Updated July 25, 2023

Shares Outstanding Formula (Table of Contents)

What is the Shares Outstanding Formula?

The term “shares outstanding” of a business refers to the number of authorized shares that are being either held by the promoters of the company or sold to the public shareholders while excluding the number of treasury stocks that have been bought back by the company itself. In other words, shares outstanding indicates the number of shares of a company available at the open market.

Please don’t confuse shares outstanding with authorized stock and issued stock as they are completely different, and shares outstanding is a subset of both authorized stock and issued stock.

The formula for shares outstanding is quite straight and simple and it can be derived by deducting the number of treasury stock from the number of issued stock of the company. Mathematically, it is represented as,

The total number of issued and treasury stock includes both common and preferred stock available in the company balance sheet.

Examples of Shares Outstanding Formula (With Excel Template)

Let’s take an example to understand the calculation of Shares Outstanding in a better manner.

Shares Outstanding Formula – Example #1

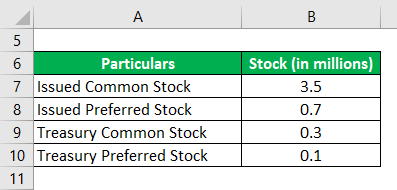

Let us consider an example of a company named KLX Inc. in order to illustrate the computation of shares outstanding. According to the balance sheet for the year 2018, the company has 5.0 million authorized common stock and 1.0 million authorized preferred stock, out of which it has issued 3.5 million common stock and 0.7 million preferred stock. During 2018, the company repurchased 0.3 million common stocks and 0.1 million preferred stocks. Based on the given information, Calculate the number of shares outstanding of the company.

Solution:

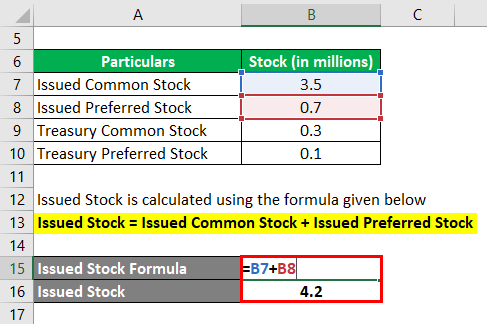

Issued Stock is calculated using the formula given below

Issued Stock = Issued Common Stock + Issued Preferred Stock

- Issued Stock = 3.5 million + 0.7 million

- Issued Stock = 4.2 million

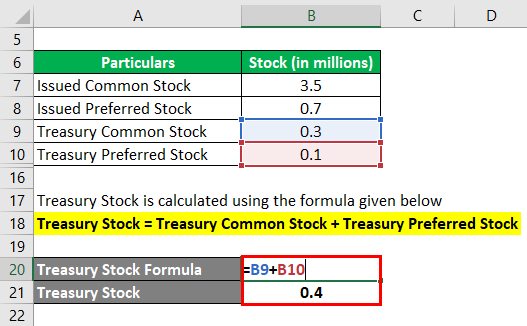

Treasury Stock is calculated using the formula given below

Treasury Stock = Treasury Common Stock + Treasury Preferred Stock

- Treasury Stock = 0.3 million + 0.1 million

- Treasury Stock = 0.4 million

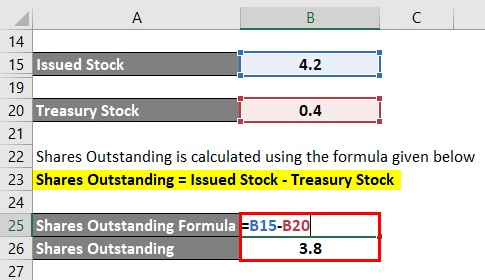

Shares Outstanding is calculated using the formula given below

Shares Outstanding = Issued Stock – Treasury Stock

- Shares Outstanding = 4.2 million – 0.4 million

- Shares Outstanding = 3.8 million

Therefore, the total number of shares outstanding for KLX Inc. at the end of the year 2018 is 3.8 million.

Shares Outstanding Formula – Example #2

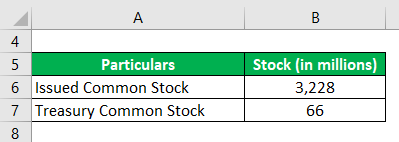

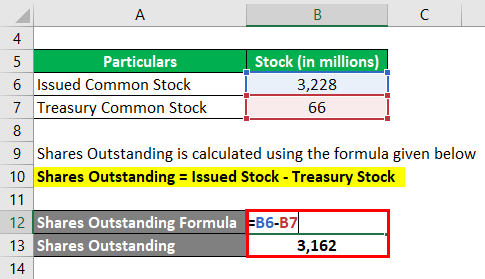

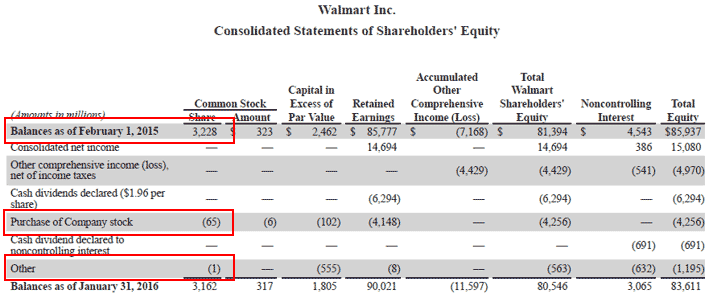

Let us take the example of Walmart Inc.’s financial for the year 2016. The opening number of issued common stock for the year was 3,228 million, while the company repurchased 66 million stock during the year. Based on the given information, Calculate the number of shares outstanding of Walmart Inc. at the end of the year 2016.

