Updated November 23, 2023

Dividend Payout Ratio Formula (Table of Contents)

- Dividend Payout Ratio Formula

- Dividend Payout Ratio Calculator

- Dividend Payout Ratio Formula in Excel (With Excel Template)

Dividend Payout Ratio Formula

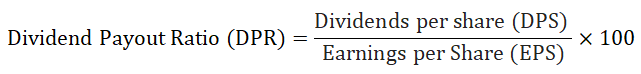

Dividend Payout Ratio Formula 1

Dividend Payout Ratio Formula 2

Dividend Payout Ratio Formula 3

The dividend payout ratio measures the percentage of net income that is distributed to shareholders in the form of dividends during a particular period (quarterly, half-yearly, or yearly). In other words, this ratio shows the portion of profits the company decides to keep funding operations and the portion of profits given to its shareholders in the form of dividends.

Example of Dividend Payout Ratio Formula

Let’s understand the calculation of the Dividend Payout Ratio by a simple example.

Example #1

Here we will discuss Formula 1

Year Ended 31st March 2018; Company ABC has distributed an annual dividend payment of INR 10.00 per share. Over the same period, ABC reported net earnings of INR 100.00 per share.

- Dividend Per Share: INR 10 per share

- Earnings per share: INR 100 per share

By using formula 1, the dividend payout ratio of ABC Company is:

- Dividend Payout ratio = (Dividends per Share * 100)/ Earnings per Share (EPS)

- Dividend Payout Ratio= (INR 10 *100)/ INR100

- Dividend Payout Ratio = 10%

We can say that ABC Company has retained 90% of its profit to the business and 10% of its net profit as dividends to its shareholders in the year ended 31st March 2018.

Here we will discuss Formula 2

Year Ended 31st March 2018; Company XYZ has distributed an annual dividend payment of INR 20.00 Crore. Over the same period, XYZ reported a net profit of INR 100.00 Crore.

- The total dividend paid: INR 20.00 Crore

- Net Profit: INR 100.00 Crore

By using formula 2, the dividend payout ratio of XYZ Company is:

- Dividend Payout Ratio = (Total Dividends / Net profit)*100

- Dividend Payout Ratio = (INR 20/ INR100) *100

- Dividend Payout Ratio = 20%

We can say that XYZ Company has retained 80% of its profit to the business and 20% of its net profit as dividends to its shareholders in the year ended 31st March 2018.

Here we will discuss Formula 3

ABC and XYZ have Retention of Profit 90% and 80%, respectively, for the year ended 31st March 2018.

Now, we can calculate the Dividend Payout Ratio by using formula 3:

| ABC Company Dividend Payout Ratio | XYZ Company Dividend Payout Ratio |

| Retention of Profit = 90%

Formula: Dividend Payout Ratio = 1- Retention Ratio = 1 – 90% |

Retention of Profit = 80%

Formula: Dividend Payout Ratio = 1- Retention Ratio = 1 – 80% |

| Dividend Payout Ratio = 10% | Dividend Payout Ratio = 20% |

Example #2

Let’s better understand the practical industry scenario on the Dividend payout ratio.

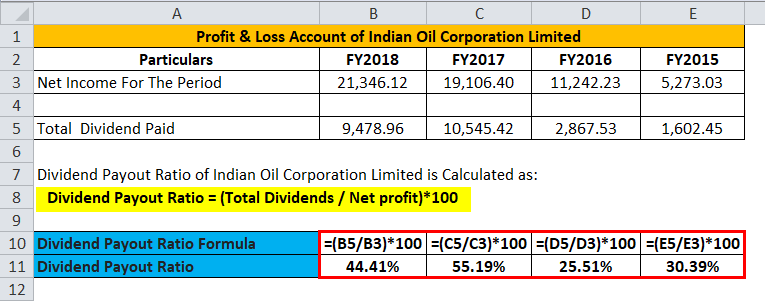

We have considered the financial figures of India Oil Corporation Ltd for FY2015 to FY2018 to calculate the Annual Dividend Payout Ratio:

| Particulars (In INR Crs) | FY2018 | FY2017 | FY2016 | FY2015 |

| Net Profit | 21,346.12 | 19,106.40 | 11,242.23 | 5,273.03 |

| Dividends | 9,478.96 | 10,545.42 | 2,867.53 | 1,602.45 |

| Dividends Payout Ratio | 44.41% | 55.19% | 25.51% | 30.39% |

The company has distributed around 44% of its net profit in dividends to its shareholders and retained about 66% of the business. There is volatility in the company’s dividend payout from FY2015 to FY2018. Generally, High cash requirements impact the dividend payout ratio for the company to its investors.

