Inventory Turnover Ratio

Inventory is one of the major factors for tracking a manufacturing company. Movement in inventory clearly shows a company’s ability to turn raw material into a finished product.

Inventory turnover ratio or days in inventory are used to track this movement. This article provides insights into the operating inventory turnover ratio formula.

Inventory Turnover Ratio Formula

The Inventory Turnover Ratio Formula helps you find a balance that is right for your business and will lead to making a profit in business.

The inventory turnover ratio and an efficient ratio formula are important. It shows how fast a company can replace a current period batch of inventories and transform it into sales to find a balance that is right for your business.

The inventory turnover ratio is a ratio that shows how many times a company has replaced and sold inventory during a period, say one year, five years, or ten years.

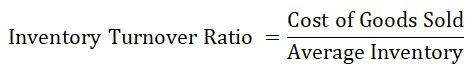

The inventory turnover ratio is a simple ratio that helps to show how effectively inventory can be managed by comparing average inventory and the cost of goods sold for a particular period. This enables you to measure how often the average inventory ratio is sold or turned in during a particular period.

Simply, it shows how often a company can sell the total average inventory amount during one year. A company with $2,000 of average inventory and sales of $40,000 effectively sold its 20 times over.

The company can divide the number of days in the period by the inventory turnover formula to calculate the days it takes to sell the inventory on hand. It can be calculated as sales divided by average inventory. For one year, the following formula can be used.

Examples

Luxurious Company sells industrial furniture for office buildings. Infrastructure During the current year, Luxurious Company reported the cost of goods sold on its income statement of $1,000,000. Luxurious’s beginning inventory was $3,000,000, and its ending inventory was $4,000,000.

Luxurious’s turnover can be calculated like the following:

First, we calculate Average Inventories,

- Average Inventories = Beginning Inventories + Ending Inventories) / 2

- Average Inventories = ($3,000,000 + $4,000,000)/2

- Average Inventories = $3500000

Then, we calculate the Inventory Turnover Ratio using the Formula.

- Inventory Turnover Ratio = Cost of Goods Sold/ Average Inventory

- Inventory Turnover Ratio = $1,000,000 / $3500000

- Inventory Turnover Ratio = 0.29

As you can see, Luxurious Furniture Company’s turnover is .29. This means that it only sold roughly a third of its inventory during the current year. It also states that it would take Luxurious Furniture Company approximately 3 years to sell its entire inventory or complete one turn. Simply put, Luxurious Furniture Company does not have very good inventory control, so it has to improve its inventory control.

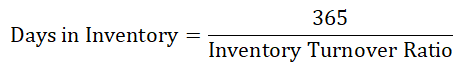

The same can be observed from the below formula:

- Days in Inventory = 365 / Inventory Turnover Ratio

- Days in Inventory = 365 / 0.29

- Days in Inventory = 1278 days

Another Example of Inventory Turnover Ratio Formula:

Calculation of inventory turnover and days inventories outstanding for XYZ, Inc. based on the information provided below:

| Opening inventories | $15,000 |

| Closing inventories | $30,000 |

| Cost of goods manufactured | $250,000 |

The cost of goods sold can be calculated below:

- Cost of goods sold = Beginning Inventories + Cost of Goods Manufactured in a company – Ending Inventories

- Cost of goods sold = $15,000 + $250,000 – $30,000

- Cost of goods sold = $235,000

First, we calculate Average Inventories,

- Average Inventories = Beginning Inventories + Ending Inventories) / 2

- Average inventories = ($15,000 + $30,000) ÷ 2

- Average inventories = $22,500

Then, we calculate the Inventory Turnover Ratio using the Formula.

- Inventory Turnover Ratio = Cost of Goods Sold/ Average Inventory

- Inventory turnover ratio = $235,000 ÷ $22,500

- Inventory turnover ratio = 10.44

After Inventory Turnover Ratio, we calculate Days in Inventory.

