Updated November 30, 2023

Cash Flow from Operations Formula (Table of Contents)

- Cash Flow from Operations Formula

- Cash Flow from Operations Calculator

- Cash Flow from Operations Formula in Excel (With Excel Template)

Cash Flow from Operations Formula

Cash flow from operation is cash generated from operational activities like manufacturing or selling goods and services. Cash is a vital component for businesses as it is necessary for their operations.

Some investors emphasize the cash flow statement more than other financial statements. The concept of elasticity assists in effectively managing cash flow. The CFO focuses on the core business of the company. It does not include long-term expenditure, investments, etc. Cash flow from operation (CFO) is a sum of net income, non-cash items, and an increase in working capital or changes in working capital.

A formula for Cash flow from the operation can be written as follows:-

Where,

- Net Income: Total income generated by a company

- Non-cash Expenses: Short-term non-expense

- Changes in Working Capital: Value of change in working capital

Examples of Cash Flow from Operations Formula

Let’s see an example to understand the Cash flow from the operations formula.

Cash Flow from Operations Formula – Example #1

A company named Neno Plastic Pvt. Ltd, manufacture plastic boxes. The company has a net income of $ 45,000, the total non-cash expenses of the company are $10,000, and changes in working capital is $2,000.

As we know,

- CFO = Net Income + Non-cash Expense + Changes in Working Capital

- CFO = $45000 + $10000 + $2000

- CFO = $57,000

So, the CFO value is $57,000 for the company.

The Cash Flow from Operations formula calculates financial figures based on the company’s specific needs, the parameters at hand, and the industry in which it operates.

Now, let us see those formulas.

Other Cash Flow from Operations Formulas-

- When the company has all the details mentioned in the cash flow statement below, the formula is used, and for income-related values, the income statement is used. Here, CFO is the sum of funds from operations and changes in working capital. It can be expressed as:-

Here, operations funds are the sum of net income, deferred taxes & investment tax credit, depreciation, depletion & amortization, and other funds the company generates. So, funds from operations can be written as:-

Now, let us see an example of its application.

Cash Flow from Operations Formula – Example #2

A company named MK Industries manufactures turbines. It has a net income of $100,000.00, machinery depreciation is $200,000.00, deferred taxes are $300,000.00, another fund company has $100,000.00, and a change in working capital is $10,000.00.

The calculation of Funds from Operations is as follows:

- Funds from Operations = Net Income + Depreciation, Depletion & Amortization + Deferred Taxes & Investment Tax Credit + Other Funds

- Funds from Operations = $100,000 + $200,000 + $300,000 + $100,000

- Funds from Operations = $700,000

The calculation of Cash flow from Operations is as follows:

- CFO = Funds from Operations + Changes in Working Capital

- CFO = $700,000 + $10,000

- CFO = $710,000

So, the cash flow from operations is $710,000.

Now, let us see another formula.

When there are fluctuations in the values of elements such as inventories, tax assets, accounts receivable, and deferred revenue over a specific period, these changes are accounted for in the cash flow from operations. In financial reporting, if there is an increase in asset values from one period to another, it is recorded as a cash outflow. Conversely, if there is an increase in liability values from one period to another, it is recorded as a cash inflow. In summary, this can be expressed using the following formula:

Let us see an example.

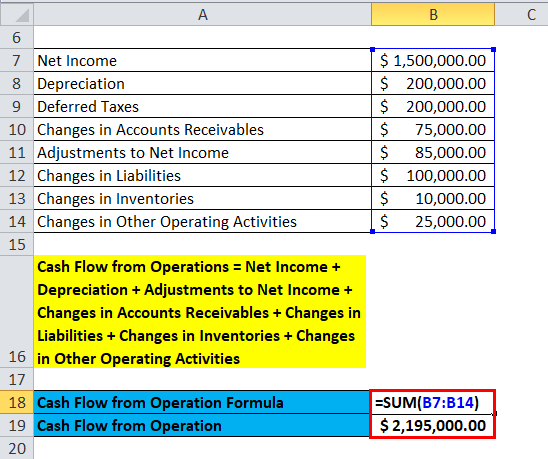

Cash Flow from Operations Formula – Example #3

Suppose a company named RK Industries manufactures auto parts. It has a net income of $1,500,000.00, depreciation of machinery is $200,000.00, deferred taxes are $200,000.00, changes in account receivable is $75,000, changes in liabilities is $100,000, changes in inventories is $10,000 changes in other operational activities is $25,000 and adjustment to income is $85,000.

Now, we will calculate the cash flow from operations for the company.

- Cash Flow from Operations = Net Income + Depreciation + Adjustments to Net Income + Changes in Accounts Receivables + Changes in Liabilities + Changes in Inventories + Changes in Other Operating Activities

- CFO = $1,500,000 + $200,000 + $200,000 + $85,000 + $75,000 + $100,000 + $10,000 + $25,000

- CFO = $2,195,000.00

Hence, the cash flow from operation is $2,195,000.

