Updated June 29, 2023

Difference Between Assessed Value vs Market Value

The following article provides an outline for Assessed Value vs Market Value. A Municipal Corporation of the district assigns a property’s assessed value to personal property or any form of owned real estate. These government bodies compare it against similar residences or properties solely for property tax collection. This tax collection procedure is an important factor in the issue of municipal bonds. Since a large portion of the revenue earned remains from the municipal bodies’ property taxes, the quality of the bond issue is directly proportionate to the ratio of assessed value and net debt of the corporation.

The valuation process determines a property’s assessed value as the buyer and seller, acting prudently and without undue influence, estimate the probable value at which they would exchange the property in an open market transaction. This estimation considers factors such as market value and potential mortgage financing options. To calculate the assessed value, you multiply the property’s market value by the assessment rate specific to your locality. For instance, if your property has a fair market value of $200,000 and your locality applies an assessment rate of 10 percent, you would multiply $200,000 by 0.10, resulting in an assessed value before exemptions of $20,000. Therefore, the assessed value would be approximately $180,000.

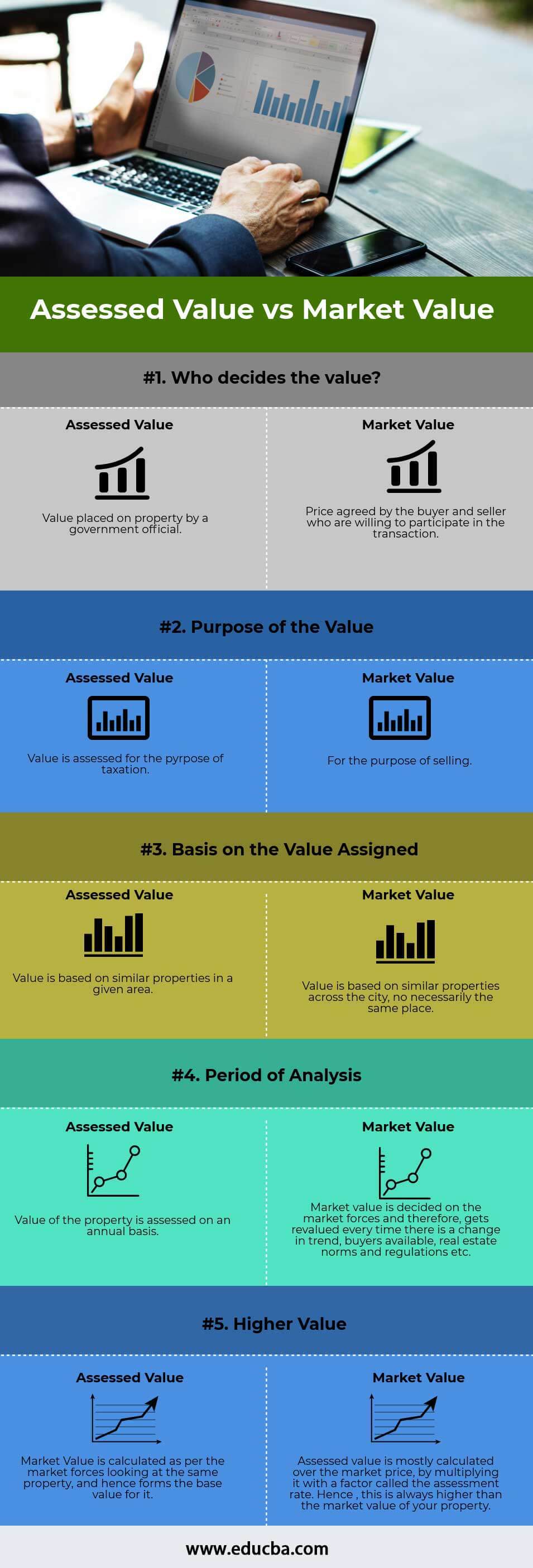

Head To Head Comparison Between Assessed Value vs Market Value (Infographics)

Below is the top 5 difference between Assessed Value vs Market Value:

Key Differences Between Assessed Value vs Market Value

Let us discuss some of the major differences between Assessed Value vs Market Value:

- Simply put, the market value of a property is the price of the property a buyer is willing to pay for, and the seller is ready to accept the same proposal. The municipal corporation of the district appoints a tax assessor to assign the assessed value, which is the value used to collect property tax.

The factors affecting the market value could be:

- External characteristics

- Internal characteristics

- Comparables

- Location

- Supply and demand

The factors affecting the assessed value

- What similar properties are selling for

- Replacement cost

- The property underwent recent improvements.

- The property is generating income in terms of rent.

- The assessed value of property usually lags the market value because the valuations done by a tax assessor are not recalculated so often or regularly. Since the tax collection is done on an annual basis, the assessment of the property for the same purpose is done around the same time and frequency. However, depending on the area you live in or have your property, every time a property is sold to a new owner, it would require a reassessment. Sometimes, the Municipal Corporation re-assesses the property only when the last value becomes outdated.

Assessed Value vs Market Value Comparison Table

Let’s look at the top 5 Comparison between Assessed Value vs Market Value

| Basis of Comparison |

Assessed Value |

Market Value |

| Who decides the value? | A value placed on a property by a government official. | Price agreed by the buyer and seller willing to participate in the transaction. |

| Purpose of the Value | Value is assessed for the purpose of taxation. | For the purpose of selling. |

| The basis on the value assigned | Value is based on similar properties in a given area. | Value is based on similar properties across the city, not necessarily the same place. |

| Period of analysis | The value of the property is assessed on an annual basis. | The market forces decide the market value and, as a result, revalue it whenever trends change, buyers become available, real estate norms and regulations change, etc. |

| Higher Value | Market Value is calculated per the market forces looking at the same property, forming its base value. | The assessment rate multiplies the market price to calculate the assessed value. Hence, this is always higher than the market value of your property. |

Conclusion

Understanding the value of a property should ideally begin with its market value. It is important to establish a clear process where the seller proposes a price, and the buyer employs their methods to assess the value and propose a fair asking price. While a property’s market value can fluctuate due to various factors, the assessed value is relatively more stable. It is crucial to note that there is no direct and definitive correlation between the two values, and the choice of which value to prioritize depends on the perspective of the party involved in the transaction. Unfortunately, this information is often misused by real estate companies and agents, who may present the higher two values as the actual property transaction price. Realtors must educate the general public about the distinctions between the Assessed Value and the Market Value of properties to enable informed decision-making.

Recommended Articles

This has guided the top difference between Assessed Value vs Market Value. Here we also discuss the Assessed Value vs Market Value key differences with infographics and a comparison table. You may also have a look at the following articles to learn more –