- Days in Inventory = 365 / Inventory Turnover Ratio

- Days inventories outstanding = 365 ÷ 10.44

- Days inventories outstanding = 34.96

Explanation of Inventory Turnover Ratio Formula

You can calculate the inventory turnover ratio by dividing the cost of goods sold for a particular period by the average inventory for the same period of time.

It is always a good method to use average inventory instead of taking only ending inventory because many companies’ inventory fluctuates greatly throughout the year. For instance, a company might purchase many inventory quantities on January 1 and sell them for the rest of the year. By December, the company had sold almost the entire inventory, and the ending balance failed to reflect the actual inventory during that year accurately. One can calculate the average inventory by adding the company’s beginning and ending inventories and dividing them by two. A company’s profit & loss statement reports the cost of goods sold.

Significance and Use

The Inventory Turnover Ratio plays a very important role because total turnover depends on two main performance components: stock purchasing and sales. The first main component is stock purchasing. If a large amount of inventory is purchased during the year, the company will have to sell more inventory to improve its turnover. If the company fails to sell these greater amounts of inventory, it will incur storage and other holding costs.

The second component is sales. Sales must be matched with inventory purchases; otherwise, the inventory will not turn effectively, making Inventory void. That’s why the sales and Purchasing departments must be in touch with each other. So, knowing the importance of Stock Purchasing and sales is relevant.

Inventory Turnover Ratio is the ratio of Cost of Goods Sold / Average Inventory during the same time period. The higher the Inventory Turnover Ratio, the more likely a business carries too much inventory. Overstocking means that cash is tied up in inventory assets for a prolonged period.

Use of Inventory Turnover Ratio Formula

The Inventory Turnover Ratio can be used in an inventory-based business company; managing your inventory efficiently results in your business’s profit and success. Too much and too little stock can drag down your bottom line. Then you may be wondering what a solution to this is.

Firstly, You need to decide your company’s inventory turnover ratio. This ratio helps you find the effective spots between having so much product it becomes Antediluvian and having enough so it does not hinder sales. It will help your inventory flow smoothly and effectively through your supply chain, keeping your customers happy and increasing your margins and forecasting.

Inventory Turnover Ratio Calculator

You can use the following Inventory Turnover Ratio Calculator

| Cost of Goods Sold | |

| Average Inventory | |

| Inventory Turnover Ratio Formula= | |

| Inventory Turnover Ratio Formula= | = |

|

|

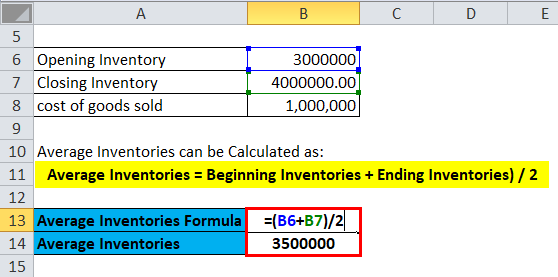

Inventory Turnover Ratio Formula in Excel (with Excel Template)

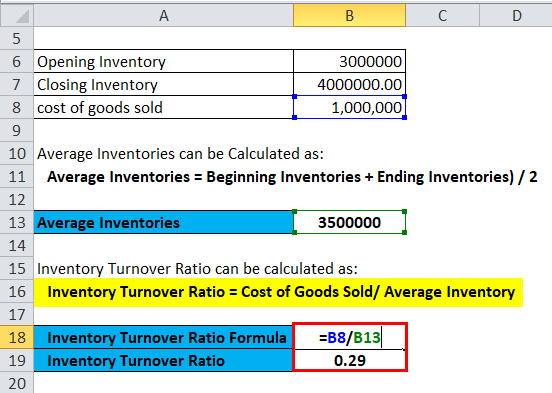

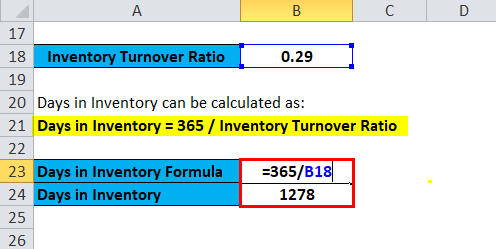

Here, we will do the same example of the Inventory Turnover Ratio formula in Excel. It is very easy and simple. You need to provide the two inputs, i.e., Average Inventories and Cost of goods sold

You can easily calculate the Inventory Turnover Ratio using the Formula in the template provided.

