Updated July 31, 2023

Table of Content

- Contribution Margin Formula

- Examples of Contribution Margin Formula (With Excel Template)

- Contribution Margin Formula Calculator

Contribution Margin Formula

The contribution margin concept establishes a relationship between cost, sales, and profit. For the Contribution margin calculation, the firm refers to its net sales and total variable expenses.

It refers to the amount left over after deducting from the revenue or sales the direct and indirect variable costs incurred in earning that revenue or sales. This left-over value then contributes to paying the periodic fixed costs of the business, with any remaining balance contributing profit to the firm. Alternatively, contribution margins can be determined by calculating the contribution margin per unit formula and the contribution ratio. The following article provides an outline for Contribution Margin Formula.

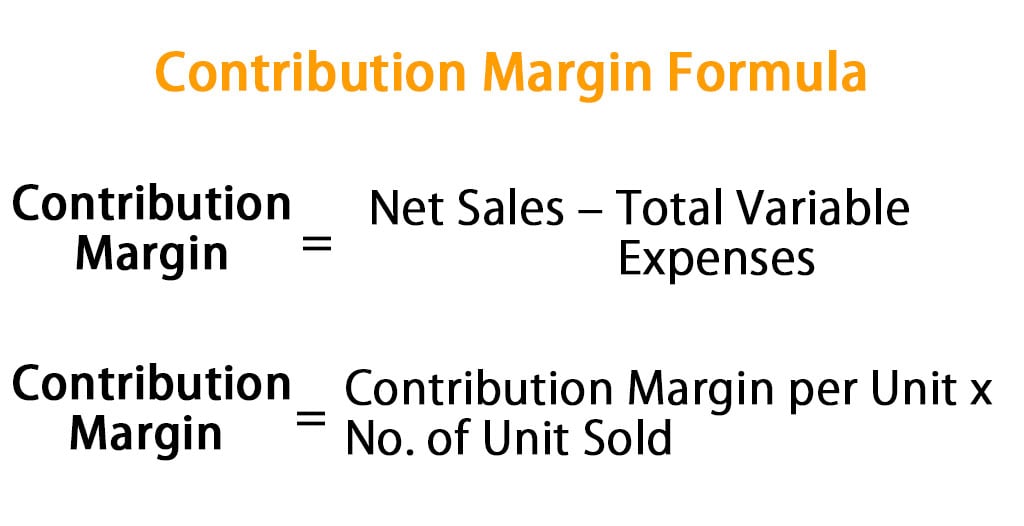

Here’s the Contribution Margin Formula:

Or,

Examples of Contribution Margin Formula (With Excel Template)

Let’s take an example to understand the calculation of the Contribution Margin formula in a better manner.

Example #1

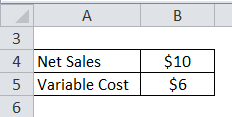

Suppose we sell a pen for $10 in the market, and the variable cost is $6. Calculate the contribution margin of the pen

We can calculate the contribution margin of the pen by using the formula given below.

Contribution Margin = Net Sales – Total Variable Expenses

- Contribution Margin= $10 – $6

- Contribution Margin = $4

The contribution margins for the sale of the pen would be $4, and selling this pen would increase the profit of the firm by $4.

Example #2

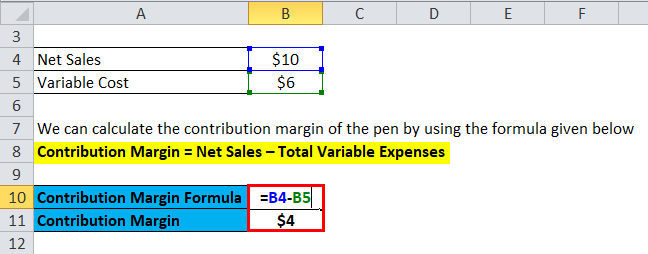

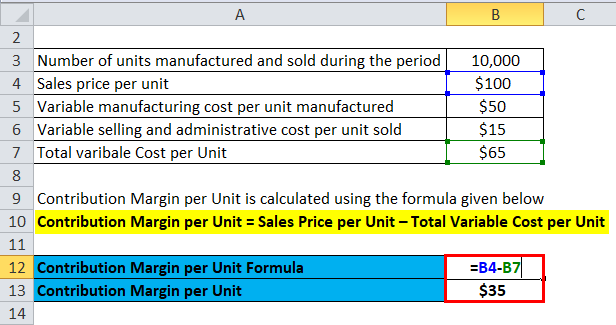

In this example, we will calculate the contribution margins of the firm per unit.

