Updated July 31, 2023

Opportunity Cost Formula (Table of Contents)

- Opportunity Cost Formula

- Opportunity Cost Formula Calculator

- Opportunity Cost Formula in Excel (With Excel Template)

Opportunity Cost Formula

Opportunity cost can be termed the next best alternative of a particular option that has been executed or is about to execute. It can be a project foreign investment or a particular option taken by a group of people or an individual for a personal purpose or a business purpose. It is a hypothetical assumption and is often measured to get the value of the actual decision made.

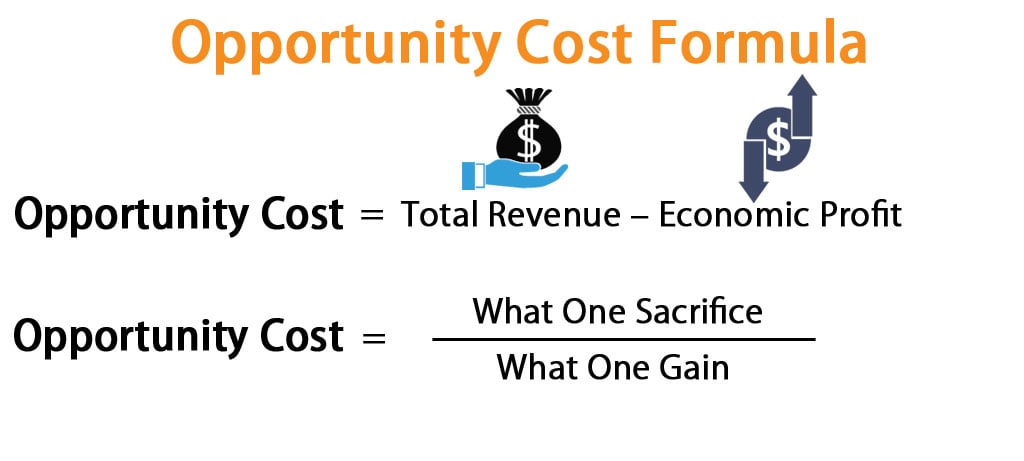

The Formula for Opportunity Cost is:

Examples of Opportunity Cost Formula

Let’s take an example to understand the calculation of the Opportunity Cost formula in a better manner.

Example #1

A Furniture manufacturer who manufactures and sells furniture was given two orders, and he can only take one order. Now it’s up to the Furniture manufacturer to decide between the two orders as he has time and labor limitations. The manufacturer has to pay wages @ INR 100/hour to the labor.

- 1st order: One table Selling Price INR 7500, the time required- 16Hours, Raw material costs- INR 1800

- 2nd Order: Two Chairs Selling Price INR 4000 each, Time required – 11 hours each, Raw material costs – INR 800 each.

Find out the better option and the opportunity costs he misses.

Solution:

As the manufacturer has two different orders with diversified characteristics, so we have to calculate the profit from both orders individually

Profit from the First Order

Opportunity Cost = Total Revenue – Economic Profit

- First Order = INR 7500 – [(16 * 100) + 1800]

- First Order = INR (7500 – 3400)

- First Order = INR 4100

Profit from the Second Order

- Second Order = INR (4000 * 2) – [(11 * 2 * 100)+ (800 * 2)]

- Second Order = INR 8000 – 3800

- Second Order = INR 4200

Conclusion – The manufacturer will take order no. 2 as it will give him much more earnings (INR 4200 vs INR 4100)

Thus the Opportunity cost is INR 4100, which the manufacturer misses during his course of business. As the manufacturer has time limitations and can take only one order at a time, he would opt for the second order.

Example #2

Tata Motors have three bulk orders, and it can take the most profitable one to strengthen its Cash Flow first, so it has to enhance its working capital to process the rest of the two orders. Find out the most profitable and the least profitable in a descending manner to protect its Cash balance. (Assume that all the Sales are made on a Cash basis).

- Order 1: 100 Cars of Selling Price of INR 4.5 lakh each, RM costs – INR 80 lakhs, Total Labor expenses – INR 22 lakhs

- Order 2: 50 Cars of Selling Price of INR 8 lakh each, RM costs – INR 95 lakhs, Total Labor expenses – INR 45 lakhs

- Order 3: 20 Trucks of Selling Price of INR 22 lakh each, RM costs – INR 1.12 Cr, Total Labor expenses – INR 38 lakhs

Solution:

From the above problem, we should calculate the profitability in each case. As we all know, Sales are made on a Cash basis, so more earnings would help the business to generate higher cash flow, and there would not be pressure on the Working capital as the company will borrow less short-term borrowings.