Solution:

Shares Outstanding is calculated using the formula given below

Shares Outstanding = Issued Stock – Treasury Stock

- Shares Outstanding = 3,228 million – 66 million

- Shares Outstanding = 3,162 million

Therefore, the total number of shares outstanding of Walmart Inc. at the end of the year 2016 is 3,162 million.

Source: Walmart Annual Reports (Investor Relations)

Shares Outstanding Formula – Example #3

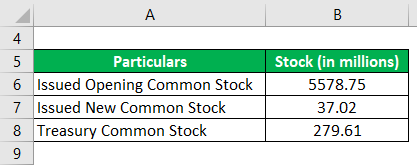

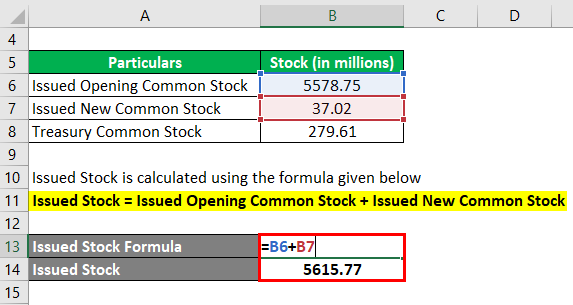

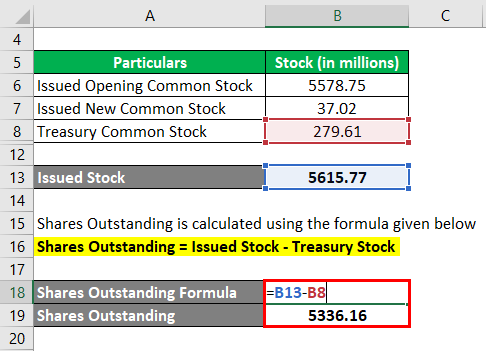

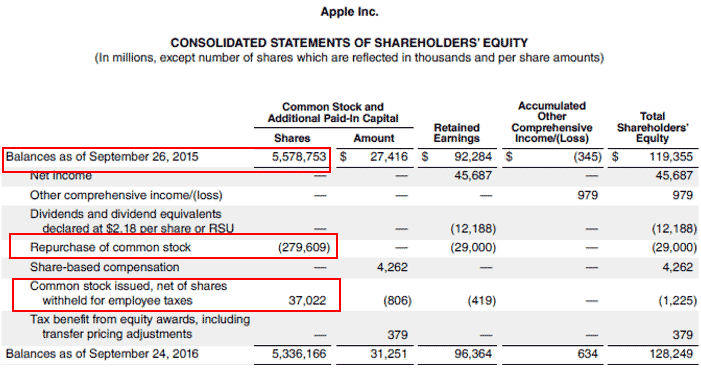

Let us take the example of Apple Inc.’ to explain slightly different kinds of calculations. During 2016, the company repurchased 279.61 million common stock and issued fresh 37.02 million common stock. Calculate the number of shares outstanding of Apple Inc. at the end of the year 2016 if the opening number of issued common stock for the year was 5,578.75 million.

Solution:

Issued Stock is calculated using the formula given below

Issued Stock = Issued Opening Common Stock + Issued New Common Stock

- Issued Stock = 5,578.75 million + 37.02 million

- Issued Stock = 5,615.77 million

Shares Outstanding is calculated using the formula given below

Shares Outstanding = Issued Stock – Treasury Stock

- Shares Outstanding = 5,615.77 million – 279.61 million

- Shares Outstanding = 5,336.16 million

Therefore, the total number of shares outstanding of Apple Inc. at the end of the year 2016 is 5,336.16 million.

SourceLink: Apple Inc. Balance Sheet

Explanation

The formula for shares outstanding can be derived by using the following steps:

Step 1: Firstly, note from the balance sheet the number of common stock and preferred stock issued by the company. They are provided as a separate line item under equity capital.

Issued Stock = Issued Common Stock + Issued Preferred Stock

Step 2: Next, note the number of shares purchased back by the company over the period of time. They are known as treasury stock are also reported as separate line items under equity capital.

Treasury Stock = Treasury Common Stock + Treasury Preferred Stock

Step 3: Finally, the formula for shares outstanding can be derived by deducting the number of treasury stock (step 2) from the number of issued stock (step 1) as shown below.

Shares Outstanding = Issued Stock – Treasury Stock

Relevance and Use of Shares Outstanding Formula

From the point of view of an investor, it is essential to understand the concept of shares outstanding as it is primarily used in the calculation of market capitalization, earnings per share (EPS), cash flow per share, etc.

The number of shares outstanding increases with the issue of new shares and stock split, while it decreases with share re-purchase and reverses split.

Shares Outstanding Formula Calculator

You can use the following Shares Outstanding Formula Calculator

| Issued Stock | |

| Treasury Stock | |

| Shares Outstanding | |

| Shares Outstanding = | Issued Stock – Treasury Stock |

| = | 0 – 0 |

| = | 0 |

Recommended Articles

This is a guide to Shares Outstanding Formula. Here we discuss how to calculate shares outstanding along with practical examples. we also provide an interest calculator with a downloadable excel template. You may also look at the following articles to learn more –