A Firm sells a single product known as product A. Sales and cost figures of the firm are given below:

Solution:

By using the above information provided by the Firm, we can calculate per unit and the total contribution margin of product A as below:

The formula to calculate the Contribution Margin per Unit is as below:

Contribution Margin per Unit = Sales Price per Unit – Total Variable Cost per Unit

- Contribution Margin per Unit = $100 – $65

- Contribution Margin per Unit = $35 per unit

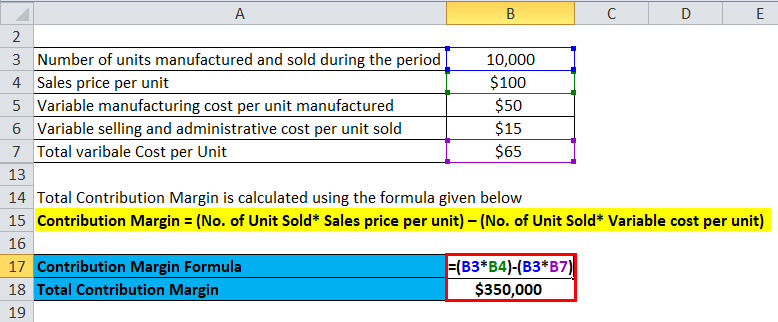

The formula to calculate Total Contribution Margin is as below:

Contribution Margin = Net Sales – Total Variable Expenses

Contribution Margin = (No. of Unit Sold * Sales Price per Unit) – (No. of Unit Sold * Variable Cost per Unit)

- Total Contribution Margin = (10,000 units × $100) – (10,000 units * $65)

- Total Contribution Margin = $10,00,000 – $6,50,000

- Total Contribution Margin = $3,50,000

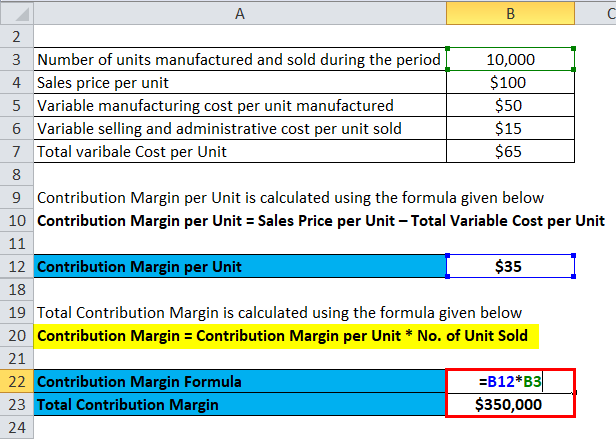

Or

The formula to calculate Total Contribution Margin is as below:

Contribution Margin = Contribution Margin per Unit * No. of Unit Sold

- Total Contribution Margin = $35 * 10,000 units

- Total Contribution Margin = $350,000

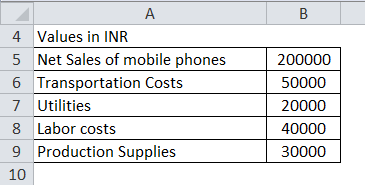

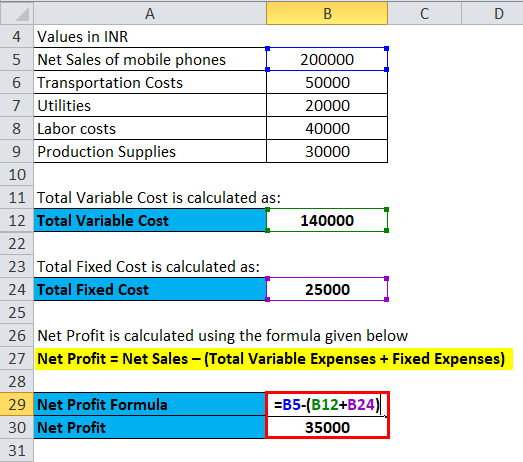

Example #3

In this example, we will calculate the contribution margins alternatively with Net profit and fixed cost. Let’s discuss the financial data of the firm to calculate contribution margins.

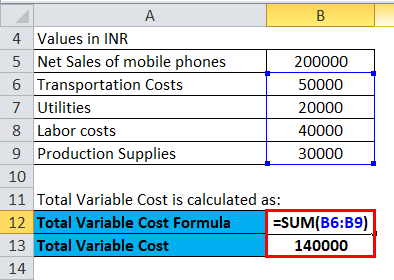

During the financial year 2018, Firm ABC has sold mobile phones of INR 2,00,000, and followings are the variable cost for the firm:

Solution:

Total Variable Cost is calculated as

- Total Variable Cost = INR (50,000+20,000+40,000+30,000)

- Total Variable Cost = INR 1,40,000

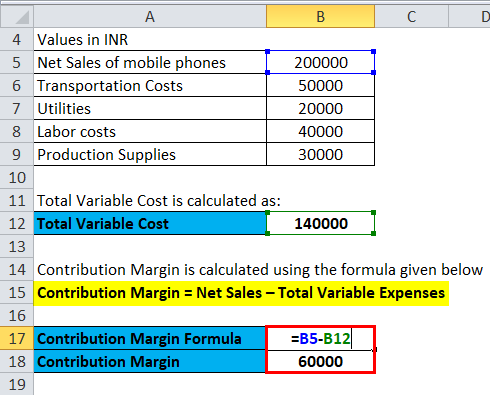

The formula to calculate Contribution Margin is as below:

Contribution Margin = Net Sales – Total Variable Expenses

- Contribution Margin = INR 2,00,000 – INR 1,40,000

- Contribution Margin = INR 60,000

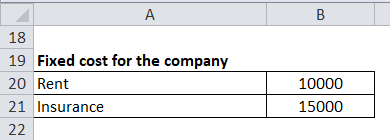

We can say that ABC Firm has left over INR 60,000 to meet its fixed expenses, and any remainder after meeting the fixed cost will be the profit for the firm. The fixed cost of the firm ABC includes the following:

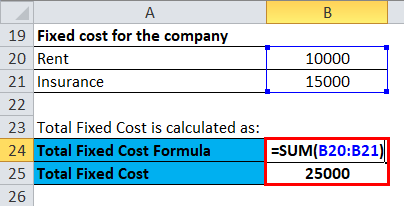

The calculation of Total Fixed Cost is as below:

- Total Fixed Cost = INR 10,000 + INR 15,000

- Total Fixed Cost = INR 25,000

The formula to calculate Net Profit is as below:

Net Profit = Net Sales – (Total Variable Expenses + Fixed Expenses)

- Net Profit = INR 2,00,000 – (1,40,000 + 25,000)

- Net Profit = INR 35,000

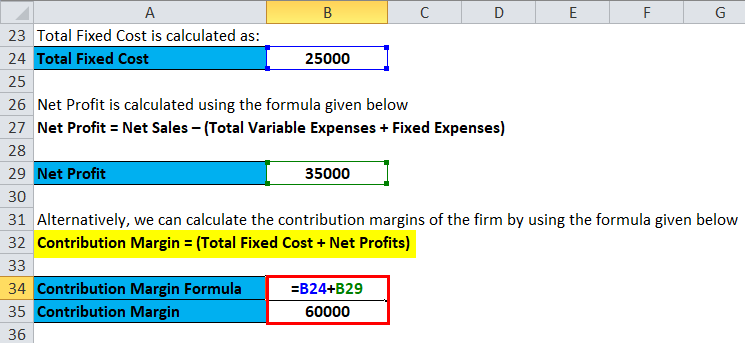

Alternatively, we can calculate the contribution margins of the firm by using the formula given below.

Contribution Margin = (Total Fixed Cost + Net Profits)

- Contribution Margins = INR (25,000 + 35,000)

- Contribution Margins = INR 60,000

Explanation

After deducting the direct and indirect variable costs incurred in earning the revenue, the contribution margin represents the amount left-over. This left-over value then contributes to paying the periodic fixed costs of the business, with any remaining balance contributing profit to the owners. Hence, we can calculate contribution margins by deducting the total variable cost from the total sales.

To calculate the contribution margins, we need to consider three things:

- Fixed Expenses: Fixed expenses do not change irrespective of sales volume, such as rent, salary, insurance, utilities, office, depreciation, fees, etc.

- Variable Expenses: Variable expenses are those expenses that tend to change with the volume of sales, such as the cost of goods sold.

- Price: The price of the product is the price set by the firm to sell at wholesale price or cost of manufacturing the product plus markup.

Alternate Contribution Margin formula:

We can represent the contribution margin in percentage as well. Alternatively, it is known as the ‘contribution to sales’ ratio or ‘Profit Volume’ ratio. This ratio represents the percentage of sales income available to cover its fixed cost expenses and to provide operating income to a firm.

Unit contribution margin per unit denotes the profit potential of a product or activity from the sale of each unit to cover per-unit fixed costs and generate profit for the firm. E.g., if a firm sells a product at Rs 10 per piece and incurs variable costs per unit of Rs 7, the unit contribution margin will be Rs 3 (10 – 7).

Relevance and Uses of Contribution Margin Formula

Companies use the contribution margin in their operational decisions, applying it in various ways for different levels of decision-making.

- By using the contribution margin, the firm uses in break-even analysis. The breakeven point for a firm is when the revenue of the firm equals its expenses; also, we can that the point where the firm is having neither a net profit nor net loss.

- The firm uses contribution margin analysis to measure its operating leverage, as it enables them to gauge how growth in sales translates into growth in profits.

- The contribution margin is also used to judge whether a firm has monopoly power in competition law, such as using the Lerner Index.

- A contribution margin is also used to compare individual product lines and be estimated to set sales goals.

Contribution Margin Formula Calculator

You can use the following Contribution Margin Calculator.

| Net Sales | |

| Total Variable Expenses | |

| Contribution Margin Formula | |

| Contribution Margin Formula = | Net Sales – Total Variable Expenses |

| = | 0 – 0 |

| = | 0 |

Recommended Articles

This has been a guide to the Contribution Margin formula. Here we discuss How to Calculate the Contribution Margin along with practical examples. We also provide Contribution Margin Calculator with a downloadable Excel template. You may also look at the following articles to learn more –