Updated July 26, 2023

Difference Between Period Cost vs Product Cost

Period cost vs Product cost is nothing but the expenses in the company, and any management of a company wants a separate measurement cost because any business cost is a major concern. The cost of any product is classified into Period cost and Product cost based on its relation with the products.

Classification of cost into periods and products is generally for financial accounting purposes. Both terms are important in the development of an income statement. A proper determination of revenues and expenses must be based on a well-defined distinction between Period cost and Product cost.

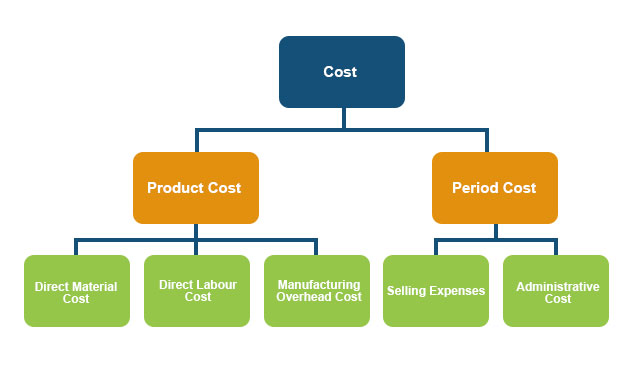

Diagrammatic Representation of Cost

Period Cost

Period cost is the expense incurred; the period cost is all costs, not product costs. The cost incurred on the headquarters parts of the operation, such as all of the selling expenses and general and administrative costs, will be categorized as a period cost.

Period cost is not in manufacturing or transporting the assets to their final destination. That’s why the period cost is also a non-manufacturing cost. Period costs are on the income statement as expenses in the period they were incurred.

Period costs are often known as operating expenses or selling, general and administrative expenses. This cost is time-oriented and is more associated with time passage than transactional events. Period cost is important for generating revenues, but it does not directly link with units of products.

Product Cost

All expenses incurred in the factory or manufacturing unit for producing the assets are product or manufacturing costs.

There are three major categories of product costs which are as follows:

- Direct Material cost.

- Direct Labour cost.

- Manufacturing Overhead Cost.

Product costs are one of the most important costs managers need to know. Knowing the cost of a product is necessary to ensure its price is correct, or the company should increase or decrease production or even discontinue the product altogether.

Most companies use two different definitions of total product cost and Inventoriable product cost. The company uses the total cost for internal decision-making. It includes all the costs of the value chain.

Company management needs to know the total costs to price goods high enough to cover these costs and still make a normal profit. Inventoriable product costs, sometimes just product costs, are only incurred during the value chain’s production stage. Inventoriable product costs are required for the cost of the assets, that is inventory, rather than total product costs.

