Capital Employed Formula

We can calculate Capital Employed by using 2 formulas:

Capital Employed Formula #1

Capital Employed Formula #2

Where,

- Total Assets: the total assets owned by a business entity or an individual. The owner expends economic value items over time to benefit from assets, which, if the assets belong to a business, the accounting records usually record, and the balance sheet reflects them as either current or long-term assets. A few categories in which assets can be classified are Cash, Marketable securities, Inventory, Accounts receivable, Prepaid expenses, Fixed assets, Intangible assets, etc.

- Current Liability: it is a company’s obligation that is due within a period of one year or in an operating cycle. Moreover, current liabilities are paid using a current asset, such as cash or new current liability. Current liabilities appear on the company’s balance sheet and can be classified as short-term debt, accrued liabilities, accounts payable, etc.

- Non-Current Assets: it is the company’s long-term investments for which the total is not realized within an accounting year. Non-current assets include plant & machinery, property, patents & investments in other companies, etc. Noncurrent assets appear in the company’s balance sheet.

- Working Capital: it is the difference between Current assets & current liabilities. It is used in the day-to-day operations and transactions of the company.

Examples of Capital Employed Formula

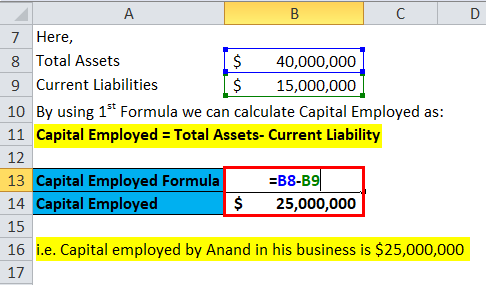

All the figures utilized for Capital Employed calculation can be found on the company’s balance sheet.

Capital Employed Calculation using 1st Formula

Suppose we want to calculate the amount of Capital Anand employs in his business. We can get the required information in the balance sheet for calculating the capital. The balance sheet of Anand Group Private Limited states that it has Total Assets of $40,000,000 and Current Liabilities of $15,000,000.

Now, we can calculate Capital Employed as:

- Capital Employed = Total Assets- Current Liability

- Capital Employed = $40,000,000 – $15,000,000.

- Capital Employed = $25,000,000

i.e. Capital employed by Anand in his business is $25,000,000.

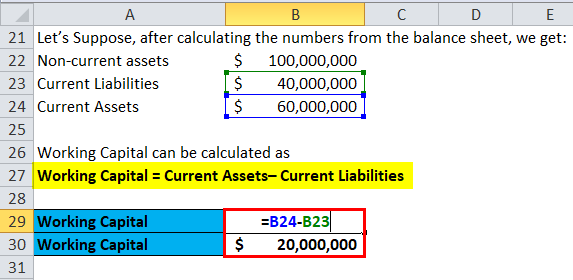

Capital Employed Calculation using 2nd Formula

A capital Employed calculation In the second method, we need to calculate Non-Current assets and Current Liabilities and Current assets. The amount of non-current assets and current assets are available on the Assets side of the balance sheet, and current liabilities are on the Liabilities side of the Balance Sheet.

Let’s Suppose, after calculating the numbers from the balance sheet, we get:

- Non-current assets = $100 Million

- Current Liabilities = $40 Million

- Current Assets = $60 Million

Now, we can calculate Capital Employed as:

- Capital Employed = $100 + ($60-$40) Million

- Capital Employed = $120 Million

Explanation of Capital Employed Formula

The Capital Employed Formula evaluates the total capital investors employ in any business to realize profits. You can calculate it in two ways, as described above. However, the main idea remains the same, i.e., to evaluate the total capital employed by the investors in any business to realize profits.

A higher level of risk is indicated when the amount of capital employed is high and is not sourced from Equity shareholders. It shows an aggressive business expansion and growth plans. If the plan goes successfully, it may provide a higher return to the investors.

To calculate the return on capital employed, divide the net operating profit (EBIT) by the amount of employed capital. We can also calculate ROCE by dividing (EBIT) earnings before interest & taxes by the difference between total assets & current liabilities.

Significance and Use

Determining the return on capital employed involves using Capital Employed.

Return on capital employed is a profitability ratio that the investors use to calculate the approximate return value they will receive in the future.

ROCE can be calculated by comparing the Net Operating profit to the capital employed; it gives information to the investors on how much each dollar return will be received for each dollar of capital employed. The Return on Capital Employed (ROCE) calculation involves dividing EBIT (Net Operating Profit) by Capital Employed, expressed as the formula ROCE = EBIT / Capital Employed. Companies generally prefer ROCE over return on equity or return on assets as it considers long-term financing, providing a comprehensive measure of the company’s overall performance and profitability over an extended period.

Interpretation of Capital Employed Formula

An investor usually goes for Return on Capital Employed (ROCE) to evaluate the company’s operational efficiency and analyze future growth in value. The main drawback of ROCE is that it measures return against the book value of assets in the business. As these are depreciated, the ROCE will increase even though cash flow remains unchanged. Thus, older businesses with depreciated assets will tend to have higher ROCE than newer, possibly better businesses.

Capital Employed Calculator

You can use the following Capital Employed Calculator

| Total Assets | |

| Current Liability | |

| Capital Employed Formula | |

| Capital Employed Formula = | Total Assets – Current Liability |

| = | 0 – 0 |

| = | 0 |

Capital Employed Formula in Excel (With Excel Template)

Here, we will do the same example of the Capital Employed formula in Excel. It is very easy and simple. You must provide the inputs of Non-Current Assets, Current Liabilities, and Current Assets. You can easily calculate the Capital Employed using the Formula in the template provided.

In this example, we calculate Capital Employed using 1st formula, i.e, Capital Employed = Total Assets- Current Liability

In this example, we calculate Capital Employed using 2nd formula, i.e

first, we need to calculate Working Capital, i.e,

Then, we can calculate the Capital Employed

Recommended Articles

This has been a guide to a capital-employed formula. Here, we discuss its uses along with practical examples. We also provide a Capital Employed Calculator with a downloadable Excel template. You may also look at the following articles to learn more –