Explanation

Cash flow from operation is the sum of net income, non-cash item expenses, and an increase in working capital or changes in working capital. That reflects cash inflow in a company. One can get it from the income statement of the company. The main components that show cash flow are accounts receivable, inventory, depreciation, and accounts payable. The account payable is the liabilities account. Cash flow is affected by a company’s earnings, including its net income. Additionally, non-cash transactions are accounted for through non-cash accounts, and alterations in working capital are utilized to address the company’s short-term expenses.

There are some other ways through which one can calculate CFO.

Methods to Calculate Cash Flow from Operation

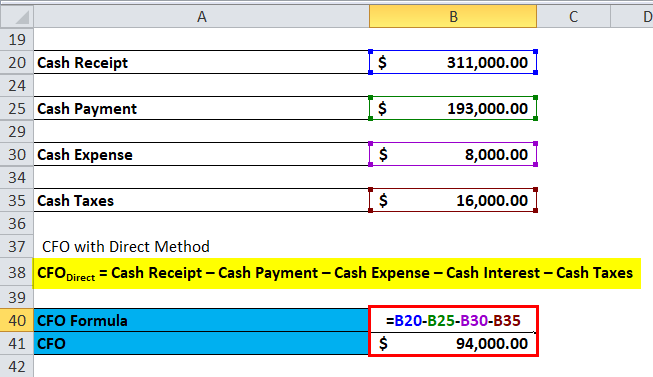

Direct Method

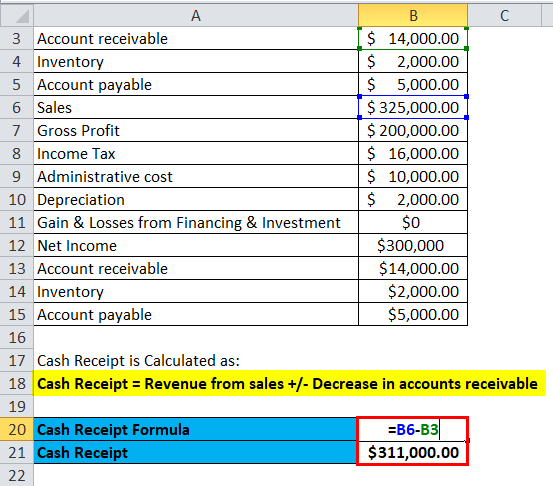

The calculation of the CFO involves calculating all types of cash transactions, such as cash expenses, cash payments, cash receipts, and cash interest and taxes.

Where,

- Cash Receipt = Revenue from sales +/- Decrease in accounts receivable

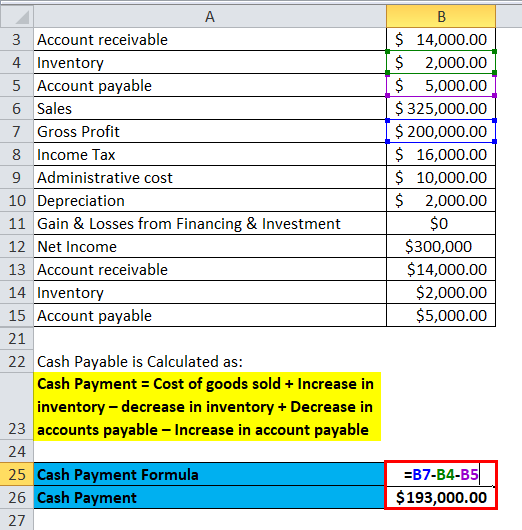

- Cash Payment = Cost of goods sold + Increase in inventory – decrease in inventory + Decrease in accounts payable – Increase in accounts payable

- Cash Expense = Includes changes in operating activities.

- Cash Interest = Interest Expense + Decrease in interest payable – Increase in interest payable

