What is the Depreciation Formula?

Depreciation is the decrease in the value of a fixed asset, like a building or equipment, over its lifetime until it becomes worthless or reaches a minimal value.

The basic depreciation formula is:

Imagine you have a brand-new car that you just bought. With time, as you use the car, its value decreases. The more you drive it, the more it gets older, and it might not look as new and shiny anymore. After a few years, if you decide to sell it, people may not be willing to pay the same price you did because it’s no longer a brand-new car.

This decrease in the value of the car over time is called depreciation. Your car loses value as you drive it more due to factors like it gets scratches/dents, it loses demand, etc.

Depreciation is an important concept in the business world, as companies need to monitor it due to its impact on their finances. For instance, if a company wants to sell machinery it bought a few years ago, it must consider its depreciated value. This value estimates what the company can anticipate receiving from the sale. Companies have various options when it comes to calculating depreciation. They can choose from a range of formulas specifically designed for this purpose.

There are four primary formulas involved, and we will explore them one by one with examples for better understanding.

Depreciation Formula Types

1. Straight-Line Method

This is the easiest way of calculating how much value something loses each year. It’s like how using a laptop too much over time makes it less valuable. At the end of using that item, it is worth nothing or very less. We call this value the “residual value.”

The straight-line method gives us the amount of value the item loses each year. According to this method, the item’s value goes down by the same amount each year until it reaches zero.

The formula is:

Depreciation = ——————————————

Useful Life of Asset

Where,

- Asset Cost is the initial cost or purchase price of the asset.

- Residual Value is the estimated value of the asset at the end of its useful life.

- The useful Life of an Asset is the expected period over which the asset will be in use.

2. Unit of Production Method

It is a way to calculate how much value something loses based on how much it’s used or how many units it produces. Instead of just looking at the time we have used the product, we look at how much work it does.

For example, if you have a gas cylinder that can make a total of 10,000 cups of tea. We can find out how much value the cylinder loses after producing each new cup of tea. Each time we make tea, it loses a little bit of its value. By the time it has made all 10,000 cups, it has lost all of its value.

The formula is:

Depreciation = —————————————- x Units Produced

Life-Time Production

Where,

- Life-Time Production is the expected total production output or usage of the asset throughout its useful life.

- Units Produced are the actual number of units produced or the level of usage of the asset.

3. Double Declining Balance Method

The double declining balance method is a way to figure out how much something loses value each year. This method helps us see that some things lose value quickly at the beginning and slower later on.

Let’s say you buy a dress for $500 and wear it for 4 years. In the first year, it loses a lot of value and becomes worth $300 (a decrease of $200). Then, in the second year, it loses more value and becomes worth $150 (a decrease of $150). By the third year, it’s only worth $50 (a decrease of $100); after the fourth year, it has no value left.

The formula is:

Depreciation = 2 x ——————————————————–

Useful Life of Asset

Where,

- Accumulated Depreciation is the total depreciation expense recognized over the asset’s life up to a specific point in time.

4. Sum-of-years’ Digits

In this method, we assign the item’s total loss of value over the time that we use it. This method gives more loss in the beginning and less loss later on, making it go down gradually. To do this, we add the numbers from 1 to the estimated useful life. For example, if the life is 6 years, we add 1 + 2 + 3 + 4 + 5+6, which is 21.