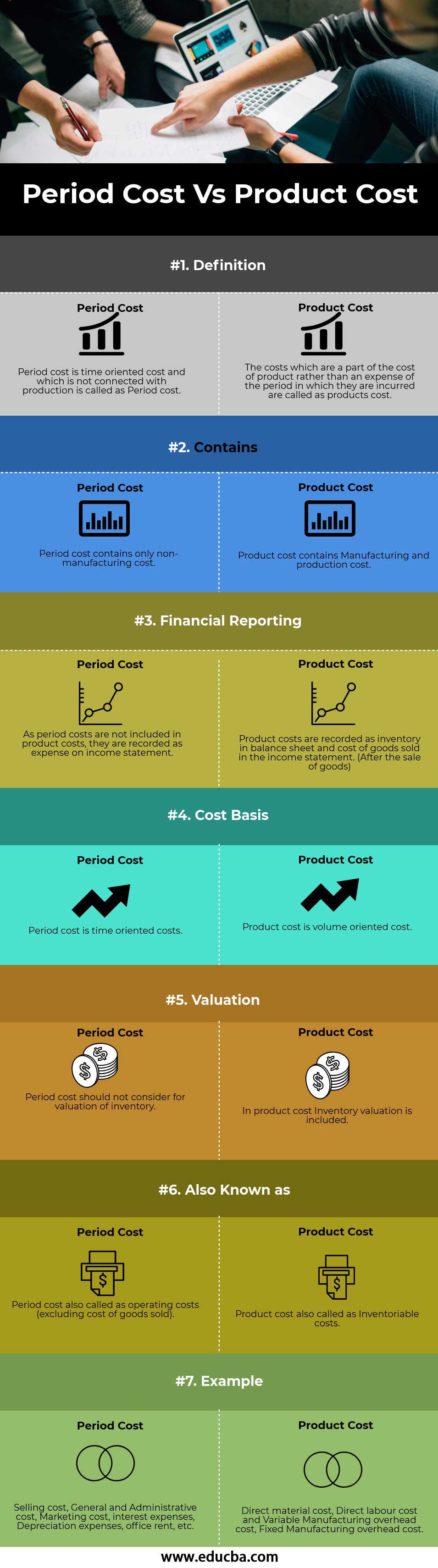

Head-to-Head Comparison Between Period Cost vs Product Cost (Infographics)

Below are the top 7 differences between Period Cost and Product Cost:

Key Differences Between Period Cost vs Product Cost

Let us discuss some of the major differences between Period Cost and Product Cost:

- Product cost is that cost that is directly or indirectly traceable with the product. Direct costs include direct material and labor costs, and indirect costs include manufacturing overhead. Period cost is a cost that is not traceable with the product is a period cost. It means that period cost has nothing to do with the product.

- Simply put, we can say that product cost is the cost of inventory valuation. However, the period cost should not be for inventory valuation.

- If cost is due to resources related to manufacturing and production, then it is considered product cost. Many countries’ product costs are also inventoriable costs. If the cost is not part of the manufacturing process, it is a period cost.

- Product cost is evaluated based on the volume because, throughout the production, the product unit price will be the same only volume of it will change. However, the Period cost is based on time. Expenditures are identified more with a time period than with finished product costs.

- For financial reporting purposes, the product cost becomes a component of the cost of goods manufacturing and the cost of goods sold and is in the balance sheet. However, the period cost expenses to the income statement for financial reporting purposes.

Period Cost vs Product Cost Comparison of Table

Let us discuss the topmost differences between Period Cost vs Product Cost:

| Difference | Period Cost | Product cost |

| Definition | Period cost is a time-oriented cost and is not connected with production is called Period cost. | The costs which are a part of the cost of the product rather than the expense of the period in which they are incurred are called product costs. |

| Contains | Period cost contains only non-manufacturing costs. | Product cost contains Manufacturing and production cost. |

| Financial Reporting | As period costs are not product costs, they are recorded as expenses on the income statement. | Product costs are recorded as inventory in the balance sheet, and the cost of goods sold in the income statement. (After the sale of goods) |

| Cost Basis | Period cost is time-oriented costs. | Product cost is a volume-oriented cost. |

| Valuation | Period cost should not consider for the valuation of inventory. | In product cost, Inventory valuation is included. |

| Also Known as | Period costs are also operating costs (excluding the cost of goods sold). | Product costs are also inventoriable costs. |

| Example | Selling costs, General and Administrative costs, Marketing costs, interest expenses, Depreciation expenses, office rent, etc. | Direct material cost, labor cost, Variable Manufacturing overhead cost, and Fixed Manufacturing overhead cost. |

Conclusion

From the above description, we can conclude that the cost due to the manufacturing unit is product cost, and the cost other than product cost is a period cost. Period cost is not in a straight line with the production of the end product. This period cost is not assigned to the products and is recorded on the income statement for the period they incurred. Product cost methods help company management price the end product to cover the production cost and profit from it. Cost segregation helps the company analyze the data in detail, which helps them make internal decision.

Recommended Articles

This has been a guide to Period Cost vs Product Cost. Here we have discussed the period cost vs product key differences with infographics and a comparison table. You can also go through our other suggested articles to learn more –