In the first example,

First, we calculate Average Inventories,

Then, we calculate the Inventory Turnover Ratio using the Formula.

After Inventory Turnover Ratio, we calculate Days in Inventory.

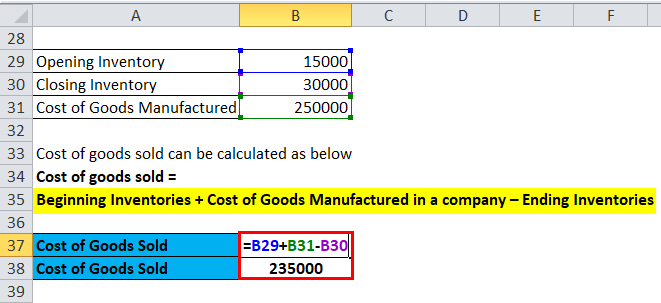

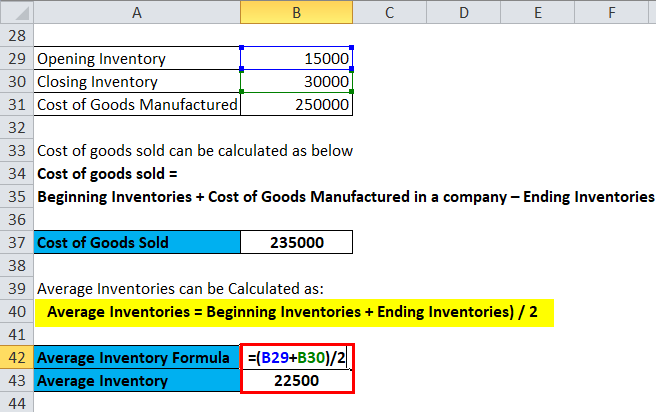

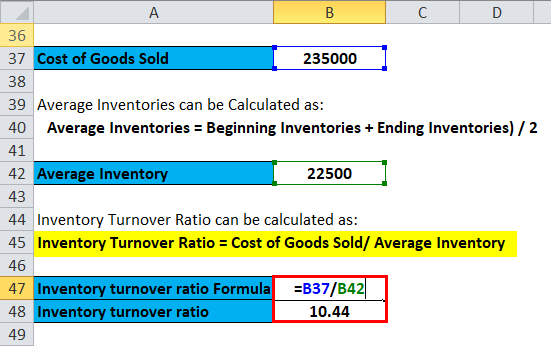

In the second example,

You can calculate the cost of goods sold using the following formula.

First, we calculate Average Inventories.

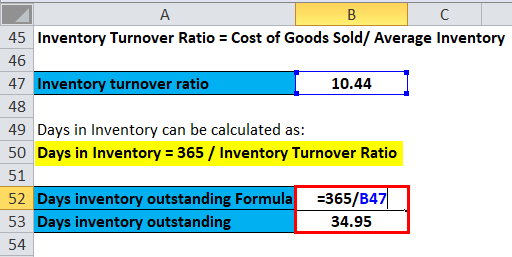

Then, we calculate the Inventory Turnover Ratio using the Formula:

After Inventory Turnover Ratio, we calculate the Days in Inventory.

Recommended Articles

This is a guide to the Inventory Turnover Ratio formula. Here, we discuss its uses along with practical examples. We also provide the Inventory Turnover Ratio Calculator with a downloadable Excel template. You may also look at the following articles to learn more –