Updated August 1, 2023

Simple Interest Rate Formula (Table of Contents)

- Simple Interest Rate Formula

- Examples of Simple Interest Rate Formula (With Excel Template)

- Simple Interest Rate Calculator

Simple Interest Rate Formula

In general parlance, Interest refers to the additional amount paid for obtaining monetary assistance from the lender. In finance terms, when we borrow some amount from any bank or financial institution, we have to repay that amount along with some additional amount for availing of that facility. Such extra amount paid is termed as Interest.

Interest can be of different types like Simple Interest, Compound Interest, Effective Interest, Annual Yield, etc. In this article, we will discuss Simple Interests.

Simple Interest Formula is one of the easiest ways of calculating interest on Short term Loans and Advances and Term Loans. In the case of Simple Interest, the lender calculates interest on the loan amount, also referred to as the principal amount of the loan.

In this case, the lender does not calculate interest on the interest amount accruing on the loan amount, as in the Compound Interest Formula case. To calculate Simple Interest, we need the Amount Borrowed along with the period for which it has been borrowed and the Rate of Interest.

The formula for Simple Interest is as follows:

This formula is also abbreviated as:

Where,

- I = Interest Amount

- P = Loan Amount or Amount Borrowed

- R = Rate of Simple Interest

- T = Tenure of Loan or Time Horizon

Examples of Simple Interest Rate Formula (With Excel Template)

Let us understand this formula with the help of some examples.

Simple Interest Rate Formula – Example #1

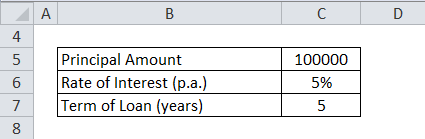

Ram took a loan from his banker of Rs.100000 for a period of 5 years. The rate of interest was 5% per annum. Calculate the interest amount and his total obligation at the end of year 5.

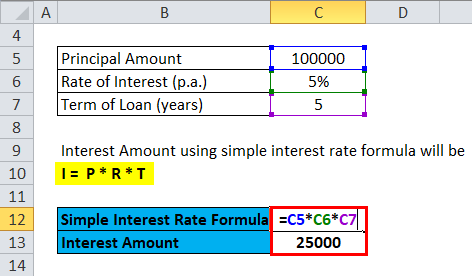

So, the Interest Amount using simple interest rate formula will be:

- I = P * R * T

- I = 100000 *5% *5

- I = Rs.25000

Interest Amount is Rs. 25000

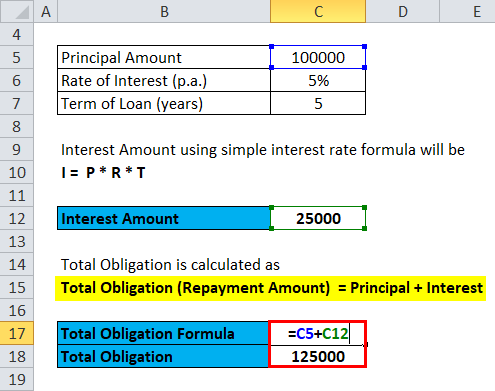

Total Obligation is calculated as

- Total Obligation (Repayment Amount) = Principal + Interest

- Repayment Amount = 100000 + 25000

- Repayment Amount = Rs. 125000

Simple Interest Rate Formula – Example #2

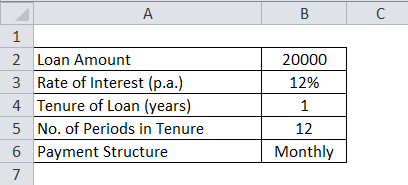

Ram purchased a Mobile of Rs.20000 from an outlet at a loan. The terms of the loan are as follows:

Calculate the EMI and Interest amount per period.

Here,

- P = 20000

- R = 12%p.a.

- Time = 1Year

- No. of periods for payment (N) = 12 monthly

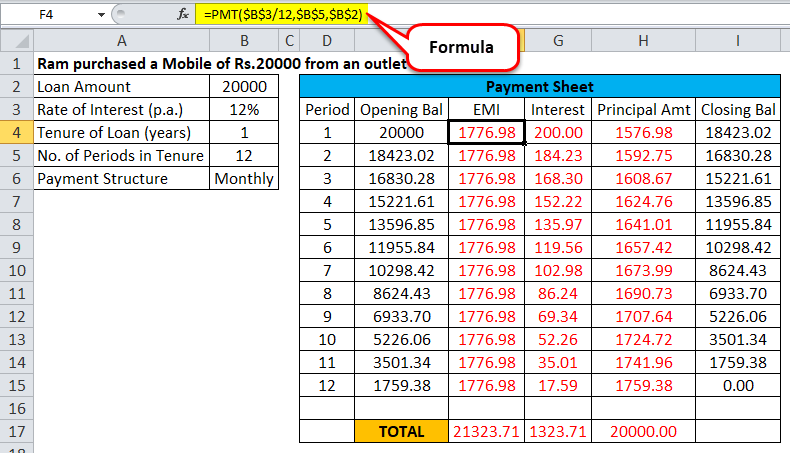

So, EMI and Interest amounts can be calculated in Excel using PMT Function. Alternatively, we can also calculate the EMI and Interest using the formula,

