Updated July 26, 2023

Definition of Cash Ratio

“Cash Ratio” is the liquidity ratio that assesses whether a company can pay off its current liabilities with only cash and cash equivalents. Compared to the current and quick ratios, the cash ratio is a more conservative liquidity ratio since it limits the ability to repay short-term liabilities using only cash or near-cash resources.

The existing or prospective creditors find this information useful as they can assess how much money they can loan the company.

Typically it is expressed in numbers that are either greater than, equal to, or less than 1. If the ratio is greater than 1, then it indicates that the company has more than enough cash and cash equivalent to pay off the current liabilities if required to be paid immediately. However, very few companies end up in such a situation as maintaining such high liquid reserves is practically not advisable. On the other hand, if the ratio is equal to 1, it indicates that the company has just enough cash and cash equivalents to pay off the current liabilities. If a company has a cash ratio of less than 1, it means it has more current liabilities than what it can pay off with its cash and cash equivalents.

Formula

To calculate the Cash Ratio, divide the sum of cash and other cash equivalents by the total current liabilities. The mathematical representation is as follows:

Examples of Cash Ratio (With Excel Template)

Let’s take an example to understand the calculation of the Cash Ratio formula in a better manner.

Example – #1

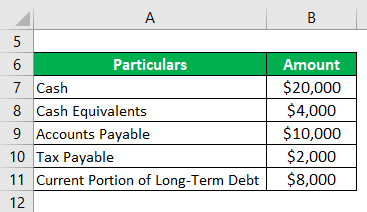

Let us take the example of Dixie’s Palace, which is a restaurant, and currently, it is planning to remodel its dining room. The restaurant’s owner has applied for a bank loan worth $200,000 to fund the remodeling. The following information is available from its balance sheet:

Solution:

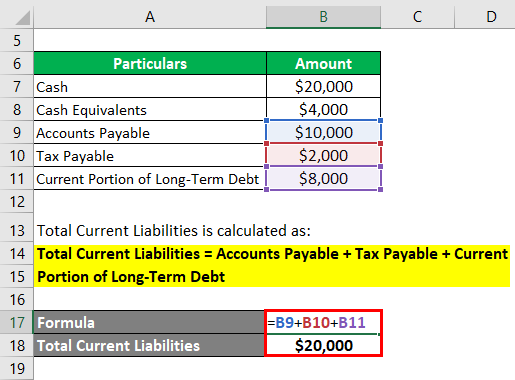

Total Current Liabilities is calculated as:

Total Current Liabilities = Accounts Payable + Tax Payable + Current Portion of Long-Term Debt

- Total Current Liabilities = $10,000 + $2,000 + $8,000

- Total Current Liabilities = $20,000

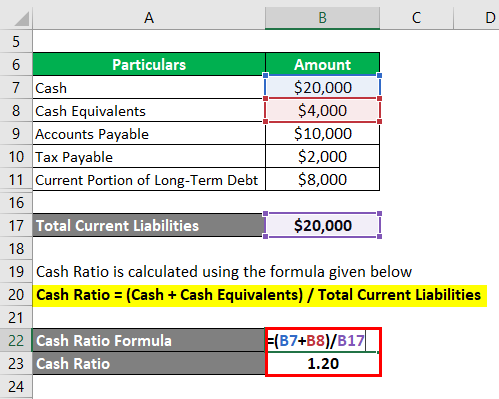

It is calculated by using the formula given below

Cash Ratio = (Cash + Cash Equivalents) / Total Current Liabilities

- CR= ($20,000 + $4,000) / $20,000

- CR= 1.20

Therefore, the cash ratio for Dixie’s Palace stood at 1.20, which is a fairly high cash reserve and seems comfortable for the bank.

