Updated October 23, 2023

Introduction to the Commodities Stock Market

Yes, the obvious answer is either a supermarket or a grocery store.

But If I tell you that there exists a stock market of these commodities where the commodities are traded like shares, will you believe my sentence? You may wonder about this, but you don’t have any other option than to believe my sentence, as this is an absolute truth. The market where these commodities are traded is called the Commodities Stock Market by people.

Let’s understand more about this market.

Meaning of Commodities Stock Market

You must have a little grip on the meaning of the commodities stock market. Yes, it is a physical or a virtual place where buying, selling, and trading raw or primary products occurs. The commodities stock market is similar to the equity market but involves trading commodities instead of buying or selling shares. For investors’ purposes, about 50 major commodity markets worldwide facilitate investment trade in nearly 100 primary commodities.

Now, you may think how old these commodities market trends are?… Records trace rice futures trading in Japan back to the 17th century.

So, throughout this article, you read the words commodities, commodities, and commodities. You must be wondering what exactly comes in the category of commodities.

These commodities can be majorly classified into the following:

- Precious Metals: Gold, Silver, Platinum, etc.

- Other Metals: Nickel, Aluminum, Copper, etc.

- Agro-Based Commodities: Wheat, Corn, Cotton, Oils, Oilseeds, etc.

- Soft Commodities: Coffee, Cocoa, Sugar, etc.

- Live-Stock: Live Cattle, Pork Bellies, etc.

- Energy: Crude Oil, Natural Gas, Gasoline, etc.

Let’s look at the different segments of the commodities stock market.

There are two major segments of the commodities stock market. They are the over-the-counter (OTC) market and Exchange-traded market. Les understands each one of them now.

Characteristics of the Over-the-counter (OTC) Market

The Over Counter market, called the OTC market, operates without a formal trading structure. Parties trade based on bilateral understanding.

The market is also called a Customized Market because it lacks a formal structure. In terms of commodity trading, OTC represents the spot trading of commodities. The trades in these markets are delivery-based, and as it is unregulated, there can be a counter-party risk in terms of disclosure of information between the parties.

Characteristics of Exchange-Traded Market

People also refer to this market as the derivatives market. In this marketplace, commodities are traded over the exchange. It is a standardized and regulated market. Thus, exchange acts as an intermediary to all commodity transactions and takes the initial margin from both sides of the trade as a guarantee.

Recommended Courses

- Online Corporate Finance Training

- Complete Equity Valuation Training

- Derivatives Market Online Course

- IFRS Course

Why is there a Need for the Exchange-traded Commodity Derivatives Market?

- With an Exchange-based platform, the reach becomes wider, which, of course, leads to greater participation.

- Also, small participants like wholesalers do not have to depend solely on the local demand and supply chain. They can access many participants associated with the demand and supply function through the exchange.

- Another advantage is to the other participants, like speculators and arbitragers, who can study the price patterns through various commodity market analysis software like technical analysis and deal in the most efficient price.

Determinant Factors of Commodity Prices

This market is highly volatile, and different factors affect commodity prices. Some of these factors are discussed below:

- Demand and Supply: It’s well-known that when demand for a commodity is higher than the supply, its price increases, and vice versa. There always exists some kind of imbalance between the two regarding commodities, which results in constantly fluctuating prices.

- Weather Conditions: As we know, most commodities traded in the world markets are agricultural goods, and the production of these goods depends on the weather conditions. Suppose sudden changes in climatic conditions happen, like inadequate rainfall or droughts. In that case, it might affect the availability of agricultural goods in the world market, causing scarcity and pushing commodities market trends upwards.

- Economic and Political Conditions: The economic and political conditions of the countries producing and consuming them also influence the prices of commodities as another major factor.

Government policies also influence the commodities market prices. E.g., If the Indian government increases oil import duty, the price will increase proportionately.

Other factors like inflation, seasonal variations, currency movements, etc., are majorly responsible for price fluctuations in the commodities market trends.

Participants in the Commodities Market Trends

They divide these market participants into hedgers, speculators, and arbitrageurs.

1. Hedgers

Hedging, in simple language, means the reduction of risk. Consequently, any investor looking to reduce his risk is known as Hedger. In the market, hedgers take positions opposite to the risks they are exposed to. For example, a Corn farmer will sell corn futures to hedge against the risk of falling corn prices.

2. Speculators

These are the investors who speculate on the direction of the futures prices to make a profit. They hypothesize expected price movements and take positions accordingly. Thus, trading in a commodity futures market is an investment option.