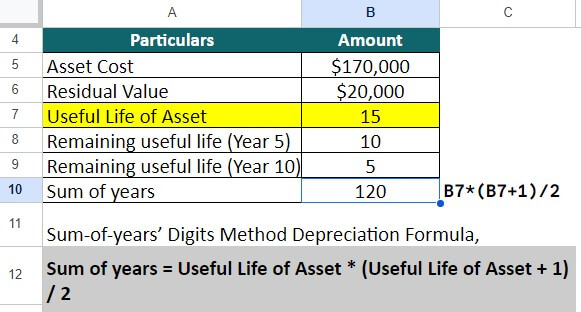

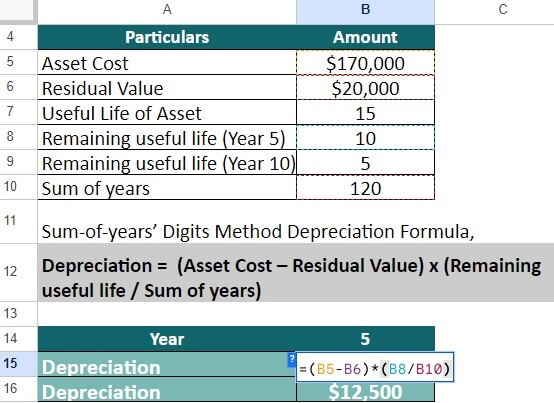

The formula is:

Depreciation = (Asset Cost – Residual Value) x ———————————

Sum of years

Where,

- Remaining Useful Life is the number of years the asset is expected to be useful from the current accounting period onwards.

- The sum of Years is the sum of the digits representing the years of the asset’s useful life (e.g., for a 5-year useful life, the sum of years is 1+2+3+4+5 = 15). Moreover, you can also use the formula: Useful Life of Asset x (Useful Life of Asset + 1) / 2 for quick calculation.

Examples of Depreciation Formula (With Excel Template)

Let us solve a few examples to easily understand how to calculate Depreciation using each formula.

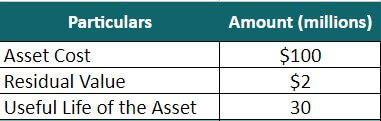

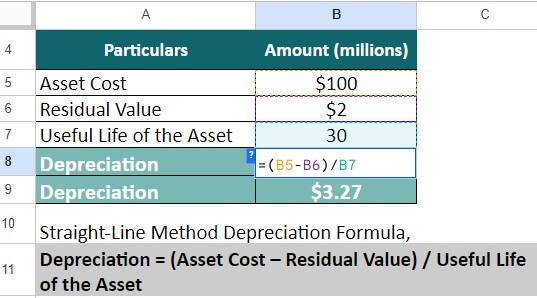

Example #1 Straight-Line Method – Depreciation of an Aircraft

An airline purchases a new airplane for $100 million. Its useful life is 30 years, and its residual value is $2 million. Calculate the depreciation for the 10th and 20th years.

Given,

Solution:

Let us calculate depreciation using the following straight-line method formula,

= ($100 million – $2 million) / 30 = $3.27 million

In this method, the calculated depreciation expense will remain the same for all the years until the end of its useful life. Thus, the asset’s depreciation for years 10 and 20 is $3.27 million.

