Updated August 1, 2023

Difference Between Expense vs Expenditure

The occurrence of expenditure while running a business is very normal and natural. Generally, the expenditure is incurred to increase the business’s efficiency and further enhance the returns. The terms expense vs expenditure might appear synonyms to a non-specialist. Still, when used in the making and preparing financial statements, the terms expenses vs expenditures will face different meanings altogether. The entity, company, or organization incurs expenses as a type of cost to generate revenues within a specific period. These expenses are reported in the annually prepared income statement.

Companies or entities will record the cost of goods and services sold at a specific time to be expensed. Other expenses recorded by the firms or the organizations will include salaries, advertising, utilities, interests, and rent. Expenditure can be referred to as the amount that has been incurred by the firm or a company or an organization after it purchases an asset or reduction in its liability, among others. Expenditure will cover all the costs incurred by the entities or the companies in purchasing services and goods or payment of recurring expenses. For example, the amount incurred to offset a liability can be referred to as an expenditure, not an expense.

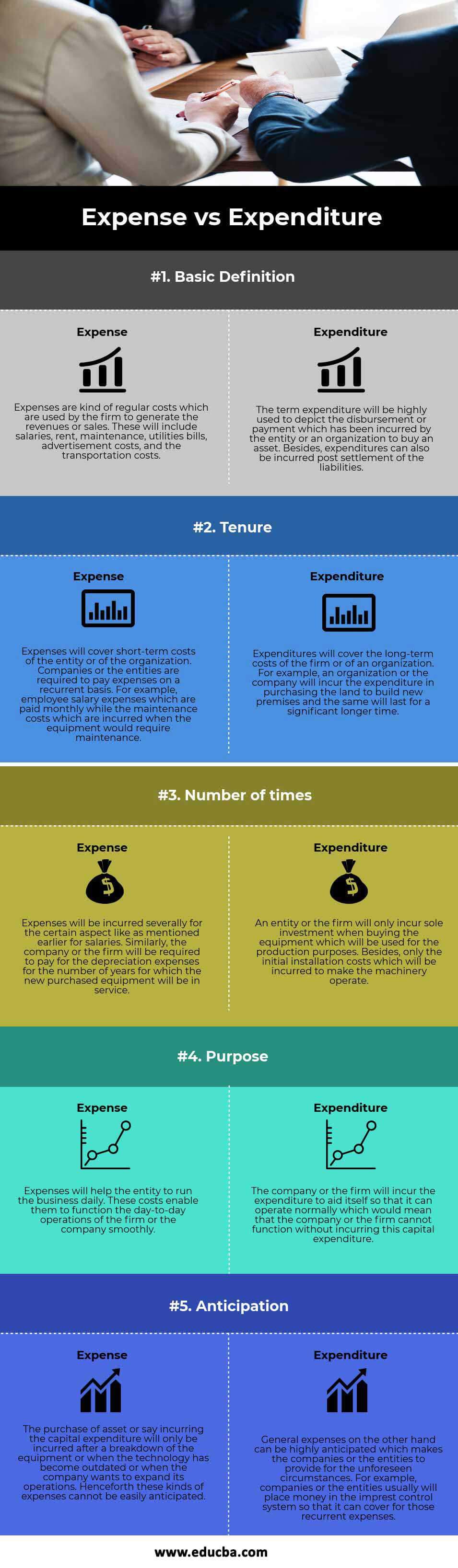

Head To Head Comparison Between Expense vs Expenditure(Infographics)

Below is the top 5 difference between Expense vs Expenditure:

Key Differences Between Expense vs Expenditure

let us discuss some of the major Difference Between Expense vs Expenditure

- Expenditure will generate future economic benefits for the company, but the expenses will only benefit the current period.

- The major difference between Expense vs Expenditure is that the expenditure is a single-time investment of money. On the contrary, expenses will occur frequently, monthly, weekly, or even daily.

- The Balance Sheet presents expenditures under the asset side, while the Income Statement includes them as depreciation. Expenses, on the other hand, are solely displayed in the Income Statement.

- Expenditures can be capitalized as opposed to expenses, which are not capitalized but are taken to the Income statement in the same period, which reduces the entity’s net income.

- Expenditure is longer-term. Conversely, Expenses are of the shorter term.

- Expenditure will attempt to improve the earning capacity of the company or the firm or entity. On the contrary, expenses will aim to maintain or say retain the firm’s earning capacity or the company.

- Expenditure cannot be matched with capital receipts. And on the flip side, expenses can be matched with the revenue receipts.

Expense vs Expenditure Comparison Table

Below is the 5 topmost comparison between Expense vs Expenditure

| Basis of Comparison |

Expense |

Expenditure |

| Basic Definition | Expenses are regular costs used by the firm to generate revenues or sales. These will include salaries, rent, maintenance, utility bills, advertisement, and transportation costs. | Entities or organizations frequently use the term expenditure to describe the disbursement or payment they incur when acquiring an asset. Furthermore, expenditures can also occur after the settlement of liabilities. |

| Tenure | Expenses will cover the short-term costs of the entity or the organization. Companies or entities must pay expenses regularly. For instance, employee salary expenses are paid monthly, while maintenance costs are incurred when equipment requires maintenance. | Expenditures will cover the long-term costs of the firm or an organization. For example, an organization or company will incur the expenditure in purchasing land to build new premises, which will last significantly longer. |

| Number of times | An entity or firm incurs sole investment when purchasing equipment for production purposes. Additionally, they incur only the initial installation costs to ensure the machinery operates. | An entity or firm incurs sole investment when purchasing equipment for production purposes. Additionally, they incur only the initial installation costs to ensure the machinery operates. |

| Purpose | Expenses will help the entity to run the business daily. These costs enable them to function smoothly in the firm or the company’s day-to-day operations. | The company or the firm will incur the expenditure to aid itself in operating normally, meaning that it cannot function without incurring this capital expenditure. |

| Anticipation | The company incurs purchasing an asset or capital expenditure only when the equipment breaks down, the technology becomes outdated, or the company plans to expand its operations. Therefore, anticipating these expenses takes work. | In contrast, companies or entities can effectively anticipate general expenses, enabling them to provide for unforeseen circumstances. For example, companies or entities usually place money in the imprest control system to cover those recurrent expenses. |

Conclusion

Expenses vs Expenditures are the terms used in the accounting department to refer to costs incurred by the company, firm, or organization. Expenses refer to the costs which are incurred by firms or enterprises so that they can earn revenue. Expenditures are the costs incurred when buying the assets for the firm or the organization or the company or paying for a significant proportion of the firm’s or the company’s liabilities.

Some costs will include utilities, transportation, salaries, and depreciation expenses. Other differences between expenses and the expenditure will include implications on the financial statements, number of times incurred, purpose, tenure, and anticipation which have already been discussed. Both Expenses vs Expenditure have their own demerits and merits.

Recommended Articles

This has been a guide to the top difference between Expense vs Expenditure. Here we also discuss the Expense vs Expenditure key differences with infographics, and the comparison table. You may also have a look at the following articles to learn more.