3. Arbitrageurs

They are the traders who attempt to profit from pricing inefficiencies in the commodities stock market. Arbitrage, in a way, involves the sale and purchase of the same commodities in different markets simultaneously. Usually, such transactions are risk-free.

Wondering how the commodities stock market works?

Major Commodity Exchanges

Let’s now look at the world’s major commodity exchanges:

1. Chicago Board of Trading, Known as CBOT

They established this as the first commodities stock market exchange in the world in the year 1848. It is one of the leading exchanges in the world for trading in the future and options. In the beginning, CBOT dealt with agricultural commodities. Futures contracts in CBOT evolved over a while to facilitate the trading of non-storable farm commodities and nonagricultural products like Gold and Silver.

2. New York Mercantile Exchange, known as NYMEX

It is the world’s biggest exchange for trading in physical commodity futures. It is a primary trading forum for energy products and precious metals. The commodities stock market exchange has been in existence for 132 years. It performs trades through two divisions – The NYMEX division, which deals in energy and Platinum, and the COMEX division, which deals in all other metals.

3. People Know the London Metal Exchange as LME

The primary focus of LME is to provide a market for participants from the non-ferrous base metals and related industries to safeguard against risk due to movement in base metal prices and also arrive at a price that sets the benchmark globally. The exchange trades 24 hours a day. Future contracts run daily for three months, unlike other commodities market trends primarily based on monthly prompt dates.

What is the History of Commodities Stock Markets in India?

India is an agricultural country with a long history of commodities stock market trading. India had a thriving futures market for commodities like gold, silver, cotton, edible oils, etc., since the years when foreign countries ruled it. Due to natural calamities like droughts, scarcity, and government policies, futures trading in most commodities was banned in the mid-1960s. However, they restarted commodities stock market trading in recent years. Sometimes, people localize futures markets for specific commodities. For example, Kerala, the spice city, has an exchange for Pepper, Mumbai, the economic capital, is a center for gold, and so on.

In general, India has six national commodity exchanges, namely:

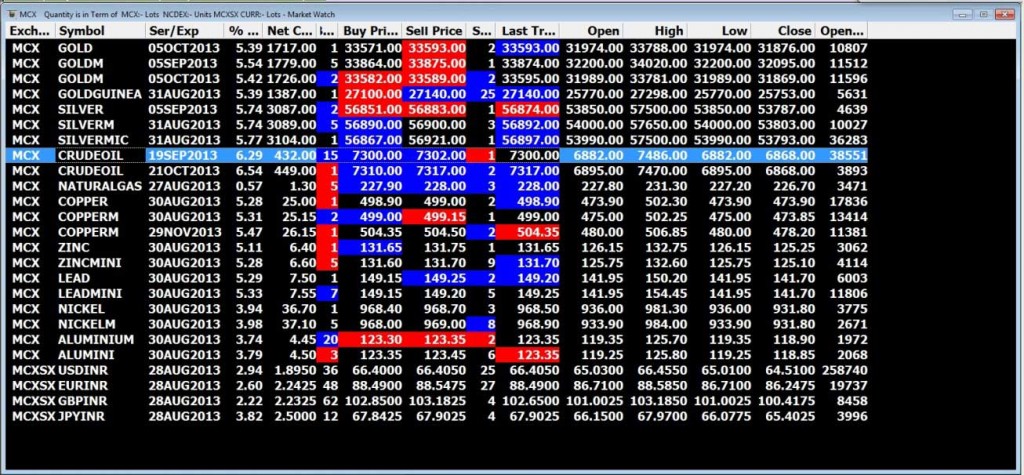

- Multi Commodity Exchange (MCX), located in Mumbai

- National Commodity and Derivatives Exchange (NCDEX), located in Mumbai

- National Multi-Commodity Exchange (NMCE) is located in Ahmedabad.

- Indian Commodity Exchange (ICEX), located in Mumbai

- The ACE Derivatives Exchange ( ACE ) is located in Mumbai

- The Universal Commodity Exchange (UCX) is located in Navi Mumbai.

Recent Developments in the Commodities Stock Market

The way shares are traded in the stock market, the Indian government has also allowed national stock exchanges like the Multi Commodity Exchange (MCX) to come forward and deal with the commodity derivatives in an electronic format.

These exchanges carry out trading on an order-driven and screen-based trading system. These exchanges are regulated by the Forward Markets Commission (FMC).

Commodities Stock Market, Infographic

Learn the juice of this article in just a single minute: Commodities Stock Market.

Recommended Articles

This has been a guide on the commodities stock market. Here, we have discussed the Basic Concept and the characteristics of the commodities stock market. You may also look at the following articles to learn more –