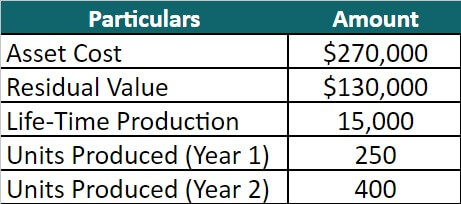

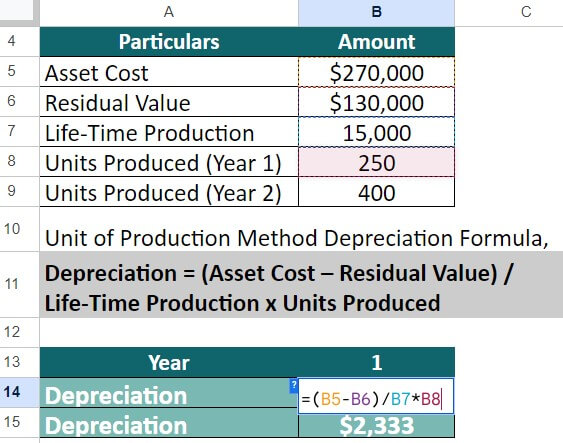

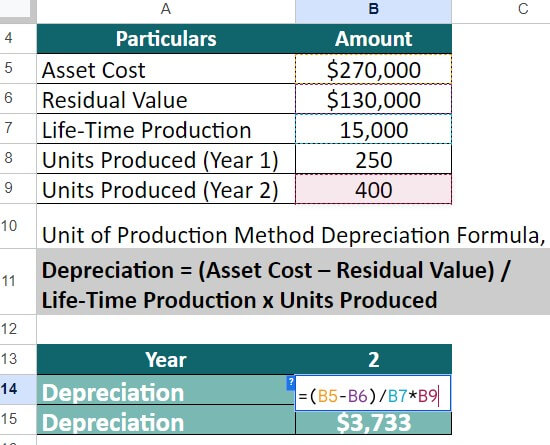

Example #2 Unit of Production Method – Mining Instrument

A company purchases a mining instrument for $270,000; its residual value is $130,000. As per the company, the device can mine 15,000 tons of minerals. Calculate the depreciation expense of the instrument for the first two years.

Let us assume that the equipment mines for 250 tons in the first year and 400 tons in the second year.

Given,

Solution:

Find out the depreciation expense using the below formula,

Year 1: Depreciation = ($270,000 – $130,000) / 15,000 x 250 = $2,333

Year 2: Depreciation = ($270,000 – $130,000) / 15,000 x 400 = $3,733

Therefore, the asset depreciates by $2,333 in the first year and $3,733 in the second year.

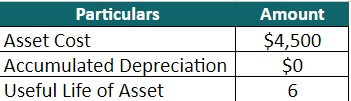

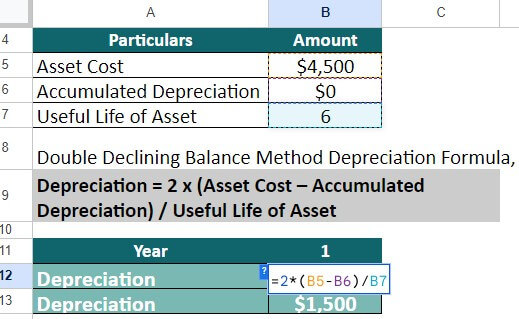

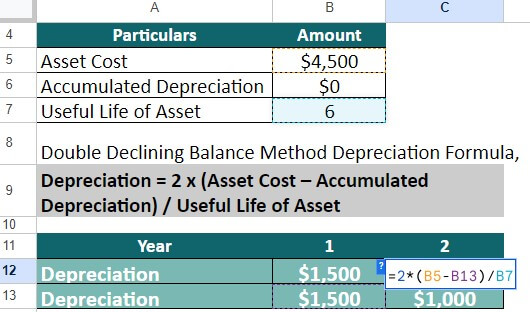

Example #3 Double Declining Balance Method – Technology

A startup Firm sets up a network server system that costs $4,500. Its useful life is 6 years. Calculate the new technology’s depreciation for the first two years.

Given,

Solution:

Let us determine the depreciation for the asset using the formula,

Year 1: Depreciation = 2 x ($4,500– 0) / 6 = $1,500

Year 2: Depreciation = 2 x ($4,500 – $1,500) / 6 = $1,000

As per the double declining method, the asset’s depreciation expense in years 1 and 2 are $1,500 and $1,000, respectively.

Example #4 Sum-of-years’ Digits Method – Farming Vehicle

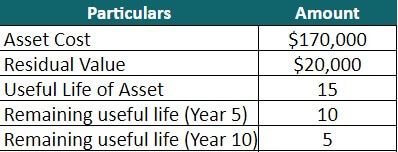

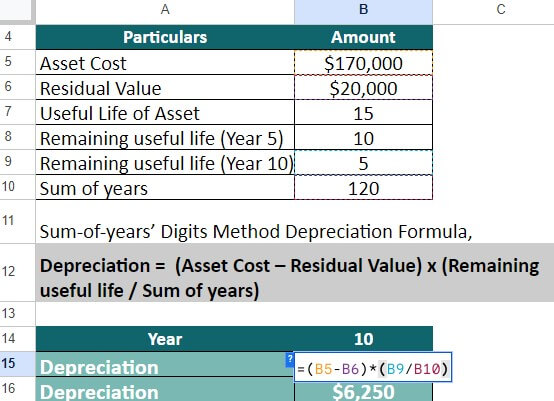

A New York farmer, Alicia, purchases a tractor for her wheat farm. She gets the tractor for $170,000 with a residual value of $20,000; its useful life is 15 years. Calculate its depreciation for the 5th and 10th years.