- EMI = [P * R * (1+R)^N]/[(1+R)^N-1]

- EMI = [20000*12%*(1+12%)^12]/[(1+12%)^12-1]

- EMI = Rs. 1776.98

Using the formula, we know that Ram has to pay an EMI of Rs.1776.98 for 12 months. His Interest payment for each period will reduce, and correspondingly, principal repayment will increase gradually, resulting in full payment of the loan amount and interest at the end of 12 months.

The figure shows the calculation of EMI, Principal repayment, and Interest involved in each EMI.

As we can see, EMI will remain the same, and with each monthly installment repayment, the Outstanding Loan Amount will also reduce and become zero at the end of the loan term.

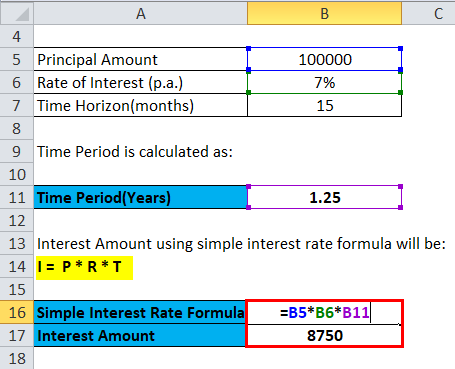

Simple Interest Rate Formula – Example #3

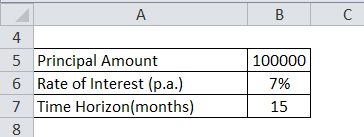

DHFL Ltd issued a coupon-bearing bond of Rs.100000, with an interest rate of 7% p.a. The bond has a useful life of 15 months, after which the bond will be redeemed.

Interest earned by the investor can be calculated as follows:

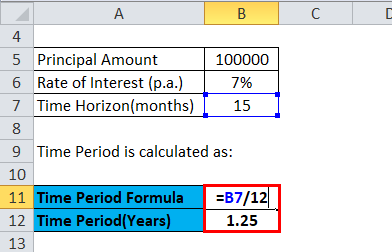

We need to bring the interest rate and the time period in symmetry to calculate interest. So,

The time period is calculated as:

- Time period = 15 /12 years

- Time period =1.25 years

Interest Amount using simple interest rate formula will be:

- I = P * R * T

- I = 100000 * 7% * 1.25

- I = Rs.8750

So, the interest earned by an investor on the redeemable bond is Rs.8750.

Explanation

The interest Rate Formula helps know the Interest obligation of the borrower for the loan undertaken, and it also helps lenders like financial institutions and banks to calculate the net interest income earned for the assistance given.

One should remember that when calculating simple interest, the Rate of Interest and Time Period of the loan need to be symmetrical. If the interest rate is expressed per annum, one should also express the number of periods annually. On the other hand, if the Time period is monthly or quarterly, one should convert the Interest rate accordingly to match the monthly or quarterly frequency.

In this formula, the Interest amount is higher in the Initial period of the Loan and gradually decreases over the remaining life of the loan.

Significance and Use of Simple Interest Rate Formula

- This formula is one of the simplest formulas for calculating Interest Obligation, and it does not consider the features of the compound interest formula i.e. Interest on interest.

- This formula is used in the case of Short Term Loans & Advances, and Borrowings.

- Banking Industries also use this formula for calculating interest on Saving Bank accounts and Short Term Deposits.

- The Simple Interest Rate Formula is also used to calculate interest on car loans and other consumer loans.

- Certificate of Deposits (CD) is also embedded with the Simple Interest Rate feature.

- Bonds also pay simple interest in the form of coupon payments.

Simple Interest Rate Calculator

You can use the following Simple Interest Rate Calculator

| Principal Amount | |

| Rate of Interest | |

| Time Period | |

| Simple Interest Rate Formula | |

| Simple Interest Rate Formula = | Principal Amount x Rate of Interest x Time Period |

| = | 0 x 0 x 0 = 0 |

Recommended Articles

This has been a guide to the Simple Interest Rate formula. Here we discuss its uses along with practical examples. We also provide a Simple Interest Rate Calculator with a downloadable Excel template. You may also look at the following articles to learn more –