Updated July 29, 2023

Sustainable Growth Rate Formula (Table of Contents)

- Sustainable Growth Rate Formula

- Examples of Sustainable Growth Rate Formula (With Excel Template)

- Sustainable Growth Rate Formula Calculator

Sustainable Growth Rate Formula

In simple language, the sustainable growth rate is the maximum growth rate that a company can achieve, keeping its capital structure intact and sustaining it without any additional debt requirement or equity infusion.

It is the growth rate that a company can foresee in the long term. This growth rate is important for both small businesses and large companies. For a small business, this is the growth rate it can sustain without putting additional money from its pocket or taking a loan. Similarly, large corporates can use their sustainable growth rates to determine whether they have enough capital to fulfill their strategic goals.

This is also an indicator to see at what stage of its life cycle a company is in. It also helps us in determining the chances of default by a company. The higher the growth rate, the greater the earnings volatility the higher the risk and chances of default. Efficient management will not increase their leverage and risk of default and will try to target the sales level which is sustainable for them.

The sustainable growth rate formula is calculated by multiplying the company’s retention rate of its earnings by its return on equity. The formula to calculate the sustainable growth rate is:

If there is no direct information on ROE is provided, it can be calculated as follows:

Retention rate is the rate of earnings a company reinvests in its business. In other words, once all the dividends are paid to shareholders, the left amount is the retention rate.

So,

Examples of Sustainable Growth Rate Formula (With Excel Template)

Let’s take an example to understand the calculation of the Sustainable Growth Rate formula in a better manner.

Example #1

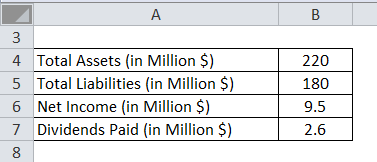

Consider a small-scale listed company X’s, which is a wholesale dealer of auto spare parts. Below is the snapshot of X’s financial details

So to find X’s sustainable growth rate, we need to find ROE and retention rate.

The formula to calculate Equity is as below:

Equity = Total Assets – Total Liabilities

- Equity = 220 – 180

- Equity = 40

The formula to calculate ROE is as below:

ROE = Net Income / Equity

- ROE = 9.5 / 40

- ROE = 23.75%

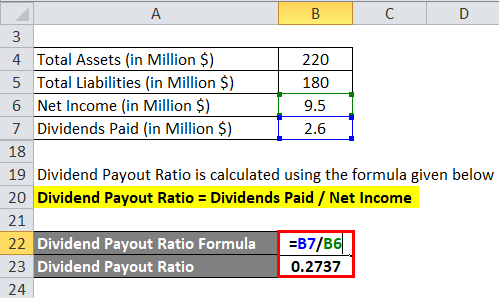

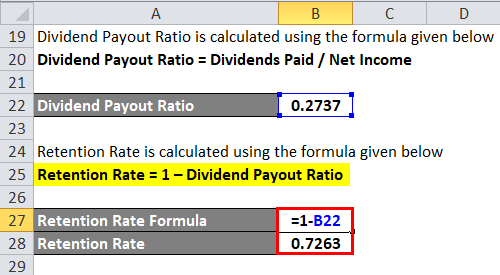

The formula to calculate Dividend Payout Ratio is as below:

Dividend Payout Ratio = Dividends Paid / Net Income

- Dividend Payout Ratio = 2.6 / 9.5

- Dividend Payout Ratio = 0.2737

The formula to calculate Retention Rate is as below:

Retention Rate = 1 – Dividend Payout Ratio

- Retention Rate = 1 – 0.2737

- Retention Rate = 0.7263

The formula to calculate Sustainable Growth Rate is as below:

Sustainable Growth Rate = Return on Equity (ROE) * Retention Rate

- Sustainable Growth Rate = 23.75% * 0.7263

- Sustainable Growth Rate = 17.25%

Example #2

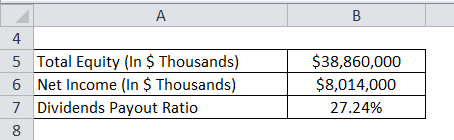

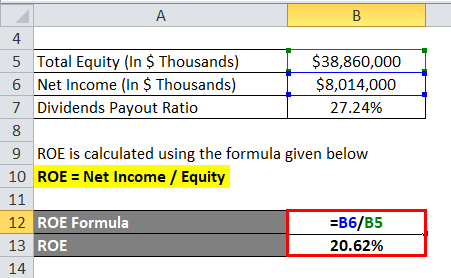

Now let’s see some practical examples. I have taken General Motors as a Target Company, for which we need to calculate the sustainable growth rate. Below is the extract of their financial statements for 2018:

ROE = Net Income / Equity

- ROE = $8,014,000 / $38,860,000

- ROE = 20.62%

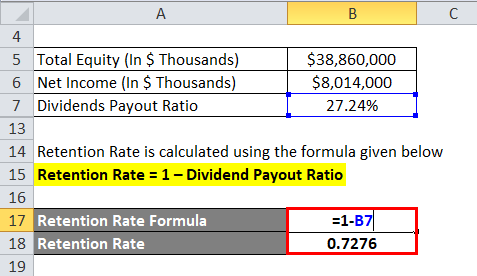

Retention Rate = 1 – Dividend Payout Ratio

- Retention Rate = 1 – 27.24%

- Retention Rate = 0.7276

Sustainable Growth Rate = Return on Equity (ROE) * Retention Rate

- Sustainable Growth Rate = 0.7276 * 20.62%

- Sustainable Growth Rate = 15.01%

Explanation of the Sustainable Growth Rate Formula

Every business wants to grow and achieve new heights. So every company wants to achieve a sustainable growth rate, but some limitations and headwinds can stop a business from growing and achieving its sustainable growth rate.

Any company expanding its operations needs to invest in the growing business. So they must spend money purchasing fixed assets like plants, equipment, etc. Because of this, they need to fund that investment via external financing. So basically, they have to fund their growth from outside resources and financing. Similarly, capital-intensive companies, like oil and gas, etc., have no choice but to use debt and equity financing to keep running since their equipment, etc., are quite expensive.

Companies sometimes indulge themselves in a price war to increase their growth and business. They keep on slashing their prices to acquire more customers. But they do this at the cost of their profitability and growth, and this is not sustainable in the long term. Same way, proper and apt business planning helps businesses achieve sustainable growth in the long term. But if long-term planning is poor, there might be a period of high growth rate initially, but it cannot be sustained in the long term.

Relevance and Uses

As discussed above, the sustainable growth rate formula assumes that a company wants to increase its sales and revenue by maintaining its target capital structure and a stable dividend payout ratio. So to do that, companies can do the following measures:

- Improve cash flow by shifting the mix of sales towards more profitable products

- Improve the receivables and/or inventory turnover so that working capital improves

- Reduce dividend payments and reinvest more money into the business.

For companies, sustaining a high growth rate in the long term is difficult. There are several reasons, including market competition, changes in economic conditions, and the need to increase research and development.

In a nutshell, the sustainable growth rate is one of the key parameters businesses need to analyze and consider when making any strategic decisions and raising money from external sources. If the growth cannot be sustained and we take huge debt, it will expose us to a high probability of default.

Sustainable Growth Rate Formula Calculator

You can use the following Sustainable Growth Rate Calculator.

| Return on Equity(ROE) | |

| Retention Rate | |

| Sustainable Growth Rate Formula = | |

| Sustainable Growth Rate Formula = | Return on Equity(ROE) x Retention Rate |

| = | 0 x 0 = 0 |

Recommended Articles

This has been a guide to the Sustainable Growth Rate formula. Here we discuss How to Calculate Sustainable Growth Rate along with practical examples. We also provide a Sustainable Growth Rate Calculator with a downloadable Excel template. You may also look at the following articles to learn more –