Updated July 27, 2023

Dividend Formula (Table of Contents)

What is Dividend Formula?

The term “dividend formula” associated with the computation of total dividend paid out which is the share of the company’s earnings paid to the outstanding shareholders of the company in the form of dividends.

A dividend is an amount that an investor receives on his/her share from the invested company. The formula for total dividend can be derived by multiplying net income and dividend payout ratio. The dividend payout ratio can have any value in the range of 0 to 1. Mathematically, the formula is represented as,

Examples of Dividend Formula (With Excel Template)

Let’s take an example to understand the calculation in a better manner.

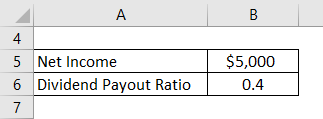

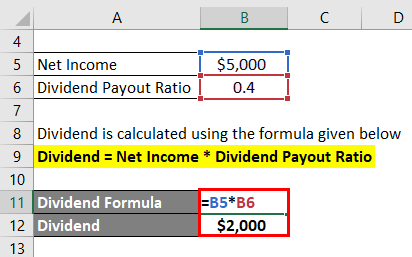

Dividend Formula – Example #1

Let us take the example of a company with a net income of $5,000 and a dividend payout ratio of 0.40. Calculate the total dividend paid out to the current shareholder of the company.

Solution:

Dividend is calculated using the formula given below

Dividend = Net Income * Dividend Payout Ratio

- Dividend = $5,000 * 0.4

- Dividend = $2,000

Therefore, the company paid out total dividends of $2,000 to the current shareholders.

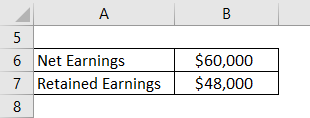

Dividend Formula – Example #2

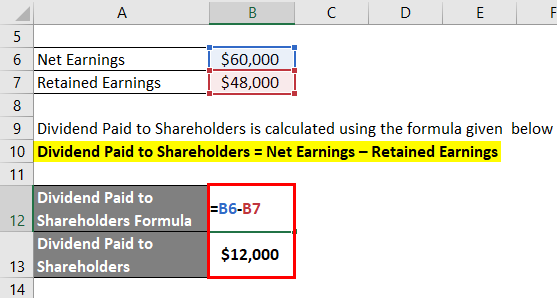

Let us take another example where the company with net earnings of $60,000 during the year 20XX has decided to retain $48,000 in the business while paying out the remaining to the shareholders in the form of dividends. Based on the given information, calculate the total dividend payout ratio of the company during the current year.

Solution:

Dividend Paid to Shareholders is calculated using the formula given below

Dividend Paid to Shareholders = Net Earnings – Retained Earnings

- Dividend Paid to Shareholders = $60,000 – $48,000

- Dividend Paid to Shareholders = $12,000

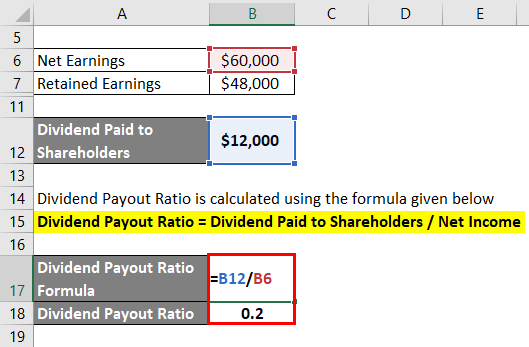

Dividend Payout Ratio is calculated using the formula given below

Dividend Payout Ratio = Dividend Paid to Shareholders / Net Income

- Dividend Payout Ratio = $12,000 / $60,000

- Dividend Payout Ratio = 0.2

Therefore, the company maintained a dividend payout ratio of 0.2 during the year 20XX.

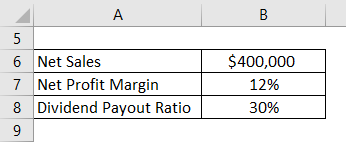

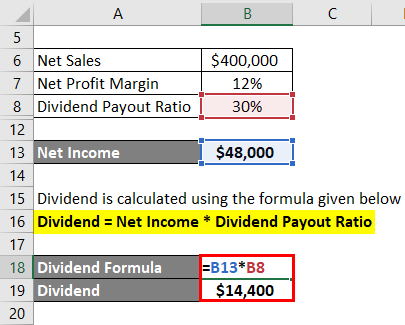

Dividend Formula – Example #3

Let us take the example of a company named ASD Ltd that has achieved net sales of $400,000 during last year. The company managed a net profit margin of 12% and historically they are known to distribute 30% of the net earnings to the shareholders in the form of dividends. Calculate the total dividend paid out to the shareholders in this company based on the given information.