Example – #2

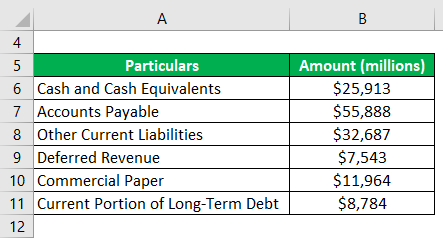

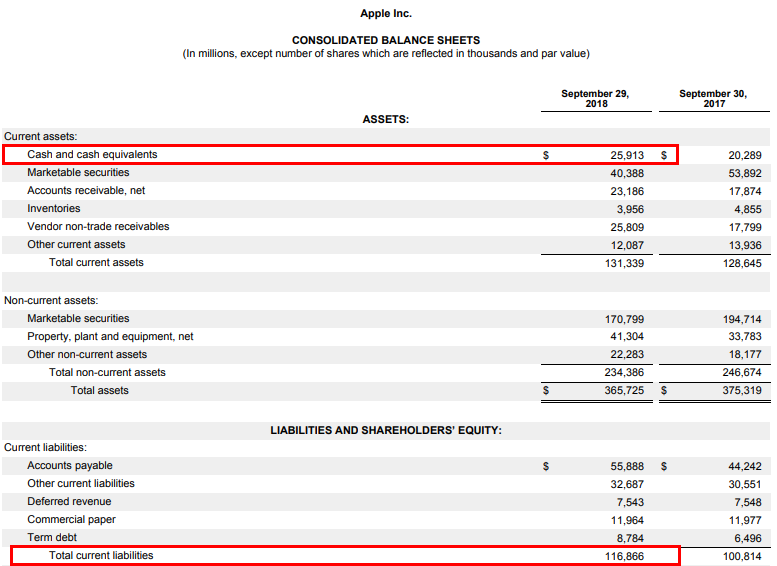

Let us take the example of Apple Inc. to understand the concept of cash ratio in real life. As per the annual report for the year ended on Sep 29, 2018, the following information is available:

Solution:

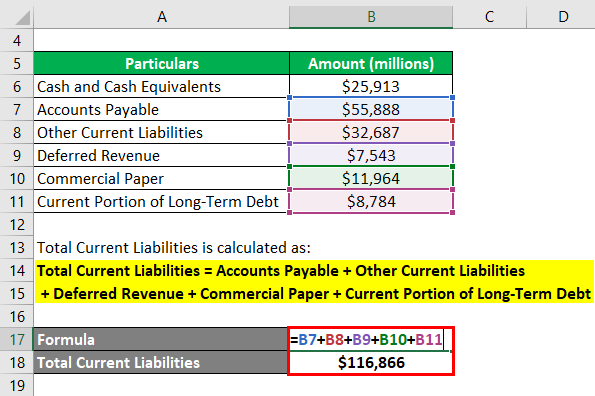

Total Current Liabilities is calculated as:

Total Current Liabilities = Accounts Payable + Other Current Liabilities + Deferred Revenue + Commercial Paper + Current Portion of Long-Term Debt

- Total Current Liabilities = $55,888 + $32,687 + $7,543 + $11,964 + $8,784

- Total Current Liabilities = $116,866 million

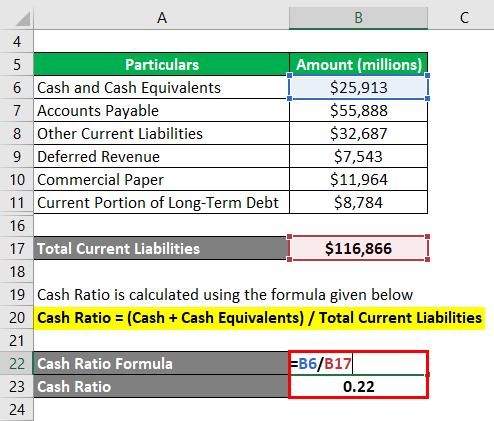

It is calculated by using the formula given below

Cash Ratio = (Cash + Cash Equivalents) / Total Current Liabilities

- CR= $25,913 / $116,866

- CR = 0.22

Therefore, the cash ratio for Apple Inc. stood at 0.22 as of Sep 29, 2018.

Source: d18rn0p25nwr6d.cloudfront.net

Advantages and Disadvantages

Let’s look at the Advantages and Disadvantages of Cash Ratio below:

Advantages

- It helps in the assessment of the cash richness of a company. It helps determine a company’s financial strength in the near term based on its most liquid assets, i.e. cash. As such, it is clear that the higher the ratio, the more stable the company is.

- It also helps in understanding the growth strategy or prospects of a company. A higher value of the ratio indicates that the company holds significant growth potential through mergers and acquisitions. On the other hand, a lower value indicates limited growth potential.

- Investors and analysts consider the cash ratio a more conservative and stricter liquidity ratio than the current and quick ratios. This is because the cash ratio measures liquidity based on assets that can be easily converted into cash, specifically cash and cash equivalents.

Disadvantages

- There is great ambiguity regarding the instruments that can be considered cash equivalents. Such confusion can end up giving misleading results.

- It does not consider the crisis’s impact on otherwise easily saleable securities. Although it only considers the most liquid form of assets, even the cash equivalents are difficult to trade during the crisis.

- Since it is not practically advisable for a company to maintain such high levels of cash and cash equivalent assets to cover current liabilities, the cash ratio is seldom used in any kind of financial analysis.

Conclusion

So, it can be seen that it is a liquidity measure that helps the creditors assess the company’s liquidity position. However, most investors would prefer less cash on the balance sheet and want them to invest in business activities to generate higher returns.

Recommended Articles

This has been a guide to the Cash Ratio formula. We discuss the introduction, examples, advantages, disadvantages, and a downloadable Excel template. You can also go through our other suggested articles to learn more –