Profitability from First Order

- First Order = INR [(4, 50,000 * 100) – (80,00,000 + 22,00,000)]

- First Order = INR 4,50,00,000 – 1,02,00,000

- First Order = INR 3,48,00,000

Profitability from Second Order

- Second Order = INR [(8,00,000 * 50) – (95,00,000 + 45,00,000)]

- Second Order = INR (4,00,00,000 – 1,40,00,000)

- Second Order= INR 2,60,00,000

Profitability from Third Order

- Third Order = INR [(22,00,000 * 20) – (1,12,00,000 + 38,00,000)]

- Third Order = INR 4,40,00,000 – 1,50,00,000

- Third Order = INR 2, 90,00,000

Thus Tata Motors will undertake the First order First, then it will take the Third order, and lastly, it will take the second order to profitability to strengthen its working capital. Thus the opportunity costs after the First Order is done would be = INR (2.9 +2.6) Cr or INR 5.5 Cr (as the company has not executed the other orders and it might choose not to execute), and after the second order, the opportunity costs would be INR 2.6 cr.

Example #3

Larsen and Toubro Ltd has two orders for execution, But it can undertake only one. Based on the following data, choose which one to operate and the opportunity costs.

- Order one will derive a Revenue of INR 10,00,000 and Costs 4,00,000.

- Order two will derive a Revenue worth INR 12,00,000 and will cost INR 8,00,000.

Solution:

Profitability from First Order

- First Order = INR 10,00,000 – 4,00,000

- First Order = INR 6,00,000

Profitability from Second Order

- Second Order = INR 12,00,000 – 8,00,000

- Second Order = INR 4,00,000

Thus L&T will take order one, and the Opportunity costs of not taking second order would be INR 400000.

Explanation of Opportunity Cost Formula

The formula calculates the best options and the second best possible option in terms of value, which was not chosen during the course of production.

Relevance and Uses

- Assessing relative prices of commodities

The concept is very much used for measuring the prices or the value of different communities used in a manufacturing concern.

For example, according to the economics theory, we know that goods are scarce and human wants are unlimited. So a particular commodity or raw material can only be used for one purpose. So the best possible end product has to decide by the authority which can serve human wants in a better way.

- Deciding the Salary or remuneration of professionals

Opportunity cost could be used during the fixation of salary for a particular job. When a benchmark is created based upon the remuneration of that particular professional when he or she might be offered for another job. The suspect the capability and the productive names of professionals, one can use opportunity cost as a benchmark of remuneration.

- Allocation of resources

Proper allocation of scarce resources

As we all know, resources are scarce, so to get optimum value or efficiency, one has to decide the best possible use of resources to give the end consumer the best satisfaction. In other words, one has to process the raw materials into doors kind of products which would give optimum satisfaction to the user.

For example, if a piece of wood can be used to make one table or three chairs, then the best possible outcome should be chosen, which would help several people.

Opportunity Cost Formula Calculator

You can use the following Opportunity Cost Calculator

| Total Revenue | |

| Economic Profit | |

| Opportunity Cost Formula | |

| Opportunity Cost Formula = | Total Revenue – Economic Profit |

| = | 0 – 0 |

| = | 0 |

Opportunity Cost Formula in Excel (With Excel Template)

Here we will do the same example of the Opportunity Cost formula in Excel. It is very easy and simple.

You can easily calculate the Opportunity Cost using the Formula in the template provided.

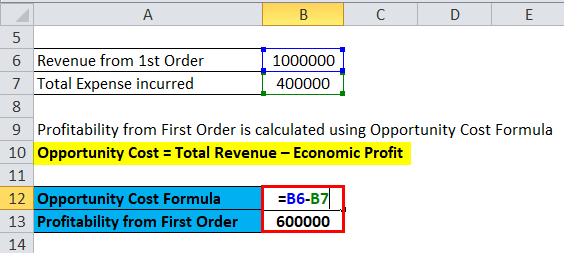

The calculation for Profitability from First Order using Opportunity Cost Formula is as below:

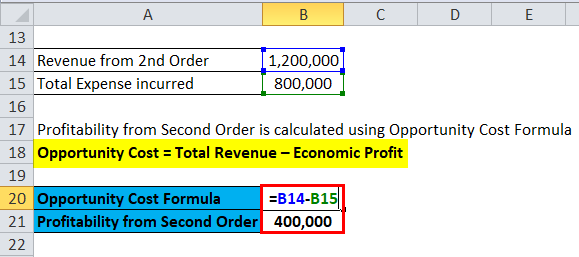

The calculation for Profitability from the Second Order using the Opportunity Cost Formula is as below:

Recommended Articles

This has been a guide to the Opportunity Cost formula. Here we discuss How to Calculate Opportunity Cost along with practical examples. We also provide an Opportunity Cost Calculator with a downloadable Excel template. You may also look at the following articles to learn more –