Given,

Solution:

- The sum of years will be,

= 15 x (15+1)/2 = 120

- Let us compute the asset’s depreciation value for years 1 and 2 using the given formula,

Year 1: Depreciation = ($170,000 – $20,000) x (10/120) = $12,500

Year 2: Depreciation = ($170,000 – $20,000) x (5/120) = $6,250

The depreciation for year 5 is $12,500, and for year 10 is $6,250.

Example #5 All Methods – Plant Machinery

In this example, let us calculate the depreciation for an asset using all four depreciation formulas.

Let us take the example of plant machinery worth $3,500,000. It has an estimated useful life of 10 years and a residual value of $200,000. Moreover, the machinery is expected to produce 200,000 units over its useful life of 10 years. Calculate the depreciation for the first 2 years.

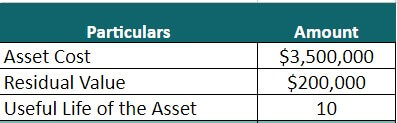

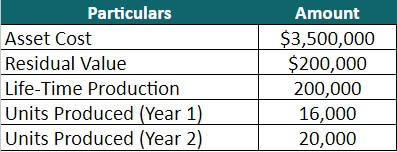

1. Straight-Line Method

Given,

Solution:

We will calculate depreciation using the following formula,

= ($3,500,000 – $200,000) / 10 = $330,000

As the calculated depreciation expense is the same for all years, the asset’s depreciation for years 1 and 2 is $330,000.

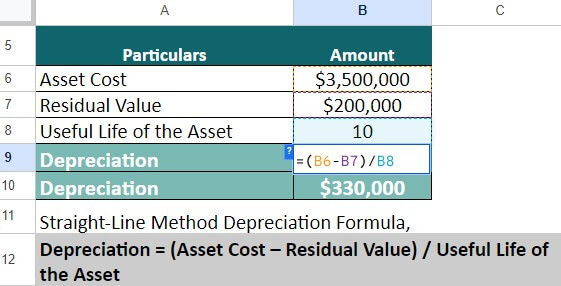

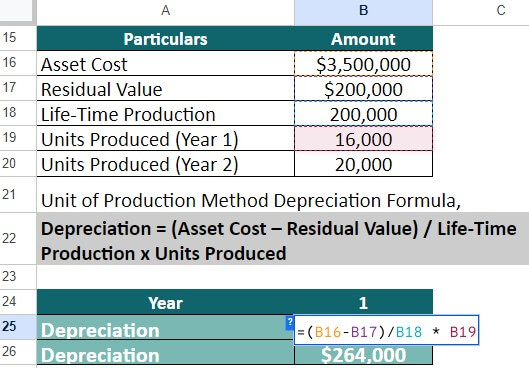

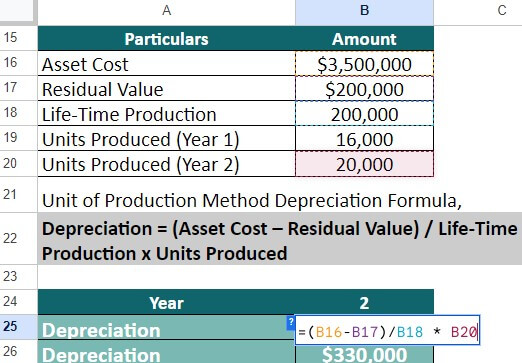

2. Unit of Production Method

Let us assume that the machinery produces 16,000 units in year 1 and 20,000 units in year 2.

Given,

Solution:

Find out the depreciation expense using the below formula,

Year 1: Depreciation = ($3,500,000 – $200,000) / 200,000 x 16,000

= $264,000

Year 2: Depreciation = ($3,500,000 – $200,000) / 200,000 x 20,000

= $330,000

Therefore, the asset depreciates by $264,000 in the first year and $330,000 in the second year.

