Updated July 31, 2023

Difference Between Present Value vs Future Value

Present and future values are the terms used in the financial world to calculate the future and current net worth of money we have today with us. Business owners or investors use the concept of present value vs future value derived from the time value of money and its monetary concept in their everyday activities. It is a simple idea that whatever money is received today is worth more than money to be received one year from now or any other future date. It is important to calculate the time value of money so that the investor can distinguish between the worth of investment that offers them different returns at different times.

Present Value

Present value is nothing but how much the future sum of money is worth today. It is one of the important concepts in finance, and it is a basis for stock pricing, bond pricing, financial modeling, banking, insurance, etc. Present value provides an estimated amount to be spent today to have an investment worth a certain amount of money at a specific point. Present value is also called a discounted value. It is an indicator for investors that whatever money they will receive today can earn a return in the future. With the help of present value, method investors calculate the present value of a firm’s expected cash flow to decide whether a stock is worth investing in today.

The formula for calculating PV is shown below

Here ‘CF’ is future cash flow, ‘r’ is a discounted rate of return, and ‘n’ is the number of periods or years.

Example

Let’s say that you have been promised by someone that he will give you 10,000.00 Rs 5 year from today and the interest rate is 8%. So no, we want to know what the present value of 10,000.00 Rs which you will receive in the future so,

- PV = 10,000/ (1+0.08)5

- PV = 6805.83 (To the nearest Decimal)

So present-day value of Rs 10,000.00 is Rs 6805.83

Future Value

Future Value is the amount of money that will grow over some time with simple or compounded interest. It is one of the most important concepts of finance, and it is based on the time value of money. Investors use this method to know the future value of their investment after a certain period of time calculates based on the assumed growth rate. So future value basically tells us how much money you will get in any sort of investment in the coming future.

Future value is calculated using the formula

Here ‘PV is’ Present Value, ‘FV’ is the future Value, ‘r’ is the rate of return, and ‘n’ is the number of periods or years.

Example

Let’s see the example.

Suppose Ram is investing a sum of Rs 3000 in some fixed deposit for one year, and for the same, Ram will receive interest with a rate of 7℅. So at the end of the year, Ram will receive 3210 Rs, that is 3000 Principal plus 210 Rs interest. So we can say that Rs 3210 is today’s money’s future value, which is Rs 3000. Similarly, using the compound interest formula, we can calculate the FV of 3210 Rs after 2 years.

Diagrammatic representation of present value vs future value:

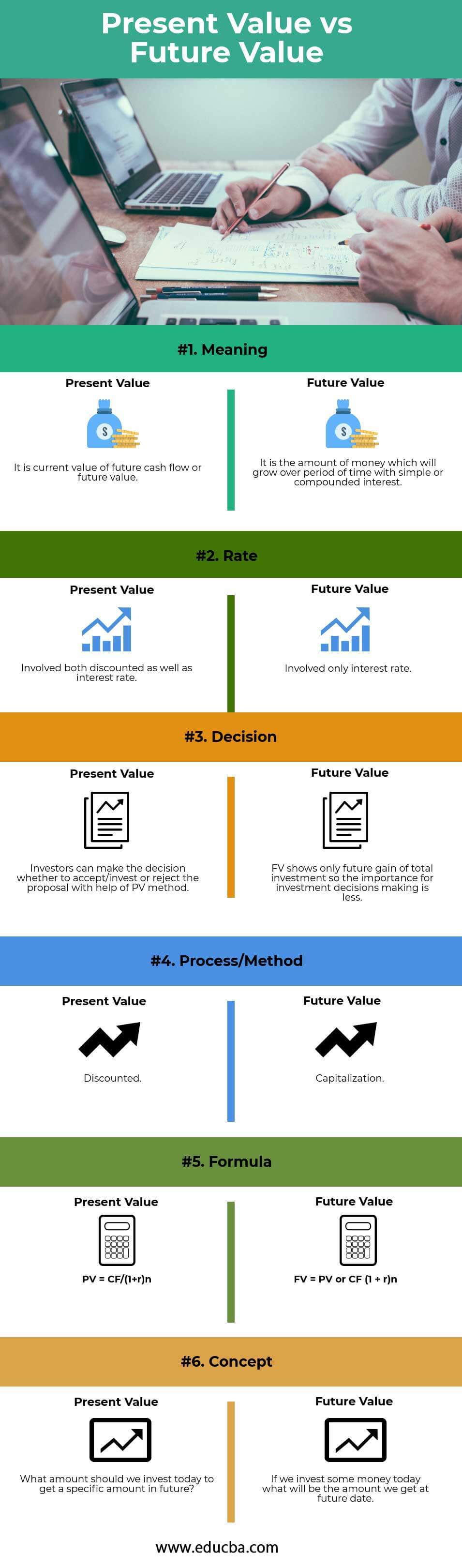

Head To Head Comparison Between Present Value vs Future Value (Infographics)

Below is the top 6 difference between Present Value vs Future Value

Key Differences Between Present Value vs Future Value

Let us discuss some major differences between Present Value and Future Value.

- Present value is the current value of future cash flow, whereas future value is the value of future cash flow after specific periods or years.

- The present value considers inflation and discounts a future sum of money, while the future value does not consider inflation and represents the actual value of a future sum of money.

- Present value involves both discounted and interest rates, whereas future value involves only interest rates.

- Present value helps investors determine whether to accept/invest or reject the proposal, whereas future value lets investors estimate how much they will gain based on the interest rate.

- The process of finding present value is called discounted, whereas the process of finding future is called capitalization.

- In the present value, the future value is given, whereas, in the case of the future value, the present value is already specified.

Present Value vs Future Value Comparison Table

Let’s look at the top 6 Comparison between Present Value vs Future Value

|

The Basis Of Comparison |

Present Value |

Future Value |

| Meaning | It is the current value of future cash flow or future value. | It is the amount of money that will grow over a period of time with simple or compounded interest. |

| Rate | Involved both discounted as well as the interest rates. | Involved only interest rate. |

| Decision | Investors can decide whether to accept/invest, or reject the proposal with the help of the PV method. | FV shows the only future gain of total investment, so tnvestment decision-making is less. important |

| Process/ Method | Discounted | Capitalization |

| Formula | PV = CF/(1+r)n | FV = PV or CF (1 + r)n |

| Concept | What amount should we invest today to get a specific amount in the future? | If we invest some money today, what will be the amount we get at the future date. |

Conclusion

So from above, it is clear that time value is the economic concept, and the calculation of present value vs future value provides basic data to the investor to make a rational investment decision. The current value is the sum of money of future cash flows. Today, the future value is the value of future cash flows at a specific date. The present value is calculated by considering inflation. In contrast, a future value is a nominal value, and it adjusts only the interest rate to calculate the future profit of the investment. There is one similarity that exists between the present value vs future value.

If the interest rate and period remain constant, then future value and present value increase or vice versa. The calculation of present value is very important for business. It allows the investor to compare the cash flow at different times. In short present value vs future value is a lump-sum payment, and a series of equal payments over equal periods of time is called an annuity.

Recommended Articles

This has been a guide to the top difference between Present Value vs Future Value. Here, we discuss the Present Value vs Future Value key differences with infographics and a comparison table. You may also have a look at the following articles to learn more.