Updated November 24, 2023

Free Cash Flow Formula (Table of Contents)

- Free Cash Flow Formula

- Free Cash Flow Formula Calculator

- Free Cash Flow Formula in Excel(With Excel Template)

Free Cash Flow Formula

Free Cash Flow can be defined as the cash flow available to the firm net of any funds invested in capital expenditure and working capital for the year.

Here’s the Free Cash Flow Formula:

Examples of Free Cash Flow Formula

Let’s take an example to find out the Free Cash Flow for a company: –

Example #1

Company A has an operating cash flow of $50000, and capital expenditure for the year is $30000. The networking capital for the year is $5000.

Hence,

The free cash flow available to the firm for the calendar year is as follows: –

- Free Cash Flow = Operating Cash Flow – Capital Expenditure – Net Working Capital

- Free Cash Flow = $50000 – $30000 – $5000

- Free Cash Flow = $15000

Hence, the Free Cash Flow for the year is $15000

Example #2

Take the example of Schlumberger, which has an operating cash flow of $300 million. The capital expenditure for the year is $50 million, and the networking capital is $125 million.

Hence,

The free cash flow available to the firm for the calendar year is as follows: –

- Free Cash Flow = Operating Cash Flow – Capital Expenditure – Net Working Capital

- Free Cash Flow = $300 million – $50 million – $125 million

- Free Cash Flow = $125 million

Hence, the Free Cash Flow For the year is $125 Million

Example #3

Take the example of Exxon Mobil, which has an operating cash flow of $550 million. The capital expenditure for the year is $100 million, and the networking capital is $175 million.

Hence,

The free cash flow available to the firm for the calendar year is as follows: –

- Free Cash Flow = Operating Cash Flow – Capital Expenditure – Net Working Capital

- Free Cash Flow = $550 million – $100 million – $175 million

- Free Cash Flow = $275 million

Hence, the Free Cash Flow for the year is $275 Million

Explanation of Free Cash Flow Formula

Free Cash Flow can be defined as the cash flow available to the firm net of any funds invested in capital expenditure and working capital for the year.

The formula for the free cash flow is

FCF = Operating Cash Flow – Capital Expenditure – Net Working Capital

- Operating Cash Flow

It can be determined in two ways: –

Operating Cash Flow = EBIT (1-t) + Depreciation and Non-cash expenses

Or

Operating Cash Flow = Net Income + Interest (1-t) + Depreciation and non-cash expenses

Where EBIT is Earnings before Interest and Taxes.

- Net Working Capital

Net working capital = Working CapitalCurrent year – Working Capitalprevious year

Working capital in any year = Accounts Receivable + Inventory – Accounts Payable

- Capital Expenditure

The capital expenditure can be determined from the Balance Sheet, Cash Flow Statement, or both.

Capex for a year = PPEcurrent year – PPEprevious year + Depreciation & Amortization

Where PPE stands for Property, Plant, and Equipment

Significance and Use

Investors majorly use Free Cash Flow to estimate the health of any company. It can provide deep insights into the firm’s financial operations and whether sufficient cash flow is present to fund future expansion. Free cash flow also indicates to the investors that ample cash flow is available with the company to reduce its debt, fund future expansion, give investors dividends, buy back stock, etc.

The company cannot utilize its capital expenditure properly if free cash flow is negative for multiple years. Alternatively, it may also mean that working capital is not managed correctly, impacting sales and the bottom line. It can also provide insights into trends, such as whether the accounts receivable and accounts payable are managed efficiently.

Free cash flow is also a vital technique to value an entire company. The Discounted Cash Flow method uses Free Cash Flow for a set number of years, either 5, 10, or so on, and then discounts those cash flows using the Weighted Average Cost of Capital to reach a specific valuation for the company. There are two types of Free Cash Flows. One is the Free Cash Flow to the firm, and the other is the Free Cash Flow to the Equity. As the name indicates, the Free Cash Flow to the firm denotes the cash flow available to the entire firm, including shareholders and debtholders. Free Cash Flow to Equity represents the cash flow available to shareholders only after subtracting debt payments to the debtholders.

Investors also use Free Cash Flow as a proxy for stock prices. The fundamental underlying principle is whether the company can generate sufficient cash for its operations. Hence, if any particular company has high or improving cash flows over the years, but its stock is sufficiently undervalued, or if there is a disparity, it is worth investing in as the market has not considered the company’s good performance.

Free Cash Flow Formula Calculator

You can use the following Free Cash Flow Formula Calculator

| Operating Cash Flow | |

| Capital Expenditure | |

| Working Capital | |

| Free Cash Flow Formula = | |

| Free Cash Flow Formula = | Operating Cash Flow – Capital Expenditure– Working Capital |

| = | 0 – 0– 0 |

| = | 0 |

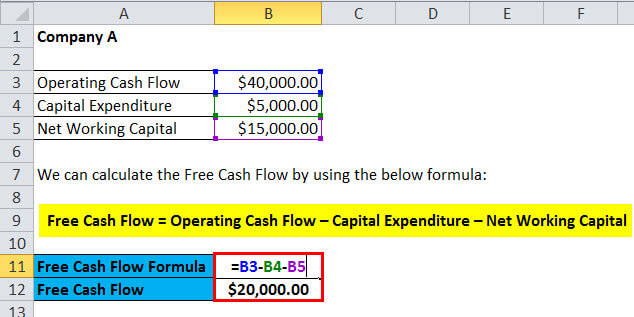

Free Cash Flow Formula in Excel (With Excel template)

Here, we will do an Excel example of the Free Cash Flow Formula. It is very easy and simple. You need to provide the three inputs, i.e., Operating Cash Flow, Capital Expenditure, and Net Working Capital

You can easily calculate the Free Cash Flow using the formula in the template provided.

Conclusion

Free Cash Flow indicates whether the company generates sufficient cash to fund its operations. It also signals that the company has the cash to reduce its debt, fund future expansion, or pay dividends to its investors. Free Cash Flow is calculated by taking net income, adding back any non-cash expenses, and subtracting capital expenditure and any changes in working capital in that year. Free Cash Flow is used in various ways, primarily by investors, to gain insights into a company’s health and value the company. If the market has not considered a company’s good performance and the stock prices do not reflect higher cash flows, it suggests that the company is a good investment opportunity.

Recommended Articles

This has guided the Free Cash Flow Formula; we discuss its uses and practical examples here. We also provide you with a Free Cash Flow calculator along with a downloadable Excel template.