Updated July 28, 2023

Market to Book Ratio Formula (Table of Contents)

- Market to Book Ratio Formula

- Examples of Market to Book Ratio Formula (With Excel Template)

- Market to Book Ratio Formula Calculator

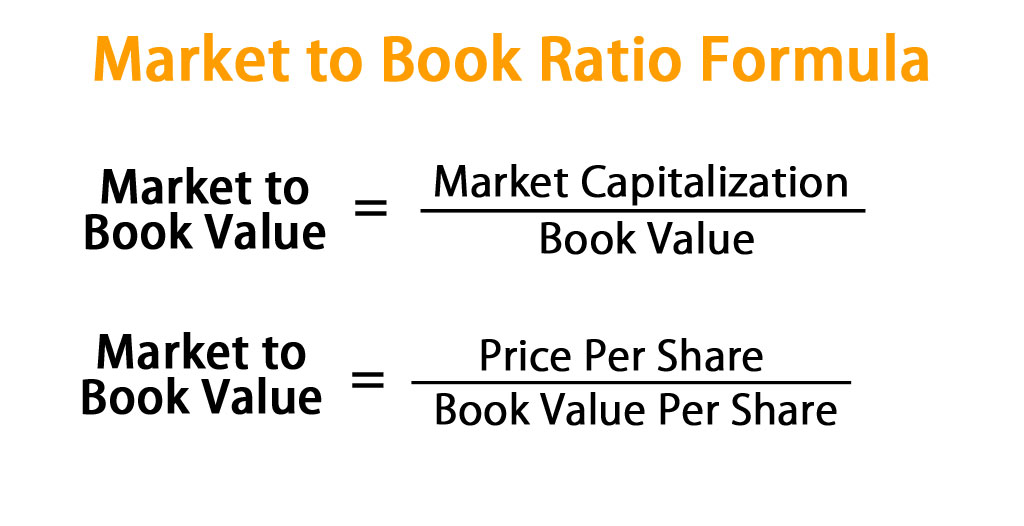

Market to Book Ratio Formula

Market Value is the total value of the shares outstanding in the market. In other words, it is a company’s market capitalization at a given time.

Therefore, it can be calculated as:

On the other hand, book value is the value per the books of the accounts of a given company. Therefore, it could be understood as the shareholder’s equity capital or the total assets of a company, less total liabilities, intangible assets, and preferred share capital. Hence, it is calculated as shown below:

Or,

Hence, there are two formulas for calculating the Market to book value.

Related Courses

Finance for Non-Finance Managers Course (7 Courses)Investment Banking Course (123 Courses, 25+ Projects)Financial Modeling Course (7 Courses, 14 Projects)

Or,

Examples of Market to Book Ratio Formula (With Excel Template)

Let’s take an example to understand the calculation of the Market to Book Ratio in a better manner.

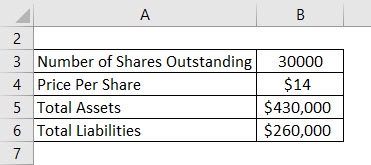

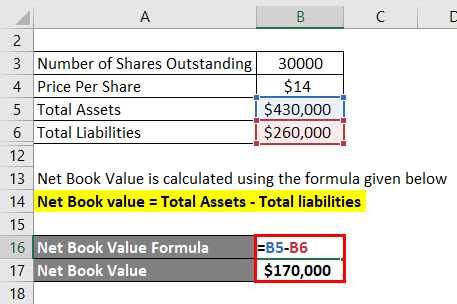

Market to Book Ratio Formula – Example #1.

Below is a general example of a company calculating the Market to Book Value ratio.

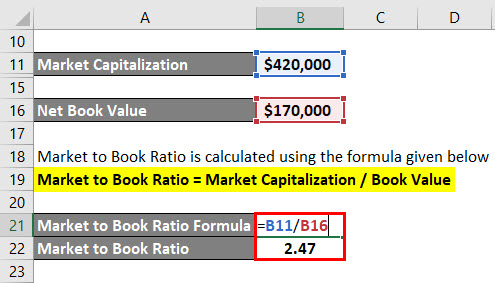

Market Capitalization is calculated using the formula given below

Market Capitalization = Price Per Share * Total Shares Outstanding

- Market Capitalization = $14 * 30000

- Market Capitalization = $420,000

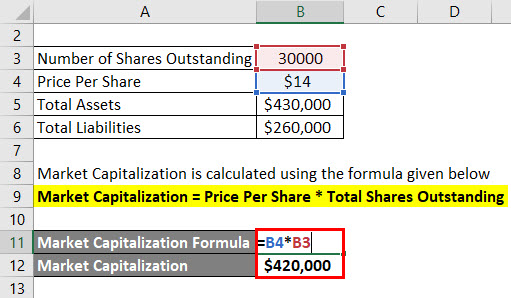

Net Book Value is calculated using the formula given below

Net Book Value = Total Assets – Total liabilities

- Net Book Value = $430,000 – $260,000

- Net Book Value = $170,000

Market to Book Ratio is calculated using the formula given below

Market to Book Ratio = Market Capitalization / Book Value

- Market to Book Ratio = $420,000 / $170,000

- Market to Book Ratio = 2.47

Market to Book Ratio Formula – Example #2

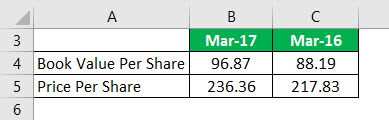

Calculate the Market to Book Value Ratio from the following information.

