Updated August 1, 2023

Difference Between Simple Interest vs Compound Interest

Anyone considering a loan first looks at the cost of doing so. You will look at the lowest possible rates if you want to borrow. However, from an investor’s point of view, a high rate will be beneficial.

When a lender, financial institution, or bank lends money to a borrower, they charge an extra amount to the total amount borrowed. This extra amount is termed an Interest rate. Interest charged can be of two times Simple Interest vs Compound Interest. Lenders charge simple interest only on the loan amount while they charge and calculate compound interest on both the loan amount and the accumulated interest.

In simple interest, the borrower pays the amount of the money borrowed for a fixed period of time. In compound interest, the lender adds it back to the principal amount whenever the interest is due for payment. This Simple Interest vs Compound Interest article will highlight the differences between simple and compound interest.

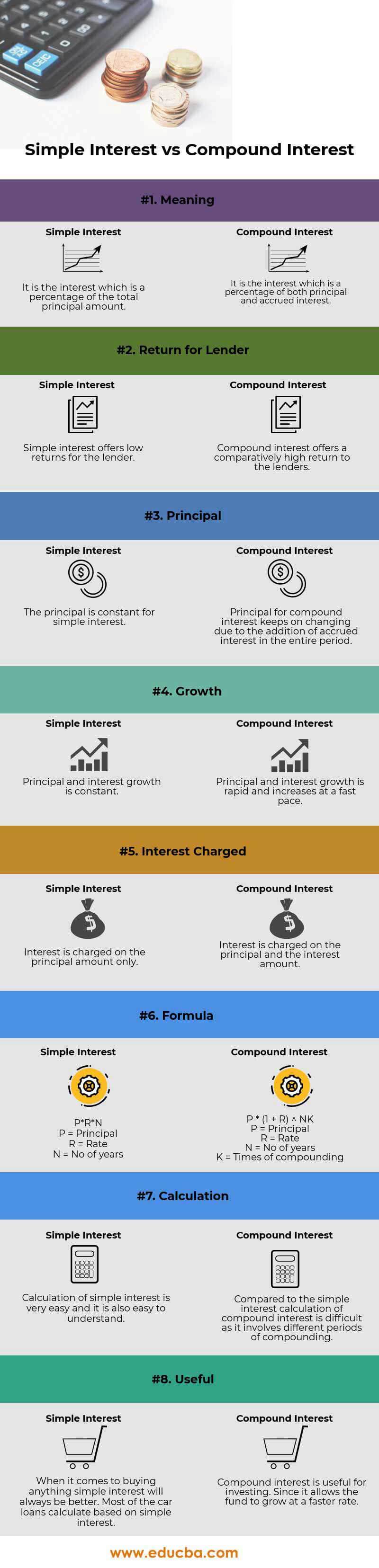

Head To Head Comparison Between Simple Interest vs Compound Interest (Infographics)

Below is the top 8 difference between Simple Interest vs Compound Interest

Key Differences Between Simple Interest vs Compound Interest

Both Simple Interests vs Compound Interest are popular choices in the market; let us discuss some of the major differences:

- Simple interest charges interest on the total principal amount taken for a specific period of time, based solely on the use of funds. Calculating simple interest is quite straightforward and the fastest way to calculate interest. An example of simple interest is car loans, which must be paid on the borrowed amount.

- Compound interest is calculated on the revised principal. The revised principal is calculated based on the interest charged on the accrued interest. The principal amount, therefore, keeps on increasing. The higher the amount of loan and periods similar will be the interest. Interest is to be paid on the principal, and the interest accrued

The time interval between the payment and the calculation is known as the Conversion Period. Below are the frequencies and how they are compounded

- 1 day – Daily

- 1 week – Weekly

- 1 month – Monthly

- 3 months – Quarterly

- 6 months – Semiannually

- 12 months – Annually

- The formula for calculating Simple interest is – P*R*N

(P = Principal, R = Rate, N = No of years)

Formula for calculating Compound interest is – P {(1 + i)n – 1}

- Return on compound interest is higher than on simple interest

- The growth rate of simple interest is lower than that of compound interest

- Calculation of simple interest is easier than on compound interest

Example of Simple Interest

If a borrower borrows $1000 from a lender @10% per annum for three years, then the interest charged will be $300, and the total amount to be paid back will be $1300. The $300 interest is charged for using the amount. The sum of interest and principal is known as the total amount. One point is that the higher the amount borrowed and the higher the number of periods, the higher the interest will be.

Comparison of the amount of Simple and Compound Interest –

Suppose John deposited Rs 1000 in the bank and gets a return of 5% per annum for a period of three years. We will now calculate the total amount he will receive at the end of the third year.

Here,

- Principal (P) = Rs 1000

- Rate (R) = 5%

- Time/Period (T)= 3 years

By using the Simple Interest Formula

- Simple Interest Calculation = (P x R x T)/100

- Simple Interest Calculation= 1000 x 5 x 3/100

- Simple Interest Calculation = 150

Now we will find out the Compound Interest by Using Compound Interest Formula.

- Compound Interest Calculation = P [(1 + R)n – 1]

- Compound Interest Calculation = 1000 x {(1 + 5/100)^3 – 1}

- Compound Interest Calculation = 157.625

Simple Interest vs Compound Interest Comparison Table

Below is the 8 topmost comparison between Simple Interest vs Compound Interest

| Basis Of Comparison |

Simple Interest |

Compound Interest |

| Meaning | It is the interest which is a percentage of the total principal amount | It is the interest which is a percentage of both principal and accrued interest |

| Return for lender | Simple interest offers low returns for the lender | The compound interest offers a comparatively high return to the lenders |

| Principal | The principal is constant for simple interest | The principal for compound interest keeps changing due to the addition of accrued interest in the entire period. |

| Growth | Principal and interest growth is constant | Principal and interest growth is rapid and increases at a fast pace |

| Interest Charged | Charged on the principal amount only | Charged on the principal and the interest amount |

| Formula | P*R*N

|

P * (1 + R) ^ NK

|

| Calculation | Calculation of simple interest is very easy, and it is also easy to understand | Compared to simple interest, compound interest calculation is difficult as it involves different compounding periods. |

| Useful | When it comes to buying anything, simple interest will always be better. Most car loans calculate based on simple interest. | Compound interest is useful for investing. Since it allows the fund to grow at a faster rate |

Conclusion

Interest can be termed as a fee for using someone else’s money. The reasons for paying interest include risk, inflation, time value of money (effect of compounding), and opportunity cost.

As the above formula explains, simple interest is easy to calculate, and compound interest is difficult and complex. As in the previous example, if we calculate both simple and compound interest for a particular time, rate, and principal, then it is observed that compound interest is always greater than simple interest due to the effect of compounding, also known as the time value of money.

Understanding these two methods’ differences will allow you to pick the right loan and find the best alternative to store your earnings. If you are a borrower and don’t want to put yourself in a long, expensive debt, you will look for a loan that does not compound. But if you are an investor who wishes to earn loads of money that you can use later, you will look for options that will compound, and the frequency is higher.

Recommended Articles

This has guided the top difference between Simple Interest vs Compound Interest. Here we also discuss the Simple Interest vs Compound Interest key differences with infographics and a comparison table. You may also have a look at the following articles to learn more.