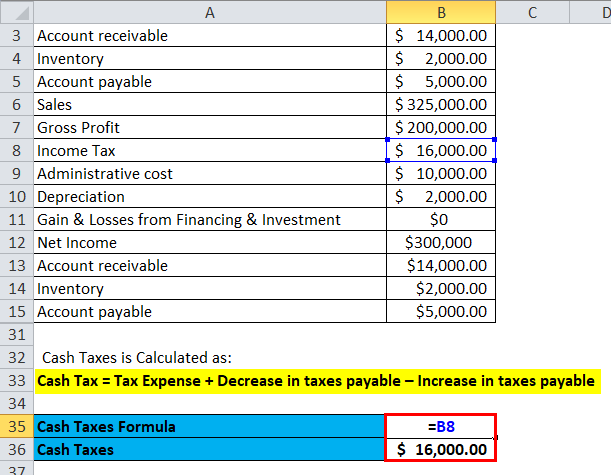

- Cash Tax = Tax Expense + Decrease in taxes payable – Increase in taxes payable

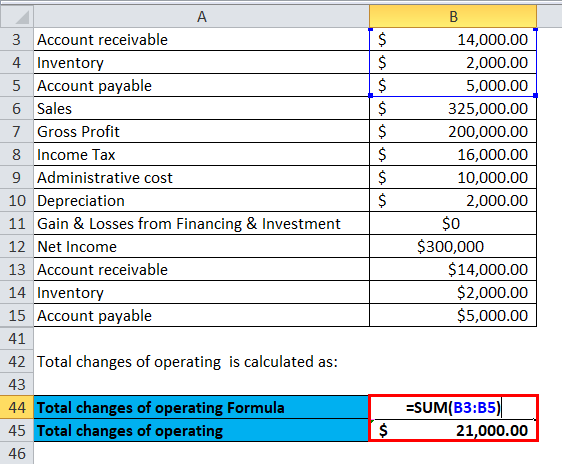

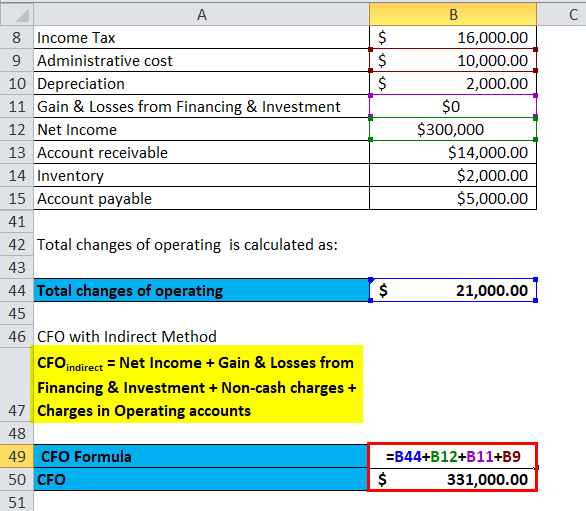

Indirect Method

The indirect method adjusts as per changes in the balance sheet. CFO is the sum of net income, gains and losses from financing & investment, non-cash charges, and changes in operating accounts.

Let’s see an example.

A company, Kim Corporation has the below details. We will calculate CFO with both direct and indirect methods.

| Account receivable | $14,000.00 |

| Inventory | $2,000.00 |

| Account payable | $5,000.00 |

| Sales | $325,000.00 |

| Gross Profit | $200,000.00 |

| Income Tax | $16,000.00 |

| Administrative cost | $10,000.00 |

| Depreciation | $2,000.00 |

| Gain & Losses from Financing & Investment | $0 |

| Net Income | $300,000 |

| Account receivable | $14,000.00 |

| Inventory | $2,000.00 |

| Account payable | $5,000.00 |

Calculation with Direct Method–

- Cash receipt = 3,25,000 – 14,000= $3,11,000

- Cash Payment = 2,00,000 – 2,000 – 5,000 = $1,93,000

- Cash Expense = 10,000 – 2,000 = $8,000

- Cash Tax = $16,000

CFODirect = Cash Receipt – Cash Payment – Cash Expense – Cash Interest – Cash Taxes

CFODirect = $3,11,000 – $1,93,000 – $8,000 – 0 – $16,000 = $94,000

Calculation with Indirect Method:-

Suppose the initial value is zero.

Total changes of operating = 14,000 + 2,000 + 5,000 = $21,000

CFOindirect = Net Income + Gain & Losses from Financing & Investment + Non-cash charges + Charges in Operating accounts

CFOindirect = $300,000 + $0 + $10,000 + $21,000 = $3,31,000

Significance and Uses of Cash Flow from Operations Formula

The uses of CFO are as follows:-

- CFO helps to check the cash flow of a business.

- CFO helps to find the area of generation of cash and helps to maintain it.

- It helps a company make financial decisions.

A sufficient amount of cash is crucial for the efficient functioning of a business as it enables various opportunities such as business expansion, product launches, debt reduction, and timely payment of obligations. When a company effectively manages and utilizes its cash flow from operations, it is anticipated that the company’s share price will experience growth in the future.

Cash Flow from Operations Formula Calculator

You can use the following Cash Flow from Operations Calculator

| Net Income | |

| Non-Cash Expense | |

| Changes in Working Capital | |

| Cash Flow from Operation Formula = | |

| Cash Flow from Operation Formula = | Net Income + Non-Cash Expense + Changes in Working Capital | |

| 0 + 0 + 0 = | 0 |

Cash Flow from Operations Formula in Excel (With Excel Template)

Here we will do the same example of the Cash Flow from Operations formula in Excel. It is very easy and simple.

You can easily calculate the Cash Flow from Operations using the Formula in the template provided.

Cash flow from operations for Neno Plastic Pvt. Ltd is calculated as:

Cash flow from operations for MK Industries calculation:

Cash flow from operations for RK Industries calculation:

Recommended Articles

This has been a guide to the Cash Flow from Operations formula. Here we discuss its uses along with practical examples. We also provide you with Cash Flow from Operations Calculator with a downloadable Excel template. You may also look at the following articles to learn more –