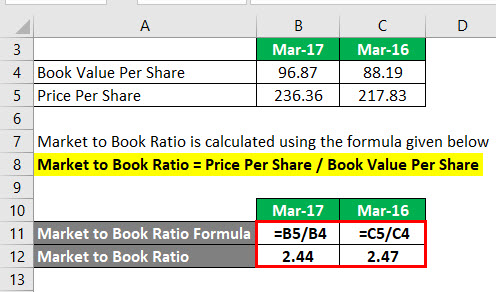

Market to Book Ratio is calculated using the formula given below

Market to Book Ratio = Price Per Share / Book Value Per Share

For March 2017

- Market to Book Ratio = 236.36 / 96.87

- Market to Book Ratio = 2.44

For March 2016

- Market to Book Ratio = 217.83 / 88.19

- Market to Book Ratio = 2.47

A lower price to book ratio is helpful for investors to pick a stock or a company to invest in. A lower ratio is indicative of what the company is valued lower than when compared to 2017. From 2016 to 2017, the company has attracted more investors for which the price per share is seen to increase.

A higher share price along with a reduced or lower asset value is actually providing higher returns on the assets. It is because a growth opportunity or any good news for the company is foreseen by the market and is pulling the share price up.

Market to Book Ratio Formula – Example #3

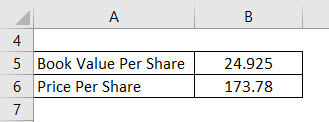

Calculate the Market to Book Value ratio from the following information.

Method #1

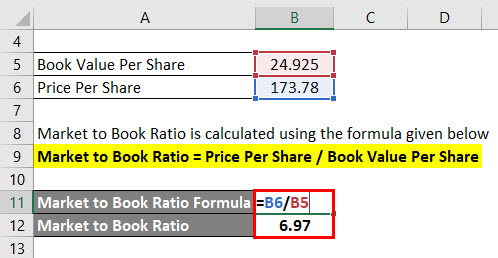

Market to Book Ratio is calculated using the formula given below

Market to Book Ratio = Price Per Share / Book Value Per Share

- Market to Book Ratio = 173.78 / 24.925

- Market to Book Ratio = 6.97

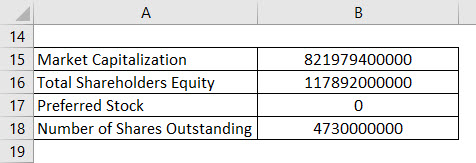

Method #2

Book Value is calculated using the formula given below

Book Value = Total Shareholders Equity – Preferred Stock

- Book Value = 117892000000 – 0

- Book Value = 117892000000

Market to Book Ratio is calculated using the formula given below

Market to Book Ratio = Market Capitalization / Book Value

- Market to Book Ratio = 821979400000 / 117892000000

- Market to Book Ratio = 6.97

The two ways of calculating the same ratio are depicted above using the example of the company- Apple Inc. The first method shows the per share data; hence, we can calculate the Price to Book Ratio. The second method is when we do not arrive at or use the per share items; hence, we are using the Market Capitalized value as of the date which is 31st Dec 2018, and the total book value, which is the Total Shareholders’ capital less the preferred capital.

Explanation

The market to book value ratio is calculated by dividing the current market price per share by the book value per share per the company’s most recent quarter.

This ratio is used by the investors and other stakeholders to understand how the company is performing or the market’s perception about the company and particular, stock. It is used to denote how much equity the investors are paying for each value in net assets. It is, simply, the amount of money that a shareholder is liable to receive if the company goes into liquidation.

Relevance and Uses of Market to Book Ratio Formula

A lower Market to Book Value ratio when compared to peers or its own previous periods indicates that the stock is undervalued. This is a good sign wherein it can attract more and more growth opportunities. A higher Market to Book Value indicates overvaluation of the stock. It implies that the investors are expecting the management to create more value from the total set of the assets available.

This ratio is preferred by many investors as it provides a relatively stable parameter that can be compared to the market price of a stock. The amount and the usage vary from industry to industry. Industries that require more infrastructure capital will mostly trade at lower ratios. However, just like most other company ratios, the Market Book Value ratio does not provide any information on a firm’s ability to generate profit or other benefits for its investors and other stakeholders.

Market to Book Ratio Formula Calculator

You can use the following Market to Book Ratio Calculator

| Market Capitalization | |

| Book Value | |

| Market to Book Value | |

| Market to Book Value | = |

|

|

Recommended Articles

This is a guide to Market to Book Ratio formula. Here we have discussed how to calculate Market to Book Ratio along with practical examples. We have also provided a Market to Book Ratio calculator with a downloadable excel template. You may also look at the following articles to learn more –

- Guide to Net Realizable Value Formula

- Examples of Debt Service Coverage Ratio Formula

- Calculator For Capital Employed Formula

- How to Calculate Price Elasticity?

- Calculator For Accumulated Depreciation Formula

- Shares Outstanding Formula

- Depreciation Formula | Examples with Excel Template