Updated November 20, 2023

Dividends per Share Formula (Table of Contents)

- Dividends per Share Formula

- Dividends Per Share Calculator

- Dividends Per Share Formula in Excel (With Excel Template)

Dividends Per Share Formula

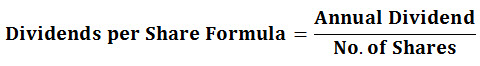

The Formula for calculating Dividends per Share Formula is as follows:

Where,

The annual Dividend is the total Dividend paid to the shareholders for holding each Share of the company; it is paid out at the end of the financial year.

The number of shares is the outstanding number of shares held by all company shareholders. The shareholders, i.e., company investors, currently own the number of shares indicated by this number. The investors can be categorized as insiders, institutional investors, and ESOPs. Outstanding shares figures are available on a company’s balance sheet. Outstanding shares can be used to calculate earnings per share of a company, the market capitalization of a company, or cash flow per Share.

Examples of Dividends Per Share Formula

Example #1

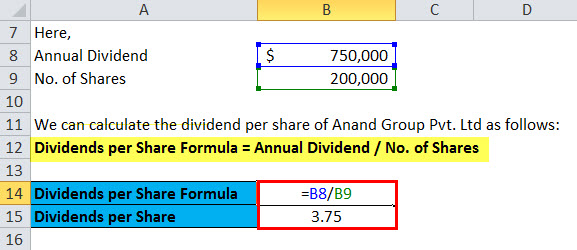

Anand Group Pvt Ltd announced a total dividend of $750,000 to shareholders in the closing financial year. The company has 200000 shares outstanding on its balance sheet.

We can calculate the Dividend per Share by dividing the total Dividend by the outstanding shares.

- Dividends per Share Formula = Annual Dividend / No. of Shares Outstanding

- Dividend per share = $750,000 / 2,000,00

- Dividend per share= $3.75 dividends per Share

Example #2

Let’s assume Jagriti Financial Services paid a total of $2,50,000 in dividends over the last one year; they have also provided a special one-time dividend of $47500 to the existing shareholders. Jagriti Financial Services have 200000 shares outstanding. We have to calculate the Dividend per Share paid by Jagriti Financial Services.

We can calculate the Dividend per Share by using the Formula

For this, we have to calculate the Annual Dividend, which can be calculated as follows:

- Annual Dividend = Total Dividend paid – Special One-time Dividend

- Annual Dividend = $(2,50,000-47,500)

- Annual Dividend = $2,02,500

Therefore, now we will calculate Dividends per Share Formula

- Dividends per Share Formula = Annual Dividend / No. of Shares Outstanding

- Dividend per share = $2,02,500/2,00,000

- Dividend per Share = $1.01 dividend per Share

Example #3

Anand Group of Company has paid annual dividends of $5,000. Outstanding Stock at the beginning was 4000, and Outstanding Stock at the end was 6000. We must calculate the Dividend per share of Anand Group of a company.

In the above example, we can find out the average outstanding shares by using the simple average:

- Outstanding stock = 4000

- Ending outstanding stock = 6000

By using a simple average, we can get the average outstanding Stock,

- Average outstanding stock = (Beginning Outstanding Stock + Ending Outstanding Stock)/2

- Average outstanding stock = (4000 + 6000) / 2 = 10,000 / 2 = 5000.

- Average outstanding stock= 10,000 / 2

- Average outstanding stock= 5000.

And the annual dividends paid were $5000.

Using the Dividend per share formula, we get the following:

- Dividends per Share Formula = Annual Dividend / No. of Shares Outstanding

- Dividends per Share = $5,000 / 5000.

- Dividends per Share = $1 per Share

Hence, we got the Dividends per Share Formula as $1 per Share

Explanation

Dividend per Share is the total amount of dividends issued to the shareholders for every Share of equity stock by the company.

The most crucial point in the Dividends per Share Formula is the “Number of shares.” For calculating the number of outstanding shares, we can either find the average exceptional shares by using the simple average of the beginning and ending shares, or we can use a weighted average. The method of calculating the number of shares depends on the company’s approach, i.e., we can use the weighted average method if the company pays the Dividend in January and issues new shares in December.

The other point of the Dividend per Share formula is the Annual Dividend, i.e., Dividends paid to the investors over the entire year; it does not include any special dividends. However, interim dividends are included in the calculation of the Annual Dividend.

Special dividends are not included in the annual Dividend as it’s paid only once and is not a regular payment to the stockholders.

Interim dividends are included in the annual Dividend as they are those paid to shareholders that have been declared earlier and paid before a company’s annual dividend payout.

Significance and Use of Dividends Per Share

For an investor prospect, it is essential to understand the concept of Dividend per Share. Dividends per Share demonstrate to the investors How the company uses its income. Investors can find the dividends paid to them in the company’s financial statements. For investors, the Dividend per Share is the easiest method to calculate the expected dividend payment amount the company will be giving. A lower Dividend per Share doesn’t mean the company has no growth potential. To analyze the growth potential of any company, we need to calculate the financial ratios and the dividend yield.

Investors looking to invest in any company can use Dividends per Share and the formula explained above. Investors can evaluate stocks based on the payout of dividends and invest in the company accordingly. This Formula alone cannot provide an overall view of a company’s performance, as some companies retain their earnings for organic/inorganic growth instead of paying out dividends. A company with a lower dividend payout ratio, i.e., a Dividend paid to stockholders (Proportion of net income), is very low; these companies will reinvest its net income, which will lead to an increase in the company valuation and future expansion.

Investors can use Dividends per Share to calculate other financial formulas such as Annual dividends and the Number of Shares Outstanding.

Dividends Per Share Calculator

You can use the following Dividends Per Share Calculator

| Annual Dividend | |

| No. of Shares | |

| Dividends per Share Formula= | |

| Dividends per Share Formula= | = |

|

|

Dividends Per Share Formula in Excel (With Excel Template)

Here we will do the same example of the Dividends Per Share in Excel. It is easy and simple. You must provide the two inputs, i.e., Annual Dividend and No. of Shares Outstanding

You can easily calculate the Dividends Per Share using the Formula in the template provided.

In this template, we have to solve the Dividends Per Share Formula

Recommended Articles

This has been a guide to the Dividends Per Share Formula; here, we discuss its uses and practical examples. We also provide you with a Dividends Per Share calculator along with a downloadable Excel template.