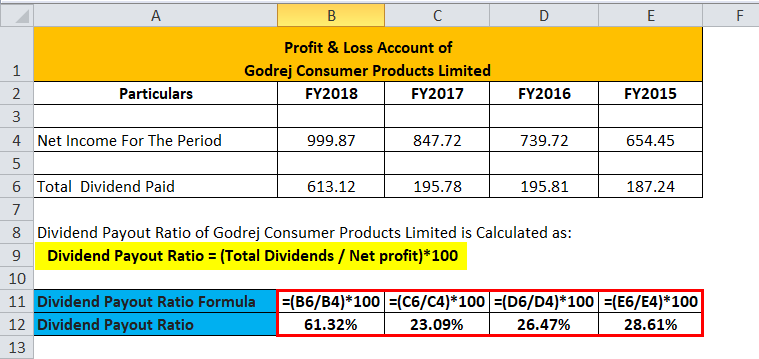

Example #3

We have considered the financial figures of Godrej Consumer Products Limited for FY2015 to FY2018 to calculate the Annual Dividend Payout Ratio

| Particulars (In INR Crs) | FY2018 | FY2017 | FY2016 | FY2015 |

| Net Profit | 999.87 | 847.72 | 739.72 | 654.45 |

| Dividends | 613.12 | 195.78 | 195.81 | 187.24 |

| Dividends Payout Ratio | 61.32% | 23.09% | 26.47% | 28.61% |

The company has distributed around 61% of its net profit in dividends to its shareholders and retained around 39% in the business. There is volatility in the company’s dividend payout from FY2015 to FY2018.

Explanation

A company pays its shareholders/investors a dividend to distribute its profit for the period as against their investments. When a company earns a profit for the period, it can retain a proportion or full of its profit in the business and pay a proportion of the profit in the form of a dividend to its shareholders. Distribution of dividends to shareholders may be in cash, or the company has a growth plan by reinvestment of dividends; it can be paid by the issue of additional shares or share repurchase at a higher price.

Many Public companies usually pay a dividend on a fixed schedule (Quarterly, half-yearly, or yearly). Still, they may declare a dividend at any point, sometimes called a special dividend (Interim Dividend), to distinguish it from the fixed schedule of dividend declarations. Often, a company doesn’t pay a dividend to the shareholders because of its expansion or growth plan.

From the income and expenditure accounts of the company, we can get the net Income for the year, and in a balance sheet, retained earnings would be found. We can check the footnotes of the company to know the dividends paid by the company for the particular year and the balance sheet to learn the retained earrings.

Significance and Use of Dividend Payout Ratio Formula

- A stock’s dividend and market price are interrelated because investors want the current dividend more than future capital gain or dividends.

- Generally, Investors prefer higher dividend payout stocks over low dividend payout stocks.

- It helps to understand the investor about the future plans of the company in the short term or long term.

- A balanced payout of dividends will help sustain the industry for a more extended period by retained profit in the up-gradation of machinery, Research and development, etc.

- Retained earnings and dividend payout are interrelated, and retained earnings help the company strengthen its net worth and lead to a comfortable capital structure.

Dividend Payout Ratio Calculator

You can use the following Dividend Payout Ratio Calculator

| Dividends per Share | |

| Earnings per Share | |

| Dividend Payout Ratio | |

| Dividend Payout Ratio = |

|

||||||||||

|

Dividend Payout Ratio Formula in Excel (With Excel Template)

Here we will do the same example of the Dividend Payout Ratio formula in Excel. It is straightforward. You need to provide the two inputs, i.e., Total Dividends and Net profit

You can easily calculate the Dividend Payout Ratio using the Formula in the template provided.

The dividend Payout Ratio of India Oil Corporation Limited is Calculated as follows:

The dividend Payout Ratio of India Godrej Consumer Products Limited is Calculated as follows:

Recommended Articles

This has been a guide to a Dividend Payout Ratio formula. Here we discuss its uses along with practical examples. We also provide a Dividend Payout Ratio Calculator with a downloadable Excel template. You may also look at the following articles to learn more –