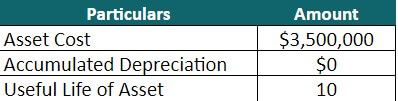

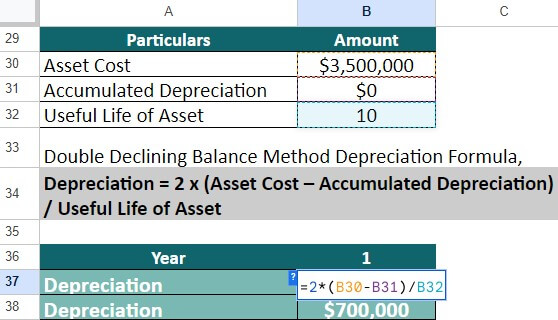

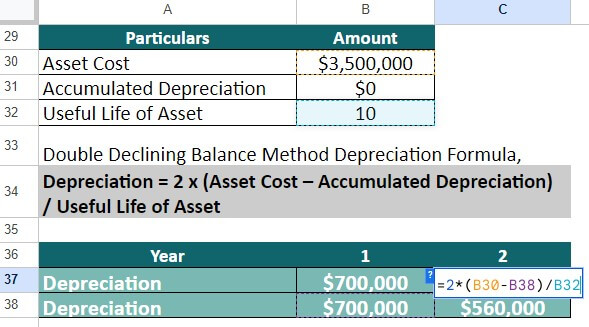

3. Double Declining Balance Method

Given,

Solution:

Let us determine the depreciation for the asset using the formula,

Year 1: Depreciation = 2 x ($3,500,000 – 0) / 10 = $700,000

Year 2: Depreciation = 2 x ($3,500,000 – $700,000) / 10 = $560,000

As per the double declining method, the asset’s depreciation expense in years 1 and 2 are $700,000 and $560,000, respectively.

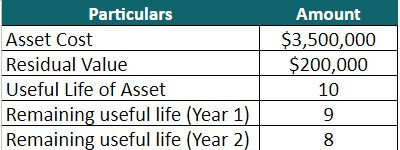

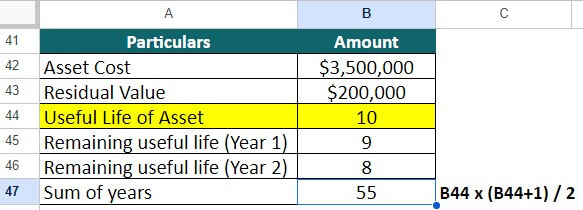

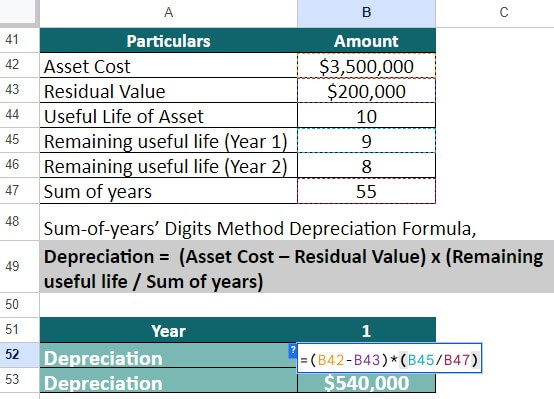

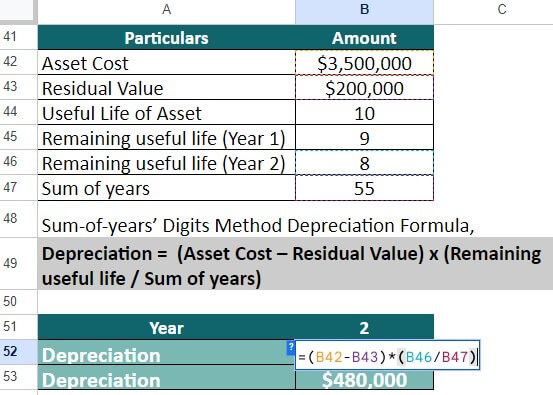

4. Sum-of-years’ Digits Method

Given,

Solution:

- First, let us calculate the sum of years’ value. Use the following formula for that,

= 10 x (10+1)/2 = 55

- Let us compute the asset’s depreciation value for years 1 and 2 using the given formula,

Year 1: Depreciation = ($3,500,000 – $200,000) x (9/55) = $540,000

Year 2: Depreciation = ($3,500,000 – $200,000) x (8/55) = $480,000

As per the sum of years’ formula, the depreciation for the machinery is $540,000 in the first year and $480,000 in the second year.

