Updated November 23, 2023

Difference Between Actuary vs Accountant

Both Actuary vs Accountant jobs primarily need running numbers, analyzing data, financial reporting, statistical analysis, and research. An actuary must analyze statistical data and calculate insurance risks and premiums. Scenarios might be the probability of an individual making medical claims based on personal health background, the risk of property loss in a given region, or the rate of early death due to the accident and calculating the premium for the term insurance. If one enjoys working with large sets of numbers and information to find out relations between many different categories, one may consider a career as an actuary.

Accountants generally work more than actuaries, and help firms account for internal financial data like client transactions, customer transactions, investments, payroll, and other expenses. Unlike actuaries, accountants work in different industries or specific roles; however, accountants are responsible for a department’s or firm’s financial records that are correct and complete in the stipulated time.

Actuary Performs the Following Functions

- Collect and analyze the required statistical data for further analysis and study.

- Analyze the events in detail and the associated risks, which can increase the costs for the firm; for example, sudden death or a natural disaster will cause an insurance firm loss due to payments made to nominees, and insurance payments can hurt badly to the insurance company badly.

- Design and implement different business strategies like insurance investments and pension plans to minimize losses and maximize profit. The actuary has to create in-depth reports to explain the business strategies and their benefits to the company.

- Explain the reports to the shareholders, like executives, clients, and government officials.

Types of Actuaries

- Health Insurance Actuaries

- Life Insurance Actuaries

- Pension and Retirement Actuaries

- Property and Casualty Insurance Actuaries

Accountant Performs the Following Functions

- Organize and maintain accurate records

- Prepare and examine financial records

- Ensure that financial statements comply with laws and regulations

- Assess financial operations

- Compute taxes owed, prepare tax returns, and ensure prompt payment

- Advise ways to reduce costs, enhance revenues, and improve profits

Accounting is one of the most important roles in any business function; along with technical skillsets, it requires integrity in professional and business relationships and objectivity, lack of bias, and no conflict of interest between individuals and related parties.

