shows that for every $1 of assets that Company Anand Ltd has, they have $0.75 of debt. A ratio below 1.0 indicates that the company has less debt than assets.

Example #2

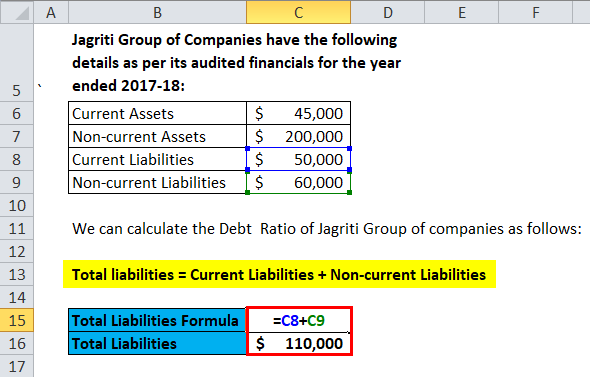

Jagriti Group of Companies has the following details as per its audited financials for the year ended 2017-18:

- Current Assets – $45,000

- Non-current Assets – $200,000

- Current Liabilities – $50,000

- Non-current Liabilities – $60,000

We need to calculate the debt ratio of the Jagriti Group of Companies.

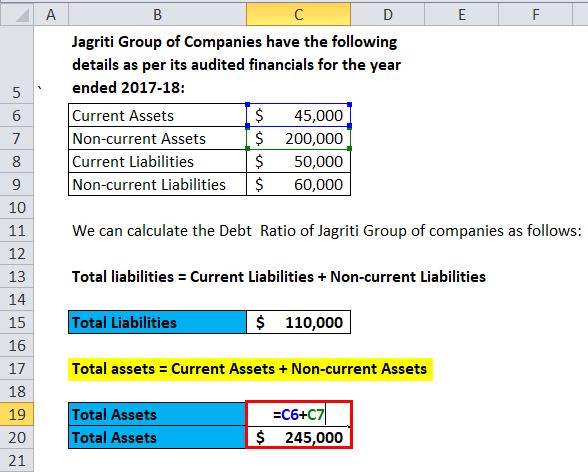

As we can see in the above case, the Total Assets and Total Liability are not provided, then we have to calculate Total Assets and Total Liability by using the below formula:

- Total assets = (Current Assets + Non-current Assets)

- Total assets = ($45,000 + $200,000)

- Total assets = $245,000

- Total liabilities = Current Liabilities + Non-current Liabilities

- Total liabilities = ($50,000 + $60,000)

- Total liabilities = $110,000

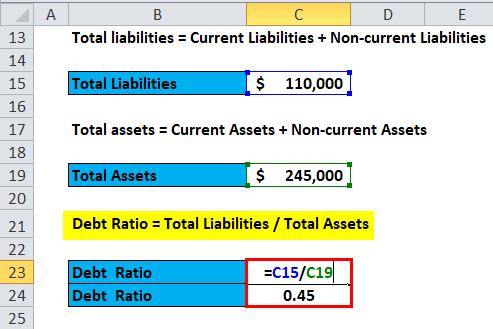

We can calculate the Debt Ratio for Jagriti Groupby using the Debt Ratio Formula:

- Debt Ratio = Total Liabilities / Total Assets

- Debt Ratio = $110,000 / $245,000

- Debt Ratio = 0.45 or 44%

The debt ratio of Jagriti Group of Companies is 0.45.

Example #3

The following figures have been obtained from the balance sheet of the Anand Group of Companies.

- Current Assets – $50,000

- Non-current Assets – $200,000

- Total Liabilities – $90,000

- Shareholder Equity- $160,000

We need to calculate the debt ratio of the Anand Group of Companies.

For calculating the Debt Ratio, we need Total Liability and Total Assets. We need to calculate Total Assets by using the formula.

- Total assets = Current Assets + Non-current Assets

- Total Assets = ($50,000 + $200,000)

- Total Assets = $250,000

We can calculate the Debt Ratio for Anand Group of Companies Group by using the Debt Ratio Formula:

- Debt Ratio = Total Liabilities / Total Assets

- Debt Ratio= $90,000/ $250,000

- Debt Ratio = 0.36 or 36%

The debt ratio of Anand Group of Companies is 0.36.

Explanation

The debt ratio measures the weightage of leverage in a company’s capital structure; it is further used for measuring risk. If the debt ratio is high, it shows the company has a higher burden of repaying the principal and interest, which may impact the company’s cash flow. It can create a glitch in financial performance, or the default situation may arise.

Assets and Liabilities are the two most important terms in any company’s balance sheet. Investors can interpret whether the company has enough assets to pay off its liabilities by looking at these two items. And this is what we call the debt ratio.

The debt ratio can be used as a measure of financial leverage. If a company has a Debt Ratio greater than 0.50, then the company is called a Leveraged Company. This shows the company has more debt funding in its capital structure. If the company has a lower debt ratio, then the company is called a Conservative company.

Significance and Use of Debt Ratio Formula

Company executives or investors mainly use the debt ratio formula:

The company’s top management can use the debt ratio formula to make the company’s top-level decisions related to its capital structure and future funding. Using the Debt ratio, the top management can decide to raise funds. Whether they want to raise funds from external sources like loans or debts or through equity. If the company has enough capital to repay its obligations, it can raise funds from external sources.

Investors who want to invest in a company can use the debt ratio formula. This formula shows whether the firm has enough assets or capital to repay the debts and other obligations as the company pays dividends to shareholders after paying all the debts and obligations of the company.

The debt ratio can be used as a measure of financial leverage. If a company’s Debt Ratio exceeds 0.50, it is classified as a Leveraged Company. This shows the company has more debt funding in its capital structure. People commonly refer to a company with a lower debt ratio as a conservative company.

If a company has a Debt Ratio lower than 0.50 shows the company is stable and has a potential for longevity. A company can raise more funds from outside for the expansion. For every industry, the benchmark Debt ratio may vary, but the 0.50 Debt ratio of a company can be reasonable. This shows that the company has two times the assets of its liabilities. Or we can say the company’s liabilities are 50 % of its total assets.

If a company has a Debt Ratio of 1, its total liabilities are equal to its total assets. Or we can say if a company wants to pay off its liabilities, it would have to sell off all its assets. If the company needs to pay off the liabilities, it must sell off all its assets; in that case, it can no longer operate.

Debt Ratio Calculator

You can use the following Debt Ratio Calculator

| Total Liabilities | |

| Total Assets | |

| Debt Ratio Formula | |

| Debt Ratio Formula | = |

|

|

Debt Ratio Formula in Excel (With Excel Template)

Here, we will do the same example of the Debt Ratio formula in Excel. It is straightforward. You need to provide the two inputs, i.e., Total Liabilities and Total Assets.

You can easily calculate the Debt Ratio Using the Formula in the template provided.

First, we need to calculate the Total Liabilities

Then, we need to calculate the Total Assets

Now, we can calculate the Debt Ratio Using Formula

Recommended Articles

This has been a guide to a Debt Ratio formula. Here, we discuss its uses along with practical examples. We also provide a Debt Ratio Calculator with a downloadable Excel template. You may also look at the following articles to learn more –