Depreciation Formula Calculator

Use the following calculator for the depreciation formula.

| Asset Cost | |

| Residual Value | |

| Useful Life of Asset | |

| Depreciation = | |

| Depreciation = | (Asset Cost - Residual Value) / Useful Life of Asset |

| = | (0 - 0) / 0 = 0 |

Importance of Depreciation Formula

The depreciation formula is important for various reasons, such as:

1. Clear Financial Reporting:

It helps companies report their financial information accurately. Depreciation spreads the cost of an asset over its useful life. This way, companies can recognize their expenses in the correct period, which gives a true picture of how well the company is doing.

2. Matching Expenses:

The depreciation formula follows a rule called the matching principle. This principle says that firms should recognize their expenses in the same period in which they help generate revenue. For example, if a $100 printer helps a graphic designer earn $500 in 2023. They should recognize the deprecation of that printer in that year only.

3. Valuing the Asset:

As assets get older or become less valuable, their fair market value goes down. The depreciation formula helps show this decrease in value over time. It allows companies to account for the lower worth of the asset, which is essential for showing the correct value of assets on the balance sheet.

4. Tax Rules:

In many places, businesses can deduct depreciation expenses from their taxable income. This reduces the amount of tax they have to pay. Using the depreciation formula helps calculate these deductible expenses.

5. Planning Investments:

The depreciation formula is also useful for planning and deciding on long-term investment projects. This process is called capital budgeting. By considering the depreciation expense, companies can understand the cash flows related to an asset and make smart choices about how they spend their money.

Limitations of the Depreciation Formula

Here are the key limitations of the depreciation formula:

1. Simplified assumption:

The depreciation formula makes very simple guesses about how long an asset will be useful and how much value it will lose. But, in reality, all of this depends on the item, how much we use it, how we take care of it, etc. So, the formula can give unrealistic values.

2. Ignores salvage value:

The formula assumes that at the end of an item’s useful life, it has no value left. But, sometimes, even after using an item for a very long time, it is possible that the item still has value. Finding another use for that item is also possible, which the formula does not consider.

3. Non-monetary factors:

The formula only thinks about how much value an item loses. It does not consider that things can go out of fashion or the demand for that item can fall. Like when a new iPhone is released, the demand for an old iPhone falls, but it does not mean the phone loses its value.

Frequently Asked Questions (FAQs)

Q1. Can the depreciation formula be applied to all types of assets?

Answer: The depreciation formula primarily applies to tangible assets such as buildings, equipment, and vehicles. Intangible assets, like patents or copyrights, may require different methods, such as amortization. Each asset type has specific rules and guidelines for depreciation.

Q2. Can the depreciation formula be changed once it is selected?

Answer: Generally, once you choose and apply a depreciation formula, you should keep it the same. However, suppose there is a change in accounting standards or a significant change in the asset’s useful life or expected usage. In that case, you can change the method you are using. Nonetheless, changes in the depreciation formula may require prior approval or disclosure.

Q3. How is depreciation recorded in financial statements?

Answer: Companies record the depreciation expense on the income statement as an operating expense. Simultaneously, companies record the accumulated depreciation, which represents the cumulative depreciation over time, as a contra-asset account on the balance sheet to reduce the asset’s carrying value.

Q4. Is depreciation a DR or CR?

Answer: Depreciation is an expense, which means it is typically recorded as a debit (DR) entry. The debit entry for depreciation increases the expense account and reduces the net income.

Simultaneously, the accumulated depreciation is a contra-asset account on the balance sheet, representing the cumulative depreciation charged against the asset. The accumulated depreciation account is a credit (CR) entry.

Recommended Articles

This article describes the 4 Depreciation Formulas and explains each with the use of Excel examples. We have also added a downloadable Excel template for your use. You can see the following articles to learn more,