Various career paths in accounting

- Public Accountant

- Tax Accountant

- Forensic Accountant

- Financial Accountant

- Managerial Accountant

- Financial Planner

- Internal Auditor

- Government Accountant

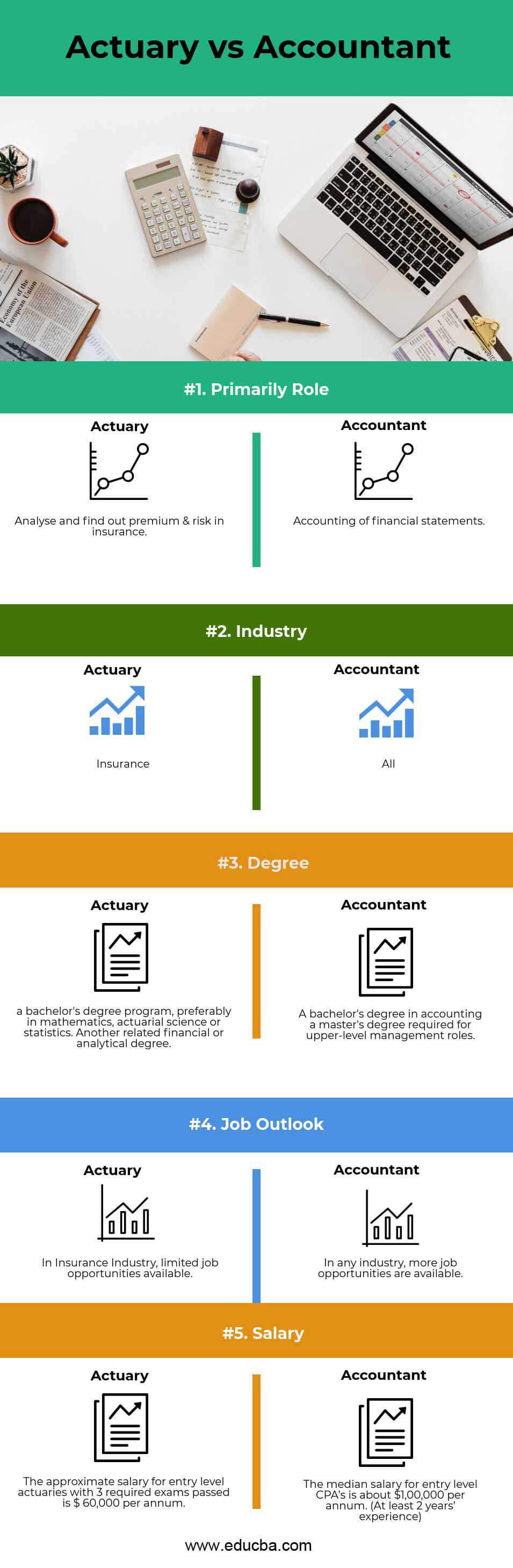

Head To Head Comparison Between Actuary vs Accountant (Infographics)

Below is the top 5 difference between an Actuary and vs Accountant

Key Differences Between Actuary vs Accountant

Both Actuary vs Accountant are popular choices in the market; let us discuss some significant differences between Actuary vs Accountant.

Actuaries are employed in insurance companies. All insurance companies will need actuaries in the background to assess and manage the risk involved in providing insurance. All company needs an accountant. Most of them have a finance department with many accountants working together for financial statement analysis and creating a financial statement. Actuaries have limited opportunities in a job but salary-wise and pay scale growth-wise, they have brighter prospects than the accountant.

Accountants have numerous opportunities in a job, but compared to actuaries, pay scale growth is limited. Still, both the Actuary vs Accountant jobs are high-paying across the countries. The demand for both Actuary vs Accountant looks very strong in the coming years. Still, a relatively smaller number of actuarial positions will be available compared to accountant positions. It also suggests that the probability of finding an accountant job will be easier than actuaries. If one goes by the actuarial route, one should have a backup plan that will allow one to gain relative experience and then switch to an actuarial job. In some cases, accountants are responsible for making the content of financial records as financial reports or year-end financial statements, or the accountant may focus on legally required financial information like taxes.

Actuary vs Accountant Comparison Table

Below are the five topmost comparisons between Actuary vs Accountant

| Parameter | Actuary | Accountant |

| Primarily Role | Analyze and find out premiums & risks in insurance. | Accounting of financial statements |

| Industry | Insurance | All |

| Degree | a bachelor’s degree program, preferably in mathematics, actuarial science, or statistics. Another related financial or analytical degree | A bachelor’s degree in accounting

a master’s degree is required for upper-level management roles |

| Job Outlook | In the Insurance Industry, limited job opportunities are available. | In any industry, more job opportunities are available. |

| Salary | The approximate salary for entry-level actuaries with 3 required exams passed is $ 60,000 per annum. | The median salary for entry-level CPAs is about $1,00,000 per annum. (At least 2 years experience) |

Conclusion

In actuary vs accountant, both professionals work on the same type of information, handle financial data, and generate statistics. Yet, both will have different business functions and serve different organizational purposes.

Almost all actuaries are employed in insurance companies, which deal mainly with risks and premiums. Actuaries will provide the mathematical probability of a future event (such as natural disasters or accidents) and advise insurance managers on minimizing any possible financial impact of untoward events. Actuaries also advise insurance firms how much premium should be charged for each different insurance product and which type of customers to ensure. They also advise on possible business profit by adding new insurance products and discontinuing existing ones.

Accountants work with organizations, handling financial transactions by recording financial information in a given time period. Accountants’ jobs might also include financial analyzing and reporting, auditing accounts, preparing tax returns, or/acting as an advisor on various financial matters related to the organization. The tasks of an accountant are more varied than those of an actuary.

Recommended Articles

This has been a guide to the top difference between an Actuary vs Accountant. We discuss the Actuary vs Accountant key differences with infographics and a comparison table. You may also have a look at the following articles to learn more.