Solution:

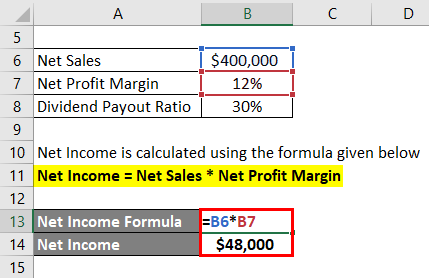

Net Income is calculated using the formula given below

Net Income = Net Sales * Net Profit Margin

- Net Income = $400,000 * 12%

- Net Income = $48,000

Dividend is calculated using the formula given below

Dividend = Net Income * Dividend Payout Ratio

- Dividend = $48,000 * 30%

- Dividend = $14,400

Therefore, the total dividend paid out to the shareholders, in this case, is $14,400.

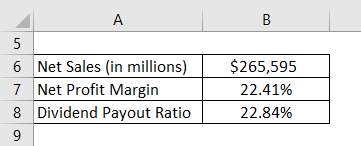

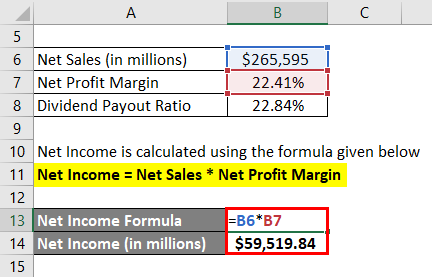

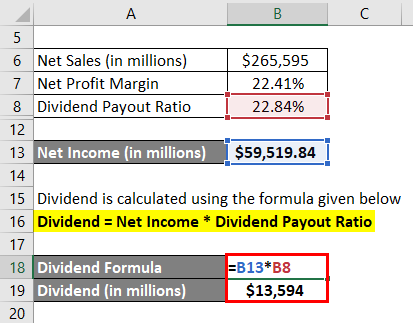

Dividend Formula – Example #4

Let us take the real-life example of Apple Inc. The company clocked net sales of $265,595 million during the year ending on September 29, 2018. The net profit margin of the company remained healthy at 22.41% and it decided to pay out 22.84% of the net earnings to the shareholders in the form of dividends. Calculate the total dividend paid out to the shareholders of Apple Inc. during the year.

Solution:

Net Income is calculated using the formula given below

Net Income = Net Sales * Net Profit Margin

- Net Income = $265,595 * 22.41%

- Net Income = $59,519.84 million

Dividend is calculated using the formula given below

Dividend = Net Income * Dividend Payout Ratio

- Dividend = $59,519.84 * 22.84%

- Dividend = $13,594 million

Therefore, the outstanding shareholders of Apple Inc. earned a total dividend of $13,594 million during the year ending on September 29, 2018.

Explanation

The formula for dividend can be derived by using the following steps:

Step 1: Firstly, determine the net income of the company which is easily available as one of the major line items in the income statement.

Step 2: Next, determine the dividend payout ratio. It basically represents the portion of the net income that the company wishes to distribute among the shareholders. Its value can be assessed from the company’s historical dividend payout trends.

Step 3: Finally, the formula for total dividend can be derived by multiplying net income and dividend payout ratio as shown below.

Relevance and Uses

The dividend formula is a very important concept for both the company and the existing and prospective investors because it helps in drawing the investors by demonstrating a company’s financial strength and well-being. Most of the investors feel delighted when offered regular dividends and view it as a source of steady cash inflow. As such, a large section of the investor community is attracted to such dividend-paying companies. Further, dividend payout is usually associated with strong companies having a positive outlook regarding their future earnings. In fact, the dividend payments can make the stocks look more attractive among the investors resulting in increased market value. However, there are companies with strong growth expectations that believe in holding back the dividend payout in order to fund internal investment requirements to grow rapidly.

Calculator

You can use the following Dividend Calculator

| Net Income | |

| Dividend Payout Ratio | |

| Dividend | |

| Dividend = | Net Income x Dividend Payout Ratio |

| = | 0 x 0 = 0 |

Recommended Articles

This has been a guide to Dividend Formula. Here we discuss How to Calculate Dividend along with practical examples. We also provide a Calculator with a downloadable Excel template. You may also look at the following articles to learn more –