Updated November 24, 2023

Difference Between Liability vs Expense

Both liability vs expense result in the cash outflow of funds and are known to be of a similar nature. But we often forget that some differences are very important to understand and interpret between liabilities vs expenses. Every business that is currently running and operational has liabilities and assets. Also, it has income expenses, which are a part of the Income statement, and liabilities and assets are part of a balance sheet. Liabilities and expenses are cash outflow in the business. An expense is always a liability to incur, and when it gets incurred, it is shown as a cash outflow from the cash flow and gets accrued in the income statement. The expense is a subset of liability in simple terms. Expense, until not paid off, is a liability in nature.

Liability is an obligation of the business to pay during the course of time. Liability can be current or non-current in nature. Current liabilities must be paid in one year or less, while non-current liabilities can extend more than one year. Generally, in the book of accounts, items like debt from financial institutions or borrowings extending more than a year come under non-current liabilities. Liabilities are taken into the balance sheet of the company to create or expand, for example, financial debt to introduce a new product segment in the market or to make inorganic growth in the industry. The benefits of any liability can be shown only over the years and are not immediate.

On the other hand, expenses are all current and are incurred during a particular year. Expenses refer to day to day expenditures of the business and all the major expenses that fill the firm’s income statement. Expenses are generally recurring in nature. For example, staff cost, Rent, electricity, etc. expenses are the cost to run the company that must be paid. Expenses affect the operational capacity of the firm and it becomes necessary for any business to pay their expenses on time to maintain their creditworthiness in the market and keep the business cycle churning.

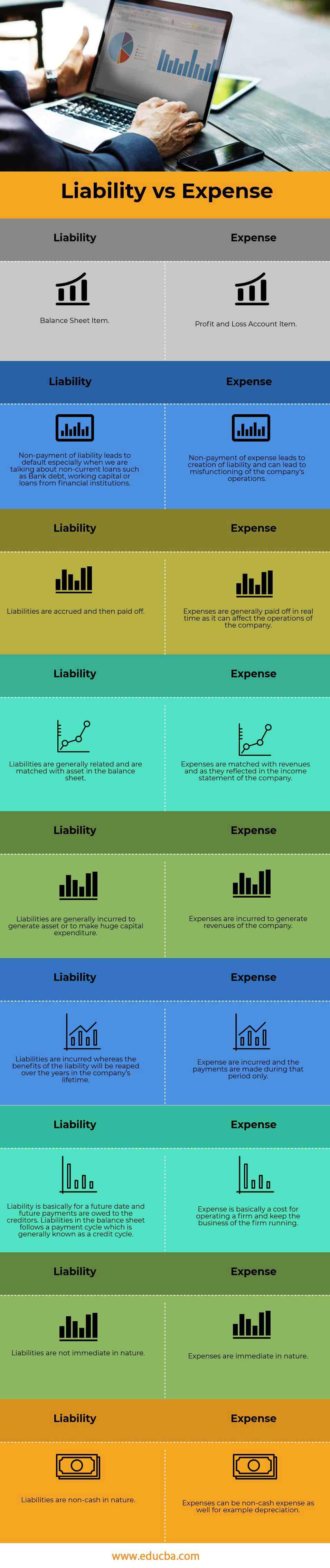

Head To Head Comparison Between Liability vs Expense (Infographics)

Below is the top 9 difference between Liability vs Expense

Key Differences Between Liability vs Expense

Both Liabilities vs Expenses are popular choices in the market; let us discuss some of the major Difference Between Liability vs Expense

- Expense is recurring in nature, whereas liability may or may not be recurring in nature

- Liability may or may not be current in nature. There are non-current liabilities as well, whereas expenses are mainly current in nature and need to be paid during a year or quarters

- Liabilities are shown in the Balance sheet of the company, whereas expenses are shown in the income statement of the company

- Liabilities of a company are shown as on date as a balance sheet of any company is prepared as on date, whereas expenses are reflected during a particular period of time

- Liabilities are generally reduced, whereas expenses are paid-off. For example, paying interest on the debt is an expense that is paid off but paying back the debt is not an expense. It signifies a reduction of liabilities

- Expenses can be categorized as operational, capital, or financial. Liabilities can also be categorized under similar heads but in the balance sheet, they are shown as current, non-current, secured, unsecured, contingent, or current.

Liability vs Expense Comparison Table

Below is the 9 topmost comparison between Liability vs Expense

|

Liability |

Expense |

| Balance Sheet Item | Profit and Loss Account Item |

| Non-payment of liability leads to default, especially when we are talking about non-current loans such as Bank debt, working capital, or loans from financial institutions | Non-payment of expenses leads to the creation of liability and can lead to the misfunctioning of the company’s operations |

| Liabilities are accrued and then paid off | Expenses are generally paid off in real time as it can affect the operations of the company |

| Liabilities are generally related and are matched with an asset in the balance sheet | Expenses are matched with revenues and as they reflected in the income statement of the company |

| Liabilities are generally incurred to generate an asset or to make a huge capital expenditure | The company incurs expenses to generate revenues. |

| Liabilities are incurred, whereas the benefits of the liability will be reaped over the years in the company’s lifetime | During the period, the company incurs an expense and makes the payments. |

| Liability is for a future date, and future payments are owed to the creditors. Liabilities in the balance sheet follow a payment cycle which is generally known as a credit cycle | An expense is a cost for operating a firm and keeping the business of the firm running |

| Liabilities are not immediate in nature | Expenses are immediate in nature |

| Liabilities are non-cash in nature | Expenses can be a non-cash expenses as well, for example, depreciation |

Conclusion

Both Liabilities vs Expenses are vital to any business that wants to become an industry leader or manage its operations successfully. Both Liabilities vs Expense needs to be checked by the business periodically. A business should draft a clear plan and strategy for the future and how much they are projected to make CAPEX expenditures and incur expenses. Good business and company should thoroughly analyze how much liability the business can take on its balance sheet as there is no clear distinction between liabilities and expenses as they are often used interchangeably and are of a similar nature. But a good accountant should consider the thin line between Liability vs Expense.

However, both should be seen in the light of Profitability and Assets.

Recommended Articles

This has been a guide to the top difference between Liability vs Expense. Here we also discuss the Liability vs Expense key differences with infographics, and comparison table. You may also have a look at the following articles to learn more.